Another very interesting development. US banks have reportedly shunned US Treasuries in favor of stashing cash.

From Bloomberg:

Never before have America’s banks been so wary of risking their cash deposits on U.S. government debt.After holdings of U.S. debt surged to a record $1.89 trillion in 2012, lenders from Citigroup Inc. to Bank of America Corp. and Wells Fargo & Co. (WFC) are culling for the first time in six years and amassing dollars. Banks’ $1.8 trillion of the bonds now equal less than 70 percent of their cash, the least since the Federal Reserve began compiling the data in 1973.With net interest margins falling to the lowest since 2006, banks are spurning Treasuries and hoarding unprecedented amounts of cash on prospects that loan demand will revive as a strengthening economy leads the Fed to reduce its own debt purchases. Five years of cheap-money policies also have depressed yields and made it less attractive for banks to buy Treasuries as a way to bolster income.

Lowest government bond holdings on record…

Banks’ stakes of Treasuries and federal agency bonds have declined more than $80 billion in 2013, data compiled by the Fed show. That would be the first annual decrease since 2007. At the same time, cash held by banks has surged by a record $882 billion this year to an all-time high of $2.59 trillion.Government bonds now represent 69 percent of banks’ cash, which would be the lowest on record and the first time lenders ended a year with a smaller proportion of U.S. debt relative to cash since 1980, the data show. Banks’ holdings of assets consisting primarily of municipal bonds, asset-backed securities, company debt and equity investments have also risen.

Some observations

US Banks have now been lending to Wall Street at a record pace.

Banks holdings have rotated from USTs into cash but also partly into equities.

Banks appear to be sensing trouble with the US treasury markets as indeed cash assets of all commercial banks have spiked to unprecedented levels.

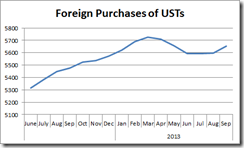

US treasuries (USTs) have mainly been supported by foreigners (mostly by the Chinese and the Japanese) which has staved off a bond market rout. (Data from the US Treasury TIC)

I argue that the behind the controversial Senkaku island dispute has been the politics of US Treasury holdings by China and Japan or the financing of the US government spending.

You see Japanese and Chinese record holding of USTs comes amidst a partial recovery from a near term decline in the overall purchases of USTs by foreigners. This means that in terms of foreign holdings, USTs has been essentially a Chinese-Japanese affair.

Yet if the Chinese government makes good on her threat to trim holdings of USTs, along with a continuing decline of UST holdings by most of foreigners (ex-Japan), and if US banks persist to reduce exposure then this leaves the US Federal Reserve as the buyer of last resort.

The Fed now owns a third or 32.47% of the 10 year UST equivalent according to the Zero Hedge

This tell us that there will hardly be any taper, because a taper means a dearth of buyer of USTs which also extrapolates to a bond market disaster.

Lastly the above report seems as partial vindication to what I wrote on USTs 2 weeks back

Mr. Bernanke’s tapering bluff was called last September.Aside from tapering expectations, rising rates of US treasuries (USTs) have been partly reflecting on a combination of the following factors-inflationary boom gaining traction which has spurred accelerating demand for credit thus pushing up interest rates.-erosion of real savings or the diminishment of wealth generators or growing scarcity of real resources due to the massive misallocation of resources prompted by central bank inflationist policies.-diminishing returns of central bank policies where continued monetary pumping has led to higher rates.-inflation premium, despite relatively low statistical CPI. Perhaps markets have been pricing inflation of asset bubbles-growing credit risks of the US government-Triffin Dilemma or Triffin Paradox where improving US trade deficits have been reducing US dollar liquidity flows into the global economy.

Any astute observer will realize that a single policy mistake can bring--the entire house of cards standing on a credit bubble--crumbling down.

No comments:

Post a Comment