One of the bizarre and outrageously foolish or patently absurd commentary I have read has been to allude to the current commodity selloffs to what I call as the theology of deflation, particularly the cultish belief that money printing does not create inflation.

Yet if we go by such logic, then hyperinflation should have never existed.

Doug Noland of the Credit Bubble Bulletin debunks such ridiculousness:

With global central bankers “printing” desperately, the collapse in gold stocks and sinking commodities prices were not supposed to happen. Is it evidence of imminent deflation? How could that be, with the Fed and Bank of Japan combining for about $170bn of monthly “money printing.” Are they not doing enough? How is deflation possible with China’s “total social financing” expanding an incredible $1 Trillion during the first quarter? How is deflation a serious risk in the face of ultra-loose financial conditions in the U.S. and basically near-free “money” available round the globe?Well, deflation is not really the issue. Instead, so-called “deflation” can be viewed as the typical consequence of bursting asset and Credit Bubbles. And going all the way back to the early nineties, the Fed has misunderstood and misdiagnosed the problem. It is a popular pastime to criticize the Germans for their inflation fixation. Well, history will identify a much more dangerous fixation on deflation that spread from the U.S. to much of the world.I see sinking commodities prices as one more data point supporting the view of failed central bank policy doctrine. For one, it confirms that unprecedented monetary stimulus is largely bypassing real economies on its way to Bubbling global securities markets. I also see faltering commodities markets as confirmation of my “crowded trade” thesis. For too many years (going back to the 90’s) the Fed and global central bank policies have incentivized leveraged speculation. This has fostered a massive inflation in this global pool of speculative finance that has ensured too much market-based liquidity (“money”) has been chasing a limited amount of risk assets. Speculative excess today encompasses all markets, including gold and the commodities. Over recent months, these Bubbles have become increasingly unwieldy and unstable. Commodities are the first to crack.

In the theology of deflation espoused by monetary cranks, financial markets and the economy operates like spatial black holes, they are supposedly sucked into a ‘liquidity trap’ premised on the ‘dearth of aggregate demand’ and on interventionists creed of "pushing on a string" or of the failure of monetary policies to induce spending. Thus the need for government intervention to inflate the system (inflationism) to encourge spending.

Further money cranks tells us there has been no link between inflation and deflation. Or that there are hardly any relationship of how falling markets could have been a result of prior inflation.

Bubbles are essentially nonexistent for them. Inflationism has been seen as operating in a vacuum with barely any adverse consequences because these represent the immaculate acts of hallowed governments. Whereas deflation has been projected as “market failure”.

Yet we see plummeting commodity prices, contradictory to such obtuse view, as representing many factors.

Global financial markets (stocks and bonds) have been seen as having implicit government support (e.g. the Bernanke Put or Bernanke doctrine), thus the safe haven status may have temporarily gravitated towards government backed papers rather than commodities.

Yet this doesn’t entail that endless money printing will not or never generate price inflation. Again such logic anchored on free lunch, simply wishes away the laws of economics.

Second, falling commodity prices doesn’t mean the absence of price inflation but rather monetary inflation has been manifested via price inflation in assets or asset bubbles so far.

The “don’t fight the central banks” mantra has led the marketplace to go for yield hunting by materially racking up credit growth.

The surge in Japan’s stocks via “Abenomics” policies has prompted for massive jump in margin trades in Japan’s equity markets (chart from Zero Hedge). This mirrors the record performance of US equity markets.

Both markets suggests that government policies has heavily influenced market actions to chase yields by absorbing or accruing more unsustainable debt.

China’s massive money growth backed by financial expansion have masked the marked deterioration in her economy. This perhaps supports the essence of the broad based gold led commodity panic.

And as Mr. Noland points out, cracking commodity prices may be portentous of the periphery to the core symptom of a coming crisis.

Falling commodity prices will initially hurt the emerging markets and could likely spread through the world.

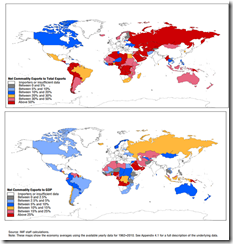

Commodity exports plays a substantial role in emerging economies (IMF)

This means that global growth will be jeopardized thereby increasing the risks of bubble busts from the periphery (emerging markets and frontier markets)

Emerging markets are supposed to comprise nearly 50% of global growth this year. (chart from the Daily Bell)

I also earlier pointed out that Indonesia's boom has been popularly attributed to commodity exports, even when latest developments suggests more of a property bubble. The Financial Times warns of an ASEAN bubble and notes of an unwieldy boom in Indonesia's luxury real estate projects.

Ciputra Development, which builds luxury condominiums, said that while prices in central Jakarta, the capital, had been growing at a rapid clip – about 30-40 per cent a year – a new trend had emerged.

If woes from Indonesia's commodity exports will spread through the property sector, then the Indonesian economy will become highly vulnerable. This makes the region including the Philippines susceptible too.

Boom will segue into a bust.

Yet the recourse to eternal money printing will one day set another path. (chart from Zero hedge).

Inflationism comes in stages. Thus every stage commands a different outcome. We are still operating on bubble cycles from which the current gold-commodity pressures signify as the typical the denial stage from inflation risks provoked by Fed policies.

As the great Ludwig von Mises predicted. (bold mine)

This first stage of the inflationary process may last for many years. While it lasts, the prices of many goods and services are not yet adjusted to the altered money relation. There are still people in the country who have not yet become aware of the fact that they are confronted with a price revolution which will finally result in a considerable rise of all prices, although the extent of this rise will not be the same in the various commodities and services.These people still believe that prices one day will drop. Waiting for this day, they restrict their purchases and concomitantly increase their cash holdings. As long as such ideas are still held by public opinion, it is not yet too late for the government to abandon its inflationary policy.But then, finally, the masses wake up. They become suddenly aware of the fact that inflation is a deliberate policy and will go on endlessly. A breakdown occurs. The crack-up boom appears. Everybody is anxious to swap his money against "real" goods, no matter whether he needs them or not, no matter how much money he has to pay for them.

In short we are in a stage where people have yet to become aware of a price revolution ahead even when policies have been directed towards them.

We have seen such setting before.

Gold prices surged from $35 in 1971, which began during the Nixon Shock or after the closing of gold window based on the Bretton Woods gold exchange standard, to about $190 in 1975 or 4.4x the 1971 level. Following the peak, gold prices plunged by about 45% to around $105 in 1976. (chart from chartrus.com)

The returns from Gold’s recent boom from $ 300 to $ 1,900 has been about 5.3x before today’s dive. So there may be some parallel.

Then, the interim collapse has served as springboard for gold’s resurgence. Gold prices evenutally hit $850 in the early 80s. (chart from chartrus.com)

Of course, the stagflation days of 1970-80s has vastly been different than today.

Debt levels of advanced economies has already surpassed the World War II highs. (from US Global Investors) This is why advanced economies has resorted to derring-do or bravado policies of unprecedented inflationism from central banks.

Most of which has been meant to finance fiscal deficits, increasing the likelihood of the risks of price inflation and debt default over time. Such has been the typical outcome based on EIGHT centuries of crises according to non-Austrian Harvard economist Carmen Reinhart (along with Harvard contemporary Kenneth Rogoff).

Monetary cranks essentially tells us that “this time is different”. They believe that they are immune from the rules of nature. They denigrate history.

Moreover there has been a global pandemic of bubbles, which simply means that the path dependency for governments policies will be directed towards sustaining them.

Authorities will resort to bailouts, rescues and further inflationism in fear of bubble busts in order to maintain the status quo.

This will not be limited to advanced economies but will apply to emerging markets including the Philippines as well.

Another difference is that, then, US monetary policies had been severely tightened which caused a spike in interest rates and two recessions. US Federal Reserve’s Paul Volcker had been credited to have stopped the inflationary side of stagflation or the “disinflationary scenario”, according to the Wikipedia.org

Another difference is that, then, US monetary policies had been severely tightened which caused a spike in interest rates and two recessions. US Federal Reserve’s Paul Volcker had been credited to have stopped the inflationary side of stagflation or the “disinflationary scenario”, according to the Wikipedia.org

Today, there has been a rabid fear of recessions

Globalization too, from the opening of China, India and many emerging markets, led to increased productivity which essentially offset inflation levels. A 2005 study from the Federal Reserve of Kansas City notes that

Rogoff also credits the “increased level of competition—in both product and labor markets—that has resulted from the interplay of increased globalization, deregulation, and a decreased role for governments in many countries” as contributing to the reduction in global inflation.

Today with almost every economy indulging in bubble policies and therefore serially blowing bubbles, capital consumption leads to decreased productivity, heightening the risks of price inflation.

The Royal Bank of Scotland recently pointed out that Asia’s credit bubble has been accompanied by decreasing labor productivity. When the public’s activities having been directed towards financial market speculation than production, then evidently labor productivity has to decline.

Of course, direct confiscation of people’s savings via the banking system ala Cyprus will also become a key factor for the prospective search for monetary refuge.

Third, in the world of financial globalization, speculative bubbles translates to immensely intertwined markets, such that volatility in global markets, particularly in JGBs may have prompted for massive reallocation or a shift in incentives towards government backed securities.

This Reuters article gives us a clue:

The Royal Bank of Scotland recently pointed out that Asia’s credit bubble has been accompanied by decreasing labor productivity. When the public’s activities having been directed towards financial market speculation than production, then evidently labor productivity has to decline.

Of course, direct confiscation of people’s savings via the banking system ala Cyprus will also become a key factor for the prospective search for monetary refuge.

Third, in the world of financial globalization, speculative bubbles translates to immensely intertwined markets, such that volatility in global markets, particularly in JGBs may have prompted for massive reallocation or a shift in incentives towards government backed securities.

This Reuters article gives us a clue:

"The scale of the decline has been absolutely breathtaking. We tried to rally and that just didn't get anywhere ... there hasn't been any downside support, it's like a knife through butter," Societe Generale analyst Robin Bhar said.

The pace of the sell-off appeared tied to volatility in the price of Japanese government bonds, which has forced certain holders to sell other assets to meet the risk modeling of their investment portfolios.

Fourth is that such selloffs has deliberately been engineered by Wall Street most possibly to project support on Fed policies for more inflationism. Wall Street, thus peddles the inflation bogeyman to spur political authorities to maintain or deepen inflationism which benefits them most

In my edited response to a friend on the recent record levels of US markets, I explain the redistribution of Fed Policies to Wall Street to the latter's benefits

Given the relative impact (Cantillon Effects) from the Fed’s money printing, those who get the money first, particularly Wall Street, e.g. primary dealers and bondholders who sell bonds to the FED via QE, the 2008 bailout money (TARP), proceeds from the Fed’s Interest Rate on Excess Reserves and etc, may have used such to speculate on the stock markets and the credit markets (e.g. junk bonds, revival of CDOs) rather than to lend to main street. Thus the parallel universe: economic growth has been tepid, but financial market booms.

There has also been the interlocking relationship between bond and stock markets as I earlier pointed out here

Since December the politically connected Goldman Sachs has called for the selling of gold which has been followed by a coterie of Wall Street allies

From the Star Online:

Several renowned global financial institutions such as Credit Suisse Group AG, Goldman Sachs Group Inc, Nomura Holdings Inc, Deutsche Bank AG, UBS Ag, and Socit Gnrale SA (SocGen) have already turned bearish on gold in recent weeks, and cut their gold-price forecast for 2013 and 2014.

So current selloff cannot be dismissed as having been a purely market dynamic and not having been influenced by a grand design to promote further inflationism.

Lastly, as I noted during the start of the year, gold’s 12 year consecutive rise has been ripe for profit taking.

Although, so far, with the exception of gold, no trend has moved in a straight line, so it would be natural for gold to undergo a year of negative returns.

Expect this selloff in gold-commodity sphere to increase risks towards a transition to a global crisis, and for central banks to engage in more aggressive inflationism.

Such transition will eventually bring about the risks of stagflation.

No comments:

Post a Comment