A lack of transparency results in distrust and a deep sense of insecurity—Dalai Lama

In this issue

I. 2023 Reinforced PLDT and Metro Pacific’s Financial Liquidity Challenges

A. PLDT’s 2023 Record Income Boosted by a Plunge in Depreciation!

B. PLDT’s Mounting Liquidity Challenges: Despite the Colossal Cell Tower Sale-Leaseback Deals

C. The Lack of Transparency Leads to Higher Financial Risks

II. 2023 Reinforced Metro Pacific Investment’s Liquidity Challenges

I. 2023 Reinforced PLDT and Metro Pacific’s Financial Liquidity Challenges

Despite recording record sales and income growth, firms controlled by Tycoon Manny V. Pangilinan, such as PLDT and MPI, have faced sustained challenges in their respective balance sheets. How sustainable is this?

A. PLDT’s 2023 Record Income Boosted by a Plunge in Depreciation!

In a world where corporate news often resembles disguised press releases, this article demonstrates a semblance of "balance" in reporting. Hence, we have included extended excerpts from it.

Inquirer.net, March 08, 2024: PLDT Inc. more than doubled its net income to P26.61 billion last year after registering better revenues and a significant decline in expenses, strengthening its balance sheet that was previously injured by a multibillion-peso budget overrun. This marks the return of the telco giant to the income level before it got embroiled in a P48-billion budget mess. In 2022, its net income plunged by 60 percent to P10.49 billion to account for accelerated depreciation related to overspending. Revenues last year were up 3 percent to P210.95 billion, the bulk of which were accounted for by data and broadband business. Expenses declined by 24 percent to P158.47 billion as depreciation costs slowed down. Core income improved by 3 percent to P34.34 billion last year. It is estimated to reach P35 billion this year as consolidated service revenue and earnings before interest, taxes, depreciation and amortization are projected to grow by mid-single digit. (bold added)

Figure 1

Our role is to fill the gaps.

As a side note, the largest telco firm, PLDT [PSE: TEL] reported significant revisions in its topline and expenditure segments of its income statement covering at least 2021 and 2022, which were "reclassified to reflect the discontinued operations of certain ePLDT subsidiaries." Nonetheless, although the firm's Financial Statement (FS) retained the net income figures, the adjustments included the EPS.

The alterations made in 2021 and 2022 may introduce ambiguity into the upcoming quarterly data, which includes information from 2023 and 2024—unless 2021 and 2022 will be explicitly included. Such adjustments not only impact minority shareholders but also contribute to opacity regarding the industry's health.

Circling back to its FS, since reaching its peak of 6.98% in 2020, TEL's revenue growth rate has been slowing. (Figure 1, lower chart)

In terms of pesos, sales revenue reached a record high. However, with the 2023 CORE CPI at 6.6%, when adjusting for inflation (CORE CPI), TEL's 'real' revenue growth fell by 3.6% in 2023!

Statistical smoke and mirrors are a byproduct of inflation.

However, did the slowdown in the topline indicate competitors taking a bigger slice of the pie, or did it signify an emerging slack in 'real' economic conditions?

The performances of its competitors should give us more clues.

Figure 2

As reported in the news, net income growth spiked by 149.9% to reach a record Php 26.824 billion, slightly surpassing the 2021 high of Php 26.7 billion. The emergence of the 2022 "budget overrun" caused volatility in their financial statements. (Figure 1, upper graph)

A significant factor contributing to the spike in net income was a 40.75% decrease in depreciation, amounting to Php 40.2 billion! (Figure 2, lower pane)

That's right. Accounting gymnastics appear to have boosted TEL's net income.

B. PLDT’s Mounting Liquidity Challenges: Despite the Colossal Cell Tower Sale-Leaseback Deals

Ironically, despite the record increase in net income, TEL has been struggling to secure liquidity.

The firm not only plans to decrease capital expenditures but intends to sell some of its data center operations.

Inquirer.net, March 8, 2024: Yu said bringing down capex would translate to a positive free cash flow, which the company can use to extinguish obligations. The telco player has a net debt of P239.8 billion as of end-December 2023…To inject more liquidity, Pangilinan said they were also planning to sell some of the company’s data center assets—and discussions with a potential foreign buyer were ongoing...Meanwhile, PLDT chief legal counsel Marilyn Victorio-Aquino said the $3-million settlement for the budget overrun lawsuit was being processed for approval by the US District Court of Central District of California.“Once that is done, then the case against PLDT and all the defendants will be dismissed,” she said, noting the payment to plaintiffs would not impact the company’s financials. (bold added)

Or, despite the recent 'sale-leaseback' operations involving PLDT's cell towers, securing liquidity remains a substantial challenge for the firm.

Figure 3

TEL's sale-leaseback operations, according to their FS, (Figure 3, upper table)

On April 19, 2022, Smart and DMPI signed Sale and Purchase Agreements with a subsidiary of Edotco Group and a subsidiary of EdgePoint, or the TowerCos, in connection with the sale of 5,907 telecom towers and related passive telecommunication infrastructure for Php77 billion…

In 2023, we completed additional sale of 854 telecom towers to Edotco and Edgepoint for a total consideration of Php11,302 million. We recognized gain on sale and leaseback for these transactions totaling to Php4,240 million…

Meanwhile, on December 15, 2022 and March 16, 2023, Smart and DMPI signed a new set of Sale and Purchase Agreements, with Unity, and Frontier Tower Associates Philippines Inc., or Frontier, respectively, in connection with the sale of 1,662 telecom towers and related passive telecom infrastructure for a total of Php21,309 million.

In 2023, we completed the sale of 851 telecom towers to Unity and Frontier for a total consideration of Php11,163 million…

On March 18, 2024, Smart and DMPI completed additional sale of 111 telecom towers for a consideration of Php1,332 million. [PLDT, p.62]

What has become of the substantial proceeds from this continuing asset liquidation operations?

Despite achieving record net income, why have these initiatives failed to halt the downward trend in the firm's cash reserves?

Cash reserves peaked in 2018, and 2023 further reinforced this downward trajectory.

Although short-term debt plummeted by 64% to Php 11.63 billion, the reduction in cash reserves to Php 16.2 billion indicates a sustained narrowing of the gap. (Figure 3, lower diagram)

Conversely, the firm's gross debt ballooned by Php 5.22 billion in 2023, reaching a record Php 254.8 billion.

This significant increase in debt levels, coupled with rising interest rates, has exerted pressure on financing costs.

Figure 4

Financing costs surged by 17% to a record Php 13.76 billion, representing an all-time high of 6.5% relative to revenues.

C. The Lack of Transparency Leads to Higher Financial Risks

The tightening liquidity has reportedly restrained the firm's horizontal expansion.

Notably, despite obtaining clearance from the Philippine Competition Commission (PCC), TEL's proposed acquisition of ABS-CBN's Skycable fell through. This failure was attributed to "disagreements in the final terms, " purportedly stemming from the acquiree's "high debt" level.

Was the aborted deal due to a fallout in negotiations (new information from due diligence)? Or was the proposed M&A aimed at enhancing the acquirer's financial standing?

As an aside, it's bizarre to see a bureaucracy supposedly working to "protect consumers" against a "monopoly" when many of its policies, most importantly the BSP's easy money regime, have led to a Pacman Strategy (cartelization) in favor of the elite firms!

In essence, the divergence in TEL's 2023 financial conditions (emerging symptoms of illiquidity amidst record profit) suggests more about accounting distortions.

As recently noted,

If the supervising authorities can't balance the order for the minority shareholders, the industry and the economy, why should we suppose that markets are pricing capital effectively? (Prudent Investor, 2024)

The lack of transparency leads to increased financial risks.

II. 2023 Reinforced Metro Pacific Investment’s Liquidity Challenges

In a related vein, recently delisted Metro Pacific Investments (MPI), an infrastructure and utility firm chaired by tycoon Manuel Pangilinan (who also chairs PLDT), published its 2023 financial performance in early March.

The Philippine Stock Exchange (PSE) announced the effective delisting date of MPI as October 9th.

Inquirer.net, March 7, 2024: Metro Pacific Investments Corp., the utilities and infrastructure giant led by tycoon Manuel V. Pangilinan, announced its highest ever profits in 2023 as major business units saw robust growth. The owner of Manila Electric Co., toll roads, water services and hospitals said net income in 2023 surged almost 90 percent to P19.9 billion—beating internal income expectations for the year by more than 20 percent. Metro Pacific chief finance officer June Cheryl A. Cabal-Revilla said earnings were lifted by the sharp rebound in its power generation segment, and higher tariffs at water arm Maynilad Water Services Inc. (bold added)

The article projected an entirely bullish backdrop.

But here are the unseen factors:

Figure 5

1. As a firm focused on utilities and infrastructure, MPI benefited from higher CPI. Both sales and profit margins increased in line with the CPI. (Figure 5)

How sustainable is the revenue growth model of a firm that relies on the sustained erosion of consumers' purchasing power?

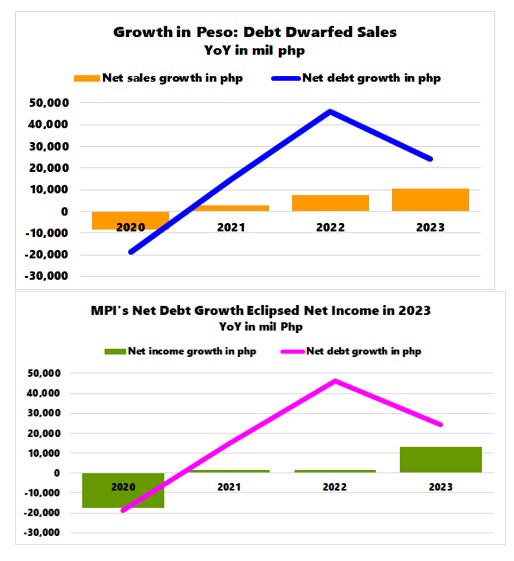

2. However, behind the scenes, debt has outpaced sales and income growth in pesos.

Total debt increased by 8.3%, reaching a record Php 316.7 billion, a rise of Php 24.24 billion. Sales grew by 20.5% or Php 10.45 billion, to attain an unprecedented Php 61.33 billion.

Figure 6

In pesos, net debt grew more than twice the net sales and 83% more than the net income, which doubled to Php 26.36 billion, increasing by Php 13.22 billion. (Figure 6)

Figure 7

3. Despite a 17.2% increase in cash reserves to reach Php 39.4 billion, which broke the four-year downtrend, short-term liquidity remains under stress. Short-term debt surged by 88%, to hit Php 39.2 billion, an increase of Php 18.4 billion. (Figure 7, upper chart)

Short-term debt levels remain slightly below cash reserves.

4. The escalating debt burden heightens risk factors.

Rising debt levels and higher interest rates have led to substantial financing costs. Interest expense surged by 26.2% to reach a record Php 13 billion. (Figure 7, lower graph)

A significant slowdown in topline activities or profit margin squeeze could exacerbate the firm's liquidity pressures and elevate its credit risk profile.

As concluded last September:

If anything, MPI's episode showcases why the BSP has been dithering over its policies. The BSP's "trickle-down" effect is in jeopardy, demonstrated by the debt-to-eyeballs firms of the elites, which are on the precipice. (Prudent Investor Newsletter)

___

References

PLDT, 17-A Annual Report, PSE.org.ph, March 27, 2024

Prudent Investor Newsletters, PSEi 30 6,950: Desperate Times Calls for Desperate ICT-SM Led Sy Group Pump; The Quest for Better Absolute Returns, March 11, 2024

Prudent Investor Newsletters The PSE’s Proposed Capital Controls, Metro Pacific’s Mounting Liquidity Challenges: Is the GSIS Providing an Implicit Backstop? September 10, 2023