Financial market crashes have become real time.

Well, last night oil prices plummeted again. The European Brent crashed 5.87% to 53.11 per bbl while the US counterpart the WTIC dived 5.42% to close BELOW $50 or $49.95 a bbl.

The chart above from chartrus.com reveals that the present levels of US WTIC have reached 2009 post Lehman crisis levels.

Then, oil prices responded to deteriorating economic and financial conditions. Today, oil prices seem to lead the way.

Collapsing oil prices hit key stock markets of major oil producers, such as the Gulf Cooperation Council, quite hard.

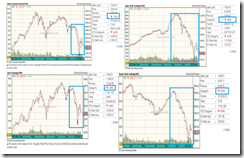

The recent sharp bounce that partly negated losses from the harrowing crash that began last September seem to have been truncated as Dubai Financial, Saudi’s Tadawul, and Qatar’s DSM suffered 3.35%, 2.99% and 1.91% respectively (charts from Asmainfo.com) last night.

In short, bear market forces seem as reinforcing its presence in these stock markets.

Yesterday’s oil price meltdown affected least Oman’s Muscat and Bahrain Bourse. Nonetheless, again bear markets have become a dominant feature for GCC bourses.

A prolonged below cost of production oil prices will translate to heavy economic losses for Arab oil producing states. Such will also entail political repercussions as welfare programs of these nations depend on elevated oil prices as discussed here. This will also have geopolitical ramifications.

Incidentally, as I previously pointed these nations play host to a majority of Philippine OFWs.

More than half or about 56% of OFWs according to the Philippine Overseas Employment Administration (POEA) have been deployed to this region. Will OFWs (and their employers) be immune from an economic or financial crisis? This isn’t 2008 where the epicenter of the crisis was in the US, hence remittances had been spared from retrenchment. For this crisis, there will be multiple hotbeds.

So a financial-economic collapse (possibly compounded by political mayhem) in GCC nations may impede any remittance growth that could compound on the travails of the Philippine bubble economy.

It’s not just in emerging markets, though, last night Europe’s stock markets likewise convulsed.

Part of the concerns had not only been about oil but about a GREXIT or Greek default from tumultuous Greek politics based on the failure to muster majority support for a presidential candidate.

Incredibly German’s DAX was slammed 3% (table above from Bloomberg).

Crashing Greek stocks lost another 5.63% yesterday.

Apparently broad based selling also buffetted near record US stock markets.

The XLE Energy Sector endured another tailspin down by 4.19%. Yesterday’s clobbering only fortified the bear market forces affecting the US energy sector which has diverged from her peers.

I propounded that the slumping energy sector will eventually impact the rest of the markets. Divergence will become convergence; periphery to the core.

Remember, the reemergence of heightened financial volatility comes in the face of October’s stock market bailout via stimulus implemented by ECB, BoJ-GPIF, and the PBOC.

This implies that the soothing or opiate effects, which had a 3 month window, has been losing traction.

Will Ms. Yellen come to the rescue???

Will Ms. Yellen come to the rescue???

No comments:

Post a Comment