``What I must do is all that concerns me, not what the people think. This rule, equally arduous in actual and in intellectual life, may serve for the whole distinction between greatness and meanness. It is the harder because you will always find those who think they know what is your duty better than you know it. It is easy in the world to live after the world's opinion; it is easy in solitude to live after our own; but the great man is he who in the midst of the crowd keeps with perfect sweetness the independence of solitude.” Ralph Waldo Emerson, Self Reliance

The Follies of Groupthink

Groupthink is when people substitute the opinion of the consensus or the group for their own. It is a product of group cohesion, which leads to a deterioration of “mental efficiency, reality testing, and moral judgment”[1] or particularly the erosion of critical thinking.

This thought process also sacrifices independence, uniqueness, toleration of alternative perspectives and independent thinking in pursuit of group cohesiveness, mostly with the aim to reduce group conflict or maintain balance.

By casting off critical thinking, groupthink leads to hasty, irrational decisions and actions that could be harmful. Think fraternity violence.

If based on social psychologist Irving Janis’ 1970s study on groupthink, the eight symptoms are[2]: (bold emphasis and italics mine)

1. Illusion of invulnerability –Creates excessive optimism that encourages taking extreme risks.

2. Collective rationalization – Members discount warnings and do not reconsider their assumptions.

3. Belief in inherent morality – Members believe in the rightness of their cause and therefore ignore the ethical or moral consequences of their decisions.

4. Stereotyped views of out-groups – Negative views of “enemy” make effective responses to conflict seem unnecessary.

5. Direct pressure on dissenters – Members are under pressure not to express arguments against any of the group’s views.

6. Self-censorship – Doubts and deviations from the perceived group consensus are not expressed.

7. Illusion of unanimity – The majority view and judgments are assumed to be unanimous.

8. Self-appointed ‘mindguards’ – Members protect the group and the leader from information that is problematic or contradictory to the group’s cohesiveness, view, and/or decisions.

In other words, Groupthink embodies the psychological properties that characterize most religious, political and economic forms of social zealotry.

Applied to investing, groupthink represents as the wisdom of the crowd at the extreme levels or near the inflection point of any major trend.

The Wisdom Of The Crowds

In analysing social aspects of life, crowd psychology always operate as very critical factors in determining the sentiment and the possible path of people’s action. This means that crowd psychology does not represent random walk, but as collective sentiment brought about by the crowd’s reaction to the fluid circumstances they are faced with.

Whether vetting on the outcome of national elections, observing the behaviour of horse racing enthusiasts or examining the behaviour the financial markets or the real economy, we run a common ground of crowd psychology in different stages.

The crowd psychology comprises as form of social signalling.

Since people are intrinsically social animals, we always have the frequent sublime need to commune as group, and such is the reason why society has ultimately flourished over the centuries, even amidst the destructive impulses likewise inherent in men to dominate and to plunder (that has led to wars).

Ever since the eons of our prehistoric ancestors, as hunters, our progenitors operated on groups (tribes) to seek protection from among each other, to have a greater chance of attaining the goal of a successful hunt, and importantly, to achieve posterity via gene reproduction purposes.

Conforming to these social patterns is how man’s actions have mostly been directed.

As example “Keeping up with the Jones’” is a common catchphrase that signifies attempts by the individual to emulate an elevated social status in terms material possessions.

The crowd psychology also represents a form of tradition.

For instance the perpetuation of various forms of superstitions, such as in politics, are part of the tradition based crowd psychology.

As English philosopher and liberal political theorist Herbert Spencer once wrote[3],

“The great political superstition of the past was the divine right of kings. The great political superstition of the present is the divine right of parliaments. The oil of anointing seems unawares to have dripped from the head of the one on to the heads of the many, and given sacredness to them also and to their decrees.” (emphasis added)

Applied to politics, the crowd psychology hardly distinguishes between functioning reality and the romanticized expectations of government as supermen.

Traditionalism also finds its way deeply rooted into culture, economics, religion and others aspects of social life.

Of course traditionalism via the crowd psychology can also be used as an escape mechanism.

In Henry Kaufman’s Memoirs, he writes[4],

``Most predictions fall within a rather narrow range that does not deviate from consensus views in the financial community. In large measure, this reflects an all-too-human propensity to minimize risk and avoid isolation. There is, after all, comfort in running with the crowd. Doing so makes it impossible to be singled out for being wrong, and allows one to avoid envy or resentment that often inflicts those who are right more often than not.” (emphasis added)

In other words, traditionalism, or applied conventionally, could be used as an advantage to secure social acceptance.

As in the case above, it can be used to as pretext to elude responsibility. And conversely, as ploy to generate ‘networking’ effects.

A good example of this is from Prof Angelo Codevilla[5], who aptly he describes how the American ruling class have used traditionalism (conventionalism) to secure their current position.

``Today's ruling class, from Boston to San Diego, was formed by an educational system that exposed them to the same ideas and gave them remarkably uniform guidance, as well as tastes and habits. These amount to a social canon of judgments about good and evil, complete with secular sacred history, sins (against minorities and the environment), and saints. Using the right words and avoiding the wrong ones when referring to such matters -- speaking the "in" language -- serves as a badge of identity. Regardless of what business or profession they are in, their road up included government channels and government money because, as government has grown, its boundary with the rest of American life has become indistinct.” (emphasis added)

In short, to be sociologically “IN” means to assimilate conventional ‘uniform’ behavior, de facto ethics and morality as normative.

Importantly, crowd psychology is a form of social expression.

Political elections are the strongest demonstrations of crowd expression.

And so with market bubbles, as James Surowiecki writes[6],

``Bubbles and crashes are textbook examples of collective decision making gone wrong. In a bubble, all of the conditions that make groups intelligent -- independence, diversity, private judgement--disappear.” (emphasis added)

Crowd psychology isn’t always wrong though.

In financial markets crowd psychology can be depicted by trends. Major trends, for instance, are emblematic of the direction of the dominance of crowd behaviour.

As Shawn Andrew of Ricercar Fund observed[7],

“The CROWD is always wrong at market turning points but often times right once a trend sets in. The reason many market fighters go broke is they believe the CROWD is always wrong. There is nothing further from the truth. Unless volatility is extremely low or very high one should think twice before betting against the CROWD.” (all caps original)

The fact of the matter is that it is groupthink or the excessiveness of the crowd to impetuously gravitate towards the collective opinion as the assumed gospel of truth that creates such instability.

Of course, this can only happen when underlying incentives are set to condition people’s mind. Such conditions, in terms of financial markets, include government policies as interest rate manipulation, inflationism, tax policies, the picking winners or losers and etc...

Lessons From The Crowd

So what are the lessons we should learn?

Crowd psychology is a very essential variable in determining social trends (political, economic, and financial trends)

In financial markets, the flow with the crowd is useful for as long as they reflect on the general trend, and for as long as conditions are yet distant from reaching groupthink status.

Groupthink fallacy is the surrender of one’s opinion for the collective. This accounts for as a loss of critical thinking and is reflective of emotional impulses in the decision making of the crowd. When groupthink becomes the dominant mindset of the crowd, an ensuing volatile episode can be expected to occur applied to both markets and politics (bubble implosion or political upheaval).

Though crowd-following is useful, doing what the crowd does isn’t. This prominent quote from a movie character Alan Ashley-Pitt in Quigley Down Under, says it all[8]

"The man who follows the crowd will usually get no further than the crowd. The man who walks alone is likely to find himself in places no one has ever been."

That’s because thinking with the crowd exposes one to deep vulnerability, since crowd psychology hardly represents what the reality is. This is especially pertinent to the markets or even to politics.

Gustave Le Bon[9] spared no sympathy on the crowd’s unintelligence, he wrote,

``This very fact that crowds possess in common ordinary qualities explains why they can never accomplish acts demanding a high degree of intelligence. The decisions affecting matters of general interest come to by an assembly of men of distinction, but specialists in different walks of life, are not sensibly superior to the decisions that would be adopted by a gathering of imbeciles. The truth is, they can only bring to bear in common on the work in hand those mediocre qualities which are the birthright of every average individual. In crowds it is stupidity and not mother-wit that is accumulated.” (emphasis added)

And it’s not just Mr. Le Bon, but likewise one of the world’s richest and most successful investor, Mr. Warren Buffett, the sage of Omaha, subtlety admonishes people from using crowd psychology as justification to trade or invest[10],

"A great IQ is not needed to do well as an investor, what is needed is the ability to detach yourself from the crowd."

Why? Because what matters is independent ‘critical’ thinking! This ability, in my opinion, is to get within the ambit of what is consistently effective or what works and what doesn’t.

Author James Surowiecki sees non-correlation and diversity of knowledge as important variables to independent thinking, he writes[11]

``Independence is important to intelligent decision making for two reasons. First, it keeps the mistakes that people make from becoming correlated. Errors in individual judgement won't wreck the group's collective judgement as long as those errors aren't systematically pointing in the same direction. One of the quickest ways to make people's judgements systematically biased is to make them dependent on each other for information. Second, independent individuals are more likely to have a new information rather than the same old data everyone is already familiar with. The smartest groups, then, are made up of people with diverse perspectives who are able to stay independent of each other. Independence doesn't imply rationality or impartiality though. You can be biased and irrational, but as long as you're independent, you won't make the group any dumber.”

Since groupthink extinguishes personal opinion for the collective then the variability of information becomes eroded and homogenized and thus expanding the potential errors of the consensus in their assessment and their succeeding courses of action. Thus, independent thinking not only maintains the diversity of opinion and information, but should likewise be representative of more “efficient” markets.

Nevertheless, the groupthink phases of crowd psychology should be taken advantage of by people in the know.

THUS, people who think for themselves, who are not afraid to get socially ostracized and or lose ‘temporal’ acceptance via conformity or signalling, or are prepared to go against conventionalism/traditionalism are the people who are likely to work through with right actions derived from pertinent independent analysis.

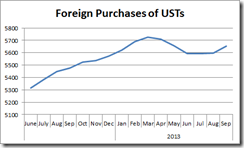

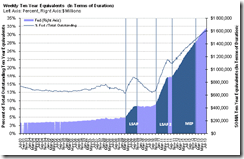

If there is one single market today which resonates actions of a bubble matched by groupthink psychology it is the US treasury markets.

The 10 year treasury whose bond yields are near the 3 decade long lows (left window), which I flipped to demonstrate the degree of the bubble action (red upside trend at the right window) is currently matched by the humdrum of daily fervid incantations of mainstream opinion makers and their followers, pumped up by from the insights of policymakers, of the mythical “deflation”.

As a caveat, let me repeat “mythical”, in the world of central banking, deflation would only exist once policymakers abandon to use of the printing press and accept the dominance of market forces.

This isn’t happening.

[1] Psysr.org, What is Group Think

[2] Ibid

[3] Spencer, Herbert, The Great Political Superstition (1884)

[4] Random Roving Blogspot, Running With The Crowd

[5] Codevilla Angelo M. Codevilla America's Ruling Class -- And the Perils of Revolution, Spectator.org

[6] Surowiecki, James The Wisdom of The Crowd (p 244) bloggiaim.com

[7] Andrew, Shawn; Jeffrey Hirsch Stock Trader’s Almanac 2010

[8] Iwise.com, Alan Ashley-Pitt

[9] Le Bon, Gustave Le Bon The Crowd p. 17

[10] MoneyCentral MSN.com 12 steps to being a 'Zen millionaire'

[11] Surowiecki, James loc sit