The biggest cost of a world that cowers from challenging accepted beliefs is the loss of a multitude of promising fresh intellects that dare not follow any bold, independent train of thought, lest they become outcasts. This is a tragedy of our times — indeed, a tragedy for all times — because the first duty of a great thinker is to follow his intellect, regardless of where it may lead him. Emerson was so right when he said that “Nothing is as sacred as the integrity of your own mind.” Which is precisely the problem. Today, millions of people have no respect for their own minds. That’s why most of the world’s population is trapped in mental slavery, which makes their brains fertile ground for sound bites, talking points, slogans, and unsubstantiated social media blather.-- Robert Ringer

In this issue

Phisix 7,100: 2Q GDP Hype, One Day Crashes Have Hardly Been Isolated Events

-Does the Philippine Stock Market Merit Media’s Headline Coverage?

-2Q GDP and 1H GDP A Big Consensus Miss, Big Downgrades Ahead?

-2Q GDP Buoyed by Household Consumption and Construction

-2Q GDP: Statistics Not Equal to Economics: Construction Industry

-2Q GDP: Statistics Not Equal to Economics: Household Consumption

-Falling GDP Signifies a Secular Trend Underwritten by the BSP’s Trickle Down Approach Policies

-Phisix 7,100: One Day Crashes Have Hardly Been Isolated Events

-Phisix 7,100: This IS NOT 2013, Volatility will Continue

Phisix 7,100: 2Q GDP Hype, One Day Crashes Have Hardly Been Isolated Events

Does the Philippine Stock Market Merit Media’s Headline Coverage?

It’s always easy to take things for granted, just because they are what seem they are.

The PSEi’s Black Monday crash apparently grabbed mainstream headlines as exhibited by the widest read readership among domestic broadsheets, the Inquirer. This is something which I expected.

Does anybody ever ask if the activities in domestic stock market warrant main headline coverage, whether it is about record highs or crashes?

Does the Philippine stock market really have such a huge economic, if not social significance?

Well, it can be easily argued that since the Inquirer’s readership caters to the upper class so that’s would be their prerogative. I guess that’s part of the story. But the Inquirer I used above only epitomizes the convention.

The Philippine Stock Exchange disclosed the other week that based on their survey, in 2014 “total investor accounts, which include traditional and online accounts, also rose to 640,665 in 2014, higher by 9.4 percent from the previous year's 585,562 total”[1]

In perspective, this means that if we consider the estimated population of the Philippines at 100 million in 2014 (based on Worldometer), people that have direct accounts with PSE brokers constitute only .64% of the population! That’s only three quarters of ONE percent!

Even if we consider the indirect accounts, such as UITFs and mutual funds, the likely optimistic percentage of the population exposed to the stock market would be at 2-2.5% (assuming 3-4x the direct accounts). 2-2.5% of the population translates to only 2-2.5 million people out of 100 million.

The entire population of investor accounts (640K) can’t even match the nominal population growth number based at an estimated 1.7% for 2014 or at 1.7 million people!

Even if we add the indirect accounts at 3.14 million, this would only constitute 84% more of the number of Filipinos being added each year.

In other words, even from a very infinitesimal base, the Philippine stock market’s penetration level hasn't been growing enough for it to gain critical access to the public’s substantial savings in order to augment the nation’s capital formation!

Yet just look at how the BSP salivates at this fountain of untapped savings (from mostly the informal economy) for them to launch a “financial inclusion” program.

The BSP chief said in a speech last May[2]: At a gross domestic saving rate of 20.8% in inflation-adjusted terms for 2014, that translates to Php1.49 trillion in real terms or Php 2.12 trillion in nominal savings that can be mobilized. That is 2014 savings alone, quite distinct from the Php 1.80 trillion in 2013 and another Php 1.58 trillion the year before. And perhaps what is most telling is that the great bulk of this has been generated by half of the population since the other half is literally still in school.

Php 2.12 trillion? That’s about the entire output of the PSE for 2014! This means so much money to fund new enterprises! This also could mean an explosion in the PSE’s turnover!

On the other hand, for banks it means huge profits from deposits which it can use as credit multiplier and from fees on various transactions. For cronies, it means more access to depositor’s resources through the banking and capital markets. And finally for the government, it means more financing to political splurges. Even more, it implies control of people’s money through the banking system.

Like any instrument, formalization of finance can be used for good or for dissoluteness.

Yet this exposes on the critical defects with the current conditions.

And just how the heck can a survey justify that a third of the population thinks that the Philippines have achieved a developed nation status when it can’t even access such magnitude of savings? If it is not fantasy on steroids or a bubble!

Ironically, the PSE puts a lipstick on a pig by emphasizing on the surge in online growth rather than the overall conditions.

Yet some quick stock market data from the PSE’s 2014 survey:

-Online accounts represent 27% of total accounts.

-95.3% of total accounts are retail accounts while 4.7% are institutional accounts.

-Local residents constitute 98.5% share of retail accounts while 1.5% are foreigners.

The PSE report doesn’t disclose or indicate whether they have merged multiple accounts (same individual different brokers, same individual with multiple accounts on the same broker) or family accounts (individual in trust for dependant accounts). In short, the PSE estimates may be even smaller than what it reports.

Remember, a small portion of the number of accounts has been from foreigners.

One may posit, perhaps all of media coverage could be about promotions. Perhaps indeed. But empirical data hardly fits into this notion.

Let us take a purview of how the Philippine Stock Exchange (PSE) since the Great Financial Recession (GFR).

Using 2008 as base year, compounded annual growth on nominal PSE account has been at only at meager 6.28%! This comes as the PSEi recorded 25.25% CAGR returns over the same period!

Hasn’t it been awesome? Record stocks have hardly been a magnet for the public to stampede into opening accounts at the PSE!

Let me further expand on this thought. A whopping 286% returns from 2008-2014 had been accompanied by only 44% growth or an additional 195,985 stock market accounts! Wow. Of the 5 million people or so added to the population during the same period, only 195,985 had been added to PSE accounts!

Or said differently, through six years, and amidst all those euphoric media blasts, only 195,985 people had been enticed to join the PSE even when the PSEi soared by 286%!!!

So who benefited from the stock market run?

Clearly, stock market “wealth” have instead been concentrated to a very few lucky well positioned people!

Well who are they? They are primarily the majority owners of those listed shares.

To consider, the PSE accounts include those of the elites and their families and friends. Many politicians have stock market accounts too.

What’s the point? All these record stocks have merely been a playground for mostly the elites. And this has been enabled and facilitated by the BSP’s financial repression policies!

And because the part of the mainstream media’s audience have been the politically connected financial or economic elites, who again own or control many companies listed on the PSE, and because the companies of the same privileged group have been major sources for advertisement revenues, media has to cater to its interests!

Soaring stocks pump up on the equity values or net worth of elites, thus they get included in the prestigious international ranking of the wealthy individuals. Booming stocks inflates the collateral value (balance sheet “assets” and “equity”) of the firms owned by the elite, hence expanded access to credit.

Booming stocks also increases the “moneyness” of their shares for them to be used as currencies for a variety of deals (e.g. m&a, convertible shares etc…). Booming stocks also widens the window for these firms to access to public financing through the capital markets, bonds, preferred shares or equity issuance.

It’s not just the elites though. Political agents have also been principal beneficiaries of the stock market boom.

In today’s du jure political setting, the headline benefits of booming stocks equates to “confidence” on political actions of political administrations. And increased confidence means greater access to credit which should serve as wherewithal for political boondoggles. For the Philippines, remember, all those credit upgrades? Didn’t they come during the fourth year of the Philippine stock market boom? Or just in time as the Phisix hit the first record at 7,400?

Increased confidence also extrapolates to expanded political capital. Having more political capital translates to greater vote generating capacity. This also means broader room to push for political programs that benefits the interests of such tenured politicians.

Such stock market influenced embellishments have been portrayed as a boon to the “economy”!

Haven’t you noticed, stock markets of the world have become the principal tools for policy making, thus the predominance of negative real rates (Zero or negative bound) policies and QEs?

The economic ideology supposedly backing this has been the “wealth effect” or the dependence on spending in boosting the economy due to changes in wealth.

As an aside, instead of wealth effect, the real reason for the de facto global central bank standard of monetary easing has been to subsidize the increasingly debt dependent or credit addicted economies and to inflate debt away.

The Philippines’ BSP chief openly admitted to this subsidy back in 2009. Even in a speech last May 2015 on “financial inclusion”, the BSP chief said: “While the trickle-down approach to spread the benefits of development is good, it is not enough; we want to be more proactive[3]. And proactive means the tapping of informal savings into the banking system.

See “trickle down approach”? This is what negative real rates have been about—a subsidy to the politicians and their cronies. Of course, this comes in the hope of that an economic boom in favor of the elites will trickle down. But please don’t ever tell this to Pope Francis.

Yet for all the negative rate subsidies since 2009—which are again an invisible wealth transfers—have done little to induce the average citizenry to jump into the stock market bandwagon.

In other words, instead of trickle-down, for the past six years, the PSE and the Filipino savers got morsels and crumbs!

What this monetary subsidy has done instead was to push money supply growth at 30+% for 10 consecutive months that has only crimped on the average citizenry’s purchasing power.

Moreover, in six years, firms of the elites have used up most of the economy’s resources channeled through bank credit expansion. These firms financed government spending through inflated taxes. Meanwhile, the “low” government debt has been subsidized by the artificially lowering of interest rates. And what seems as ‘fiscally responsible’ has only signified a smoke and mirror move through shift of the brazen use of speculative and unproductive credit from government to the private sector!

Yet all these again have led to the peso’s shrinking purchasing power.

So what other major reason has media been reporting the stock market to the public? To justify those invisible transfers to vested interest groups.

What’s in it for media aside from additional revenues? Well, the most important: DIRECT access to political power. And direct access to political power equals implicit political power.

In politics, haven’t you noticed of the revolving door relationship between media and politicians? Or of celebrities becoming politicians and vice versa? How about the intermarriages between celebrities and politicians? Media, in essence, has played the role of kingmakers.

And another benefit: continued protection from competition of the industry through legal barriers: foreign ownership of mass media (with the exception of recording) is totally restricted.

You see it’s the Orwellian ‘newspeak’ and ‘double speak’ principle in action. Control of the language means control of thought. Control of thought means control of actions. Therefore, media language has predominantly been designed to control the public’s action through all the spin, embellishments, whitewashes and blandishments whether as news, opinions or documentaries.

And control of language means the representation of the stock market as indicator of the domestic “economic” trends.

And what’s the relationship between investing and media’s headline reporting of the stock market?

Well, the latter justifies, rationalizes and popularizes excesses from political redistribution that has been facilitated and channeled through money manipulation. However, excesses are an anathema for investments!

Or the non-fact informational junks that media peddles is exactly the opposite of what investors require.

The legendary investor Sir John Templeton has a valuable tip against these excesses: Bull markets are born on pessimism, grown on scepticism, mature on optimism and die on euphoria. The time of maximum pessimism is the best time to buy, and the time of maximum optimism is the best time to sell.

Rings a bell?

2Q GDP and 1H GDP A Big Consensus Miss, Big Downgrades Ahead?

SECOND Quarter 2015 GDP recorded 5.6%. That’s after the first quarter GDP of 5.2% had been downgraded to 5%. So first semester GDP was reported at 5.3%. That’s way way way off the government’s target of 7-8%.

Yet improvements from 2Q G-R-O-W-T-H has dominated domestic media which at the same time has sterilized on the offsetting sluggish performance of 1Q 2015.

However for media like the Bloomberg, the underperformance or “missed target” signifies future G-R-O-W-T-H downgrades. They cite Barclays for their forecast cut on Philippine G-R-O-W-T-H.

Simple math tells us that at 5.3% for 1H, it would NEED the next two quarters to attain an average of 6.7% just to reach an annual 6%, which has been the floor of most of mainstream expectations.

The next question is can an average of 6.7% be reached? How?

With 6.7% seemingly seen as a Herculean task, it would be natural for the consensus to go about downscaling G-R-O-W-T-H expectations.

Here are the 2015 forecasts by some of the major international institutions: Moody’s 6.6% (2Q GDP at 6.88!), ADB 6.4%, and the IMF 6.2%.

So if these entities downgrade G-R-O-W-T-H, how will this affect headline bullishness?

2Q GDP Buoyed by Household Consumption and Construction

Of course, it may not be a Herculean task at all. That’s because the government can show whatever numbers they want to show. That’s also the government because being a monopolist, nobody will dare question its veracity.

GDP is a statistically constructed model based mostly from surveys.

With supposedly a third of the population believing that the Philippines has achieved a developed world status, then perhaps part of this fantasy must have been reflected on such government numbers.

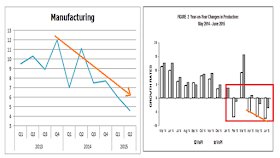

The above represents the breakdown of the two components of GDP, the industry (left) and the expenditure (right)

From the industry GDP perspective, 2Q was powered by the mainly the service sector led by real estate and trade. The capital goods sector performed largely below expectations, but was partly buoyed by construction (primarily through government backed by the private sector). Construction accounted for 6.65% of the GDP pie.

On the expenditure side, household final consumption (HFCE) which represented 66% of the GDP supposedly delivered the gist of the headline numbers.

This was supported by capital formation (20% share of the expenditure pie) mostly from again from construction and from fixed capital. Curiously, the National Statistical Coordination Board (NSCB) hardly provided for the nitty gritty of where the fabulous 17.4% fixed capital formation G-R-O-W-T-H emanated. The NSCB silence is a puzzle.

So 2Q GDP basically had been driven by mainly the twin forces of household consumption- construction.

2Q GDP: Statistics Not Equal to Economics: Construction Industry

In the world of statistics, prices barely play a role in the determination of the economic activities.

Prices of construction retail and wholesale materials have been sinking for the previous TWO consecutive quarters or in the 1H (which extended to July)!!! [see left]

What the 2Q GDP implies has been that an avalanche of supplies has totally overwhelmed the robust demand from government and private sector construction activities. This supply deluge have virtually forced down prices of materials used by the industry for more than a quarter.

Said differently, the race to build capacity has had NO upward pressure on prices even when the industry has been massively using credit to finance the supposedly aggressive expansions.

Ironically, those price statistics also come from the same government agency.

The question is: where has supply been coming from?

Definitely not from manufacturing!

The NSCB’s Manufacturing GDP for the 2Q at current prices was at 1.4% (left). At constant (headline) prices this was at 4.6%.

Manufacturing GDP peaked in Q4 2013 and has continually been in decline. The downtrend hasn’t been linear as this has been marked by the sporadic gains.

Meanwhile, the PSA’s Industrial production survey exhibited that in terms of value (VAPI), industrial output has been CONTRACTING or NEGATIVE for 3 successive months covering the 2Q (right)! The shrinkage has been at substantial rate ranging from 5-7%! And contraction has occurred in 5 out of 6 months for the year 2015!

Two opposing views: The PSA’s industrial output has been NEGATIVE but the NSCB’s output has been positive. To add, while the latter has been positive, the underlying trend reveals of a rapid slowdown.

If US President John F. Kennedy were alive today, in seeing the above, he’d probably ask (paraphrased), “are talking of the same country here?”

So serial oversupply could have hardly emerged from domestic production.

How about imports?

Imports have hardly demonstrated a boom for 2015. This has been a bad sign for domestic demand.

Except for June 2015, Philippine imports have been sluggish from the start of the year whether seen from trends based on year on year changes (left) or from nominal values (right).

The spike in June imports could be from expectations of frontloading of imports due to expectations of a weaker peso and or from politics plaguing Bureau of Customs.

So there has been little evidence of a surge in supply from imports to have extrapolated to a ramp in supply inventories.

Thus, GDP data from the construction industry hasn’t been consistent with the statistical data of another department from the same government agency.

And again, construction activities continue to be heavily financed by substantial credit growth! Bank loans to the industry grew by 28.93% in June and 24.62% last July! But this has been down from the highs of 40% to 50+% in all of 2013 through mid-2014!

With all the new money absorbed by the industry, where have all these resources been flowing to or where have they been spent at for construction material prices to significantly drop!

Note: The BSP imposed a new 2009 Philippine Standard Industrial Classification (PSIC) which it didn’t apply or adjust to the previous data, so with the new statistical standard, I’m left with limited numbers to chart on.

2Q GDP: Statistics Not Equal to Economics: Household Consumption

The same flagrant price-output disparities can be seen in household activities via slumping CPI (left), retail (middle) and wholesale (right) price indices. In short, the whole consumer industry, based on government’s data, had manifested disinflation or downside price pressures.

Why?

There are two ways to assess household activities: the source of finance and the expenditures.

In the past two years, growth of remittances resonated with HFCE.

2Q GDP numbers tells us that “this time is different”. HFCE sharply rebounded even when the remittance growth had modestly expanded (upper left window)

If OFWs remittances have departed from HFCE activities, then where have households getting money to finance their expenditures? That’s if they are spending at all.

The only thing that soared in the 1Q was Makati CBD and Quezon City land prices and the record stocks. It was a windfall to the few who dabbled with them. But what of the rest?

The NSCB admits that 1Q GDP was weaker than earlier reported. Online job markets have been tumbling. So weak economy and weak jobs equals greater spending?

Or perhaps weak economy plus weak labor market equals greater savings?

In contradiction to the household spending indicators of the GDP, the BSP’s personal savings data via tradingeconomics.com exhibited that households have been saving rather spending in 2015! (see lower window)

Money saved is not money spent.

In fact, savings has intensified in the 2Q (lower window)!

The present savings trend seems consistent with the price trends in CPI, Retail and Wholesale. Present savings trend also appears to match with the BSP’s second quarter survey which revealed of a bearish outlook for consumers.

So which of the government agencies have been wrong or has been misrepresenting their numbers, the BSP and the PSA or the NSCB?

If the BSP is wrong then where have consumers been spending?

Some clues from OFW remittances.

Based on the BSP’s studies, remittances have been spent, according to the Inquirer, mainly for food (71 percent). Some other uses are for education (39 percent), medical expenses (28 percent) and emergencies (22 percent). Very few cited purpose for productive use like buying assets (13 percent) and start business (6 percent)[4].

So food, education, health and SAVINGS comprise the major segments of the household budget from OFW remittance flows.

But the real estate industry tells us that a quarter of their clients have been financed by OFW remittances. This means that those 13% of remittance budget translates to 25% sales for the industry. Otherwise, either the BSP has been understating the OFW’s “buying assets” or the real estate industry has been overstating the contribution of OFWs to their sales figures.

Moving away from only the OFWs, retail activities have hardly squared with HFCE activities as shown in the right chart above.

Like remittances, retail activities seem to considerably lag HFCE growth. This simply means that if the households haven’t been spending on retail outlets then they must be spending elsewhere. Or, households may not be spending as much as what government data has revealed.

Comparatively, the current rate of household spending has reached a prime which would be equivalent to 3Q 2013. That’s when the GDP grew by 7%!

So has consumer spending reached a point of diminishing returns for it to fail to goose up statistical growth? Or again, has the government been inflating G-R-O-W-T-H figures?

Real world activities already have shown signs of slowdown in consumer activities. I have pointed out that consolidated revenue G-R-O-W-T-H for some major retail outlets like the SM group hasn’t been supportive of what the government says.

Now let me suppose that consumers have been spending elsewhere.

If the BSP’s remittance spending should give a clue then education, which signifies the second biggest segment of remittance spending, should reveal of a sharp of bounce.

Perhaps some of this has indeed been channeled on education.

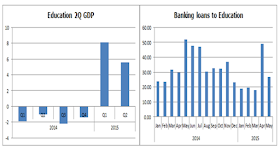

But paradoxically education GDP has been negative throughout 2014! Education GDP only soared in the 1H of 2015!

Whatever happened to the controversial education inflation last year? And yet what happened to all those massive expansions and or the mushrooming of new schools? Why education’s negative contribution in 2014? What happened to the 25-50% surge in banking loans to the industry?

So perhaps some of the spending could have been directed here. But again, perhaps not.

And again household finance, spending and savings have all sung different songs in the 2Q.

At the end of the day, GDP has NOT been an accurate representation of real economic activities.

2Q GDP 2015, in my opinion, has been vastly exaggerated.

Falling GDP Signifies a Secular Trend Underwritten by the BSP’s Trickle Down Approach Policies

The general trend of the annual GDP provides important hints to its overall direction (see left). Since 2010, the general trend of the annual GDP has been on a decline. This 5 year trend has been likely indicative of a secular, and hardly a countercyclical trend.

This downtrend trend could have been partly influenced by statistical “reversion to the mean”. But economic activities represent human action. This means human actions dictate on the seeming “reversion to the mean” dynamics.

So what could cause a G-R-O-W-T-H regression?

In simple terms, these would represent factors that would impose structural and or institutional restraints or impediments on people from freely conducting commercial activities, the freedom to own, produce, exchange and to accumulate capital & or savings.

And politics would signify as a major obstacle to economic advancement. As the great Austrian economist Ludwig von Mises wrote[5]:

Restriction of production means that the government either forbids or makes more difficult or more expensive the production, transportation, or distribution of definite articles, or the application of definite modes of production, transportation, or distribution. The authority thus eliminates some of the means available for the satisfaction of human wants. The effect of its interference is that people are prevented from using their knowledge and abilities, their labor and their material means of production in the way in which they would earn the highest returns and satisfy their needs as much as possible. Such interference makes people poorer and less satisfied.

And when governments imposes redistributionist policies, similar to the BSP’s trickle down approach via negative real rate subsidies, then this derails economic coordination away from the genuine market process towards a distorted marketplace highlighted by the accumulation of malinvestments or capital decumulation.

In effect, when debt is valued and prioritized politically, coming at the expense of savers, then economic activities funded by debt will balloon. And much of these debt finance activities will be channeled to unproductive, speculative activities.

And since debt represents the frontloading of spending, today’s spending boom will come at the expense of tomorrow. Such is the time asymmetric nature of debt based policies: it emphasizes on the short term or on instant gratification which same time neglects future costs.

This matches with nature of politics which has predominantly been short term oriented.

The Philippine 2Q 2015 GDP recorded a 5.2% rate based on current prices (or a headline rate of 5.6% based on constant prices). On the other hand, the BSP’s banking sector industry loans (outside consumer and repos) had an average of 14.5% in 2Q (see left window).

In short, bank credit expansion has almost been THRICE the GDP!!!

Yet the share of the bubble sectors (construction, real estate, trade, finance) account for 41.5% of the GDP pie (hotels not included in my count).

Based on BSP data on June’s distribution of industry bank loans, about half of bank loans have been funneled to these bubble sectors (hotel included)

And if my suspicion is correct where the actual GDP has been significantly lower than the reported GDP, then the exposure to credit risk by the banking system has been bigger than appreciated by the establishment.

Let me add that as an update bank credit conditions continue to moderate as of July 2015 .

Based on BSP’s latest data, the G-R-O-W-T-H rate of banking loans to the industry has resumed its downdraft (see below right). Y-o-y growth has slumped to 13.36%, the lowest rate since November 2013.

This credit swoon has been by accompanied a sustained sharp downturn in money supply growth. Money supply growth (M3) skidded back to 8.5% the February 2015 low. The disinflationary pressures from money and credit have brought CPI below the BSP’s target at 1.2%.

All these have been happening in the face of sustained interventions to steepen the bond yields. This means that the artificial steepening (implied credit easing) via interventions at the bond markets have failed to juice up bank lending activities.

Yet the sustained downturn in the conditions of credit, money and prices, which all implies of tighter liquidity, will likely prompt the BSP to ease. If the BSP obliges with demands from the industry, then this will likely escalate on the peso’s plunge (see below left)

Moreover, as previously explained, the weak peso-strong US dollar dynamic aggravates on the travails of the real economy or even the GDP. This is aside from the amplified volatility from the currency fluctuations.

It’s simply amazing to see how the establishment with all their army of experts have been unable to recognize of the fundamental relationships between prices, money, credit and production. Failure to do so leads to blindness.

Just look at Moody’s 6.88% 2Q forecast, this is the kind of pretensions that can only be emerge out of the obsession to statistical or quant numbers.

Phisix 7,100: One Day Crashes Have Hardly Been Isolated Events

The Philippine benchmark closed the week down by only -2.48%. This marks a big 63% recovery from Monday’s crash of 6.7%.

Interestingly, PSE officials went on a victory lap as the Phisix crossed back to 7,000 at the thought that the Philippines’ stock market troubles have passed.

PSE officials seem to think that politically induced market excesses are free lunches without consequences.

Anyway, it’s hardly been noted that the crash on Monday, 24th of August recorded some “FIRSTs” in the Philippine stock market history.

In terms of % loss, it hasn’t been the largest. The bear market of 2007 to 2008 produced one of, if not, the worst crashes in terms of %: October 10 and October 27 with their respective one day 8.3% and 12.8% annihilation of stocks. I haven’t looked back at the 1979, 1997 and 2002 episodes.

During the taper tantrum days of 2013, the biggest crash was on June 13, where the index dived 6.75% or 442.57 points.

However August 24 Monday set a new record in terms of nominal points. The nominal figure from the 6.7% crash was 487.97 points. This surpasses the June 2013 milestone.

This should hallmark the largest loss in nominal points since we are dealing with the index at 7,000.

More “FIRST” trivia.

Monday August 24, posted the BIGGEST one day nominal MARGIN from a broad based market collapse. During that fateful day, there were 212 declining issues as against only 13 advancers or a margin of 199!

This has been unparalleled even when compared to 2008. That’s because traded issues today have been the largest ever.

But the extent of panic has still been distant from 2008. Seen in the context of proportionality or the panic ratio (losing over winning issue), this week’s 16 losers for every winner still pales with the October 23 2008 episode, which had 39 losers for every winner (3 advancers 117 decliners)!

Yet there have been five accounts in October 2008 which showed of single digit performance by advancing issues. The panic ratio from these events vis-à-vis today had been larger in three of the five incidents

This shows of the gravity of panic in 2008, which hardly has been the case today.

Additionally, Monday’s crash hasn’t been an anomaly. Crashes are signs of the ventilation of embedded imbalances. There won’t be crashes without justification on them.

There have been many developing signs that hinted to this eventuality.

The market’s shrinking liquidity as expressed by the diminishing Peso volume, increased deterioration of market breadth and reduced stock market trading activities had all converge to presage this. I warned[6]:

The lesson: In bullmarkets watch the “bid”, in bear markets watch the “ask”. The conditions underlying the bids or asks—which represents the investor risk preferences—will determine the direction of momentum. Remember, the long term represents the sum of short actions. As an old saw goes, the journey to a thousand miles begins with a single step (Laozi). Applied to Philippine stocks, once again, the intensifying decline in the trading volume highlights heightened clues of dissipating bids…. Said differently, buyers at current price levels have been erecting less and less barriers against mounting sellers.

And all it takes was for a big headline issue to function as trigger[7].

The reason why the Philippine assets remain relatively sturdy has been because sellers have NOT yet been aggressive since the HEADLINES tell them so. The establishment believes that the boom can still be maintained even when the core has been eroding. They are relying on HOPE. And this is the reason behind the headline management.They manage statistics and the markets to keep intact what they see as ‘animal spirits’. The exposé on DBP’s wash sale should be a wonderful example.Besides, headlines shows of no crunch time yet, here or overseas. But no one can guarantee how long this endures.But when reality eventually filters into the headline; perhaps as in the form of economic numbers or a surprise missed interest payment by a major company, or the appearance of a major global event risk, then bids will evaporate.

Bullseye!

This advance decline spread was a dead giveaway.

Four weeks of relentless broad based market selling just culminated with a big one day event! Like seething volcano, the selloff unleashed or disgorged all the pressures that have been accumulating within the PSE.

Thus, the ensuing three day rally was in response from the severely OVERSOLD conditions. Of course, such had been aided by index managers.

Now peso volume has reappeared at 6,700. But at Friday’s 7,100, excluding special block sales, peso volume seem to show signs of erosion anew. If current volume can’t be maintained, then expect selling pressures will reappear.

This volatility hasn’t ended.

Besides, ONE day panics have not usually signified an isolated incident.

One day panics are usually followed by another crash, or a string of crashes or by an eventual weakening or a combination thereof.

Just a few recent examples.

Thailand’s December 15th flash crash was accompanied by a substantial rally that eventually faded. Today, the SET trades at a lower level than the day when the flash crash occurred. (see left) The fresh lows come even as the SET staged a ferocious surge during the last two days of last week.

Following the sudden abandonment of the euro cap, Swiss stocks crashed last January as represented by the SMI (see middle). Like Thailand, the SMI had a sizeable rally which eventually hit a wall. Today the SMI seems fast approaching the January lows.

China’s Shanghai index should be the epitome of serial crashes.

The SSEC’s correction turned into a ghastly series of collapses. This became especially pronounced when the Chinese government intervened and transmogrified the stock market into a political Frankenstein stock market.

The Shanghai index crashed by another 18.7% early this week, but the Chinese government has been reported to have mobilized (and mandated) pension money worth 2 trillion yuan ($313.05 billion) to shore up the embattled stock markets.

Meanwhile, the government agency responsible for the stock market bailout, China Securities Finance Corp. (CSFC), has been reported to be in talks with banks to attain access to another 1.4 trillion yuan ($219 billion) to fund another series of massive stock market rescue.

The Chinese government has not only throwing the kitchen but the entire community to save the stock market.

Yet, it’s sad to see some people in China commit suicide due to losses from stock market bubbles which had been a creation of the government

The Phisix has been no stranger to crashes.

Again during the taper tantrum, the PSEi crashed by 6.75% in June 13, 2013 (advance decline spread 18 winners as against 182 losers, 24 unchanged). Like today, the crash entailed a massive counterstrike from the bulls. In four days, bulls almost erased the one day loss with an accrued 6.5% advance.

It turned out that this rally had merely been a gap filling move. Sellers took the cue to disgorge when buyers hit the resistance.

A week after, the Phisix was LOWER than the June 13 level.

There was another 6% crash in August 22. But the Phisix found the lows similar to the June crash which functioned as the floor. The third floor was cemented in December without a crash. The rest is history.

Will history rhyme?

Phisix 7,100: This IS NOT 2013, Volatility will Continue

Just a reminder: This isn’t 2013.

The scale and breadth of market volatility has been dissimilar.

Volatility has been surfacing with a vengeance.

Stock market volatility continues to resurface (as seen in October and December 2014). But increased intensity has only accompanied its reappearance.

Commodity prices just hit new lows. This has partly dragged emerging market financial markets and economies with it.

China is in the process of experiencing the real economy effects from the devastating stock market crash and from its interventions. The yuan depreciation is just one of them.

The US has felt the stock market tremor, a scale not seen in 2013

While ASEAN currencies weakened, they didn’t crash in 2013.

Malaysian stocks totally ignored the taper tantrum and soared to new highs even as the rest of ASEAN stocks fumbled.

Today, Malaysia looks increasingly a flashpoint for an Asian crisis 2.0.

Even last week’s USD-Asia reprieve had done little to alleviate the ringgit’s woes. The scale of ringgit’s loss was diminished for the week, but still a loss nonetheless. The Korean won and Taiwan dollar sharply rallied (left)

Asian markets had been inspired by the incredible recoil by US stocks following a four day rout (right). However, the fierce ASEAN stock markets rally comes even as the selloff in their respective currencies continues.

The stock market rally can easily be described as a dead cat’s or an oversold bounce.

Has last week’s crash turned into the PSEi into ‘bargains’ to hunt as media portrays of them?

Well the above PERs as of August 27, tell us why the current volatility has hardly dinted on those ridiculously mispriced or overvalued securities.

This also tells us why volatility hasn’t ended.

[1] PSE Online stock market accounts continue to enjoy huge growth August 17, 2015 PSE.org

[2] Amando M. Tetangco, Jr Rural Banks: Portals of Inclusiveness for Juan and Juana dela Cruz May 18, 2015, BSP.gov.ph

[3] Amando M. Tetangco Jr. Acting Together for Financial Inclusion May 20, 2015 BSP.gov.ph

[4] Inquirer.net Why borrowers prefer informal fund sources August 19, 2015

[5] Ludwig von Mises, 1. The Nature of Restriction Part Six: The Hampered Market Economy, Chapter XXIX. Restriction of Production p.736 Human Action Mises.org

[6] See Phisix 7,600: 5.2% 1Q GDP Another Data Pump! DBP Accused of Market Manipulation; Scapegoating The US Dollar May 31, 2015

No comments:

Post a Comment