I’m taking this week off from my weekly stock market outlook.

In gratitude to my readers, I will leave something for you to ponder on this weekend: Important charts depicting what seems as the greater fool theory in motion at the US stock markets. Remember, what happens to the US will most likely have a domino effect to the world.

Greater fool theory—buying assets in the hope that greater fools will buy the same assets at a much higher price—or as per Wikipedia.org—”a situation where the price of an object is not being driven by intrinsic values, but by expectations that irrational bidders for limited assets or commodities, will set the price”

Bullishness in investor sentiment has now reached extreme levels (Zero Hedge). The sustained upside movement has only strengthened the convictions of the bulls and the fools, luring more and more of them into a bidding spree.

Yet this appear to be signs of a ‘crowded trade’ where everybody’s "all in" and everyone's expecting higher prices from more fools buying at higher prices (endowment bias).

Question is but what if there are lesser number of fools to sell to?

Question is but what if there are lesser number of fools to sell to?

Who could be the fools?

Record US stocks have been driven mostly by retail/household punters (in billion of dollars).

Household buying of US stocks have also reached milestone highs, drifting slightly above the 2000 and 2007 levels (Yardeni.com).

The last 2 times US households furiously stampeded into the stock markets, bear markets followed (see pink rectangles). Remember the crash from the dot.com bubble bust and the US housing mortgage bubble bust? Again household buying has reached "peak" levels of 2000 and 2007.

Question is could the Bernanke-Yellen policies have transformed stocks into a “permanently high plateau” (to borrow from the late economist Irving Fisher)?

Will this time be different?

What has financed such bidding frenzy from the bulls and the fools? The short answer is DEBT.

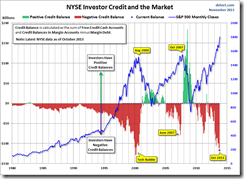

Record US stocks have now coincided with record margin debt.

Margin ‘real inflation-adjusted’ debt has currently surpassed the 2000 levels but has been slightly off the 2007 record highs.

Margin debt including free cash accounts and credit balances in margin accounts or Credit Balance as the sum of Free Credit Cash Accounts and Credit Balances in Margin Accounts minus Margin Debt as per Doug Short, which are also at record levels, reveals how punters have increasingly used leveraged to push up stocks to record territory.

It's more than just margin debt and investor credit.

Systemic leverage in order to chase yields have been intensifying and broadening, from bond issuance to finance stock buybacks, near record consumer and industrial loans, stratospheric unprecedented levels for commercial real estate lending and more.

Systemic leverage in order to chase yields have been intensifying and broadening, from bond issuance to finance stock buybacks, near record consumer and industrial loans, stratospheric unprecedented levels for commercial real estate lending and more.

What have the bulls and the fools been buying?

Record stocks comes amidst declining EPS (Business Insider)…

…as well as record negative over positive eps announcements (Zero Hedge).

All these means that the fools have been chasing multiples rather than eps growth with escalating debt.

Will the current bonanza via a “don’t worry be happy” trade remain in favor of the stock market bulls and the fools?

Perhaps. Depending on how many more fools can be seduced into the frenzied pile up. Mania phases can have an extended period of euphoria. Manias signify the "peak" of the bubble cycles where convictions have been the strongest.

Nevertheless the farther the height of the serial increases, the bigger the accumulation of risk via more debt, the greater the fall.

Perhaps. Depending on how many more fools can be seduced into the frenzied pile up. Mania phases can have an extended period of euphoria. Manias signify the "peak" of the bubble cycles where convictions have been the strongest.

Nevertheless the farther the height of the serial increases, the bigger the accumulation of risk via more debt, the greater the fall.

Based on the “log periodic” pattern designed by economist Didier Sornette where bubbles reflect on “a widening gap between the increasingly extrapolative expectations of market participants and the prospective returns that can be estimated through present-value relationships linking prices and likely cash flows” current momentum indicates of an accelerating odds of a text-book stock market crash, according to fund manager John Hussman

Well such risks will be discarded and the ignored by the bulls and their fools because stock markets, for them, have been perceived as a one way street: "up, up, up and away!"—courtesy of the Greenspan-Bernanke-Yellen Put, which some believe have worked as an elixir.

At the end of the day, let us see who will be holding the proverbial bag.

At the end of the day, let us see who will be holding the proverbial bag.

No comments:

Post a Comment