The destructionist policy of interventionism and Socialism has plunged the world into great misery. Politicians are helpless in the face of the crisis they have conjured up. They cannot recommend any way out except more inflation or, as they call it now, reflation. Economic life is to be "cranked up again" by new bank credits (that is, by additional "circulation" credit) as the moderates demand, or by the issue of fresh government paper money, which is the more radical programme. But increases in the quantity of money and fiduciary media will not enrich the world or build up what destructionism has torn down. Expansion of credit does lead to a boom at first, it is true, but sooner or later this boom is bound to crash and bring about a new depression. Only apparent and temporary relief can be won by tricks of banking and currency. In the long run they must land the nation in profounder catastrophe. For the damage such methods inflict on national well-being is all the heavier, the longer people have managed to deceive themselves with the illusion of prosperity which the continuous creation of credit has conjured up—Ludwig von Mises, Socialism: An Economic Sociological Analysis

In this issue

Phisix 7,500: SMPH’s Earnings Booby Traps, Crashing Malaysian Ringgit: Déjà vu 1997-8?

-Crashing Malaysia’s Ringgit and Indonesia’s Rupiah: Déjà vu 1997-8?

-Ringgit Crash: Commodity Prices or Malaysia’s Political Crisis as Convenient Bogeyman

-Philippines July GIR: Marginal Decline, But Subject to Big Revisions

-July CPI, Retail Prices and ONLINE Jobs Point to Economic Slowdown

-Phisix 7,500: The Alignment of Shrinking Liquidity, Market Internals and the Death Cross

-Hidden Booby Traps in SMPH’s Flowery 1H Earnings

Phisix 7,500: SMPH’s Earnings Booby Traps, Crashing Malaysian Ringgit: Déjà vu 1997-8?

Crashing Malaysia’s Ringgit and Indonesia’s Rupiah: Déjà vu 1997-8?

The silent run on the rupiah and the ringgit have now become a recognized phenomenon.

The Economist magazine wrote on August 8th that these currencies have been “Plunging like it’s 1998” as “The rupiah and ringgit plumb depths unseen since the Asian financial crisis”.[1]

The popular English publication observed that the currency predicament of the ringgit and rupiah has been due to “heavy dependence on commodities, but also by political ructions in both countries.”

But the Economist forgot about an even MORE important factor for ASEAN’s plunging currencies: DEBT!

Interestingly, déjà vu 1997-8 is now in the picture.

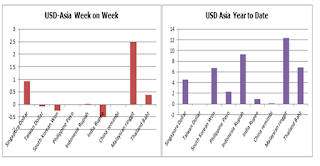

Even when most of the region’s currencies have largely been in a reprieve from the sustained battering, Malaysia’s ringgit tumbled by 2.5% last week. To add this to the year to date performance, the Malaysian ringgit has hemorrhaged by 12.3%. (Data above from Bloomberg Asian currencies)

The USD-MYR (ringgit) as shown by the Yahoo chart (left) has soared by about 25% year on year. This means the Malaysian ringgit can now be considered technically a ‘currency crash’ or an “annual depreciation (devaluation) greater than or equal to 15 percent per annum” as I presented last week.

Meanwhile, the Malaysia’s stock market, represented by the KLSE, which reveals of a ‘massive head and shoulder’ formation, is about to test the December 2014 lows. (see Yahoo chart right)

Over the week, the KLSE slumped 2.35% while year to date losses has accrued to -4.5%. From the record high in August 2014, the KLSE has been on a correction mode or down by 11%.

The ringgit’s and the KLSE’s rout has been marked by capital outflows. Foreign investors dumped equities to the tune of $3 billion last week, “the biggest outflow since 2008” according to the Bloomberg.

In addition, Malaysia’s foreign currency reserves plummeted below the $ 100 billion threshold “for the first time since 2010” notes the same article.

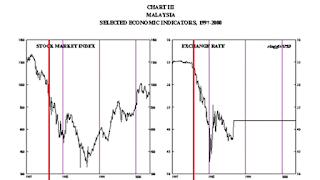

For a little bit of nostalgia, this is how the Malaysia’s KLSE and ringgit performed during the Asian crisis. (charts from the IMF) The ringgit was pegged to the USD prior to the crisis.

But currency pressures led the Malaysian government to float the ringgit which came under fire (right). The Malaysian government pegged the ringgit anew in 1998.

The ringgit’s recent collapse has begun to trigger a selloff in Malaysia’s bond markets. Yields of both 5 and 10 year maturities has vaulted last week (charts from investing.com). Soaring bond yields will have nasty ramifications.

Should the carnage (panic selling) of the ringgit continue, deepening risk aversion and expectations of higher inflation may likely incite bonds yields to ascend.

Eventually this will force up Malaysia’s policy interest rates. And higher rates, consequently, will adversely impact Malaysia’s debt and funding conditions.

These are yet the formative stages of what appears to be an unfolding Asian crisis 2.0.

Yet the recent market volatility has already been pushing up insurance premiums (5 Year CDS- based on Deutsche Bank data) based on default probabilities of ASEAN government debts.

YET it’s not just been about the ringgit’s collapse. There is also the issue of precipitous currency volatility. Combined, these dynamics have already been contributing to the already slowing economy.

But the linkages don’t stop there. There will be an economic-financial feedback mechanism where an economic downturn will lead to financial losses and vice versa. The epiphenomenon will be the shrinkage of systemic liquidity. The process of which will be spotlighted by the following feedback loop: the emergence of cash flow problems to debt servicing problems and to constrictions on access to credit. Finally, liquidity shrinkage will lead to insolvency, and concomitantly, to liquidations.

In short, a currency crash will likely be transmitted to as a banking or debt crisis.

History provides clues. YET like a thumbprint, every crisis is unique. But ALL financial crises have been centered on a single factor: CREDIT overdose.

Previously, currency crises have been consequences of sovereign debt or banking crises.

YET given the structural shift in central bank policy paradigm that has veered towards the current activist ‘preemptive’ actions against any economic weakness, which have been highlighted by zero bound and QE monetary policies, perhaps the causal process now runs in the reverse; currency crashes may serve as trigger to a debt or banking/financial crisis.

Ringgit Crash: Commodity Prices or Malaysia’s Political Crisis as Convenient Bogeyman

Collapsing commodity prices or political crisis will hardly pose as the major causes for a currency run.

Collapsing commodity prices will impact directly on producers and indirectly related upstream and downstream industries. But they are unlikely to affect the general economy UNLESS these have been OVERLEVERAGED. The link of leverage risks flows from the commodity producers to the financiers (banks), and consequently, to other sectors dependent on the financiers.

It is also improbable for Malaysia’s political crisis to spark a currency crash.

Early July 2015, Prime Minister Najib Razak has been alleged to have received $700 million in deposits from troubled state fund 1MDB wired into his personal account (Reuters/Businessinsider). This has dominated Malaysia’s political landscape since.

(So with governments, what else have been new?)

Malaysia’s government has attempted to even clampdown on social media networks that dealt with this scandal.

I pointed out last March that the Pandora’s Box on the 1MDB scandal has been pried open by a media exposé of a politically connected tycoon who siphoned out of $700 million of1MDB’s funds through a Swiss bank account.

Despite the brouhaha, all these will barely prompt for a run a ringgit.

Yet here is the critical link between the 1MDB scandal and ringgit.

The controversial state fund 1MDB, which I pointed out in June 2014, represents a cross between a sovereign wealth fund and private investment vehicle, has been laboring under $11 billion worth of debt.

In November 2014 I predicted[2] (bold added)

In addition, entities like the 1Malaysia Development Berhad (1MDB) which is a hybrid of a sovereign wealth fund and a private investment vehicle has acquired leveraged from which their operations can hardly cover interest payments. And as I noted last June, the Malaysian government has been borrowing based on contingent liabilities and off balance sheet budget, like the (1MDB), in order to circumvent or skirt government imposed debt cap. In short, overleveraging by both the private and public sectors renders Malaysia vulnerable to both external and internal triggers that could implode the system.

Essentially, Malaysia’s patronage politics concealed a ticking time bomb in the form of unserviceable major debt yoke at the 1MDB.

And given the massive leverage built into the ASEAN system, as shown by the World Bank data as of end 2012 which should be vastly expanded today, a déjà vu 1997 should be expected.

In January 2014 I wrote on the risks of an ASEAN black swan event

Such fantastic debt expanse has been enabled, facilitated and tolerated by financial repression policies of zero bound rates. Yet take away the policy subsidy, the system would be vulnerable to a credit-funding squeeze.

Yet there is no such thing as a free lunch. The markets will forcibly take away such unsustainable policy subsidies.

Even the mainstream has been warning on this.

Last November 2014, British media BBC featured a video on Malaysia’s ‘retirement crisis’. Malaysia’s retirement crisis essentially signifies a savings crisis.

Then I wrote[3]:

Why Malaysians can’t save? In a word, inflationism—overspending financed by overborrowing from zero bound rates, not only by the private sector but also by government as revealed by sustained deficits and ballooning external debt where both actions has been manifested by soaring money supply that has led to price inflation in assets (housing and stock market) and the real economy (CPI) or the shrinkage of purchasing power.

And also in January 2015, I pointed out how Malaysia’s PM Razak was forced to go on public to DENY a crisis!

Apparently, the run on the ringgit represents the chicken coming home to roost. Commodities and political crisis has only functioned as aggravating circumstances.

Nonetheless, all these sickening dependence on debt will have its day of reckoning. It’s not about IF but about WHEN.

YET for as long as the run on ringgit and rupiah will continue, the issue now will revolve around the invisible level of the system’s breaking point. At what levels before the cumulative systemic imbalances becomes totally unglued and unravels hastily? At what level before bank capital buffers yield to liquidity seizures, serial debt defaults and asset impairments?

And for as long as the run on ringgit and rupiah will continue, the risk is high for an Asian crisis 2.0 to resurface anytime 2015-2016.

Finally, forex reserves, which have been highly touted by the mainstream as defense against crisis, have been hardly shown signs of as an effective tool for macro stability.

Instead, forex reserves have represented symptoms of brazen maladjustments or malinvestments accumulated into the global financial system. This has been brought about by the incumbent paper money system or the US dollar standard where inflationism has become standard instrument to promote political goals. Yet inflationism has been embraced by the public as a virtue that comes without baneful consequences. Current developments will pop this credulous belief-bubble or delusions.

In short, foreign currency reserves do not serve as a free pass on debt.

Also it’s ridiculous to say that floating exchange rates will render Asia less vulnerable to crises. In reality, the opposite has been true; floating exchange rates has functioned as key channels for the transfusion of humongous bubbles around the world (e.g. carry trades, derivatives and etc…)

As economist Judy Shelton recently wrote[4]: (bold mine)

The irony is that the advent of floating rates should have meant that governments would no longer have to accumulate foreign reserves. If the value of currencies is truly left to the market under floating rates, and destabilizing speculation cannot rationally persist, why should governments concern themselves with trying to limit exchange rate movements? Why build up expensive war chests of gold and dollars (or euros, pound sterling, yen) to defend their own currencies against supply-and-demand forces? Pressured by the exigencies of real-world economic shocks and the anxieties of fiscal scrambling, political demands for currency protection will always trump the elegance of theoretical constructs.In truth, the experiment with floating rates since the end of Bretton Woods has brought about Friedman’s worst nightmare: It has empowered central banks—particularly the Federal Reserve— and strengthened government control over the private sector.

Philippines July GIR: Marginal Decline, But Subject to Big Revisions

Philippine Gross International Reserves as reported by the Bangko Sentral ng Pilipinas (BSP) dropped by only $200 million last July.

The BSP explains the decline as having been due to “ mainly to the payments made by the National Government (NG) for its maturing foreign exchange obligations and revaluation adjustments on the BSP’s gold holdings and foreign currency-denominated reserves. These were partially offset by the BSP’s foreign exchange operations and income from investments abroad as well as the NG’s net foreign currency deposits.”[5]

The above shows of the July GIR level (left) and the foreign exchange (right) segment. The reason I show of the forex portion of the GIR is because of its coincidence with the actions of the USD-peso. When the USD soared from 43 in September 2013 to 45.32 in late January 2014, the forex segment of the GIR cratered. Here I suspect that the forex portion was mainly used to boost the peso. Over the same period, Philippine GIR levels abruptly fell too.

Meanwhile, the spike in forex reserves in September 2014 looked like an anomaly.

Presently, again I suspect that the reason for the decline in forex reserves has been due to interventions in support of the peso. This comes even as the overall GIRs have declined by a minimal amount.

It looks like the 45.30-40 levels have functioned as trigger point for the BSP’s interventions.

Let me add that the July number is a PRELIMINARY figure subject to revisions.

The BSP makes big revisions!

For instance, the original June data was at $80.760 billion. Current or July data shows of a June GIR at $80.644 billion. That’s a $116 million difference.

The difference between July PRELIMINARY data and the June REVISED data reduced the July deficit to just $200 million instead of $316 million (when based on both preliminary data)

The adjustments in the May data have even been strikingly larger. The original was posted at $ 80,858.8. This was later revised to 80,405.0 for a $ 405 million difference. In other words, preliminary headline BSP data is meaningless in the sense that they are subject to major revisions.

And I suspect that the July revisions will be on the downside. Given that the USD-php breached the said 45.30-40 levels during the last half of the month, I suspect MORE resources would have been used to defend the peso

Furthermore, GIRs again have been about the “stock” of foreign exchange reserves. They do not exhibit the “flow”. Considering the positive current account (which should also reflect on OFW and BPO remittances), the non-growth of GIRs most likely extrapolates to the likely use of these surpluses (that failed to be included as stock) to defend the peso.

Should the region’s currency strains worsen, I expect the Philippine GIRs, like her neighbors, to dramatically fall.

July CPI, Retail Prices and ONLINE Jobs Point to Economic Slowdown

Last week, the Philippine government released July’s CPI. Both the BSP and Philippine Statistics Authority (PSA) noted of a stunning only .8% increase year on year!

I say ‘stunning’ because bank credit growth while on a declining trend has still been at double digit growth rate. Yet liquidity measures, slowing credit growth trend and July CPI have been indicative of a sharply slowing REAL economy

Even more, July’s data, according to BSP assessment “is slightly below the Government’s inflation target range of 3.0 percent ± 1.0 percentage point for 2015”.

So current price developments exceeded BSP targets. The BSP make the numbers yet the numbers fail on their targets. Has this been designed to justify chopping of the interest rates?

Yet here is how the BSP rationalizes the July CPI[6] (bold mine): The lower July inflation reading was attributed largely to slower increases in the prices of food items. Slower food inflation due to adequate domestic supply of key food items—such as rice, fish, milk, fruits, and sugar—as well as the decline in the prices of corn, oils, and vegetables helped push down inflation. Meanwhile, non-food inflation was steady as the slight uptick in actual rentals for housing and out-patient health services were offset by the decline in electricity, gas, and other fuels and operation of personal transport equipment. It should be noted that the inflation for electricity, gas, and other fuels fell as a result of downward adjustment in electricity rates and price reductions in kerosene and LPG while inflation in operation of personal transport equipment declined on lower pump prices of diesel and gasoline (in turn reflecting the continued decline in international oil prices).

The BSP always say that bank credit growth reflect on the economic conditions. On the other hand, they say that liquidity measures are manifestations of bank credit activities. So if liquidity has been shrinking (left), then this means the state of the economy must be leveling off despite the still double digit growth in bank credit.

But in contradiction, they have been repeatedly saying that domestic demand remains strong and proves this by picking on selective evidence like car sales.

And the irony too is that the BSP looks at CPI as STRICTLY a supply side phenomenon. But when they imposed on financial repression policy of negative real rates as economic subsidy in 2009, they see this in terms of boosting aggregate demand through monetary easing. So how has aggregate demand through policy easing been affecting CPI? They never explain. Instead they engage in equivocation or they weasel or fudge.

Let us put this way if there has been “adequate domestic supply”, how or what about the state of demand? Why should CPI fall if demand has been strong? Producers don’t care about prices and profits to just mechanically produce? Importers don’t bother about prices and profits to just relentlessly import? Yet both imports and industrial output have been contracting.

Whatever happened to the relationship between prices and the law of demand and supply? And the public is made to believe that such discussion is about economics? Yet how can economics be without the coordinating function of prices?

Last week I covered the latest BSP’s survey which revealed of weak Wholesale and Retail April PMIs (aside from manufacturing)

Recent price data from the Philippine Statistics Authority (PSA) confirms of a sustained retail activity slowdown in the 2Q based on June’s data.

From the PSA[7]: Year-on-Year The General Retail Price Index (GRPI) in the National Capital Region (NCR) further slowed down to 0.9 percent in June 2015. It increased by 1.5 percent last month and in June 2014, 2.9 percent. The indices of mineral fuels, lubricants and related materials and machinery and transport equipment continued to post negative annual rates of 15.5 percent and 0.8 percent, respectively. In addition, slower annual gains were recorded in the heavily-weighted food index at 2.7 percent; beverages and tobacco index, 4.0 percent; and manufactured goods classified chiefly by materials index, 0.7 percent. A faster annual increase was however, registered in crude materials, inedible except fuels index at 1.2 percent. Movements in the indices of chemicals, including animal and vegetable oils and fats and miscellaneous manufactured articles remained at 1.7 percent.

Why have prices been continually falling? On a month to month basis, retail prices have even been contracting (CPI deflation)! Month on month, July CPI has barely budged at .1%.

Retail prices, CPI and April PMI have been singing the same tune!

Yet where has all the freshly minted money been going or flowing to? Debt payments? And or speculative ramp on stocks and properties?

Such speculative orgy must have sent 1Q Makati CBD prices to soar by a shocking 25% year on year! Thus, could the “slight uptick in actual rentals for housing” in July CPI have been a spillover from the property speculation???

If BSP data on Makati property prices is true, then I can just imagine how a surge in rental prices in Makati will crucify businesses.

So in 1H 2015 instead of investments, many have just elected to gamble away their savings or borrowed money? In contemporary times, many have come to believe that gambling is synonymous to “making money”.

And because of lackadaisical investments, jobs have become even scarcer.

Online jobs continue to nosedive. Monster.com’s June data reveals that online hiring plunged 32% year on year. Yet they call this “a significant improvement in growth from -43% in May 2015”[8]. Huh?

Officers from monster.com must have been scathingly pilloried by the throng of believers who think that the Philippines have reached a developed economy status to force the latter to utter such balderdash.

The reason for the June improvement has been due to the lower June 2014 data (see left). On a month on month or on a quarter level, there has been HARDLY a significant progress…if there has been any at all.

For June, biggest job gains have been in the BPO sector at 8% and in the Customer Service jobs at 10%. On the other hand, the biggest losers have been the Production/ Manufacturing, Automotive and Ancillary sector with a 56% collapse and the Engineering/ Production, Real Estate jobs at 49% crash.

If one would notice, real economy prices have matched with job activities. Philippine manufacturing producers (input) prices has sustained NINE months of price contraction as of June based on PSA data. Estimates of Industrial output has slumped 5 out of 6 months as of May. So prices, jobs, and surveyed activities have chimed.

G-R-O-W-T-H has been dramatically downshifting.

And the most productive sectors of the economy have materially slowing if not contracting.

And it’s not just monster.com, the other online job I have been monitoring has slowed even faster. Overall jobs have crashed 41% as of last week from April 2015.

The apparent economic slowdown in the face of declining liquidity due to slowing credit growth should serve as a testament of Philippine economy’s entrenched dependence on credit as a key driver of economic activities. It is a sign how the Philippines has been transformed into a BUBBLE economy.

The collapse in growth in money supply or domestic liquidity as a consequence of moderating credit growth simply means that the invisible redistribution process that built on malinvestments or capital consumption has equally been slowing. The ramifications will be to bring about those early malinvestments to the surface. They have now become apparent in the form of economic downturn. This should be followed by financial and economic losses. Finally this will transit into to credit and liquidity contraction, as well as to asset liquidations.

History tells us that the obverse of every credit mania had been a crash. This time will NOT be different.

Finally, the PSA divides CPI into two categories: a general CPI and the bottom 30% of households. The bottom 30% has been those who earn 62k or less (as of 2009). The bottom 30% accounted for 5.737 million families or an estimated 30% of the 19.128 million families as of 2011. Here are their alleged features.

The PSA’s CPI for the 1H of 2015 for the underprivileged has been at 2.6%. This compares to the 1.9% for the general headline CPI (year to date). Unless the bottom 30 has seen an increase income, the 2.6% CPI should serve as a crushing blow to this group’s purchasing power. If these numbers are anywhere accurate, then the economic anguish of such group will only exacerbate their ordeals.

Thank the BSP for their “trickle down” policies of transferring whatever residual purchasing power left to them for the benefit of the politically connected economic elites and to the powers that be.

Phisix 7,500: The Alignment of Shrinking Liquidity, Market Internals and the Death Cross

The PSEi closed marginally lower or by .23% last week. But that’s after a volatile week which saw an incredible roundtrip—the significant gains posted at the start of the week, especially on Wednesday, had been neutralized by bigger losses from the last two trading sessions.

The losses would have even been larger save for the last minute or marking the close pump on Friday which shaved off about a quarter or more of the session’s losses.

Yet last week’s index performance hardly reflected on broad market activities.

First, sectoral indices manifested a bearish bias. Four of the six major sectors were in the red. The property sector’s substantial advance (+2.19%) basically mitigated the week’s headline losses. The property sector was partially supported by the slight gains in the holding sector.

The property sector’s advance has been prompted for by a media blitz on strong ‘earnings’ by SMPH. Unfortunately as discussed below, the 1H disclosure by the shopping mall titan has been loaded with booby traps.

In addition, the PSEi firms were divided in performance: losers edged out gainers 16 to 14 or by a margin of 2.

Also, losers dominated the broad markets with a substantial 103 margin. Interestingly, losers controlled daily activities by 4 to 1. Index gains on daily activities have hardly been a factor in influencing general market activities.

The broader market continues to selloff.

Additionally, among PSEi firms, bears have captured more recruits.

PLDT and MPI have traded places. MPI moved out of the bear’s camp, but PLDT now has a foot inside. PLDT marks, the first of the top 10 biggest issues, to fall into the clutches of the bears.

I rearranged the table to reflect on actual rankings based on Friday’s market cap based weightings.

Record breaking issues, SMPH and GLO have climbed to the fifth and to the sixteen spot. However 11 issues or 36.67% of PSEi basket are members of the bears, with eight prospective recruits.

Moreover, this week’s trading activities have again been marked by low peso volume (Php 7.7 billion) and a continuing stagnation in the number of issues traded and daily trades.

In sum, stock market liquidity continues to shrivel.

Finally, from the charting aspect, bearish forces seem as gaining ground.

Since the trough in June 12, there have been three attempts to push the headline index beyond the 7,670-80 resistance level. Yet all three attempts have been foiled. Chart technicians may construe this as a mini triple top.

And since the April peak going through last week’s activities, the ramifications of aggregate selling pressures have prompted the 50 day moving averages (blue) to crossover with 200 day moving averages (red).

For chart aficionados this is known as the bearish DEATH CROSS.

Hidden Booby Trap in SMPH’s Flowery 1H Earnings

Last week’s stock market pump on SMPH has been a curiosity because of media and the establishment’s serenade on the firm’s supposed strong earnings.

But the fustian portrayal of earnings essentially masked the ongoing decay in the SMPH’s fundamentals.

I will focus on SMPH’s topline which is equivalent to the GDP or the total value of the public’s spending on SMPH’s goods and services.

Profits can also be non recurring or temporarily recurring (from money illusion, fall in expenditures or business costs as a result of organizational efficiency from innovation, R&D, adaption of technology or a significant decline in several key input costs).

I will omit discussing the Php 18.7 billion in non recurring marketable securities gains by SMPH.

Profits can also be bloated through cooking the books or accounting magic or through other machinations such as DBP’s market manipulation

But generally, healthy profits or earnings DEPEND on topline performance.

I show TWO important categories in SMPH’s disclosures: the 1H (left) and the 2Q output (2Q)

The biggest category of SMPH’s revenues has been rent. Rent accounted for 54% of 1H and 52% of 2Q 2015 revenues. While rent increased 10.02% and 9.73% in 1H and in 2Q, it had been down from 12.47% and 12.78% over the same period in 2014.

The second most important category of SMPH’s revenues has been real estate sales. RE sales accounted for 34.23% of 1H and 36.04% of 2Q 2015 revenues. SMPH’s RE sales improved by 3.15% in the 1H, especially when compared to the 2014’s -3.65%. However 2Q output has been dismal at only .54% as against 8.62% in 2014.

A RE sales growth of .54% in 2Q means that 1Q RE sales grew by 5.76% to produce 1H 3.15%. NOTE we are talking of a LOW SINGLE DIGIT growth. Moreover, 2Q growth at .54% has been a borderline case or a sign of stagnation.

The Inquirer as cheerleader for SMPH notes that “As an indicator of future revenue growth, the housing group’s six-month reservation sales grew by 24 percent year-on-year to 6,868 units in the first half of 2015, translating to a 28 percent increase in value worth P18.8 billion. Most of the reservation sales were for Air Residences, Shore Residences, Shore 2 Residences, Fame Residences and Grace Residences.”[9]

Last year which had more liquidity juice for a speculative pump, SMPH produced 8.62% growth on 2Q. That should have been a good rate. But the significant 2q growth failed to boost 1H 2014 performance such that RE sales revenue slipped by 3.65%

In contrast, given the sharply slowing economy, marked by slowing credit and liquidity, many of those reservations will likely get forfeited. Or even worse, these numbers may have signified only a publicity embellishment.

Furthermore, note that SMPH’s overall topline revenues grew by 7.29% in 1H as against 7.25% in 2014!

Yet what happened to the string of new SM malls?

Again from the same Inquirer article: The newly opened shopping malls included SM Aura Premier, SM City BF Parañaque, Mega Fashion Hall in SM Megamall, SM City Cauayan, and SM Center Angono. These added 652,000 square meters to SMPH’s rental portfolio.

Additional 652,000 square meters of rental portfolio produced only a 1H growth of 10.02% in 2015 down from 12.47% in 2014 and equally 9.73% in 2Q 2015 as against 12.78%?

Yet given the 1Q surge in real estate property prices, how much of 1H 10.02% and 2Q 9.73% growth reflected on rent increases (money illusion) rather than from same rents and same royalty rates from sales?

IMPORTANTLY, has the increase in supply of malls in the face of the slowdown in rent revenues translated to MORE store VACANCIES????

Hmmmm. Things are getting to be MORE interesting!

And here are more skeletons in the closet as exposed from SMPH’s parent SMIC.

From another Inquirer rah rah article[10]: (bold mine) Excluding contribution from new stores, same-store sales by SM department stores grew by 3.7 percent year-on-year in the first semester as the group kept a lid on operating expenditures, SMIC senior vice president for finance Franklin Gomez said. The SM food retailing group—including the supermarkets—grew same-store sales by 1.2 percent. This unit continued to expand in both urban and rural communities, adding 20 new stores in various parts of the country.

Hear ye! Hear ye! The Philippine is supposed to be having a boom. Yet the Philippines biggest non food retail chain as seen through same store sales by SM department store and by SM supermarkets grew by just a LOW SINGLE digit of (drumroll…) 3.7% and 1.2%!!!

How awesome! What a robust growth!

And this is boom time? What more if the economy slows, will single digit growth morph into contraction?

SMPH has reportedly been earning so much profits, yet PARADOXICALLY it wants to raise Php 30 billion through bonds from the public!!! The excuse: Blame the FED!

From the Businessworld[11]: SM Prime Holdings, Inc. is set to raise roughly P30 billion from debt issues in two tranches in the next nine months to finance its 2016 spending budget before the Federal Reserve makes its move to raise borrowing costs.

Php 30 billion in perspective represents 85% of SMPH’s topline revenue for the 1H 2015. Php 30 billion signifies about 1 year and a half of SMPH’s 1Q ‘profits’ at Php 11.2 billion.

Could SMPH be running out of cash flows to fund existing projects? So it blames the FED to justify issuing more bonds in the name of profits AND capex?

Let me add that nearly HALF of the parent SMIC’s debt profile (based on 1Q 2015 17-Q) has been denominated in US dollar where only a portion of these have been hedged through currency swap contracts. This means the soaring US dollar will likely put pressure on SM’s profits.

Yet again, have profits pumps been used to justify more debt dependence for the SM group?

SMIC has allegedly so much profits, yet BDO has to raise “a $500-million multi-year syndicated term loan facility with regional and international banks” for the purpose of “refinancing of an existing term loan and for general banking and corporate purposes”[12]

How much for debt recycling? How much for the rest? So has BDO foreign currency borrowing been mainly designed as Debt IN, Debt OUT or borrowing to pay back existing loans?

With the firming of the US dollar, BDO’s foreign currency borrowing, unless they are fully hedged, would seem like playing with fire. And to play with fire, one can get burned.

The nub: A lot of SM present activities have hardly been about profits but about the use of profits to justify incurring more DEBT. This comes even as the real economy has been materially slowing, regardless of what government G-R-O-W-T-H statistics says. SM’s topline numbers all support the ongoing slowdown.

And those fund raising announced would only mean more redistribution from the depositors to financial elites.

It also means more transfer of risk from the elites to gullible depositors.

All these have been facilitated by BSP’s financial repression trickle down policies.

As a final note, another marquee retail food outlet Jollibee Foods Corporation exhibited deteriorating rate of topline growth

The blue bars represent JFC’s 1H performance growth rates. The red bars signify the 2Q growth rate.

Because JFC’s 1H earnings growth only produced 5.4%, the Inquirer omitted mentioning the growth rate on the headlines. Instead they cited the profit level of Php 2.6 billion.

Most of what is known as journalism looks like press releases

Just remember the issues cited above come with stupendous Price Earning Ratios!

Essentially almost all the top 15 issues in the PSEi have been absurdly overvalued.

Recognition of a slowdown will likely extrapolate to higher PE ratios unless prices adjust faster.

The ‘PER trap’ means that overvalued securities will be subject to eventual violent adjustments.

[1] The Economist Plunging like it’s 1998 August 8, 2015

[2] See Phisix: Weakening Asian Currencies to Weigh on Region’s Risk Assets November 10, 2014

[3] See Video: A Look at Malaysia’s Savings Retirement Crisis November 22, 2014

[4] Judy Shelton Fix What Broke: Building an Orderly and Ethical International Monetary System p 279 Cato Journal 2015

[5] Bangko Sentral ng Pilipinas End-July 2015 GIR Settles at US$80.4 Billion August 7, 2015

[6] Bangko Sentral ng Pilipinas July Inflation Edges Lower to 0.8 Percent August 5, 2015

[7] Philippine Statistics Authority General Retail Price Index in the National Capital Region (2000=100) : June 2015 August 3, 2015

[8] Monster.com Visible Improvement for Philippines’ Online Hiring, but Overall Growth Remains Negative August 2015

[9] Inquirer.net SM Prime net profit rises by 90% in H1 August 4, 2015

[10] Inquirer.net SMIC net income up 10% August 7, 2015

[11] Businessworld SM Prime to raise P30B from debt issues ahead of Fed move August 7, 2015

[12] Businessworld BDO secures three-year loan August 7, 2015

No comments:

Post a Comment