For

their part, the central bankers keep all the trappings of capitalism,

talking the talk and making the right sorts of gestures and

references. They talk “libertarian” as Friedman and then act

socialism as Keynes. No matter how little circumstances change, they

never do. And that is the ultimate problem; central banks have

hijacked capitalism in order to maintain their own authority, using

the idea of free markets in order to undercut the very ideas of

freedom and free markets. We know this because their only answer to

every single problem is the same – them.—Jeffrey

P Snider

In

this issue:

Phisix

7,250: SM Investments Posted NEGATIVE Growth in Real Estate Sales in

2015! Peso-Asian Currencies Fly on Yellen Dovishness

-Yellen

Dovishness Spurs Manic Buying on the Peso and Asian Currencies

-SM

Investment’s EPS Growth: Not Just ZERO in 2015, But a Collapse

During the Past Two Years!

-SM’s

Real Estate Sales Crashed in 4Q 2015!

-SM’s

Business Model as Epitome of Malinvestments

-Filinvest

Land: Like SM, Gross Revenues and EPS Growth Rates Tumbled in 2015

-Philippine

High End Property Prices Deflates (Q-Q)/Decelerates (Y-Y) in 4Q 2015

as Systemic Leverage Balloons!

-CEBU

Pacific EPS Marvel: Crash in Jet Fuel Prices More Than Offsets

Faltering Topline, Foreign Denominated Debt

-Has

the BSP Implemented an Undisclosed Stimulus via the Yield Curve?

Phisix

7,250: SM Investments Posted NEGATIVE Growth in Real Estate Sales in

2015! Peso-Asian Currencies Fly on Yellen Dovishness

Yellen

Dovishness Spurs Manic Buying on the Peso and Asian Currencies

The

story of the week belongs not to Philippine stocks but to the

Philippine peso. Based on official USD php rates went down by .83% to

46.015.

But

this has been more than about the peso but about the USD. That’s

because the peso simply resonated on how the region’s currencies

performed against the USD.

For

the week, the biggest USD Asian losers (or winners) were Malaysia’s

ringgit 3.63%, Singapore dollar 1.52%, Taiwan and South Korean dollar

at 1.29% a piece. On a year to date basis, the USD-Asian biggest

losers (winners) has been the Malaysian ringgit 9.38%, Indonesian

rupiah 4.5% and the Singapore dollar 4.14%. The biggest winners were

ASEAN currencies, aside from the ringgit and rupiah, the USD-thb

(Thai baht) 2.4% and the peso 1.88%.

This

week’s massive move by the region’s currency was incited by Fed

Chair Janet Yellen speech at the Economic Club of New York1

where she reinforced on what seems as the implicit Shanghai Accord by

taking on an ultra-dovish stance:

“Given

the risks to the outlook, I consider it appropriate for the Committee

to proceed cautiously in adjusting policy. This caution is especially

warranted because, with the federal funds rate so low, the FOMC's

ability to use conventional monetary policy to respond to economic

disturbances is asymmetric”

Ms

Yellen justified this by citing several risks, namely:

-China:

“One concern pertains to the pace of global growth, which is

importantly influenced by developments in China. There

is a consensus that China's economy will slow in the coming years as

it transitions away from investment toward consumption and from

exports toward domestic sources of growth. There is much uncertainty,

however, about how smoothly this transition will proceed and about

the policy framework in place to manage any financial disruptions

that might accompany it. These uncertainties were heightened by

market confusion earlier this year over China's exchange rate

policy.”

-Oil

prices: “A

second concern relates to the prospects for commodity prices,

particularly oil. For the United States, low oil prices, on net,

likely will boost spending and economic activity over the next few

years because we are still a major oil importer. But the apparent

negative reaction of financial markets to recent declines in oil

prices may in part reflect market concern that the price of oil was

nearing a financial tipping point for some countries and energy

firms. In the case of countries reliant on oil exports, the result

might be a sharp cutback in government spending; for energy-related

firms, it could entail significant financial strains and increased

layoffs. In the event oil prices were to fall again, either

development could have adverse spillover effects to the rest of the

global economy.”

-Inflation

outlook: “The

inflation outlook has also become somewhat more uncertain since the

turn of the year, in part for reasons related to risks to the outlook

for economic growth. To the extent that recent financial market

turbulence signals an increased chance of a further slowing of growth

abroad, oil prices could resume falling, and the dollar could start

rising again.”

-and

Market volatility: “The

proviso that policy will evolve as needed is especially pertinent

today in light of global economic and financial developments since

December, which at times have included significant changes in oil

prices, interest rates, and stock values.”

Ms.

Yellen’s March

29 speech sent Asian currencies flying

The

general idea is that a strong USD would mean tightening global

monetary conditions whereas a weak dollar translates to the opposite:

accommodative monetary conditions.

“Tightening”

extrapolates to financial market Risk OFF, or as example, January’s

crash. On the other hand, “accommodation” or “easing” means

Risk ON or providing fuel to combust on speculative leverage trades.

So

by jawboning down the USD, this simply meant that Ms Yellen, along

with her Shanghai

Accord peers, have virtually been shoring up price levels of risk

assets to prevent its bursting or collapse. Central banks objectives

has implicitly shifted from “maximum employment, stable prices, and

moderate long-term interest rates” towards nurturing and sustaining

bubbles. As analyst Doug Noland aptly pointed out, “the overarching

central bank “financial stability” mandate has morphed into

ensuring Bubbles don’t burst”2.

Ms

Yellen and her contemporaries seem to think that balance sheets don’t

matter and that zero bound or negative interest rates would be enough

stimulus to provide support to the financial assets in the hope of a

“trickle down” to the real economy—a hope that hasn’t been

realized since 2009. Why do you think anti-establishments

candidates Donald Trump and Bernie Sanders have been rocking the

boat in US politics? Or the rise

of right wing politics in Europe?

Nonetheless,

“accommodation” or “easing” postulated to the return of

leveraged carry trades and massive speculations that has exacerbated

short covering and panic buying on Asian currencies.

So

the runup in both stocks and currencies from January lows has been

from central banks panicking over the risk of bubbles bursting hence

the coordinated moves to provide support on risk assets via

“accommodation” or “easing”.

This

applies to the Philippines as well, so the runup in the peso and the

Phisix has been a product of speculative excess from “accommodation”

or “easing” rather than from normal course of business.

As

noted below, it would be an irony to see record highs amidst severe

deterioration in earnings growth particularly for the largest listed

Philippine firm SM investments.

For

the week, the Phsix was down by 1.56% due to three sessions of last

minute marking the closes.

So

far, the overbought Phisix has been supported by the rally in the

peso (faltering USD).

The

$64 trillion question is: How long can central banks keep stimulus

gambling addicts satisfied?

SM

Investment’s EPS Growth: Not Just ZERO in 2015, But a Collapse

During the Past Two Years!

Remember

I wrote about SM’s

ZERO income growth for 2015 a month back? Well, it has been made

official.

The

largest publicly listed firm, SM Investments released its 2015

annual report this week. And the report essentially confirms on

the ZERO income growth for 2015.

Technically

it was not zero. 2015 earnings per share (EPS) was at Php 35.68 which

was fractionally (.06% or 6/10,000) higher than the Php 35.66 in

2014. But it is allegorically ZERO.

But

it is not the ZERO that is important, rather, SM’s

eps growth rate has been in a decline for THREE straight years,

where earnings growth has plunged from high rates of 15.28% in 2012

and 9.73% in 2013 to just 2.32% in 2014 and .06% in 2015! In short,

what matters is the COLLAPSE in EPS growth!

Look

at the blue trendline in the chart above: eps growth rate has not

only been downhill growth rate since 2012, it has been zero bound in

the last two years! They look like interest rates of central banks:

from ZIRP to NIRP

Yet

despite the headline blitz to promote G-R-O-W-T-H, SM’s

reported earnings trend represents a stunning erosion of financial

performance!

And three

years of downtrend hardly signifies an anomaly!

Recall

that at the outset of 2015, the public was made to believe that

earnings growth for the entire PSE listed universe would be in the

mid-teens. And such has been the basis for the frantic and emboldened

pumping of equity prices to send the PSEi to record highs in April

2015.

Well,

it turned out that mainstream expectations had totally been

wrongheaded or out of bounds. Given SM’s dismal showing coupled

with the former biggest market cap, PLDT’s huge financial

deterioration in 2015, combined with the dismal second and third

quarter performance of the overall PSE listed firms, which were

censored by the PSE, 2015

should signify as a G-R-O-W-T-H fiasco!!!

But

in spite of Big FAT ZERO G-R-O-W-T-H for 2015, SM share prices have

incredibly skyrocketed

to carve new highs a week back! (see bottom chart)

To

repeat: under present conditions, SM’s declining eps trend and the

2015 ZERO growth EQUATES to record high share prices! Earnings,

divergent from stock prices, have been the case since 2014. But such

brazen disparities have even become more pronounced today!

This

only shows that Philippine stocks—have

not been about fundamentals,

where divergence in valuations and prices have represented an

incredible showcase of detachment from reality or egregious

misperceptions—but about

frenzied speculations!

Nonetheless

aside from sustained deliberate pumps to desperately prop up a

Potemkin headline index as seen in three

instances

last

week, the public remains spellbound to the consensus incantations of

G-R-O-W-T-H.

But

sad to say that SM’s G-R-O-W-T-H model seems to have already been

fractured.

SM’s

ZERO G-R-O-W-T-H has mainly been a function of cascading

or decaying

topline performance.

SM’s

merchandise sales or retail segment grew by only 7.25% in 2015, down

from 8.96% in 2014 and 13.84% in 2013 (top window red trendline).

SM’s

rental revenues or shopping malls slowed to 10.32% in 2015 from

16.74% in 2014 and 13.09% in 2013. (green trendline)

Worst,

SM’s real estate sales was N-E-G-A-T-I-V-E .44% in 2015! To

reiterate NEGATIVE! (see lower window)

2015

was the second time in FIVE years for SM’s real estate to post a

NEGATIVE sales growth!

In

looking from the past, it would seem an irony to see how the public

had been hypnotized by the repeated screaming of G-R-O-W-T-H!

For

instance, in their 2014 annual performance announcement, SM hinted

that real estate sales in 2015 would be vigorous largely due to

reservation sales3:

“SM

Prime’s housing group recorded a 7% increase in real estate sales

in 2014 to PHP22.2 billion, with reservation sales increasing 36.5%

to PHP35.9 billion”

Curiously,

whatever happened to the boom in reservation sales? Why the negative

sales in 2015? Has a significant majority of buyers pulled out from

long term commitments? Why?

But

it appears that the public has either so short a memory or simply

dismiss anything negative as irrelevant or politically INCORRECT.

SM’s

Real Estate Sales Crashed in 4Q 2015!

SM

real estate sales was up by a measly 3.22% through 9 months based on

the Quarterly

17-Q Report for the third period, so I was intrigued as to why

the NEGATIVE growth for the year

After

deducting the yearend from 9 month numbers,

it turned out that SM’s real estate sales crashed by a staggering

9.92%!!!

Why

the plunge? Because of too much supply? Because of a slowdown in

demand? Or because of a combination of both?

Remember

the orchestrated

two week media hype on Philippine real estate in late October 2015?

SM’s real estate performance seem to confirm my suspicions.

Of

course, to

see headline numbers degenerate in the face of a massive buildup in

capacity is by itself stunning in momentousness.

Here

is how SM expanded in 2015.

The

“SM store” added 20,932 sqm in 2015 to bring a total of 471,700

sqm of net selling area to its 53 stores. SM department store

basically expanded by 4.64%

The

number of SM supermarkets expanded to 45 with the inclusion of 5

stores in 2015. That translates to 15.4% increase in supermarket

sales potential

24

Savemore branches were opened in 2015. Such added to the overall

Savemore branches to 136 at the close of 2015. This would posit to

about 21.43% of additional store capacity.

Two

hypermarts were opened to add to the 44 at the close of the year.

This translates to 4.76% hypermart store inventories.

In

short, two 5%s, a 21% and a 15% of additional different variety of

stores only brought about retail sales growth of 7.25% in 2015! Just

exactly where was the substance of the contributions of the new

stores? Importantly just what happened to same store sales?

For

shopping malls, 5 SM malls were added to its basket of malls which at

the end of the year totaled 56. That’s 14.3% of additional malls.

In terms of floor area, the 5 malls accounted for 775,441

square meters of gross floor area (gfa) which at the yearend expanded

total gfa of SM Malls to 7.3 million sq. m. So a total of 11.9% of

gfa expansion for SM’s Malls

As

for real estate, SM barely cited the additional inventories to their

existing 27 residential projects (25 in Metro Manila and 2 in

Tagaytay) in 2015. Although in the early 2015 investor presentation

by subsidiary

SMPH, the firm’s proposed real estate expansion had been at the

range of 12,000-15,000 units which should add to their existing

79,741 units. At 12,000 that’s at least about 15% supply expansion

SM

has also docketed two commercial properties in 2015 which upped their

commercial inventory projects to 5. That’s a 66% surge in

commercial inventory.

Hotels,

convention centers and trade halls are also part of the SM’s

consumer based business models. Nonetheless, the annual report didn’t

expound much of the details of 2015 supply activities except to cite

on the overview 1,167 saleable rooms for 5 hotels, 4 convention

centers and two trade halls with total leasable space of 35,263 sqm

All

these grandiose expansions generated only rental income growth of

10.32% and 7.32% in retail sales in 2015????!!!! Worst, a NEGATIVE

-.44% growth for real estate sales???!!!

I

presented the actual part of SM’s income statement above because

the real estate segment varies from what has been declared

by its subsidiary SMPH during their latest investor presentation.

Yet

these three segments comprise the core of SM’s revenues: retail

73%, property 23% and banks 4%.

SM’s

Business Model as Epitome of Malinvestments

Let

us examine SM’s shopping mall business model.

While

2015 rental revenue growth rate (10.32%) seems to reflect on the

proportionality of supply expansion (11.9% gfa), what this suggest is

that SM Malls have been sorely remiss in the maximization of selling

space in order to generate optimum income (as seen through ratio to

selling space).

Moreover,

this suggest of the inefficient use of mall spaces or low income

rates per selling space (g.f.a) or just too much or growing idleness

(read my lips: vacancies).

Additionally,

if all of SM’s growth rates of rental revenues are attributable to

additional supplies, then how about same store sales performance?

Instead of augmenting sales growth, has

their new malls been cannibalizing sales of existing malls?

Now

even if we split the rental revenue growth rates as ascribable to

both same store sales and sales from new stores, then what the

current growth rate implies has been that retail space demand has

significantly been LESS than the barrage of existing and new

supplies!

Haven’t

all these been symptoms of diminishing returns of additional supplies

or the germination of excess capacity?

And

this applies not only to SM Malls but to her retail and real estate

segments. Yet as noted above real estate sales have already shown

NEGATIVE performance in 2015. And this should underscore on the

surplus capacity or supply outgrowth!

And

what

more of the supply contributions from competitors?

Yet

SM

proposes to keep up with the race to build supply even in the face of

growing signs of inefficient use of existing inventories or of excess

capacity.

SM

officials seem to prioritize

on the goal of acquiring the most market share relative to

competitors.

They seem to believe that the growth trajectory of domestic demand

operates in a straight line. They appear to also discern that

domestic demand are largely

unaffected by capacity conditions.

Or that they see additional inventories from them or from competitors

as having little or no bearing on profits or even on future demand.

They

seem to believe in the idea that “if you build, they will come”

or a crude interpretation of Say’s

law

But

demand doesn’t appear from nowhere or like manna from heaven, as

the consensus experts preach or as SM officials seem to espouse.

Demand

is a function of mainly income and secondarily savings and credit

which translates to individual balance sheet conditions. Demand is

also influenced by ever changing individual’s subjective

preferences, competition and innovation.

Yet

what enabled SM’s gambit have been the continued

access to cheap money

and the transfer

of resources and risk from the public to them

(via bond offerings, IPOs, mergers and acquisition using SM and SM

affiliated shares).

Of

course, what has facilitated such invisible redistribution scheme has

been the BSP’s cheap money (negative real rates or trickle down)

policies. One might add the FED’s influence to this.

Yet

SM officials appear to be so

overconfident

to expect the continuity, if not perpetuity, of BSP subsidies.

Importantly like the consensus, they fail to appreciate that excess

capacity adversely affects demand too.

Once

excess capacity materializes into financial losses, this would have

widespread chain effects that would ripple across the industry first,

and subsequently, percolate into the economy.

The

transmission mechanism will

occur next through investments,

which should grind to a screeching halt. And this will

reverberate through many other economic and financial channels

such as weak demand and spillover financial losses to suppliers (as

well as ancillary firms) and to creditors, deterioration in job

conditions, increased business uncertainties, balance sheets

pressures, eventually the worsening of credit conditions, market

volatility among many other possible chain effects.

This

may even have social impact such as to raise political risks (see US

and Europe’s politics as noted above)

With

the flagrant misreading of how economic forces operate which has been

the foundation of their current and future actions (expansions), just

how can SM’s long projected G-R-O-W-T-H emerge?

And

as for “the build and they will come model”, China’s new

sunshine

industry: build

and demolish is proof of its unviability.

SM

is the epitome of the much ballyhooed Philippine economic growth

paragon based on consumption.

And SM’s business model has essentially been mimicked by her

competitors or the industry.

Nevertheless,

SM’s

business model is a lucid example of the formation of malinvestments.

And

we are not even talking about how such fantastic misallocation of

resources had been financed (mostly through debt).

As

final thought, there is one more insight that can be derived from

SM’s 2015 financial performance: the Philippine government says

2015’s RGDP was 5.8%. Really?

Filinvest

Land: Like SM, Gross Revenues and EPS Growth Rates Tumbled in 2015

SM’s

predicament has NOT been isolated. In fact, I have been pointing out

here that decaying topline performance, soaring debt levels, cashless

profits or profits through receivables expansion and symptoms of

excess capacity has emerged in balance sheets of major listed

companies as Ayala

Corp, PLDT,

Robinsons

Land and Vista

Land.

In

short, the above

strains has evolved to become a systemic

problem rather than just based on a few firms or industry.

Add

to this list Filinvest Land.

From

their latest Press Release4:

Filinvest

Land, Inc. (FLI), one of the country’s largest residential

developers and BPO office providers, recorded an 11% rise in

consolidated net income of Php 5.10 Billion for the full year 2015

from P4.61 Billion in 2014.

Consolidated

revenues rose 7% to Php18.30 Billion from Php17.06 Billion in 2014.

The company attributes this increase to the continued strong demand

for its BPO office space as well as the growth in revenues recognized

from its residential sales business. The company’s profit increase

was also driven by its ability to manage costs. Costs of real estate

sales and rental services increased by a mere 5%. General,

administrative, selling and marketing expenses meanwhile declined by

5%

Revenues

from rental assets increased to Php2.95 Billion, a 12% increase from

the Php2.63 Billion generated in 2014, as the firm booked increased

revenues from its office buildings.

Apparently,

FLI appears to have not only assimilated on SM’s business model but

likewise appears to have duplicated on SM’s public relations

casuistry of applying magical tricks in their announcement of 2015

financial results.

While

FLI did announce their consolidated revenues and income, aside from

revenues from rental assets, palpably missing in their statement has

been the contribution of revenues from its real estate business,

which paradoxically accounted for 77% of their 2015 total revenues.

Why? Because real estate revenue growth for 2015 was only 6.41% year

on year?

Based

on their annual

report, consolidated net income grew by 10.53% (11%) but this has

been way below the 18.75% in 2014, 14.29% in 2013 and 16.67% in 2012.

Seen differently, 2015 income growth rate was down by 43.84% relative

to 2014, by 26.13% and by 36.83% compared to 2013 and 2012

respectively.

As

consolation, at least it remains as G-R-O-W-T-H! And anything

positive is what the public wants to hear. For the politically

correct crowd, form matters more than substance.

And

if one reckons on consolidated revenue growth rate, or what I would

call as FLI’s NGDP, 2015’s 7.31% has been shockingly dwarfed by

2014’s 22.08%, 2013’s 17.23% and 2012’s 21.8%. So FLI’s NGDP

transitioned from high double digits to mid single digits. I would

call this a collapse

in NGDP!

Again

as consolation, but at least it remains G-R-O-W-T-H!

Seen

from the overall picture FLI’s NGDP, EPS, real estate sales and

rental revenues have all materially deteriorated in 2015.

FLI

concentrates or specializes on middle income housing which accounts

for 79.02% of its real estate portfolio.

My

perspective has always been about follow the money trail.

For

FLI, as topline performance sag, apparently receivables growth

remains at high double digits. However, real estate inventory growth

has bounced back from a drought in 2014.

Nevertheless

slowing topline, which means lesser cash intake plus uncollected

sales due to installment payments (via receivables expansion)

compounded by capex (or the sustained race to build supply) means

dearth of financing.

So,

FLI’s recourse has been to absorb even more debt (total payable up

18.34% in 2015 relative to +11.75% 2014 and +40.9% 2013) which means

the company has been substantially increasing its reliance on balance

sheet leverage (right window).

Philippine

High End Property Prices Deflates (Q-Q)/Decelerates (Y-Y) in 4Q 2015

as Systemic Leverage Balloons!

And

FLI, SM, VLL and RLC could be just a representative of the whole.

It

is truly interesting to note that compared to key emerging markets,

Philippine corporations appear to have the most

leverage

(total liabilities/total assets) based on the IMF data as of 20145.

(see left)

What

more today where tumbling sales and increasing cash flow deficiency

means more debt acquisition?

Of

course, the above represents an apples to orange comparison because

the sources of debt differs from country to country. Nevertheless, it

is a sign of growing

vulnerability

of the domestic corporate sector.

And

another titillating factor has been that despite the conspicuous

slowdown in real estate activities as seen through the income

statement performance of KEY listed property issues, real estate

prices, particularly in Makati

CBD, continue to soar (right) …well at least for most of 2015.

So 2015 can be characterized by panic buying of Makati CBD properties

in the midst of developing slack in the volume in the context of the

industry.

However,

Q4 2015 reported a sharp downturn in growth rates based on Global

Property Guide6:

The

average price of 3-bedroom condominium units in Makati CBD rose by

2.96% in 2015, down from increases of 4.29% in 2014, 9.86% in 2013,

and 4.87% in 2012. Housing prices dropped 0.84% q-o-q during Q4 2015.

Could

this be ominous of further declines ahead? Or will momentum

accelerate or intensify?

And

has this been more confirmation of my

suspicion of the widening cracks in the real estate bubble in the 2H

of 2015?

Global

Property Guide sees Asian housing markets as “losing steam” with

significant downturns seen in Taiwan, Singapore and Indonesia in

2015.

Well

they might like to add Hong Kong’s 70%

crash in housing sales in February, and Singapore’s .7%

housing price decline in Q1 2016 which has been down by 9% from the

peak. Moodys even downgraded the credit

ratings of Singapore’s big three banks last week. This hasn’t

been a surprise considering that even Singapore’s central bank, the

Monetary Authority of Singapore (MAS) previously

fretted over the nation’s domestic credit bubble.

The

takeaway, slowing topline in the face of growing leverage and

swelling capacity means the amplification of risks. This is

regardless of what central banks may do or has done. Additionally,

decoupling especially for Asia, is a mirage.

CEBU

Pacific EPS Marvel: Crash in Jet Fuel Prices More Than Offsets

Faltering Topline, Foreign Denominated Debt

Again

declining topline performance, soaring debt levels, and symptoms of

excess capacity can be seen even in the airline industry.

Additionally,

remember the mantra low oil prices equal consumption growth? Cebu

Pacific’s (CEB) annual performance debunks all such gibberish.

Last

week, media yelled in exaltation and babbled over CEB’s 413% jump

in eps growth. The general idea was that the profit surge was about

G-R-O-W-T-H!

Yet

in contrast to mainstream blubbering, despite fabulous bottom line,

CEB’s topline had a starkly

different

message from the bottom line.

CEB’s

outstanding bottom line came with topline growth rate at only 8.66%.

Such unimpressive growth rate was significantly down by 68% from

2014’s 26.82%, but was slightly up by 5.8% compared to 2013 and

considerably down by 25.98% and 48.02% from 2012’s 11.7% and 2011’s

16.6%, respectively. (upper window)

In

other words, the CEB’s 2015 topline accounted for the second

weakest

in the last 5 years.

But

how was CEB able pull a huge payout in 2015? The simple answer: The

collapse in Jet fuel prices pulled down flying expenses by 20.02% to

more than offset foreign exchange losses and vastly reduced

consolidated revenues.

As

the company explained7:

Flying

operations expenses decreased by P5.236 billion or 20.0% to P20.916

billion for the year ended December 31, 2015 from P26.152 billion

incurred in the same period last year. This is primarily attributable

to the 23.9% decline in aviation fuel expenses to P17.659 billion for

the year ended December 31, 2015 from P23.210 billion for the same

period last year consequent to the significant drop in jet fuel

prices as referenced by the reduction in the average published fuel

MOPS price of U.S. $64.79 per barrel in the twelve months ended

December 31, 2015 from U.S. $112.48 per barrel in the same period

last year. The drop in fuel prices, however, was partially offset by

the weakening of the Philippine peso against the U.S. dollar as

referenced by the depreciation of the Philippine peso to an average

of P45.51 per U.S. dollar for the year ended December 31, 2015 from

an average of P44.40 per U.S. dollar last year based on the

Philippine Dealing and Exchange Corporation (PDEx) weighted average

rates.

Aviation

fuel accounted for 84.4% of Flying expenses and 37.7% of total

expenses. Based on indexmundi’s quote,

U.S.

Gulf Coast Kerosene-Type Jet Fuel Spot Price FOB, US$ per gallon

crashed by 40% from end December 2014 to end December 2015.

So

in 2015, CEB was a major beneficiary from the invisible transfer from

the collapse energy prices.

But

how much of the decline in fuel prices was passed over to consumers?

Well

this

was the divergent message between the topline and bottom line. The

answer was close to ZERO!

CEB

noted that the average fare was down by 2.5%

to P2,323 in 2015 from P2,382 for the same period last year.

However,

CEB added a lot of capacity in 2015: “Number of flights went up by

7.6% year on year as the Group added more aircraft to its fleet,

particularly, its acquisition of wide-body Airbus A330 aircraft with

a configuration of more than 400 all-economy class seats. The number

of aircraft increased from 52 aircraft as of December 31, 2014 to 55

aircraft as of December 31, 2015.”

So

flights increased by 7.6% as plane inventory grew by 5.8%

Perhaps

investments on capacity prevented the company from further lowering

of passenger fares.

CEB

noted that passenger traffic increased by 8.9% but passenger revenues

only added 6.2% over the year.

Heck,

passenger revenue growth rate of only 6.2% in 2015 (upper window

green line) signifies a collapse

from 2014’s 26.93%! And such was significantly down from 2013’s

7.04% and from 2012’s 8.71%. Passenger sales accounted for 76% of

overall revenues.

In

short, 2015 accounted for the weakest

passenger sales

for CEB during the past FOUR years! It was either consumers

stayed away from travel or they traveled via CEB’s competitors!

Cargo

rate growth had a better performance with 2015’s 10.01% which was

half from 2014’s 20.57% but marginally higher than 2013’s 9.6%

and 2012’s 8.56%. Cargo accounted for 6.12% of total revenues

On

the other hand, what buoyed the top line had been the booming

Auxiliary revenues: 2015’s 19.55% wasd down from 2014’s 28.73%,

but up from 2013’s 13.25% and down from 2012’s 31.11%.

Auxiliary

revenues consisted of excess baggage (up 20.4% in 2015 and accounted

for 47% share), rebooking (up 14.33% and had 32% share) and others

(inflight sales, advance seat selections, reservation booking fees

and etc… up 26.8% and had a 19% share). Auxiliary revenues

accounted for 18.33% of the entire sales for 2015

Basically,

CEB’s topline growth (8.66%) only reflected on its additional

capacity (7.6% more flights and 6% more planes) with considerable

contribution from mostly auxiliary spending of CEB passengers.

So

the collapse in oil prices, which allowed CEB to slash ticket prices

by 2.5%, produced even LESS passenger revenue growth of 6.2%

(compared to previous years). So low oil prices has NOT been equal to

consumer spending growth! NOT according to CEB’s annual financial

performance.

And

given the additional planes and flights in 2015, occupancy rates must

have been significantly lower than the previous years. Yes more signs

of excess capacity!

As

said above,

this has NOW become a SYSTEMIC issue.

Nonetheless,

even with the windfall from oil prices, CEB’s overall debt

continues to ascend, except that rate of growth has tempered down to

2015’s 8.09% from 2014’s 15.11% and from 2013’s 28.28%. This

simply means that the bonus from oil crash must have allayed the

firm’s cash flow pressures

CEB

officials must be very grateful to (OPEC and Non OPEC) national oil

producers for not only saving the day, but also providing them with a

bonanza, despite the significant headwinds.

But

CEB’s 2015 remarkable eps performance, as shown above, has not been

about G-R-O-W-T-H!

Has

the BSP Implemented an Undisclosed Stimulus via the Yield Curve?

The

Bangko Sentral ng Pilipinas reported

last week that the banking system’s credit uptake has begun to

accelerate upwards. Bank credit expansion had been up by more than

15% during the last two months, specifically 17.4% in February and

15.98% in January. (upper window)

The

significant uptick in credit expansion has been accompanied by a

resurgence

of domestic liquidity (M3) which has now reached double digits

specifically 11.8% and 11.5% over the same period.

Of

course, changes in the loan portfolio of the banking sector have not

been same. For instance, while loans to the mining sector has swelled

by 43.28% and 47.28% over the first two months of the year, bank

loans to this sector is a smidgen in terms of the share (.71%) to the

banking loan portfolio pie.

Among

the biggest borrowers by industry, the banking system’s loan

portfolio has been significantly boosted by trade (16.23% Feb, 13.65%

January), Real Estate (25.45%, 23.36%) and energy (36.42%, 35.75%).

Despite

the run in the Phisix, loans to the financial sector (6.33%, 5.25%)

underperformed. On the other hand, construction loans have been

tilting lower (27.24%, 27.89%) as with a palpable plateauing of

consumer loans (15.73%, 16.31%).

Unfortunately,

loans to the manufacturing sector remain in doldrums (5.67%, 5.49%).

The latter suggests that there has been NO big recovery in

manufacturing contra the government survey.

Two

factors from the current trend: First, paucity

in cash flows has led to more borrowings,

or second, the

race to build on the supply side

has

been rekindled.

The latter comes even as consumers seem to have second thoughts on

increasing their borrowing and spending, and, even as excess capacity

has become more evident.

The

interesting portion has been that the

accelerating credit boom have now been reflected on domestic

liquidity, which if sustained, should eventually get ventilated

through price channel, in particular, consumer price inflation.

While this should be bullish for stocks and for statistical GDP over

the interim, any

sustained surge in liquidity will prove to be the death

knell

for domestic demand.

If

consumers and producers have been harried and scathed by 10

consecutive months of 30+++% liquidity growth from 2H 2013 to 1H

2014, where the adverse impact have belatedly become evident last

year, any

significant surge in CPI will emerge as follow-up KO punch on

consumers, as soaring CPI should translate to the draining of the

consumer’s residual purchasing power. And domestic liquidity won’t

need to hit 30% growth rate just to deliver a significant impact as

the first strike has already rendered the public to become delicately

fragile.

Furthermore,

the sizable increase in bank lending has occurred even during a flat

curve or even signs of inversion in parts of the yield curve. This

only means that banks

have lowered their credit standards in order to generate volume for

their lending portfolios. So they must be trading off quality for

quantity just to chase profits. Subprime

anyone?

Moreover,

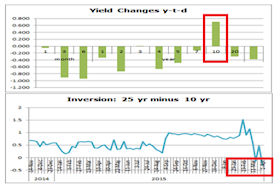

the general domestic yield curve has lately widened by most since I

began tabulating them in late 2014. That’s mainly because of the

dramatic selloff in ONLY the 10 year bond (upper window). Put

differently, only yields of the 10 year government papers has soared

on a year to date basis. But this translates to higher rates too!

But

the rest of the curve had been aggressively bid, hence the lower

yields (especially at the front) and the widening spreads!

It

is as if some entity has been trying to tacitly implement ‘stimulus’,

even in absence of formal declaration.

Yet

the unfortunate effect of the manipulation of the curve has been to

cause an inversion

between 10 year and 25 year. (lower window) So the attempt to steepen

the front has led to the inversion of the back. Interesting.

Every

action has consequences.

And

perhaps, a partial reason for the managing of the yield curve has

been due to the resurgence in consumer

NPLs particularly on auto loans in the 3Q. NPLs in Real Estate

loans have so far been marginally lower than consumer borrowing

growth, hence the appearance of calm.

But

as explained before8,

the intertemporal difference between NPLs and current loan growth

implies that current loan growth must continue to grow faster than

past loans in order to suppress NPLs

Total

portfolio loan growth has been derived from newly acquired

loans during the

stated period. However, NPLs have emanated from loans acquired from

the past that

have gone sour during the above stated reporting period.

The BSP defines non-performing loans in different loan categories

based on different periods.

So

what you have is a ratio that compares

the results of aging loans with present (freshly acquired) loans.

Thus, the

current NPL ratios exhibits credit health in the context

of quantitative rather

than qualitative conditions.

This shows again why politics have been about emphasizing on

the form rather

than of the substance…

The

point is that for as long as new loans outpace growth in NPLs then

the statistical metric of loan coverage on NPLs will remain depressed

even if NPLs have been growing.

And

because NPLs have represented ageing loan portfolio performance, any

slowdown in new loan growth will magnify NPLs.

In addition, because of the furious pace of new loans growth rate,

today’s big growth in loans will become tomorrow’s

NPLs.

And

don’t forget that

many of freshly acquired loans have been made in order to pay for

aging loans. In

other words, for entities that rely on Debt IN Debt OUT (Ponzi

finance), difficulties in access to credit will easily transform into

NPLs.

Hence,

it would be imperative for the BSP to ensure that credit must

consistently be infused into the system, or credit flows must not

only be sustained but grow, in order to satisfy the addiction of

entities or industries in order to assure of their survival. And this

is what Potemkin economies are about.

Has

this been why real estate loans have rebounded?

Additionally,

given the apparent strains in the income statements and emerging

pressures on the balance sheets of major listed companies, in the

face of previously flagging credit growth in the banking system, I

suspect that the BSP has been aware of this and thus may have acted

directly or indirectly to manage the curve in order to boost credit

supply.

Yet

I warned about the credit cycle at the crest of the 30% money supply

boom in 2014 which has been partly realized today9

The

refusal to curtail the credit boom exposes on the chronic addiction

by the Philippine government on easy money stimulus. Yet the

government has been boxed into a corner. Tighten

money supply, credit shrinks and so will the economic sectors who

breathes in the oxygen of credit that has played a vital role in the

sprucing up of the pantomime of the pseudo economic growth boom.

Tolerate

more negative real rates, debt accumulation intensifies, price

inflation will rise, the peso will fall and such credit inflation

will be reflected on interest rates, where

the outcome will be market based tightening regardless of the actions

of authorities.

We

have seen the first part—the tightening of money supply and credit

growth contraction that has incited a downturn in statistical GDP and

pressures on balance sheets of listed companies.

Now

comes the possible second phase: the resumption of the credit boom

and its untoward repercussions.

Like

the 3Q concerted media hype on the hissing property bubble, the BSP

makes a self-proclamation

about how strong the banking system is. Yet if the banking system

has indeed been strong and stable, does one really need to announce

it? Isn’t the proof of the pudding in the eating?

Or

does one apply propaganda or PR gimmickry to camouflage a system in

question? Or perhaps, has the

Bangladesh central bank heist placed the domestic banking system

and the BSP into an adverse spotlight hence the publicity response?

But

the crux, which signifies a paradox is: One cannot have a ‘strong

and stable’ banking system that finances a bubble. That’s because

financing a bubble means playing a significant role in the formation

of malinvestments.

So

once the bubble implodes, ‘strong and stable’ will prove to be a

baseless braggadocio claim.

Yet

it is easy to make an audacious and exaggerated claim especially when

one doesn’t have skin on the game.

______

1

Janet

L. Yellen, Chairwoman The

Outlook, Uncertainty, and Monetary Policy Speech at the Economic

Club of New York, New York, New York, US Federal Reserve March 29,

2016

2

Doug

Noland, Weekly

Commentary: Another Coin in the Fuse Box Credit Bubble Bulletin

April 2, 2016

3

SM

Investments Corp SM

Posts 14.4% Growth in Recurring Net Income in 2014 March 4, 2015

4

Filinvest

Land FILINVEST

LAND 2015 EARNINGS UP 11% March 18, 2016 EDGE.PSE.comp.ph

5

IMF.org

INDONESIA

SELECTED ISSUES March 2016

6

Global

Property Guide, Review

of the world's housing markets in 2015: Europe and North America in

full scale boom, Asia, Middle East slowed sharply March 22, 2016

7

Cebu

Pacific Annual

Report 2015 17 A p.18 March 30, 2016 EDGE.PSE.com.ph

8

See

Phisix

7,500: Surprise! Philippine Authorities Signals the Public to Brace

for Lower G-R-O-W-T-H!!! June 7, 2015

No comments:

Post a Comment