Life in general has never been even close to fair, so the pretense that the government can make it fair is a valuable and inexhaustible asset to politicians who want to expand government.-Thomas Sowell

Since I look at the world events from the big picture perspective, I hardly change on my views unless some random events (for me) should radically alter the embedded trends.

Following the FED-ECB announcements to support asset prices, I hold on to the premise that these actions combined with domestic interest rates are likely to feed through asset prices especially for ASEAN-Phisix markets

As I wrote last week[1],

artificially suppressed interest rates that have brought about a domestic negative real rates regime, as well as, foreign capital flow movements influenced by external credit easing policies (negative real rates and Quantitative Easing), are likely to further inflate bubble dynamics in the country and in the region, far more than their developed economy and BRIC counterparts.Yet such credit driven boom will be interpreted by the mainstream as “economic growth” when in reality they represent a bubble cycle or systemic misallocation of capital in progression.One must be reminded that bubbles come in stages. So far the Philippines seem to be at a benign phase of the bubble cycle.Again bubbles will principally be manifested on capital intensive sectors (like real estate, mining, manufacturing) and possibly, but not necessarily, through the stock markets.This means that for as long as the US does not fall into a recession or a crisis, ASEAN outperformance, fueled by a banking credit boom and foreign fund flows operating on a carry trade dynamic or interest rate and currency arbitrages (capital flight I might add), should be expected to continue.And again I will maintain that ASEAN’s record breaking streak may be sustained at least until the end of the year 2012.Yet such streak will strictly be conditional to the political-economic developments abroad, as well as, on the monetary engagements by major central banks.

It is important to point out that given the fragility of the current external environments shocks, which may be viewed as a random or “black swan” event, should not be discounted.

Nevertheless global markets as indicated by major benchmarks mostly retrenched this week.

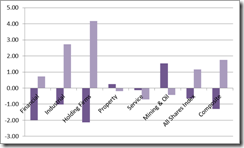

The current pullback (dark maroon bars) essentially represents reversals from last week’s material gains (light maroon bars). This is particularly true for ASEAN markets, India, Russia, France and the US.

So far, this suggests of an environment marked by trading range or a consolidation period.

For the Phisix, the current retreat off the recent record highs should be seen as countercyclical correction phase which normally follows a landmark upside breakout. This should be used as an opportunity to position or accumulate depending on the industry.

From a technical support-resistance perspective, the correction phase brings back the Phisix to the former resistance level (about 5,365), currently the minor support level.

Should the profit taking stage continue, then the 5,175-level can be seen as the next stop or the next support level.

Although my guess is that this bullmarket reprieve is likely to be short and narrow

Rotational and Seasonal Forces at Work

I may further that a rotation process typifies this week’s sectoral performance.

The mining index, which has lagged the broader market last week (light violent) and for the rest of the year, has considerably outperformed this week (dark violent).

Rotating leadership has been the crux of the inflationary boom in the Phisix.

As I pointed out last week, I expect 2013 to be the year where the mining index would regain their leadership. The alternating annual leadership since 2007, not only accounts for the normative rotational process, but also of the truism of “no trend moves in a straight line”, and or, the reversion to the mean.

I would add that seasonal factors could also be a factor in play.

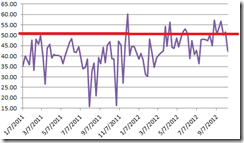

The September-October window has been notorious for major stock market crashes[2].

But given that the US Federal Reserve and the European Central Bank’s recent announcement of “unlimited” buying of bonds (estimated at $2 trillion or more), particularly aimed at providing support to financial assets, the likelihood of a nearby crash seems vastly reduced.

Again as pointed out last week, instead what we may be seeing could be the “buy the rumor, sell on news” dynamic. The massive build up of expectations from central bank steroids priced in a boom. The realization brought about by these central banker’s moves to reflate the system may have triggered some profit taking activities.

So “sell on news” could have been compounded by seasonal weakness[3]. This perhaps could be due to back to school expenditures in the US, and for the Philippines, second semester[4].

Yet as October culminates, we should expect an acceleration of the price recovery of the Phisix and ASEAN bellwethers which will likely come in the backdrop of the ECB’s active engagement of asset purchases. This should emanate from the activation or institution of the permanent bailout fund, the European Stability Mechanism[5].

Parallel Universe: Markets and Economic Reality Diverge

Lingering global economic weakness could be a factor too.

However, this seems likely a subordinate force. That’s because massive interventions in the marketplace have spawned a parallel universe—where prices of financial assets have departed from economic reality.

Proof?

The Phisix continues to break into new highs even as a sharp fall in Philippine exports last August will likely to weigh down on statistical economic growth and on earnings of export based publicly listed companies.

Contra mainstream expectations, whom have mostly been entranced by political illusions, the decline in exports validates my prognosis last July[6].

Yet no amount of downward revisions of company earnings[7] has put to halt to the year-to-date advances of US equity benchmarks specifically, the Dow Industrials 9.1%, the S&P 500 13.6% and the Nasdaq 16.85% in spite of this week’s substantial 2%+ of losses for each of them.

Similarly no amount of downward revisions[8] has been an obstacle to substantial year-to-date gains of over 10% for industrialized economies of ex-Japan Asia; Singapore, Hong Kong, Australia and New Zealand, except for Taiwan and Korea whom are up by 5%+. For emerging Asia the story has been the same, Thailand, Philippines, India, Vietnam and Indonesia has been on fire with 10-20% gains except for Malaysia (8%+).

This serve as more proof that in a world of fiat money, corporate earnings have hardly been a major factor in determining the price direction of equity markets.

Now that the FED-ECB has thrown the gauntlet for significantly more interventions, mainstream analysts have begun to bloviate about a “recovery” in earnings, i.e. to justify even higher prices.

If downside revisions hardly influenced stock prices to reflect on its “actual” state, the same analysts have now suggesting that “improvements” in earnings will extrapolate to higher stocks. It’s a bizarre twist of logic.

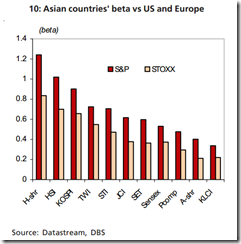

The Asian outperformance has been bruited as sporting a low beta relative to the US S&P and Euro Stoxx[9] which seem to imply of “decoupling”.

This placid state of relative low beta has accounted for the non-recessionary environment for the US. The notion of decoupling in a deeply interconnected world and financial markets resonates Sir John Templeton’s four most dangerous words in investing, “This time is different”[10]

As the Asian Development Bank warns[11],

Yet, the Lehman shock in 2008 and the ongoing eurozone debt crisis have tested the resilience of these markets, and the threat of financial contagion is real. A closer analysis shows that shock and volatility spillovers from both crises to Asian markets are quite significant.

Finally the main empirical evidence on why ASEAN has been relatively outperforming the rest of Asia…

…can be seen from ASEAN’s credit growth[12], where ASEAN has surpassed the region’s industrialized and major emerging market counterparts.

As I have repeatedly been pointing out, these have been the outcome of lesser fiscal baggage, which brings about more traction on the negative real rates imposed by their respective central banks, and from the steep yield curve, which induces the banking system to issue more credit to take advantage of the spread.

All these constitutes as main ingredients to a credit bubble.

The Progressing Inflationary Boom, Political Feel Good But Cruel Intentions

Internal market indicators remain buoyant

Despite this week’s retrenchment in major Phisix weighted issues, broadbased sentiment have been perking up behind the scenes.

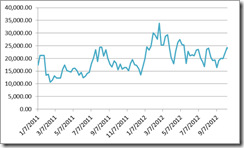

The weekly averaged daily trades have been rebounding. This means either that there have been more market participants or that current participants have been trading or churning their accounts more frequently. To do so suggests of confidence in the marketplace.

The rebound in daily trades has equally been confirmed by a bounce in the average number of issues traded daily.

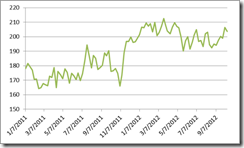

Confidence has also been diffusing to the extent where market participants have been dabbling with third tier issues.

And considering the lack of liquidity, third tier issues tend to generate outsized returns that often magnetize people afflicted with the gambler’s tick.

The supercilious idea by certain bureaucrats that some speculators have formed into syndicates of “trading gangs”[13] to take advantage of others through manipulation of the markets via social media misses the point entirely: Inflationary booms electrify the gambler’s adrenalin or the speculator’s dopamine[14].

Both charts above reveals of the broad based yield chasing phenomenon brought about by negative real rates regime.

Since incentives drives people’s actions, the incentive to punt or to wager has been prompted for by the desire to eke out returns on an environment imposed upon the unwitting public of policies that penalizes savings and rewards irresponsibility and fecklessness.

The narrowing people’s time preferences only encourage wanton wagering.

In reality people’s response to incentives from government’s manipulation of the marketplace signify as symptoms of the bubble or business cycle in motion.

Read my lips: Don’t mistake effects as the cause; it is government policies that incentivize on most of such malfeasance.

Yet people don’t realize that at the peak of a mania, imprudence becomes the norm. (see above diagrams)

As late economist Lionel Robbins wrote[15],

And if they do not last — and you can see that once people have been seized with the speculative mania it would take a continuously increasing inflation to keep them going — if these conditions do not last, then these mistakes are revealed.

The fact that authorities cannot see these manifests of their cluelessness or of their dishonesty by attempting to pass the blame onto the marketplace what truly has been a policy design, i.e. To promote aggregate demand through consumption and speculation via inflationary “euthanasia of the rentier” policies.

Let me add that if local authorities can’t seem to see this, ironically the IMF has[16]

“It is a concern,” said Laura Kodres, an assistant director in the IMF’s monetary and capital markets department, told reporters in Washington today. “The low interest rates environment has a lot of other effects besides lowering interest rates to consumers.”“Widespread evidence suggests that a prolonged period of low short-term interest rates encourages excessive risk taking” by financial institutions, the IMF wrote in a chapter of its Global Financial Stability report released today.

If financial professionals are gullible enough to fall into the low interest rate trap, then how much more the retail investors?

Yet pretentious attempts to control prices from supposed unwieldy behavior by the markets through feel good sounding regulations represents as the alter ego of inflation.

As the great Ludwig von Mises warned[17],

The second mischief is that those engaged in futile and hopeless attempts to fight the inevitable consequences of inflation — the rise in prices — are masquerading their endeavors as a fight against inflation. While fighting the symptoms, they pretend to fight the root causes of the evil. And because they do not comprehend the causal relation between the increase in money in circulation and credit expansion on the one hand and the rise in prices on the other, they practically make things worse.

This week’s substantial retreat by the Phisix has hardly accounted for as a broad market decline. This only solidifies the theory of rotation or relative pricing from an inflationary boom as evident in the stock market.

Many took profits from outperforming Phisix issues and shifted to the mining industry and to other third tier issues.

Nevertheless these signify as signs that market participants still desire to remain engaged with the stock market.

Amidst QE: The Mighty Peso and Prospective Foreign Fund Flows

Finally it has been clear that local investors have been instrumental in providing most of the support on the domestic market so far.

Typically, foreign funds accounts for about 40-45%

This matches the fund flows monitored by the IMF where foreign fund flows to emerging market bonds and to equities have remained modest through most of 2012.

This dynamic I expect to change soon.

A simple clue can be seen below

I have argued that domestic financial repression policies by developed economies will eventually prompt for more dramatic yield chasing dynamic or euphemism for capital flight on a global scale.

While all central banks have been engaged in either printing money or adding digital entries to their balance sheets, the difference is on the degree.

The highly impressive strength by the Philippine Peso exhibits this seminal phenomenon.

The Peso has been rising against the European euro, the Japanese yen, the British pound and even the Chinese Yuan. I purposely excluded the US dollar since everyone has been fixated on this, as well as, the Swiss franc which has been anchored to the euro. Nevertheless, the mainstream will be surprised to realize that the Peso has been outperforming currencies of major economies; no not because of grandeur accomplishments by political leaders but as consequence mostly from the war on interest rates from monetary actions

I believe that the Japan may spearhead that capital flight to ASEAN[18]

Considering that the valuations of currencies have to take into account principally the demand and supply as per the great Professor von Mises’ advise [19],

The valuation of a monetary unit depends not on the wealth of a country, but rather on the relationship between the quantity of, and demand for, money. Thus, even the richest country can have a bad currency and the poorest country a good one.

The supply of money remains relatively in favor of the Peso. That’s because the Bangko Sentral ng Piliipinas, or the BSP, does much less in balance sheet expansion than her peers. Oh yes you can ignore or take the verbal waffling or twaddle about the BSP refusing to print money with a grain of salt, unless they obscure or change the definition of money creation. In reality they have been doing as their peers[20].

On the demand side, the underlying and largely ignored credit boom has been painting the Philippines and the ASEAN peers as providing the economic “growth” premium.

Bottom line: Despite the current fragility from global economic anxieties, I expect financial repression in developed economies to funnel significant amount of money into ASEAN region and into the Philippines.

For now, unless stagflation becomes a clear and present danger, expect the Phisix and ASEAN markets to reach new highs until at least the year end, provided no external shocks emerge.

[1] see Phisix-ASEAN Bellwethers at Fresh Record Highs October 8, 2012

[2] Wikipedia.org List of stock market crashes and bear markets

[3] Business Insider September Is The Worst Month For Stocks — But Do You Realize HOW Bad It Really Is? September 3, 2012

[4] See Austrian Business Cycle and September Market Crashes June 27, 2012

[5] See Europe’s ESM Activated, Expect ECB to Rev Up on the Printing Press October 9, 2012

[6] See I Told You So Moment: Philippine Exports Hit in August, October 12, 2012

[7] Ed Yardeni S&P 500 Revenues & Earnings October 9, 2012

[8] DBS Group Research Economics Markets Strategy 4th Quarter September 13, 2012

[9] DBS Research ibid

[10] Parkman Bob Consider these 'words of wisdom' about investing SirJohnTempleton.org September 20, 2006

[11] Asian Development Bank ASIA BOND MONITOR SEPTEMBER 2012 ADBOnline.adb.org

[12] IMF Regional Economic Outlook Asia and Pacific Regional Economic Outlook––October 2012 Update, October 11, 2012

[13] See The Philippine SEC’s Phantasm of “Trading Gangs” October 14, 2012

[14] See The Magic of Central Banking Talk Therapy July 28, 2012

[15] Lionel Robbins The Twofold Roots of the Great Depression: Inflationism and Intervention, October 1, 2010, Mises.org

[16] Bloomberg.com Low Interest Rates May Lead to Risky Behavior, IMF Says September 28, 2012

[17] Ludwig von Mises Inflation and Price Control May 27, 2005

[18] See Will Japan’s Investments Drive the Phisix to the 10,000 levels?, March 19, 2012

[19] Ludwig von Mises STABILIZATION OF THE MONETARY UNIT—FROM THE VIEWPOINT OF THEORY (1923) THE CAUSES OF THE ECONOMIC CRISIS p.18 Mises.org

[20] See How True is it that the BSP Refuses to Print Money? October 9, 2012

No comments:

Post a Comment