Cato’s Mark Calabria says that mortgage subsidies in the US has not materially improved homeownership but has instead promoted a culture of debt.

Mr. Calabria writes, (bold highlights mine)

One of the rationales commonly given for massively subsidizing our mortgage market is that without such homeownership would be out of reach for many households. Such a rationale implies that more debt should be associated with more homeownership. (Let's set aside the obvious, how are you actually an owner without any equity?)...

By 1960, the homeownership rate was already over 60%, yet debt-to-value was less than 30%, half of the current value. Even in 1990, when homeownership reached over 64%, debt-to-value was still under 40%. From 1990 until today, the percentage of mortgage debt to value increased by over 50%, all to gain a 2 percentage point increase in homeownership. So it seems the story of the last 20 years has been a massive increase in home debt with very little increase in actual homeownership rates. The converse should also hold: reducing homeowner leverage should have little, if any, impact on homeownership rates.

Increasing debt hasn’t substantially lifted homeownership. This represents a failure of the program.

I have been saying that intentions and actions are two different things. People may say one thing, but do another. Since politicians and bureaucrats are people too, they are likely to fall into the same intent-action disparity trap.

Importantly, many people, especially those in the political arena, rake in the dough out of deliberately fudging the relationship of intent and action. They say one thing which would sounds politically correct, but applies actions that covertly benefit another party using the former as a cover.

I’d say that homeownership has merely been a strawman meant to boost another sector’s profits.

The sector I am referring to is the US financial sector which has benefited greatly from government sponsored homeownership programs. Some calls this the financialization or financial capitalism.

According to Wikipedia.org, (bold highlights mine)

Financialization is a term that describes an economic system or process that attempts to reduce all value that is exchanged (whether tangible, intangible, future or present promises, etc.) either into a financial instrument or a derivative of a financial instrument. The original intent of financialization is to be able to reduce any work-product or service to an exchangeable financial instrument, like currency, and thus make it easier for people to trade these financial instruments.

Workers, through a financial instrument such as a mortgage, could trade their promise of future work/wages for a home. Financialization of risk-sharing makes all insurance possible, the financialization of the U.S. Government's promises (bonds) makes all deficit spending possible. Financialization also makes economic rents possible.

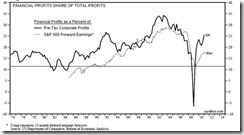

The GDP share of the US Financial Industry has been exploding. Recently even after the crisis, profits from the financial industry now accounts for ONE third of all operating profits.

Notes the Wall Street Journal Blog, (bold highlights mine)

During the darkest days of the financial crisis, when Lehman Brothers and Washington Mutual went belly up and the U.S. government had to bail out other institutions, the finance sector reported an annualized loss of $65.2 billion in the fourth quarter of 2008. It was the only quarterly loss recorded in the government data.

Since then, the sector has come roaring back. The GDP report shows finance profits jumped to $426.5 billion. While profits haven’t returned to their high levels of 2006, the gain in finance profits last quarter more than offset a drop in profits posted by nonfinancial domestic industries.

After rising like the Phoenix, the financial industry now accounts for about 30% of all operating profits. That’s an amazing share given that the sector accounts for less than 10% of the value added in the economy.

Wall Street and banking critics have pointed out the finance industry enjoys government supports not given to other companies. That includes the low cost of funds from the Federal Reserve. As a result, critics say, the U.S. economy is overly skewed toward finance.

From Yardeni.com

In my view, homeownership is a (political) means aimed at promoting an end (crony capitalism of the financial industry)

No comments:

Post a Comment