Understanding the effect of emotion on your actions has never been more important than it is now. In the midst of this great financial and economic crisis that grips the world, Central Banks are printing money in one form or another. This makes our investment world even more prone to bubbles and panics than it has been in the past. Either plague can kill you.-Barton Biggs (1932-2012)

My mantra of “Bad News is Good News” has gone mainstream.

I begin this week’s outlook with an excerpt from the Wall Street Journal’s Real Time Economics Blog[1],

The U.S. stock market has recently been buoyed by notions of central bank nirvana, an expectation of more easing help for economies and therefore a boon for riskier assets such as stocks here and in Europe.

So a ‘bad’ jobs number for the economy might still have been interpreted as ‘good’ in stock markets because of the presumed certainty of easing in September from the Federal Reserve.

Stocks are indeed rallying, perhaps on the notion that the economy is not destined to decelerate into full stall, and because the gain might not be ‘good’ enough to be ‘bad,’ ‘bad’ meaning it would deter an active Fed from moving.

“Bad news is good news is” may also extrapolate to permanent quasi-booms in that if true, means that there will never be a bust. Political talk have almost always wished away economic laws.

Symptoms of Bipolar Disorder from Bubble Policies

“Bad news is good news” today emanates from the entrenched expectations by financial markets that central bank interventions will effectively counteract on the unfolding negative developments in the economic realm.

In the past, financial securities including the stock markets reflected on the adverse changes in the economic and financial dimensions through price declines.

Today, the concept of central bank inflationist “nirvana”, which represents in psychology “conditioned stimulus”[2], has severely been distorting the price mechanism of the financial marketplace.

Financial markets become operationally detached from reality. And central bank assurances and pledges of rescues have only underscored the moral hazard of policy making that has been evident through policy induced rampant speculations.

The popularity of inflationism as the great Professor Ludwig von Mises once warned is about getting something from nothing[3].

The popularity of inflation and credit expansion, the ultimate source of the repeated attempts to render people prosperous by credit expansion, and thus the cause of the cyclical fluctuations of business, manifests itself clearly in the customary terminology. The boom is called good business, prosperity, and upswing. Its unavoidable aftermath, the readjustment of conditions to the real data of the market, is called crisis, slump, bad business, depression. People rebel against the insight that the disturbing element is to be seen in the malinvestment and the overconsumption of the boom period and that such an artificially induced boom is doomed. They are looking for the philosophers' stone to make it last.

This has not just been theory. To my experience such policies have indeed been manifesting negative influence to the unsuspecting public. For instance, my counsel to take on a defensive posture have been begrudged and misinterpreted by some as depriving them of the opportunity to earn [and of course, the urge to satisfy one’s dopamine neurons...or the gambling instinct]

Yes inflationism brings out the worst in many people.

Yet for the past two weeks, global equity markets have exhibited increasing symptoms of a bipolar disorder[4] through flashes of abruptly shifting manic-depressive moods that has been ventilated on the markets through sharp volatilities.

Under pressure from increasing evidences of a global economic slowdown, financial markets have been treated promises to inflate—such as European Central Bank’s Mario Draghi recent pledge to do “whatever it takes to save the Euro[5]”—that has prompted financial markets to soar[6]

The two day risk ON mode from the pep talk by ECB President Mario Draghi resulted to a short term price convergence from supposedly disparate asset classes that has been labeled as the “Super Mario’s trifecta”[7].

The furious synchronized rally in global stocks (represented by the US S&P 500), can also be seen in gold and in US 10 treasury prices.

An almost similar pattern has emerged this week.

Again following early accounts of weaknesses in the financial markets, reports of a concession have been in the works by ECB and EU officials that could likely facilitate for the much anticipated “Big Bazooka”, fired up the global equity markets on Friday[8].

Most of the biggest gains last Friday were seen in major European equities bellwethers such as the Stox 50, the German Dax and UK’s FTSE 100.

However in contrast to the previous week, in the bond markets, US treasuries fell (yields increased) but Spanish (orange) and Italian (green) 10 year bonds climbed or yields fell.

For the past two weeks, each time reality returned to the markets (as seen by the spike in yields and selling pressures in equity) the recourse of ECB’s Mario Draghi has been to wheedle the markets with pledges.

Friday’s massive rally in the US came despite the questionable gains in the job report (as indicated by the above opening excerpt)—the improvements in the US job markets has eclipsed the increase in the unemployment rates, and importantly, has discounted on the large number of the people who dropped out of the labor force[9].

This implies that the real reason behind the rally in the US markets has been about the return of the global RISK ON mode initiated from the prospective ECB-EU deal which may be forged anytime.

Nonetheless, despite all the popular attributions of the recent rally, the constant declarations of support by central bankers have apparently been mainly designed to keep short sellers at bay.

Yet any deal will likely prompt Spain (and or Italy) to access the fast depleting European Financial Stability Facility EFSF (temporary fund) first. The ECB would likely function as bridge financier as the access to the European Stability Mechanism (permanent fund) will have to be fully ratified by EU member states, notwithstanding the much awaited German Supreme Court ruling on the opposition filed by several German lawmakers against the German parliament’s swift passage of the bailout fund or the ESM[10].

As I noted in a blog, I think that the US Federal Reserve may defer on the mulled QE as they are likely to wait for the ECB to take the initiative and consequently watch for the effect before taking action.

The Foggy Outlook of US Markets and the US Economy

Let me add that the strong Friday rally in the US stock markets may not be that convincing as market internals reveals of a “narrowing breadth” or declining participation of gains by key index issues. This means that the large gains posted by the S&P 500 have been mostly concentrated to a few index heavyweights.

Also the Dow transports appear to diverge with the Dow Jones Industrials. According to one of the 6 basic tenets of the Dow Theory[11], the averages must confirm each other. A genuine economic recovery will become evident in the profits of both transports and industrials which should get reflected on the respective prices of these benchmarks. Thus, the conflicting signals translate to market ambiguity.

The jumbled outlook in the market internals may even signify signs of distribution or of the diminishing forces of the bulls.

This could also signal indirect interventions by political authorities via ETFs as the Bank of Japan (BoJ) has been openly conducting.

Bad news is good news.

US stocks markets respond to Pavlovian classical conditioning even as the quarterly spread between companies raising or lowering earnings guidance has been materially deteriorating during the past four consecutive quarters[12].

With 45% of revenues of the S&P 500 index companies exposed to the world economy[13] the decline in earnings guidance should be expected considering the intensifying downdraft of global economies[14].

Mohamed El-Erian, CEO of one of the leading investment firms, PIMCO, has even expressed apprehensions by citing “frightening”, “serious, synchronized slowdown”[15]

But a US slowdown may come from both internal and external forces

Capital spending in the US as measured by new factory orders has also shown significant downturn.

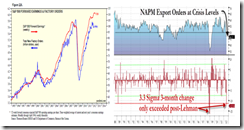

Dr. Ed Yardeni observes[16], (see left chart on the left window)

As go profits, so goes business spending. The recent stall in S&P 500 forward earnings isn’t a good omen for new factory orders, which have already stalled so far this year. Profitable companies expand their capacity by spending more on plant and equipment. Unprofitable companies scramble to cut their costs by reducing their capital outlays. In the real GDP accounts, the pace of capital spending has been slowing. It rose 5.3% (saar) during Q2 following a gain of 7.5% during Q1. Last year, such spending increased 8.6%.

And this has also been true with US export orders (right window from Sean Corrigan/Zero hedge[17])

There always will be something to be optimistic about. The question is which force will likely have a more powerful influence, the positive or the negative?

So far the continuing expansion of US business and industrial loans looks like one of the major bullish signs, but this would be highly dependent on business or capital spending indicators.

Also seasonality of stock market performances during US presidential elections, as well as, extreme bearishness of hedge funds (right window) and continued efflux by retail investors (left window Wall Street Journal[18]) represent as “crowded trade” sentiment.

Overall, I cannot see how seasonal forces and or how sentiment will overcome current fundamental deficiencies brought about the global central banking tentativeness and political gridlocks which has been prompting for today’s sluggish (bubble popping) economic outlook.

Seasonal forces mainly rely on the statistical probabilities of historical performance. This assumes previous historical conditions in the context of mathematical aggregates, as if the past had similar conditions. In reality conditions of the past have been unique. This makes reliance on statistics as a poor road map of the future.

Black Swan author and distinguished mathematician and iconoclast Nassim Nicolas Taleb in an interview with McKinsey Quarterly[19] warns about the inappropriate use of statistics

The field of statistics is based on something called the law of large numbers: as you increase your sample size, no single observation is going to hurt you. Sometimes that works. But the rules are based on classes of distribution that don’t always hold in our world. All statistics come from games. But our world doesn’t resemble games. We don’t have dice that can deliver. Instead of dice with one through six, the real world can have one through five—and then a trillion. The real world can do that.

The world is complex while aggregates rely on constants and assume simplifications.

Sentiments, on the other hand, signify as symptoms to an underlying cause.

The Phisix Ascendancy Depends on the Developments in the US

What do all these have to do with the Phisix and ASEAN stocks?

Everything.

I believe that the Phisix outperformance may continue for as long as the US does not fall into a recession.

China remains to be a significant factor too but she will likely be subordinate to the developments in the US. [I may be wrong here, as a deeper downturn in China may likely to affect many emerging market commodity exporters as well as the global supply chain networks]

However should the US economy and the financial markets capitulate to market forces, who will be exposing the massive misdirected investments through falling asset prices and through an economic recession, the chances are local and regional financial markets will likewise suffer from such agonizing cyclical adjustments.

Again like in 2007-2008 the Philippines and ASEAN may be subject to the risk of contagion.

Yet there has been little evidence in support of a regional decoupling.

And this brings us to the risk-reward trade off: I believe that under current conditions excessive optimism for the sustained ascension of the Phisix seems unwarranted. This is until central banks of major economies lay down their cards on the table or until we see some substantial improvements in the economic dimensions for major economies. However considering that inflationist policies has dominated much of the world’s economic and financial markets much of the misallocated capital will likely translate to the unwinding of speculative positions through economic and financial losses.

Also given the fluidity of developments as manifested by the alternating manic-depressive phases of how events unfold, the risks seems high that any policy errors may prompt for a swift and dramatic deterioration of conditions that may wipe any gains that may be temporarily acquired.

For me, to be excessively sanguine over local stock markets under the present conditions means the following;

1. unbounded faith in the capabilities of global and local central bankers (as well as politicians) to fix the current predicament.

2. belief that geopolitical and national political gridlocks will be resolved soon

3. a firm disposition to the theory of decoupling where the Philippines is presumed as having distinctive immunity to the risks of a global recession

4. to be hopeful that current global economic slowdown has reached an inflection point and will recover immediately

5. to simply believe for the sake of believing.

All the above simply posits of the severe underestimation of the risks conditions.

As English biologist Thomas Henry Huxley[20] once commented,

Logical consequences are the scarecrows of fools and the beacons of wise men

A US recession may not be in the cards yet, as we need to see more evidence on this. However considering the heavy dependency on the Fed’s or central banking steroids, much of the fate of the US economy will likely depend on how US political authorities will react. For instance if the FED forcefully inflates then this would likely produce a temporary patch.

While the risks of a US recession may not be imminent, such risks seem to be growing.

More Symptoms of the Philippine Boom-Bust Cycle

One of the big factors that has, so far, worked in favor of domestic stock market, as I have repeatedly been pointing out[21], has been the negative real rates which has impelled for a domestic version of yield chasing dynamic.

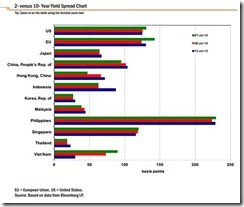

This yield chasing dynamic in the domestic financial market and the economy has been supported by a steep yield curve, which is likely to accelerate a credit driven boom. The Philippines has the steepest yield curve in Asia (chart from ADB[22]).

Such credit boom has already been visible via a double digit loan growth of the banking industry last May[23].

Also the business cycle has become quite evident in the performance of the stocks.

The banking and capital intensive property sectors have outclassed all other sectors. [If there should be no US recession, my guess is that mining and oil will resume as the market’s darlings in 2013]

As I wrote last November[24]

Although I am not sure which sector should give the best returns over the short term, I am predisposed towards what Austrian economics calls as the higher order stages of production or the capital goods industries, which are likely the beneficiaries of the business cycle, specifically, mining, property-construction and energy, as well as financials whom are likely to serve as funding intermediaries for these projects.

But again such credit driven boom will likely be subject or sensitive to the developments in the international sphere, and given the current conditions, I suspect that the credit boom may be deferred.

Miniature Bubbles: The Calata Episode

Negative real rates also give us miniature boom bust cycles or bubbles within bubbles.

I think the experience by Calata Corporation[25] [PSE: CAL], the recently listed agri product distributor, looks like a great example.

I recall of the passionate or even heated debates on a social network forum over the so-called merits of ‘investing’ based on corporate ‘fundamentals’.

Since the company listed in May, the wild price fluctuations of the issue exhibits, not of public’s perception about the company’s business model, but about the quick buck or short term mentality and the emotionally charged (greed and fear) speculative activities.

My guess is that most of those who dabbled with the issue have suffered excruciating losses than gains as Calata now trades below the IPO price at 7.5 pesos a share.

And yet due to the excessive volatility, like their counterparts in the Eurozone and elsewhere, the local authorities via the Security and Exchange Commission (SEC) recently launched an investigation for possible “stock market manipulation”[26].

This would seem more like chapter of witch-hunting that will likely end up nowhere. Nonetheless, such activities are seen as good for the populist politics of “do something”.

This unfortunate Calata incident also reveals of the way government deals with symptoms rather the disease, and who adroitly shifts the blame of the unintended consequences of social policies to the private sector.

While the Calata episode may not be representative of the entire Philippine stock markets yet, the basic lesson is that negative real rate regime molds the public’s orientation towards short term thinking, and importantly, whets on the public’s gambling appetite.

Yes many will always find ‘excuses’ to endeavor on supposed rationally based ‘investments’ when in reality they are only after “high risk-low return” dopamine seeking punts.

Negative real rates compel them towards speculative activities which in aggregate will become the dominant feature of the financial marketplace and the economy. Political suppression of interest rates therefore lays the foundations to the business or bubble cycles as speculations replace productive undertakings.

The Calata event signifies as the tip of the iceberg. Eventually as the markets go higher there will be more incidences of miniature bubbles ahead. Yet as the Japan bubble bust of 1990, Tequila crisis of 1994, Asian crisis of 1997, LTCM episode of 1998, dot.com bust in 2000 and US housing mortgage bubble bust 2008 have all shown, the broader market will likely transform into a full scale credit driven bubble if social policies remain attuned towards inflationism or the creation false prosperity from policy induced credit expansion.

As for the present state of the markets my bottom line is: For as long as global central bankers remain hesitant and only resorts to talking up the markets, in the face of a deepening slump in the global economy, I think global financial markets including the Philippines will be subject to intense price oscillations or a high risk environment.

Given the high correlationships of financial markets which has been the reason for RISK ON RISK OFF environments. Prudent investing means not having to put all your eggs in one basket.

[1] Real Time Economic Blog Are Jobs Data Bad Enough to Be Good for Stocks? Wall Street Journal, August 3, 2012

[2] Wikipedia.org Classical conditioning

[3] Mises, Ludwig von 9. The Market Economy as Affected by the Recurrence of the Trade Cycle XX. INTEREST, CREDIT EXPANSION, AND THE TRADE CYCLE, Human Action, Mises.org

[4] Wikipedia.org Bipolar disorder

[5] See What Draghi’s Statement “The ECB is Ready to do Whatever it Takes to Preserve the Euro” Means, July 29, 2012

[6] See The Magic of Central Banking Talk Therapy, July 28, 2012

[7] See Explaining Super Mario’s Trifecta, August 4, 2012

[8] See Will the Accord by the ECB-EU Politicians Pave Way for the Big Bazooka? August 3, 2012

[9] See Has Friday’s Surge by the US Stock Markets Been about the ‘Positive’ Jobs Report? August 4, 2012

[10] See Global Financial Markets: Will the EU Summit’s Honeymoon Last? July 2, 2012

[11] Wikipedia.org Dow theory

[12] Bespoke Invest Bad Guidance Continues, July 29, 2012

[13] See Why Current Market Conditions Warrants a Defensive Stance, July 9, 2012

[14] US Global Investors The Race for Resources, Investor Alert, August 3, 2012

[15] See PIMCO’s Mohamed El-Erian: “Frightening” Global Synchronized Slowdown, August 3, 2012

[16] Yardeni Ed, Capital Spending, Dr. Ed’s Blog July 31, 2012

[17] Zero Hedge US Export Orders Are Collapsing August 2, 2012

[18] Zweig Jason When Will Retail Investors Call It Quits? August 2, 2012, Wall Street Journal

[19] Mckinsey Quarterly Taking improbable events seriously: An interview with the author of The Black Swan December 2008

[20] Wikipedia.org Thomas Henry Huxley

[21] See Investing in the PSE: Will Negative Real Rates Generate Positive Real Returns? November 20, 2011

[22] ADB Key Developments in Asian Local Currency Markets AsianBondsOnline July 30, 2012

[23] Business Inquirer, Bank lending maintains double-digit growth rate in May—BSP, July 11, 2011

[24] See Phisix-ASEAN Equities: Awaiting for the Confirmation of the Bullmarket November 13, 2012

[25] Philippine Stock Exchange Calata Corporation

[26] Business Mirror Calata shares plummet as SEC confirms probe, August 2, 2012

No comments:

Post a Comment