At the confirmation hearing in the halls of the US Congress, incoming US Fed Chairwoman Janet Yellen testified[1]

I don’t see evidence at this point, in major sectors of asset prices, misalignments. Although there is limited evidence of reach for yield, we don’t see a broad buildup in leverage, where the development of risks that I think at this stage poses a risk to financial stability.

The following is a showcase of charts and reports from which Ms. Yellen “don’t see a broad buildup in leverage” and “don’t see evidence at this point, in major sectors of asset prices, misalignments”

“No build up in leverage”

US commercial and Industrial loans are at 2007 highs. Consumer loans have equally been climbing now approaching 2010 levels.

US banking exposure to the commercial real estate sector has been skyrocketing where CRE loans outstanding notes the Institute of International Finance (IIF) now stand at some USD 200 billion above pre-crisis levels.

Also US mortgage REIT assets have more than tripled since the crisis. Yet the IIF warns US REITs are vulnerable to disruptions in repo markets, as repo market funding constitutes 90% of their liabilities[2]

U.S. covenant-lite loan issuance has soared past 2007 levels now at $210 billion year to date—“a multi-year record and almost three times that of last year” according to IIF.

US companies have reportedly been selling bonds at the fastest rate ever or on record as companies try to beat potential rate increases.

According to the Wall Street Journal[3],

The $1 trillion mark was passed in the 46th week this year, according to Dealogic. In 2012, the mark was passed in the 48th week, and in 2009, the mark was passed in the 50th week. Despite the record issuance, investment-grade corporate bonds haven't had a stellar year. They have posted a 1% negative return this month and a 2.16% negative return so far this year, according to Barclays

“No misalignment of prices”

The Wilshire US REIT Trust Total Market has passed the 2007 highs.

US Farmland prices has exploded vertically. The chart represents Iowa’s farmland prices based on the first semester of the year[4].

Although declining prices of commodities has been expected to slow simmering prices farmlands

From the Wall Street Journal[5]

A multiyear run-up in the value of farmland in the U.S. Midwest may be running out of steam.Average cropland prices declined in parts of the Farm Belt in the third quarter from the previous quarter while rising at a low rate in other areas, according to separate reports this past week by regional Federal Reserve banks in Chicago, St. Louis and Kansas City.The surveys also found that some agricultural bankers expect cropland prices to decline across the Farm Belt as 2014 approaches because big harvests this fall have driven grain and soybean prices sharply lower. Corn prices also are expected to weaken after the U.S. Environmental Protection Agency on Friday proposed for the first time lowering an annual requirement for how much ethanol should be blended into gasoline.

Talk about record prices. Last week’s art auction $380.6 million at the Sotheby’s nearly hit a record high previously set at $394.1 million. Nonetheless record auctions, according to a Bloomberg report[6] were set for seven artist including Andy Warhol, Cy Twombly, Agnes Martin and Martin Kippenberger.

Francis Bacon’s ‘Three Studies of Lucian Freud’ reportedly sold for $142.4 million at Christie’s to Acquavella Galleries which bested bested Edvard Munch’s ‘The Scream’. Meanwhile Jeff Koons sold his sculpture “Balloon Dog (Orange)” for $58.4 million, an auction record for a living artist, according to another Bloomberg report[7].

Soaring stock market prices, REITs at over 2007 highs, parabolic farmland prices and record art prices have been seen as no misalignment of prices. This time is different.

Frenzied Global Bonds

Around the world, global issuance of leveraged loans has vastly surpassed 2007 highs. Global corporate bond issuance particularly on High yield bonds has also reached records.

An update on this from the Financial Times[8] (bold mine)

Global borrowers with weaker credit quality are taking advantage of investors’ relentless search for higher yields to sell a record amount of bonds so far in 2013.Intelsat, the world’s largest satellite-services company, the US casino owner Caesars Entertainment and the luxury chain Neiman Marcus have been among the low-rated borrowers to have sold a combined $38.1bn debt this year, according to Dealogic. That amount surpassed the previous record of $37bn for the whole of 2012.Bonds with the lowest possible credit ratings have soared in popularity with investors, who have been diverted from top tier government and corporate debt where central banks are suppressing interest rates.

In today’s world, there is no such thing as default risks. Everybody has been piling up on one another to bid for companies even with the worst credit rating. That’s because zero bound rates and QEs has been seen to last forever.

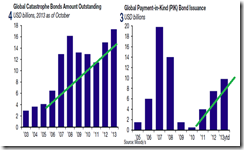

Same record high story with global catastrophe bonds and non record but rapidly rising Global Payment in Kind Bonds

See NO bubble. Move along, nothing to see here.

[1] Bloomberg.com Yellen Signals Continued QE Undeterred by Bubble Risk November 15, 2013

[2] Institute of International Finance November 2013 Capital Markets Monitor and Teleconference

[3] Wall Street Journal Companies Sell Bonds at Fastest Pace on Record November 14, 2013

[4] Irreplaceable Capital The Butterfly Effect June 15, 2013

[5] Wall Street Journal Midwest Farmland Values: Past Peak Season? November 15, 2013

[6] Bloomberg.com Warhol ‘Crash,’ Steve Cohen’s Richter Lift Sotheby’s Sale November 14, 2013

[7] Bloomberg.com Bacon, Koons Set Major Records in New York at Christie’s November 13, 2013

[8] Financial Times Record sales of lowest rated bonds November 14, 2013

No comments:

Post a Comment