It seems that the adulterated Chinese version of King Canute, whom has incredibly failed to stop the stampede out of China’s stock markets, might soon concede to the futility of their actions. That’s because there seems to be no barrier to the juggernaut in the crash of Chinese stocks.

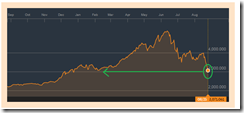

With today’s 7.63% crash, the Shanghai Index fell below the key psychological threshold of 3,000

From Bloomberg:(bold mine)

Chinese shares plummeted to extend the steepest four-day rout since 1996 on concern the government is abandoning market support measures.The Shanghai Composite Index tumbled 7.6 percent to 2,964.97 at the close, sinking below the 3,000 level for the first time in eight months. The gauge has dropped 22 percent in four days since Aug. 19. More than 700 stocks fell by the 10 percent daily limit in Shanghai on Tuesday, including PetroChina Co., the nation’s biggest company by value.Speculation around the government’s intentions has escalated since Aug. 14, after China’s securities regulator signaled authorities will pare back the campaign to prop up share prices as volatility falls. The China Securities Regulatory Commission made no attempt to reassure investors after Monday’s plunge, unlike a month ago when officials issued two statements shortly after an 8.5 percent drop.

See, China’s King Canute has almost given up in trying to quell the selling tsunami! That’s because with every effort they take, they look incredibly helpless, if not ludicrous.

Additionally, perhaps the Chinese leaders now realize that their actions only exacerbate on the ferocity of backlash.

More…

Tuesday’s drop is the seventh decline of more than 6 percent for the benchmark gauge in the past three months.The CSI 300 Index declined 7.1 percent, with gauges of energy, technology and material companies sinking more than 8 percent. PetroChina, long considered a favorite holding of state-linked rescue funds, closed at its lowest level since December…Some 17 percent of listed shares traded on mainland bourses were halted from trading Tuesday, little changed from Monday. About 40 percent were suspended during the depths of last month’s rout.Industrial & Commercial Bank of China Ltd., the nation’s second largest company, fell 5.1 percent in an 11th day of declines. Agricultural Bank of China Ltd. slid 9 percent. Futures on the CSI 300 sank by the 10 percent daily limit.

To add, according to SCMP's George Chen only 28 stocks rose today with about 2000 stocks at daily limit down.

So today’s rout brings the Shanghai index back to the February 2015 and December 2014 levels.

Should another 900 points of losses materialize, then this would extrapolate to 'back to square 1' for the index or the return to the root of the bubble cycle. And in the event this happens, this means ALL gains from the previous boom would have been expunged!

Meanwhile, the Yuan fell anew against the US dollar on likelihood of continuing capital flight from the China's multiple hissing bubbles.

On the other hand, Japan’s Nikkei 225 slumped by another 3.96% today.

Curiously, the Japanese major equity index experienced sharp intraday volatility today

After opening deep in the red, the Nikkei rallied strongly to erase all the losses to even generate modest gains going into the mid session.

These gains, unfortunately, succumb to late session collapse. So essentially the Nikkei closed at almost the same level where it opened. Fantastic round trip.

Well, US futures and German equities seem to have departed from the Asian counterparts. As of this writing, both are up by about an astonishing 3.0%+ which almost neutralizes the gist of yesterday’s losses.

Updated to add: No wonder the violent rally, China's central bank, the PBOC just cut interest rate for the Fifth Time since November 2014.

This means no surrender yet for China's Canute.

And this also means additional debt to an economy struggling to maintain its debt.

Updated to add: No wonder the violent rally, China's central bank, the PBOC just cut interest rate for the Fifth Time since November 2014.

This means no surrender yet for China's Canute.

And this also means additional debt to an economy struggling to maintain its debt.

No comments:

Post a Comment