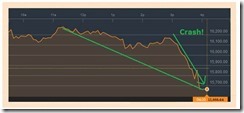

Wow. Posted below I noted of how US stocks had been drifting about 3%+ at the opening. Now I awoke to discover that another quasi crash overwhelmed them

Here’s an ex-post explanation from Bloomberg:

A rebound that took the Dow Jones Industrial Average up more than 440 points disappeared in the final hours of trading, with investors giving in to trepidation over what will happen overnight in China amid the most volatile equity markets in four years.The 30-stock gauge ended down 204.91 points, or 1.3 percent, at 15,666.44 at 4:09 p.m. in New York, and 4 percent below its session high. The peak-to-trough retreat exceeded the loss at Monday’s close, when concern about global growth ignited the worst decline for U.S. shares in four years. The Standard & Poor’s 500 Index went from up 2.9 percent to down 1.4 percent, closing at 1,867.61 as most of the selling occurred after 2 p.m.

Let me take the Dow as example to explain the quasi crash.

At 440 points that’s equivalent to 2.8%. So the Dow’s intraday peak was at 2.8%.

But the Dow ended the day down 1.29%. So the Dow’s early 2.8% pump turned into a brutal last minute 4.09% or 644 points dump!

So if China’s rate cut has been the “cause”, or if doubts on the effectiveness of the PBoC’s rate cutting has incited this shocking reversal, then this simply implies that the markets have now taken a transitioning perspective on central bank actions. They are pushing back on central bank policies!

As I wrote last weekend,

The era of central bank free lunch policies are coming to a close.

I’d add that this hasn’t just been China.

This has also been a manifestation of the entropic internal dynamic in US markets too.

Below are few examples as provided for by Gavekal Team (based on last Friday’s close)

The above only shows of the ongoing decay within US stocks even prior to the meltdown.

In short, the meltdown represented a ventilation of the gaping divergence between the headline index and market internals

Psychologically, the previous sharp slump may have been increasing strains or doubts on the sustainability of US markets at current levels.

Recent developments have really been phenomenal. And I suspect, all this marks a vital MAJOR turning or inflection point.

Let us see how Chinese stocks will respond to the rate cuts. Rationalized by media as similar to Greenspan’s pivotal 1987, the last time around the PBOC cut rates, Chinese stock crumbled. And this prompted to the series of draconian direct interventions.

No comments:

Post a Comment