The prospects of central banking inflation steroids bring hope to the forefront.

From Bloomberg,

The Dow Jones Industrial Average (INDU) climbed above 13,000, capping its longest weekly advance since January, amid speculation the European Central Bank will buy bonds to help lower borrowing costs and preserve the euro…

American stocks joined a global rally after two central bank officials said ECB President Mario Draghi will hold talks with Bundesbank President Jens Weidmann in an effort to overcome the biggest stumbling block to a new raft of measures including bond purchases. German Chancellor Angela Merkel and French President Francois Hollande echoed yesterday’s pledge by Draghi that they will do everything to protect the euro.

Bad news is good news: economic slowdown signifies as fodder for central bank support. More from the same article

Chart from tradingeconomics.com

In the U.S., data showed that the economy expanded at a slower pace in the second quarter as a softening job market prompted Americans to curb spending. Consumer confidence in July dropped to the lowest this year, according to a separate report. Cooling growth makes it harder to reduce unemployment, helping explain why Federal Reserve Chairman Ben S. Bernanke has said policy makers stand ready with more stimulus if needed.

“Growth has decelerated sharply,” said Philip Orlando, the New York-based chief equity strategist at Federated Investors Inc., which oversees $355.9 billion. He spoke in a telephone interview. “We need something to reverse that downtrend and that ‘something’ is policy.”

Consumers are cutting back just as Europe’s crisis and looming U.S. tax-policy changes dent confidence, hurting sales at companies from United Parcel Service Inc. to Procter & Gamble Co. Sales at almost 60 percent of S&P 500 (SPXL1) companies which reported second-quarter results missed estimates, data compiled by Bloomberg show. Still, 72 percent beat profit forecasts.

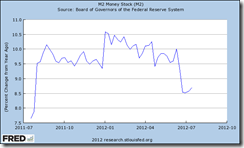

US equity markets have also been climbing amidst falling growth of money supply...

chart from St. Louis Fed

...also amidst declining forecasts or expectations for corporate earnings...

Dr. Ed Yardeni notes

As a result, the 2012 and 2013 estimates are at new lows of $104.11 and $116.41, respectively. These numbers imply earnings growth rates of 6% this year and 12% next year. They may still be too optimistic since revenue growth is likely to be closer to 5% during 2012 and 2013, while profit margins are likely to remain flat over this period.

Well, all these goes to show how financial markets, desperately seeking yields, have become ‘dopamine addicts’.

Douglas French at the Laissez Faire Books explains,

…cheap money combined with the herding animal spirits is a certain cocktail to engender bubbles. Tragically, these booms are followed by the inevitable busts, creating regret that is the difference in investors minds between the value of what is and the value of what could have been.

This is important because of dopamine, which is a chemical in the brain that helps humans decide how to take actions that will result in rewards at the right time.

People don’t get a dopamine kick when they get what they expect, only when they make an unexpected windfall. So, as Jason Zweig writes in Your Money and Your Brain, drug addicts crave ever-larger fixes to achieve the same satisfaction and “why investors have such a hankering for fast-rising stocks with ‘positive momentum’ or ‘accelerating earnings growth’.”

Also, dopamine dries up if the reward you expected fails to materialize.

The brain has 100 billion neurons and only one-thousandth of one percent produce dopamine, but “this minuscule neural minority wields enormous power over your investing decisions,” cautions Zweig.

Dopamine takes as little as a twentieth of second to reach your decision centers, estimating the value of an expected reward and more importantly propelling you to action to capture that reward. “We’ve evolved to be that way,” explains psychologist Kent Berridge, “because passively knowing about the future is not good enough.”

The effect of all this is what Zweig refers to as “the prediction addiction.” Humans hate randomness. We want to predict the unpredictable, which originates in the dopamine centers of the reflective brain, according to Zweig, leading humans to see patterns where none really exist…

The attempt to satisfy the dopamine which has been evoked by central bank policies, leads people to become increasingly more dependent on heuristics based thinking

More from Mr. French

We all tend to constantly feed our confirmation biases, seeking out experts that confirm our view of the world. We read writers that we agree with so that we can feel smarter, while ignoring or dismissing opinions different from our own.

Our brains are great for keeping us alive in the jungle. We look for patterns and motion. These instincts kept the cavemen alive, not to mention Wall Street’s technical analysts, but wreck the portfolios of investors.

Investors love a good story, but are vulnerable to anecdotes that mislead us, says Ritholtz.

No wonder markets are not sources of information, but instead sources of misinformation, according to resource investing guru Rick Rule…

“The information that people derive from markets is spectacularly wrong,” says Rule, a devotee of legendary investor Benjamin Graham. Like Graham, Rule looks for undervalued stocks and only wants to buy them when they are on sale. Quoting Graham, Rule says, “markets in the short term are voting machines, while in the long term they are weighing machines.”

Housewives are much more rational buying groceries than investors are in buying stocks. While a housewife will turn her nose up at expensive tuna fish, she will load up on it once it goes on sale. Conversely, her investor husband, in Rule’s story, is happy when the share price of his favorite stock goes up and he buys more. When the share price falls, he doesn’t buy more, as his wife does with tuna fish, but instead sells out in disgust.

In short, stock markets (and the financial markets) have been in disconnect with reality. Promises have been taken as facts.

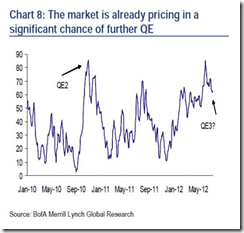

Equity markets have mostly priced in prospective central banking support via QEs…

chart from Zero Hedge

The question now is how sustainable will this talk therapy rally be? Will talk therapy be enough to reinforce the current reanimated 'animal spirits' and filter into economic reality? What if central banks don't deliver as the markets expect?

P.S. I won’t be making my regular stock market commentary tomorrow.

No comments:

Post a Comment