``The incorrigible inflationists will cry out against alleged deflation and will advertise again their patent medicine, inflation, rebaptising it re-deflation. What generates the evils is the expansionist policy. Its termination only makes the evils visible. This termination must at any rate come sooner or later, and the later it comes, the more severe are the damages which the artificial boom has caused. As things are now, after a long period of artificially low interest rates, the question is not how to avoid the hardships of the process of recovery altogether, but how to reduce them to a minimum. If one does not terminate the expansionist policy in time by a return to balanced budgets, by abstaining from government borrowing from the commercial banks and by letting the market determine the height of interest rates, one chooses the German way of 1923.”-Ludwig von Mises

As expected, like the dogs in Pavlov’s experiment, US markets passionately cheered on the assurances provided by the US Federal Reserve to provide support to her economy even by possibly resorting to unconventional means or by taking the nuclear option to the table.

In a speech last Friday, Chairman Ben Bernanke[1] said that the Federal Reserve ``is prepared to provide additional monetary accommodation through unconventional measures if it proves necessary, especially if the outlook were to deteriorate significantly”. (emphasis added)

US markets, of late, has been reeling from successive weekly losses giving rise to intensifying anxieties over a re-emergence of another recession or what many calls as “double dip recession”.

And for the mainstream, the prospect of another bout of ‘deflation’ has provided them with the ammunition to demand for more intervention from her government.

Unfortunately, as we have been repeatedly saying, inflationism is simply unsustainable. Like narcotics, it will always have soothing effects that are ephemeral in nature, but whose repercussions would always be nasty, adverse and baneful that would result to capital consumption or a lowered standard of living emanating from the unravelling of malinvestments or the misdirection of resources and on relative overconsumption. And at worst, persistent efforts to inflate could lead to a breakdown of the monetary system (hyperinflation). The 2007 US mortgage crisis had been a lucid example of the boom bust cycles from inflationism yet the public refuses to learn.

And since the time preferences of the masses are mostly directed towards the short term, the elixir of inflationism always sells. The illusion of free lunch policies is just too beguiling to reject.

As Ludwig von Mises once wrote[2], ``The favour of the masses and of the writers and politicians eager for applause goes to inflation.”

And such dynamics is exactly how the present environment operates.

Economic Hypochondria

Figure 1: Danske Bank[3]: Worries Are Intensifying

And as we previously noted[4],

For the mainstream, anything that goes down is DEFLATION. There never seems to be within the context of their vocabulary the terms as moderation, slowdown and reprieve. Everything has got to go like Superman, up up up and away!

The weakening of some economic indicators such as the manufacturing index has led many to envision the same scenario as in 2008 (see figure 1). But this seems more like an economic hypochondria, where the apparent infirmities today seems more like a manifestation of the countercyclical or reactive forces following a V-shape spike in 2009 (right window). The point is NO trend goes in a straight line.

And also this seems to be an extension of the Posttraumatic Stress Distorder (PTSD) which we accurately exposed on the mainstream’s false attribution on the crisis as being prompted by the lack of aggregate demand in 2009[5].

The follies from the same cognitive biases have reared their ugly heads, or perhaps have merely been used to justify government’s actions.

The main mistake of the mainstream is to ignore the interplay of relationships, in terms of stimulus-response action-reaction, between markets or the economy on the one hand and the policy actions from the government on the other.

The mainstream believes that ALL human actions are uniform and consequently discern linearly from such premises. They disregard the diversity of human actions which encapsulates the markets/economy and the political leadership, as well as the bureaucracy which incidentally government is basically run by human beings too. The difference lies in the incentives which drive their respective actions.

Inflationism To Protect The Banking Cartel and Gold’s Status

True, the US housing sector reveals renewed feebleness (left window). But this again is a manifestation of the failure of inflationism or the waning temporal positive effects, where the US government has tried to keep prices from reflecting the natural ‘market’ levels by using manifold interventions such as the manipulation or artificial suppression of the interest rates, quantitative easing (or printing of money), the tweaking of the accounting standards (Financial Standards Accounting Board reversed itself on FAS 157[6]), and the substantial exposure of GSE (Government Sponsored Enterprises) as Fannie Mae and Freddie Mac which currently accounts for $5.7 trillion of the $11 trillion market and provides 75% of the funds in the mortgage market[7].

In my view, whereas the official declaration (propaganda) has always been about the economy (social good), this conceals the true intent, which is to provide support and redistribute taxpayers resources to the banking cartel, whose balance sheets have been stuffed with toxic assets and thus the seeming stagnation in credit conditions.

True, the Federal Reserve has absorbed considerable part of questionable assets via the massive expansion of her balance sheets, but without the sustained redistribution from the US taxpayers to the cartel via more inflationism, this would extrapolate to the collapse of the fractional reserve banking system. Hence, the underlying economic moderation in the economy is sold to the public as requiring more inflationism.

As Murray N. Rothbard wrote[8],

It should be clear that modern fractional reserve banking is a shell game, a Ponzi scheme, a fraud in which fake warehouse receipts are issued and circulate as equivalent to the cash supposedly represented by the receipts

And the market seems to be validating such an outlook (see Figure 2)

Figure 2: Deflation? Recession? Not Quite (from stockcharts.com)

First of all, as said above we don’t believe that the US is anywhere near a recession. The gold market seems to be saying so.

We don’t believe gold is a deflation hedge. The recession of 2008 clearly indicates this phenomenon as gold’s prices materially fell along with the bear market in the S&P 500 and the strength in the US dollar or the obverse weakness of the Euro (green circles).

So gold does not elude the forces of recession, much more the forces of deflation as signified by the collapse of prices of gold along with all the other markets as the effect of the Lehman bankruptcy rippled in October of 2008.

And those making a comparison of gold’s performance during the depression days of the 1930s have only been looking at patterns without noting of the differences in the underlying conditions.

Gold during those days had been part of the monetary system. It was a gold standard then until its temporary suspension following the enactment of the Gold Reserve Act of 1933[9]. Today gold is only part of the assets of central bank reserves. It is only now where gold has seen increasing recognition as ‘store of value’ among global central bankers as gold prices continue with its winning streak[10]. So in accordance to the reflexivity theory, prices changes have been influencing the fundamental factors surrounding gold.

And also today, we have a fiat money standard backed by nothing but empty promises of government to settle.

The Function of Market Prices

Second, those “tunnelling” or obsessively fixated at the treasury markets who scream “deflation” have been misinterpreting markets.

The treasury markets have been the one of key targets of interventionism. The other way to say it is that the prices of US treasury do NOT reflect activities of free markets in relative terms as compared with gold (main window), the Euro (XEU) and the S&P 500. This means prices represent distorted or highly skewed or artificial information.

This seems apparent with indications that small or retail investors have been fleeing the US stock markets and have been gravitating into the bond markets[11]. Yet these are likely symptoms equivalent to the Pied Piper of Hamelin[12] leading the rats to their perdition as they interpret erroneously current price signals to represent reality.

We are reminded of the unwisdom of the crowds[13] which we recently wrote about, and would quote anew Gustave Le Bon who wrote[14] ``The Masses have never thirsted after truth. They turn aside from evidence that is not to their taste, preferring to deify error, if error seduce them. Whoever can supply them with illusions is easily their master; whoever attempts to destroy their illusion is always their victim.”

The crowd has been seduced by the siren song of government propaganda called “deflation”.

Remember prices serve not only as information to account for the relative balance of demand and supply, prices are the most essential tool for economic calculation.

According to Gerard Jackson[15],

``Without market prices it is impossible to engage in economic calculation and thus have a rational allocation of resources. Now the market is a coordinating process that assembles fragments of continuously changing information from millions of people; information that can only be known to them personally and expressed as preferences. The market transforms these preferences into prices which then act as signals to producers and consumers. It is this process that enables consumers to achieve the best possible outcome. If a socialist had invented the market it would have been hailed as one of man's greatest achievements. At any time there is always a configuration of prices determined by market data each price is closely interrelated with the others. No price is independent or exists in isolation. It therefore follows that to interfere with one price means interfering with others. Another fact the significance of which ardent price controllers and their supporters cannot seem to grasp. (bold emphasis mine)

Importantly, prices represent property rights which allows for voluntary exchanges between parties to happen that leads to social cooperation.

Bettina Bien Greaves says it best[16],

``Without private property, there would be no private owners bidding for goods and services, and no exchanges among real owners. Without private owners, each guided by the desire for profits and the fear of losses, there would be no market prices to indicate what people wanted and how much they were willing to pay for it. Without market prices, there would be no competition and no profit-and-loss system. And without a profit-and-loss system, there would be no network of interrelated, consumer-directed, independent producers. Without private property, competition, market prices, and a profit-and-loss system, the planners would not know what to produce, how much to produce, or how to produce it.” (emphasis added)

Thus, marginal utility (the cardinal order of want satisfaction or the scale of values), time preferences, rationing, coordination, the dynamic process of spontaneous order in the marketplace and property rights are all jeopardized when government undertakes interventionism or inflationism.

At worst, interventionism represents an assault on private property, which consequently means an attack against civil liberty.

In addition, it is important to recognize that ALL bubbles (boom-bust) cycles have been engendered by the illusion of perpetually rising prices which mainly accounts for the massive systemic distortions built from a variation mix of interventionism channelled via interest rates or monetary policies, tax policies, administrative and legislative policies all of which may combine to encourage irrational behaviour fuelled by credit expansion.

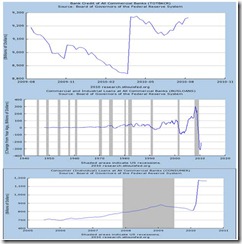

Figure 3: St. Louis Fed: Loan Conditions of US Commercial Banks

Another, I’d be careful to listen to pay heed to experts who claim that the US credit system remains totally dysfunctional (see figure 3).

At this time when the mainstream has been audibly shouting “deflation!”, bank credit of all commercial banks (upper window) seems to be ramping up.

Moreover, while commercial and industrial loans remain depressed, on an annual rate of change basis, we seem to be seeing a bottoming phase (middle window). To add, consumer loans at all commercial banks remain buoyant (lower window).

So in my view, industrial loans still remains problematic or has been the laggard, but may have already bottomed out which could likely see some improvement over the coming months.

Now if all these credit activities advances as I had long expected them to, mainly as a function of the belated effects of the yield curve[17], all the monster excess reserves held by the commercial banks at the Federal Reserve could simply turn into massive inflation. And this would be the rude awakening for the mainstream.

Therefore, deflation, for me, is no more than political propaganda, made by the major beneficiaries—the government and their clique of institutional and academic “experts”, in order to justify inflationism or extend more government control over our lives.

It would be foolish for people to simply read through economics without comprehending the indirect implications of the actions by the incumbent political leaders.

[1] Bernanke, Ben The Economic Outlook and Monetary Policy, Speech Given At the Federal Reserve Bank of Kansas City Economic Symposium, Jackson Hole, Wyoming, August 27, 2010

[2] Mises, Ludwig von The Import of the Money Relation, Human Action Chapter 17 Section 10

[3] Danske Bank, Weekly Focus, August 27, 2010

[4] See Why Deflationists Are Most Likely Wrong Again, August 15, 2010

[5] See What Posttraumatic Stress Disorder (PTSD) Have To Do With Today’s Financial Crisis, February 1, 2009

[6] North, Gary Translation of Bernanke's Jackson Hole Speech, marketoracle.co.uk August 28, 2010

[7] Laing, Jonathan What's Ahead for Fannie and Fred? Barron’s online, August 28, 2010

[8] Rothbard, Murray N. Mystery of Banking p. 97

[9] Wikipedia.org History of the United States dollar

[10] See Is Gold In A Bubble? November 22, 2009

[11] See US Markets: What Small Investors Fleeing Stocks Means, August 23, 2010

[12] Wikipedia.org Pied Piper of Hamelin

[13] See The UNwisdom Of The Crowds, August 15, 2010

[14] Le Bon, Gustave Le Bon, The Crowd The Study of the Popular Mind, p.64 McMaster University

[15] Jackson, Gerard Are price controls on the way? Brookesnews.com December 29, 2008

[16] Greaves, Bettina Bien A Prophet Without Honor in His Own Land, Mises.org

[17] See Influences Of The Yield Curve On The Equity And Commodity Markets, March 22, 2010