I have written a lot about how the evolution towards “financialization”—where the finance industry has practically grown in such a huge size to eclipse traditional economic sectors as the industry and agriculture—has been due to the US dollar standard and how this has reconfigured today’s global financial and economic structure. As examples see here, here here and here.

I have also noted that financialization has been an unintended consequence from Triffin Dilemma also brought about by the US dollar standard.

I have also noted that financialization has been an unintended consequence from Triffin Dilemma also brought about by the US dollar standard.

Former politician and current iconoclast David Stockman eloquently explains how the tampering of the incumbent monetary system, or specifically the conversion from Bretton Woods 'fixed exchange standard' to the US dollar standard operating mostly on ‘floating exchange rate’ has sired “financialization” that has benefited mostly Wall Street.(from David Stockman’s Contra Corner) [bold mine, italics original]

Under the fixed exchange rate regime of Bretton Woods—ironically, designed mostly by J.M. Keynes himself with help from Comrade Harry Dexter White—there was no $4 trillion daily currency futures and options market; no interest rate swap monster with $500 trillion outstanding and counting; no gamblers den called the SPX futures pit and all its variants, imitators, derivatives and mutations; no ETF casino for the plodders or multi-trillion market in “bespoke” (OTC) derivatives for the fast money insiders. Indeed, prior to Friedman’s victory for floating central bank money at Camp David in August 1971 there were not even any cash settled equity options at all.The world of fixed exchange rates between national monies ultimately anchored by the solemn obligation of the US government to redeem dollars for gold at $35 per ounce was happily Bloomberg-free for reasons that are obvious—albeit long forgotten. Importers and exporters did not need currency hedges because the exchange rates never changed. Interest rate swaps did not exist because the Fed did not micro-manage the yield curve. Consequently, there were no central bank generated inefficiencies and anomalies for dealers to arbitrage. Stated differently, interest rate swaps are “sold” not bought, and no dealers were selling.There were also natural two-way markets in equities and bonds because the (peacetime) Fed did not peg money market rates or interpose puts, props and bailouts under the price of capital securities. This means that returns to carry trades and high-churn speculation were vastly lower than under the current regime of monetary central planning. Financial gamblers could not buy cheap S&P puts to hedge long positions in mo-mo trades, for example, meaning that free market profits from speculative trading (i.e. hedge funds) would have been meager. Indeed, the profit from “trading the dips” is a gift of the Fed because the underlying chart pattern—mild periodic undulations rising from the lower left to the upper right–is an artifice of central bank bubble finance.And, in fact, so are all the other distincitive features of the modern equity gambling halls—index baskets, cash-settled options, ETFs, OTCs, HFTs. None of these arose from the free market; they were enabled by central bank promotion of one-way markets—that is, the Greenspan/Bernanke/Yellen “put”. The latter, in turn, is a product of the hoary doctrine called “wealth effects” which would have been laughed out of court by officials like William McChesney Martin who operated in the old world of sound money.In short, Wall Street’s triumphalist doctrine—claiming that massive financialization of the economy is a product of market innovation and technological advance—is dead wrong. We need “bloombergs” not owing to the good fortune of high speed computers and Blythe Master’s knack for financial engineering; we are stuck with them owing to the bad fortune that Nixon and then the rest of the world adopted Milton Friedman’s flawed recipe for monetary central planning.

In short, the US dollar standard has spawned one colossal global bubble finance.

I recommend that the article be read in the entirety: via the link here

I recommend that the article be read in the entirety: via the link here

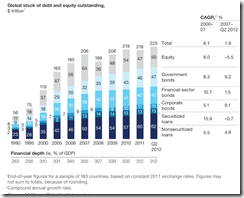

Another beneficiary of the financialization, of course, has been the government. Such has been accommodated through exploding global debt markets as shown in the chart above.

And as pointed out earlier,

Yet what is unsustainable will eventually stop.

And as pointed out earlier,

"the real reason why governments promote the quasi permanent inflationary boom is to have access to money (via credit markets and taxes) to support their pet projects. And proof of this is that global debt, according to the Bank of International Settlements have ballooned to $100 trillion or a $30 trillion or a 42% increase from 2007 to 2013 due mostly to government spending. Such colossal diversion of resources is why the world is now faced with a clear and present danger of a Black Swan economic and financial phenomenon."In other words, financialization functions as a key instrument to rechannel or divert economic resources from society to political agents and their cronies backed by guarantees from central banks. And bubble blowing is just one of the major consequences.

Yet what is unsustainable will eventually stop.

You write, the US Dollar Standard Has Spawned One Colossal Global Bubble Finance

ReplyDeleteThe US Dollar Standard was the brainchild of Milton Friedman and grew to become the age of credit which centered around currency carry trade investing in Regional Airlines, such as Ireland’s RYAAY, the Nation of Ireland, EIRL, and its Bank, IRE, as well as debt trade investing in companies such as Real Estate Investment Company, Blackstone, BX, Automobile Parts Manufacturer, DLPH, and Industrial Equipment Provider, HEES.

Fiat asset bubbles no more. Jesus Christ, acting in dispensation, a concept presented by the Apostle Paul in Ephesians 1:10, completed the age of credit during March 2014, as the Bear Market Of 2014, both in equity investments, VT, and credit investments, AGG, picked up steam, on the exhaustion of the world central banks’ monetary authority; and pivoted the world into the age of debt servitude.

The inflationism of the US Fed is history. The new normal economic dynamic is destructionism, which will be seen in economic deflation, and ever increasing austerity, coming largely from disinvestment out of currency carry trade investments, and derisking out of debt trade investing, on the exhaustion of the world central banks’ monetary authority, as these have crossed the rubicon of sound monetary policy and have made money good investments bad.

The failure of credit has commenced. The bond vigilantes calling the Interest Rate on the US Ten Year Note higher to 2.79%, in early March 2014, on the failure of trust in the world central banks to stimulate global growth, has caused Distressed investments, FAGIX, (as well as other High Yielding Debt such as JNK, BDCS, VCLT, HYXU, HYMB), which the US Fed to take in under QE 1, and trade out money good US Treasury Notes to trade lower from their early March 2014 high.

Equity is no longer leveraging higher over debt as is seen in World Stocks, VT, relative to Aggregate Credit, AGG, VT:AGG, to trade lower.

Deleveraging out of currency carry trade investments and derisking out of debt trade investments that is producing the Bear Stock Market of 2014, which is introducing Kondratieff Winter, the final phase of the Business cycle, and all four components of Total Spending will plummet introducing great economic recession, characterized by economic deflation.

The age of debt servitude features the debt serf, working through his debt servitude, where all the debts of the former age will be applied to every man, woman and child on planet earth, until all fiat wealth and fiat money is utterly pulverized into dust as is foretold in bible prophecy of Daniel 7:7.

Examples are now starting to flow in WSWS writes as Detroit water cutoffs, and as Ambrose Evans Pritchard writes with those in the Ukraine serving as an example.