Don’t you need some ‘wealth’ to create a ‘wealth fund?’ Norway did it with the money it got from North Sea oil. China’s trillion-dollar wealth fund comes from its trade surpluses. Where will the US wealth come from? The government runs deficits—Bill Bonner

In this issue

Maharlika's NGCP Investment: Economic Nationalism or a Bailout?

I. Introduction:

Maharlika's First Test: Can Conflicting Objectives Deliver Optimal Returns?

II. The Legacy of

NAPOCOR: A Historical Overview and its Cautionary Lessons

III. Geopolitical

Tensions Permeate the Power Sector

IV. MIC’s Investment in

NGCP: A Revival of Economic Nationalism? Shades of Napocor?

A. Advance National Security by

Strengthening Oversight of NGCP Management?

B. Economic Benefits: Lowering

Electricity Costs by Enhancing Grid Efficiency?

V. Maharlika's NGCP

Investment: A Bailout in Disguise? Potentially Inflating an SGP Stock

Bubble?"

VI. Maharlika’s Risks

and Potential Consequences

VII. Conclusion

Maharlika's NGCP Investment: Economic Nationalism or a Bailout?

Is Maharlika’s exposure to the National Grid Corp. about investments, economic nationalism, or a bailout of SGP? Or could hitting all three birds with one stone be feasible?

__

Nota Bene: This post does not constitute investment advice; rather, it explores the potential risks associated with the recent acquisition of the National Grid Corp. (NGCP) of the Philippines by the Maharlika Investment Corporation, through its controlling shareholder, Synergy Grid and Development Philippines Inc. (SGP).

I. Introduction: Maharlika's First Test: Can Conflicting Objectives Deliver Optimal Returns?

First some news quotes. (all bold mine)

Philippine News Agency, January 27, 2025: Under the deal, MIC will purchase preferred shares in SGP, granting the government a 20 percent stake in the company, which holds a significant 40.2 percent effective ownership in NGCP, the operator of the country’s power grid. Consing noted that the deal will also provide the government with board seats in both SGP and NGCP. “Once the acquisition is completed, we shall be entitled to two out of nine seats in the SGP board, after the total seats are increased from seven to nine. At NGCP, the government gains representation through two out of 15 board seats, following an increase in the total seats from 10 to 15,” he explained. The investment is seen as a crucial step for the government to regain control over the nation’s vital power infrastructure.

Inquirer.net, January 29, 2025: The country’s sovereign wealth fund is investing in the National Grid Corp. of the Philippines (NGCP) to allow the government to monitor the possible emergence of external threats, the head of Maharlika Investment Corp. (MIC) said on Tuesday. MIC president and chief executive officer Rafael Consing Jr. said they would also be interested in buying the 40-percent NGCP stake owned by a Chinese state-owned company once the opportunity arises.

Inquirer.net, January 28, 2025: The way NGCP can contribute to lower electricity is by ensuring that that rollout indeed happens. Because once you have that transmission grid infrastructure being rolled out successfully, then you would have more power players that can in fact get onto the grid and provide supply to the grid. And, obviously, just like any commodity, as you’ve got more supply coming in, the present power will, at some point in time, come down

The Philippines' sovereign wealth fund (SWF), the Maharlika Investment Corporation (MIC), has made its first investment by acquiring a 20% stake in Synergy Grid and Development Philippines Inc. (SGP), the majority holder of the National Grid Corporation of the Philippines (NGCP), a firm listed on the Philippine Stock Exchange (PSE)

Is this move primarily about economic interests, or does it also serve geopolitical objectives?

Is the MIC being used to facilitate the re-nationalization of NGCP by phasing out or displacing China’s state-owned State Grid Corporation of China (SGCC), which holds a 40% stake?

Or has this, in effect, been an implicit bailout of SGP?

If so, how can achieving domestic and geopolitical objectives align with the goal of attaining desired financial returns?

Or how could competing objectives be reconciled to achieve optimal returns?

II. The Legacy of NAPOCOR: A Historical Overview and its Cautionary Lessons

To better understand the current situation, let's first examine the origins of NGCP, tracing its roots back to its predecessor, the National Power Corporation (NPC).

The NAPOCOR (NPC), was once the behemoth of the Philippine power industry, centralizing control over both the generation and transmission of electricity.

Established in 1936 as a non-stock, public corporation under Commonwealth Act No. 120, nationalizing the hydroelectric industry. It was later converted into a government-owned stock corporation by Republic Act 2641 in 1960. Its charter was revised under Republic Act 6395 in 1971.

While consolidating significant influence over the Philippine electricity market, this monolithic structure came with its pitfalls.

NAPOCOR accumulated substantial debt due to a combination of over-expansion, mismanagement, political interference, and corruption.

The corporation's financial stability was further undermined by subsidies, price controls—both contributing to market imbalances—and costly contracts with Independent Power Producers (IPPs), which led to a cycle of financial losses.

In response, the Electric Power Industry Reform Act (EPIRA) of 2001 was enacted, marking the beginning of the sector's restructuring through privatization.

The Power Sector Assets and Liabilities Management Corporation (PSALM) was created to manage the sale and privatization of NPC's assets, also assuming NPC's liabilities and obligations.

Figure 1

At its peak, NAPOCOR’s debt, as reported by PSALM, had reached 1.24 trillion pesos by 2003. (Figure 1)

The National Transmission Corporation (TRANSCO) was established to manage the transmission facilities and assets previously under NAPOCOR.

This restructuring ultimately led to the formation of the National Grid Corporation of the Philippines (NGCP) in 2009, a consortium that included local business tycoons Henry Sy Jr. and Robert Coyiuto Jr., along with China’s state-owned enterprise, the State Grid Corporation of China (SGCC). NGCP assumed operational control of the country’s power grid.

The key takeaway from NAPOCOR’s experience is that its monopolistic structure created and fostered inefficiencies, corruption, and imbalances, which culminated in massive debt.

Despite the privatization, NGCP remains a legal monopoly.

Once again, NGCP operates and maintains the transmission infrastructure, such as power lines and substations, that connects power generation plants—including those owned by NAPOCOR and private generators—to distribution utilities.

III. Geopolitical Tensions Permeate the Power Sector

The current Philippine administration's foreign policy can be viewed through the lens of U.S. influence.

Evidenced by hosting four additional bases for access to the U.S. military in 2023 amidst ongoing maritime disputes in the South China Sea, this stance marks a contrast with the previous Duterte administration's more China-friendly policies.

This foreign policy shift has also been manifested in actions such as the banning of Philippine Offshore Gaming Operators (POGOs) and the legal actions against Ms. Alice Guo, a former provincial (Tarlac) mayor accused of espionage and involvement in illegal gambling.

These tensions extend to the NGCP, where the Chinese stake has been cited by media and officials as a national security risk.

According to a US politically influential think tank, "Fears in both Manila and Washington that Beijing could disable the grid in a time of crisis have lent urgency to efforts to reform its ownership and operational structure". (CSIS, 2024)

Therefore, heightened scrutiny of China’ government involvement in sectors like NGCP, justified on the ‘kill switch’ or national security risk, combined with increasing military cooperation with the U.S., suggests a Philippine foreign policy trajectory heavily influenced by Washington's strategic objectives.

IV. MIC’s Investment in NGCP: A Revival of Economic Nationalism? Shades of Napocor?

The stated objectives of MIC’s entry into NGCP through a 20% stake in SGP are twofold:

A. Advance National Security by Strengthening Oversight of NGCP Management?

MIC contends that this investment allows for governmental oversight of NGCP management, potentially counterbalancing foreign influence, particularly from China. They have also expressed interest in acquiring the entire SGCC’s stake.

However, this approach risks "political interference," one of the critical factors that historically plagued the National Power Corporation's (NPC) financial stability.

Furthermore, a move towards re-nationalization could represent a regressive step, potentially leading to deep financial losses reminiscent of NPC’s past.

B. Economic Benefits: Lowering Electricity Costs by Enhancing Grid Efficiency?

MIC has promoted the investment as a means to improve grid infrastructure, with the expectation that efficiency gains would eventually translate into lower electricity rates for consumers.

First, the latter objective appears secondary to the former. Since all government actions must be publicly justified, MIC’s interventions are presented as beneficial to the consumer.

Figure 2

The Philippines is often cited as having one of the highest electricity rates in Asia. (Figure 2, upper chart)

However, subsidies on power firms have distorted this metric. The NPC’s subsidy program significantly contributed to its debt accumulation.

Similarly, the government’s attempt to regulate fuel prices via the Oil Price Stabilization Fund (OPSF) ended up as a net subsidy, requiring large bailouts, as noted by the International Institute for Sustainable Development (IISD, 2014).

In short, Philippine experiences with subsidies have historically been unsuccessful.

It is also questionable whether dependency on energy imports directly equates to high electricity prices. (Figure 2, lower image)

This simplistic logic would lead to the conclusion that nations that are most dependent on oil and energy imports would have the highest electricity rates, which is not necessarily true—because of many other factors.

Second, MIC argues that "investing in NGCP could improve the rollout of transmission grid infrastructure, allowing more power players to supply energy to the grid."

While this proposal is ideal in theory, its practical implementation faces significant challenges.

One of the primary drivers behind high energy costs is the oligopolistic market structure, characterized by a concentration of power among a few large conglomerates.

Figure 3

The most prominent players include San Miguel Corporation (PSE: SMC), Aboitiz Power Corporation (PSE: AP), First Gen Corporation (PSE: FGEN), and Manila Electric Company (PSE: MER). In Luzon, for example, seven generation companies hold an estimated 50% of the total installed capacity. (ADMU, 2022) (Figure 3)

Despite partial deregulation, the concentration of market power among these firms potentially reduces competitive pressures and limits market alternatives, leading to price-setting behaviors that do not reflect true supply and demand dynamics.

The Wholesale Electricity Spot Market (WESM) was introduced in 2006 to foster competition, yet allegations of anti-competitive behavior emerged soon after its inception.

Moreover, while EPIRA led to privatization in segments of the industry, the slow pace of implementing reforms, such as open access provisions and retail competition, has maintained high electricity prices, as highlighted in a World Bank study.

Furthermore, the incumbent regulatory framework, despite its intent to limit market power, has not fully mitigated oligopolistic tendencies, resulting in persistently high prices for consumers. Examples: Bureaucracy and red tape, cross ownership, system losses, conflicting laws, over-taxation and more.

As a result, the oligopolistic market structure and high energy costs deter foreign direct investment (FDI), as investors seek markets with lower operational costs.

The likely substantial influence of these oligopolists on the political sphere, which protects their interests through legal frameworks, raises the risks of collusion, cartel-like behavior, and barriers to entry, thereby constraining competition.

Therefore, while MIC’s argument for infrastructure rollout benefiting consumers through competition is necessary, it is crucially insufficient.

Market concentration among large firms may have significant influence on regulations and their implementation, particularly in the upstream and midstream segments (generation, transmission, and distribution).

The slow pace of reforms aimed at fostering a competitive environment has severely limited efficiency gains, and consequently, the reduction of electricity rates.

Third, the Bangko Sentral ng Pilipinas’ (BSP) low interest rates regime has enabled these firms to accumulate substantial or large amounts of debt to finance their commercial operations, which implicitly creates obstacles for competitors unable to access cheap credit.

Alternatively, this debt accumulation poses systemic financial and economic risks.

In essence, despite EPIRA and its privatization efforts, monopolistic inefficiencies coupled with readily available cheap credit have effectively transferred NPC’s debt dilemma to the oligopoly.

Lastly, decades of easy money policies from the BSP have driven a demand boom, resulting in a significant mismatch in the sector’s economic balance. This is evident in overinvestment in areas like real estate, construction, and retail, potentially diverting resources from necessary energy infrastructure and even potentially leading to overinvestment in renewable energy sources at the expense of reliable baseload power from coal, oil, natural gas, and nuclear energy.

In sum, prioritizing the expansion of a competitive environment where the sector’s pricing reflects actual demand and supply dynamics is essential.

Liberalization, which should lower the hurdle rate, would intrinsically encourage infrastructure investment without the need for political interventions.

MIC’s promotion of economic gains from its interventions appears more as a "smoke and mirror" justification for politically colored actions.

V. Maharlika's NGCP Investment: A Bailout in Disguise? Potentially Inflating an SGP Stock Bubble?"

An even more fascinating perspective is SGP's financial health.

Certainly, as a legal monopoly, the National Grid Corporation of the Philippines (NGCP) holds a significant economic advantage—an economic moat.

Grosso modo, SGP, as the majority shareholder of NGCP, seemingly operates within a rent-seeking paradigm, where wealth is accumulated not through value creation but through leveraging of economic or political environments to secure favorable positions.

OR, for monopolists, the focus shifts from open market competition, innovation, or improvement, to maintaining their monopoly status by currying favor with political stewards. Subsequently, they leverage this privilege to extract economic rents, often at the expense of consumers or other market participants.

SGP’s financials and recent developments appear to support this narrative.

Figure 4

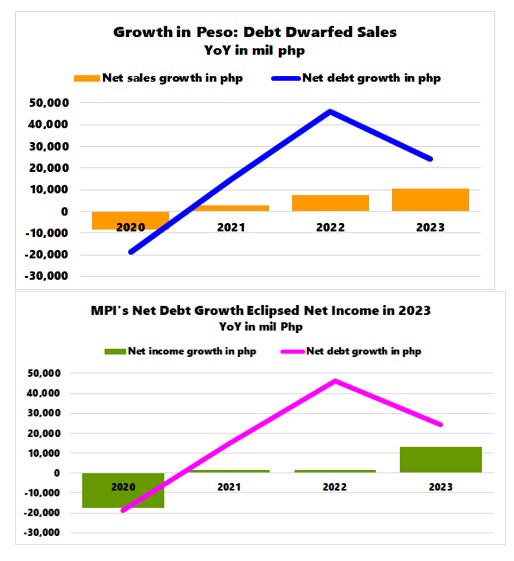

Revenue Stagnation: Since Q3 2022, SGP's quarterly revenue has grown by an average of 5.9% over 13 quarters through Q3 2024, with a Compound Annual Growth Rate (CAGR) of only 0.52% since Q3 2020.

Slowing Profit Trends: During the same periods, quarterly profits expanded by 2.67%, but shrank by 2.25% based on CAGR.

Notably, a spike in net income in Q2 2022 was attributed to "higher iMAR as approved by ERC effective January 1, 2020 and the recording of Accrued revenue for incremental iMAR 2020 for CY 2020 and 2021."

iMAR Explanation: As per Businessworld, "iMAR stands for "Interim Maximum Annual Revenue," which refers to the maximum amount of money a power transmission company like the National Grid Corporation of the Philippines (NGCP) is allowed to earn annually from its operations, as approved by the Energy Regulatory Commission (ERC) during a specific regulatory period; essentially setting a cap on how much revenue they can collect from electricity transmission services"

Figure 5Mounting Liquidity Issues: SGP's cash reserves have been contracting, with an average decrease of 3.9% over 13 quarters through Q3 2024 and a -6.7% CAGR since Q3 2020.

Surging Debt Accumulation: Conversely, debt and financing charges have escalated. Debt has grown by an average of 12.1% over 13 quarters, with a 2.1% CAGR, while financing charges increased by an average of 5.7% with a 1.9% CAGR.

SGP’s finances are not exactly healthy.

Yet NGCP’s recent activities gives further clues. (bold mine)

ABS-CBN, May 23, 2023: "The National Grid Corporation of the Philippines on Thursday said it was not to blame for delayed projects, and fended off criticism that it was making consumers pay even for delayed projects. The country’s power grid operator also insisted that power transmission improved since it took over operations from the government. A recent Senate hearing found that 66 projects, of which 33 were in Luzon, 19 in the Visayas, and 14 in Mindanao, remained unfinished. "

ABS-CBN, December 23, 2024: "The Energy Regulatory Commission (ERC) has imposed a total of P15.8 million worth of fines on the National Grid Corporation of the Philippines (NGCP) over "unjustified delays" in 34 out of 37 projects. "

SGP’s tight finances, mainly evidenced by stagnant revenues, declining profits, and deteriorating liquidity, could reflect the challenges faced by NGCP.

Further, despite the complex political nature of the operations of the grid monopoly, the ERC caps the revenue that NGCP is allowed to generate (Php 36.7 billion annually).

This limits NGCP’s financial health, potentially leading to liquidity strains and increased borrowings by SGP to finance their projects.

Fundamentally, his dynamic might resemble a high-stakes path towards Napocor 2.0.

Besides, the Department of Energy (DoE) sets the plans and policies, while NGCP, as the exclusive franchise holder, is in charge of the operation, maintenance, development, and implementation of projects for the country's power transmission system.

The ERC regulates and approves rates, monitors performance, and can impose penalties for delays or inefficiencies.

In short, since NGCP prioritizes fulfilling the administration's political agenda, it seemingly does so with little concern for consumers—does this reflect the rent-seeking paradigm?

This raises two crucial questions: aside from economic nationalism, could MIC’s entry into NGCP amount to an implicit BAILOUT of SGP?

And could this package include a deal for China’s SGCC to exit?

While we are not privy to the legal technicalities leading to MIC’s initial investment in NGCP via a 20% stake in SGP, SGP’s share prices have experienced a resurgence, or spike, since hints of MIC’s entry began to emerge late last year.

Year-to-date (YTD) returns of SGP shares totaled 17.6% as of February 7th.

Once again, this raises additional questions:

Figure 6

-Is a stock market bubble being inflated for SGP shares, benefiting not only corporate insiders and their networks, but also political figures and their allies behind the scenes?

-Considering the price plunge of SGP shares from over 700 in 2017 to the present, resulting in substantial losses for its shareholders, could this potential bailout include efforts to pump up SGP shares to recoup at least a significant portion of these deficits?

VI. Maharlika’s Risks and Potential Consequences

The paramount concern revolves around what might happen if MIC's investment, re-nationalization, or its policy of economic nationalism regarding NGCP goes awry.

What if NGCP replicates the pitfalls of its predecessor, the National Power Corporation (NPC)? How would the resulting losses or deficits be managed?

Maharlika's investment capital is derived from public funds. If MIC incurs losses, would additional taxpayer money be on the line? Would there be a necessity for a bailout of MIC itself?

How would potential deficits from MIC affect the country's fiscal health? Could this lead to higher interest rates and a weaker peso, exacerbating economic pressures?

VII. Conclusion

Ultimately, Maharlika's NGCP investment, executed through SGP, reflects a tension between seemingly conflicting objectives: securing national security interests and generating optimal returns.

While proponents tout the deal as a means to lower electricity costs and improve grid efficiency, our concern—given SGP's financial weaknesses—is that MIC’s infusion could, in effect, function as a bailout.

That is to say, the potential exposure of public funds through the SWF for political goals may conflict with, or potentially override, the Maharlika Investment Corporation’s stated goals: "to ensure economic growth by generating consistent and stable investment returns with appropriate risk limits to preserve and enhance long-term value of the fund; obtaining the best absolute return and achievable financial gains on its investments; and satisfying the requirements of liquidity, safety/security, and yield in order to ensure profitability of the GFIs’ respective funds."

____

references

Harrison Prétat, Yasir Atalan, Gregory B. Poling, and Benjamin Jensen, Energy Security and the U.S.-Philippine Alliance, Center for Strategic and International Studies, October 21, 2024

Maria Nimfa Mendoza Lessons Learned: Fossil Fuel Subsidies and Energy Sector Reform in the Philippines, March 2014, IISD.org p. iv

Majah-Leah V. Ravago, The

Nature and Causes of High Philippine Electricity Price and Potential Remedies,

January 19, 2022 Ateneo de Manila University