Wishing everyone a Happy, Healthy and a Prosperous New Year!!!

[I would like to thank my youngest son for helping me transcribe quotes from the book]

2013 has started with a bang!

Global markets have greeted the New Year with a bullish rampage to score fantastic gains over the week (see left window).

Following the joint ‘unlimited’ easing by the US Federal Reserve and the European Central Bank (ECB), whom has similarly been supported by the Bank of Japan (BoJ), global equity markets have become turbocharged.

This basically validated my main thesis last September, where I wrote[1],

I believe that the interim response from the FED-ECB policies, designed to prop up financial assets, will likely provide strong support to the global stock markets including the Philippine Phisix perhaps until the yearend, at least.The mining index, which has underperformed all sectors, will likely expunge its year to date losses at least by the yearend.The mining index will likely retake command of the leadership in 2013 as it has outperformed biyearly since 2007.

This week’s fiery opening has essentially signified a carryover from last year’s final quarter blitzkrieg (right window), a thrust which may last until the first quarter.

While the gist of my expectations for the local stock market has been mostly fulfilled, the domestic mining index sector failed to come through. Nonetheless, I still hold on to the premise that an inflationary boom will spur a rotation as it has done so for the past 8 years.

This is not based on the blind belief of repetition of patterns, but rather from the economic reasoning based on the relative transmission effects of credit and monetary expansion or the Cantillion Effects[2] as manifested in changes in relative prices.

In other words, all the money being created to “promote demand” will have to flow somewhere. And somewhere means that this will be manifested via relative pricing of equity securities, especially pronounced for an underdeveloped domestic equity market like the Philippines.

Such dynamic has become apparent in global financial markets, the same dynamic has also become evident within the Philippine Stock Exchange.

The Monkey Business Illusion and Mainstream Wisdom

Before I proceed I urge you to take this test on attention or cognitive science called the Monkey Business Illusion:

The test originally called the Invisible Gorilla[3] designed by Professors Christopher Chabris and Daniel Simons shows of people’s selective attention or inattentional blindness[4], where the limitations of people’s ability to focus leads to perceptual blindness.

In the video, people are asked to count on the number of ball passes made by team members wearing white shirts.

The stimuli to focus on the above instruction has led many observers to miss out on the appearance of the gorilla, the reduction of the number of black shirt team members and the change of color of the curtains. Half of the participants have missed the gorilla alone according to Professor Simons. [Have you been you part of those who missed one of the above? I didn’t miss the gorilla, but I overlooked the curtains]

Aside from inattentional blindness, the point is that the framing of the stimuli impels many if not most people to focus on the plausible, or what gives ‘cognitive ease’ or ‘coherent pattern of activated ideas’[5]

What has this got to do with the financial markets?

Many attribute the current financial market boom to economic performance. That’s how the mainstream experts and media frames or narrates it, especially the Philippine variety.

But if all these collective booms indeed reflected on economic performances, then why does it require global policymakers to—not only to massively cut interest rates—but to complement these credit easing measures with central bank’s balance sheet expansions?

More than half of the central banks[6] all over the world cut interest rates in 2012

Add to these the balance sheet expansions of central banks of developed economies[7]. This implies that these economies represent 95% of the $98.4 trillion bond markets from which governments share are about 45%[8]. In short, why does central banks need to support the bond markets if the world economy has been truly resilient?

If for instance, the Philippines has “solid economic growth, relatively stable exchange rate, responsive banking system that is able to withstand external shocks”, according to a Bangko Sentral ng Pilipinas (BSP) official[9], then why resort aggressive rate cutting?

What explains the parallel universe or the blatant disconnect or divergences between surging stock markets and sluggish economic growth[10] for the rest of the world in 2012?

What further explains the seemingly tight correlation[11] between the world’s top performing stock markets of 2012 and the aggressiveness in interest rate cuts by their respective national central banks? Sheer coincidence?

In short, like the invisible gorilla, many people would prefer to rely on the spoon feeding of superficial and loosely correlated ideas (stimulus) or what behavioral psychologists call as “the illusions of understanding” rather than to examine on their veracity or the soundness of their suppositions.

In a world of uncertainty, the illusion of understanding provides comfort for people in search for cognitive ease and coherence.

Dr. Kahneman explains[12]

The illusion that one has understood the past feeds the further illusion that once can predict and control the future. These illusions are comforting. They reduce the anxiety that we would experience if we allowed ourselves to fully acknowledge the uncertainties of existence. We all have a need for the reassuring message that actions have appropriate consequences, and that success will be reward wisdom and courage.

In the same context, people who insist on “contractionary forces” have been misled by the consistency bias or the error of remembering past environment and behavior as supposed to resemble today.

Money does not exist in a vacuum.

While consumer price inflation may not be apparent yet, what has been conspicuous has been a global asset boom. In short, monetary expansion has led to a global asset boom or global asset inflation.

In the recap of wold markets, Doug Noland in his Credit Bubble Bulletin[13] captures it best:

Various recent headlines support my “right tail” analysis: “Record-setting Year for Corporate Debt;” “Record Year for Junk Bonds;” “Mortgage Bonds Soar on Fed’s Refinance Push;” “[Corporate] Sales Approaching $4 Trillion in Stimulus Repast; “A Banner Year For Riskiest Debt;” “Fourth-Quarter M&A Surge Spurs Optimism..;” “Leveraged Loan Volume: $456bn in 2012, Thanks to Torrid Fourth-Quarter Market.”

The fact of the matter is, in restating Newton’s third law of motion, for every episode of inflation, there will be an equal and opposite dimension of deflation. This is known as the business cycle or bubble cycles.

Unfortunately policymakers have been attempting to prevent market from clearing, which is why the intensifying recourse on activist monetary policies.

The Psychological Impact of the Inflationary Boom

It is important to point out that inflationary boom materially affects people’s psychology and their corresponding actions.

From the behavioral finance perspective, people’s seduction to the inflationary boom can be imputed to the some of the following cognitive biases:

Outcome bias. Where people judge past decisions based on the outcome and not based on the quality or soundness of the action which led to such outcome. The Outcome bias, writes Nobel laureate Professor Daniel Kahneman, “leads observers to assess the quality of a decision not by whether the process was sound but by whether its outcome was good or bad”[14].

Halo Effect. The outcome bias prompts people to bear overall impressions or generalized conclusions or the Halo Effect. Professor Kahneman describes such cognitive bias as the “tendency to like (or dislike) everything about a person—including things you have not observed”[15]. Thus, if you like the president’s politics, Prof Kahneman analogizes, then the likehood is that you would also his voice and appearance.

Applied to the recent boom, whether one relates to the economy or politics, the current quasi-euphoric environment has been viewed by the public as having been hunky dory or as having been sanitized of risks and or that every political act by the current administration seems like King Midas.

Regression to the mean. Extraordinary may transform to mediocre performance and vice versa. Because it has been intuitive or innate for people to search for casual explanations, the idea of luck determining outcome has instinctively been rejected.

Again Dr. Kahneman[16]

When our attention is called to an event, associative memory will look for its cause-more precisely; activation will automatically spread to any cause that is already stored in memory. Casual explanations will be evoked when regression is detected, but they will be wrong because the truth is that regression to the mean has an explanation but does not have a cause.

Feedback. I have always stated that everyone’s a genius in a bullmarket. That’s because intuitive experience mostly based on false causation, tends to get reinforced by the policy induced distorted pricing mechanism.

In George Soros’ reflexivity theory[17], the current stage of the boom bust cycle encapsulates the transition of the boom phase, specifically from the growing conviction resulting in the widening divergence between reality and expectations, and the flawed perception which eventually leads to the climax—all reinforced by the manipulated price mechanism.

Substitution. Pressed for the rigors of theory or empirics to prove one’s ingrained belief, the public impulse has been to resort to “generating intuitive opinion on complex matters”. In short, people substitute hard questions with related but easier to answer question based on heuristics. This is how non-sequitor arguments are triggered and employed.

Again Dr. Kahneman explains[18],

When called upon to judge probability, people judge something else and believed that they have judged probability

Affect Heuristics. The feedback mechanism between prices and intuitive experience leads to the strengthening of convictions.

For instance in the deepening of a bullmarket, contrarian opinion will increasingly be rejected and treated as heresy. People will increasingly rely on group behavior for confirmation of their beliefs

Affect heuristic essentially deals with the emotional attitude of people when their beliefs are confronted with the tradeoff between cost and benefits.

Again Dr. Kahneman[19],

If you dislike any of these things, you probably believe that the risks are high and its benefits negligible.

As markets segue into periods of excessiveness, people’s biases will increasingly be driven by their risk taking appetite. Pollyannas will markedly overestimate on the benefits of stock market investing while distinctly underestimate the risks.

The bottom line is that the inflationary boom compounds on the many psychological errors of the public that aggravates volatility, escalates risk taking activities, i.e. what the public reads as “greed”, and sadly, eventual losses (bust).

But for the meantime, the public’s desire to placate the brain’s dopamine “pleasure chemical” neurotransmitter[20] via an orgy of speculations has made the inflationary policies quite popular.

To quote the great Austrian economist Ludwig von Mises[21], (bold mine)

The boom produces impoverishment. But still more disastrous are its moral ravages. It makes people despondent and dispirited. The more optimistic they were under the illusory prosperity of the boom, the greater is their despair and their feeling of frustration. The individual is always ready to ascribe his good luck to his own efficiency and to take it as a well-deserved reward for his talent, application, and probity. But reverses of fortune he always charges to other people, and most of all to the absurdity of social and political institutions. He does not blame the authorities for having fostered the boom. He reviles them for the inevitable collapse. In the opinion of the public, more inflation and more credit expansion are the only remedy [p. 577] against the evils which inflation and credit expansion have brought about

Key Factors for 2013

Pattern seekers should be concerned that the Phisix bullmarket may have reached a potential stage of maturity—the aging of the bubble.

The previous secular bullmarket cycle evolved around 11-12 years. Today’s bullmarket is about 10 years old. If the past will make a replay, then the Phisix must be or will likely enter a blow-off phase soon.

From the regression to mean, we are hardly seeing the same phenomenon as the 1986-1996 cycle.

Average returns from 1985 to 2012 or over 27 years is about 26% based on the annual nominal local currency. The first cycle (1985-1996) generated 50% nominal returns yearly. This cycle (2003-2012) has yielded only 23.61%, still distant from the 27 year average or from the post martial law first cycle.

This is NOT to suggest that the Phisix will need to repeat the returns of the first cycle boom, whose environment has been immensely distinct from today’s cycle. The Philippines then emerged from economic stagnation, high inflation, a debt moratorium[22] and from the clutches of the two decades of dictatorship.

But if the 27-year average should come into play, then this means that the Phisix will need to deliver far greater returns than 2012, particularly 47.45% for 2013, just to reach the mean. This assumes that the Phisix boom ends next year, which I doubt.

But I am not dependent on patterns, nor do I rely on numerical averages. In addition, this bullmarket cycle will be determined not by media and mainstream pontificating on political self-righteousness, but from the feedback loop of policymaking and the market’s response on them.

As I have written in my New Year’s edition on 2011 and 2012[23], the same dynamics that shaped the markets then will remain in play for this year:

1. Monetary authorities of developed economies will fight to sustain low interest rates.2. More Inflationism: Bailouts and QEs To Continue3. Effects of Divergent Monetary Policies4. The Globalization Factor

I may add a fifth variable: other forms of financial repression via regulatory controls: capital controls, price controls, border controls, and bank-capital regulations.

Let me repeat: the direction of the Phisix and the Peso will ultimately be determined by the direction of domestic interest rates which will likewise reflect on global trends.

Global central banks have been tweaking the interest rate channel in order to subsidize the unsustainable record levels of government debts, recapitalize and bridge-finance the embattled and highly fragile banking industry, and subordinately, to rekindle a credit fueled boom.

Yet interest rates will ultimately be determined by market forces influenced from one or a combination of the following factors as I wrote one year back[24]: the balance of demand and supply of credit, inflation expectations, perceptions of credit quality and of the scarcity or availability of capital.

For the moment, most of the monetary expansion has been absorbed by financial markets which will likely remain so until at least the first quarter of 2013.

While most central banks, including the BSP, foresees prolonged era of low interest rates, such prospects are mere guesswork.

Authorities understand that there has barely been any penalty for miscalculations, for policy mistakes and or for portraying an environment favorable to the incumbent political masters.

Moreover, crises have provided ripe opportunities for governments to exercise more control over society: the former Obama’s Chief of Staff Rahm Emmanuel (today’s Mayor of Chicago) famous quote resonates “This crisis provides the opportunity for us to do things that you could not do before."[25]

In short, authorities have been motivated or incented to produce social policies that have popular short-term effects at the expense of the future, because such policies provide intertemporal benefits to the political class: A boom projects an aura of political success that generates votes, while a crisis provides an opportunity for expanding social controls using social justice as pretext. Said differently, for many a boom makes one feel good for the taxes one pays, a bust will mean more taxes, whether you like it or not.

The knee jerk nostrums of implementing the Babel of regulations and controls has only fostered more unintended consequences and has provided benefits to those with political connections.

Two examples, one Basel Accord and the US Dodd Frank

From the Bloomberg[26],

The first Basel agreement on global banking regulation, adopted in 1988, was 30 pages long and relied on simple arithmetic. The latest update, known as Basel III, runs to 509 pages and includes 78 calculus equations…The Securities Industry and Financial Markets Association, another lobbying group, estimates that regulators will end up writing 29,000 pages of directives once Dodd-Frank is completely in place.

Complexity of rules translates to more lobbying, more revolving door relationships, more corruption, regulatory arbitrage and other unethical relationships (sex power and moolah), which works in favor of those firms who can afford such political horse trading, while at the same time works at the expense of small companies who can’t play the insider’s game.

The recent controversial US Fiscal cliff deal is an example of a supposed crisis in the making that ended up with economic concessions for the politically connected[27] and essentially pushed back any reforms on government spending. This means more political struggles ahead (as the debt ceiling debate nears) and equally more interventions by the US Federal Reserve as insurance against default.

This validates my recent view of the US fiscal cliff[28],

Nonetheless any deal reached by the two houses of Congress will likely be cosmetically in favor of increasing taxes, as against farcical spending cuts where the latter will likely be premised on growth rates rather than real cuts.Three, watch the actions of FED which will increasingly become President Obama’s major instrument for obtaining statistical economic growth, as well as, the actions of the Fed’s major collaborator, the ECB. Both of whom will likely aggressively employ balance sheet expansions that may get reflected on gold and other commodity prices.

This, despite the blarney as revealed by the FOMC minutes of the supposed dissension by growing number of FED board members of the bond buybacks for 2013. This, for me, serves as another Poker bluff[29] by the Fed.

And since there will hardly be any genuine reforms to encourage the growth of the business environment, which serves as the real source of real wealth, global and local political authorities increasingly have been resorting to central banking activism to conceal on their policy shortcomings.

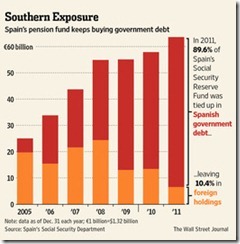

For instance despite the seeming newfound tranquillity in the Euro area and in Japan, all these have represented mirages as consequence of government and central banking prestidigitation. Example, Spain’s stealth use of her Social Security Reserve Fund[30] as buyer of Spanish government bonds may have helped in bringing down sovereign yield.

Dr. Ed Yardeni rightly notes of the magic wand from ECB’s Mario Draghi in the collapsing yield[31]:

These extraordinary declines weren't triggered by any improvement in the sorry state of state finances in the euro zone. Rather, they started when ECB President Mario Draghi declared in late July of last year that he would do “whatever it takes” to defend the euro, including buying the sovereign notes of euro zone governments. So far, the ECB hasn’t had to do much to back up Draghi’s declaration. His willingness to implement unlimited “outright monetary transactions” (OMT) has worked wonders.Draghi’s fairy dust also stopped the massive capital outflows out of Spain and Italy into Germany, as evidenced by the flattening of TARGET2 balances since last summer. Among the best-performing stock markets last year were the ones in the euro zone: Greece (33.4%), Germany (29.2), Ireland (17.1), and France (15.2).

Eventually, the current boom will get out of hand, which will be manifested through rising interest rates, which the mainstream vernacular will call “economic overheating” or may be upset by micro political-economic factors, such as the resurfacing of the solvency or credit quality issues of crisis stricken nations as the above.

Governments then will reattempt to force down rates, using downside volatility to justify such actions.

Yet such inflationism will likely spillover serially to price inflation, where the feedback loop of fighting inflation with more inflation leads to greater price inflation, or eventually market turbulence based on stagflation.

Here, the more governments rely on central banks to financial their requirements via debt monetization, the greater the risks of price inflation[32].

Expect Greater Volatility in 2013

For 2013, I expect the current global financial market boom to persist until at least the first quarter. The same dynamic should apply for the Philippine Phisix and the Peso.

Everything else after will depend on the direction of interest rates which will signify as manifestations of the market’s response to social policies and vice versa.

In short, expect markets to be fluid and highly, if not wildly, volatile. So far volatility has been on the upside.

For the Phsix, if domestic interest rates continue to remain low, perhaps we may see a blowoff phase (Phisix 8,000-8,500???) by the yearend.

Such boom may be compounded by the acceleration of capital flight into ASEAN from developed economies whose central banks have been massively expanding their balance sheets such as Japan whose outflows to Emerging Markets have been ballooning[33].

In addition, the regional and local stock market boom may likely be accompanied by the intensification of the credit financed bubble in the property sector in the real economy mostly bankrolled by the banking system.

On the other hand, if interest rates begin to marginally rise, then the Phisix may underperform or fall below consensus expectations via meagre (single digit) or even negative returns.

Nonetheless, for as long as the inflationary boom remains, I also expect a rotation towards last year’s laggards: the mining sector and possibly the service industry.

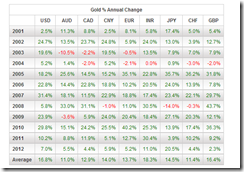

Finally it would be naïve to see lagging gold prices as underperforming. This would tantamount to the ticker tape mentality.

Despite falling short of my expectations, gold prices which I suspect has recently been subjected to politically orchestrated attacks have risen for the 12th straight year in 2012[34] in US dollar.

Although, so far, with the exception of gold, no trend has moved in a straight line, so it would be natural for gold to undergo a year of negative returns.

Nonetheless all these will also depend on the actions of monetary authorities.

In the fullness of time, markets eventually exposes on the façade erected by politically instituted controls.

I will close this week’s outlook with another noteworthy quote from the great Professor von Mises[35],

The masses, the hosts of common men, do not conceive any ideas, sound or unsound. They only choose between the ideologies developed by the intellectual leaders of mankind. But their choice is final and determines the course of events. If they prefer bad doctrines, nothing can prevent disaster.

For as long as the public continues to genuflect on the altar of politics, crises are inevitable.

[1] see FED-ECB’s Nuclear Policies: Risk ON is Back! September 17, 2012

[2] See Phisix and the Rotational Dynamics, January 30, 2012

[3] Christopher Chabris and Daniel Simons Invisible Gorilla Invisiblegorilla.com

[4] Wikipedia.org Inattentional blindness

[5] Daniel Kahneman, Thinking, Fast and Slow Farrar Straus and Giroux p. 104

[6] Central Bank News Global Monetary Policy Rate Index Interest Rates

[7] Zero Hedge How Central Bank Policy Impacts Asset Prices Part 5: How Far Can They Go? October 29, 2012

[8] See Japan PM Abe’s Economic Elixir: Inflationism December 18, 2012

[9] Malaya Business Insight BSP to keep rates low January 4, 2013

[10] See Quote of the Day: Central Banking Heroics Produced a Parallel Universe in 2012 January 5, 2012

[11] See Charts: Stock Market Boom Bust Cycles and Interest Rates December 26, 2012

[12] Kahneman, Op. cit., p.204-205

[13] Doug Noland 2012 In Review December 28, 2012 Credit Bubble Bulletin PrudentBear.com

[14] Kahneman, Op. cit., p.203

[15] Ibid. p.82

[16] Ibid. p.182

[17] George Soros, Reflexivity in the Stock Market, The Alchemy of Finance p.58 John Wiley & Sons

[18] Kahneman, Op. cit., p.98

[19] Ibid. p.103

[20] University of Michigan Health System Pleasure And Pain: Study Shows Brain's 'Pleasure Chemical' Is Involved In Response To Pain Too biopsychiatry.com

[21] Ludwig von Mises, The Market Economy as Affected by the Recurrence of the Trade Cycle, Chapter 20 Section 9, Human Action, Mises.org

[22] Country-data.com Philippines External debt

[23] See What To Expect in 2012, January 9, 2012

[24] See I Told You Moment: Philippine Phisix At Historic Highs! January 15, 2012

[25] Wall Street Journal In Crisis, Opportunity for Obama November 21, 2008

[26] Bloomberg.com Basel Becomes Babel as Conflicting Rules Undermine Safety January 9, 2013

[27] See The Fiscal Cliff Deal and Crony Capitalism January 3, 2013

[28] See The Fiscal Cliff Deal and Crony Capitalism January 3, 2013

[29] See Poker Bluffing FOMC: Probable Stop in Bond Buying January 4, 2013

[30] Wall Street Journal Spain Drains Fund Backing Pensions, January 13, 2013

[32] See Phisix’s Inflationary Boom: Normal Profit Taking From Record Highs, December 16, 2012

[33] See More Signs of Japan’s Capital Flight January 5, 2013

[34] James Turk Gold rises for the 12th consecutive year January 2, 2013 Goldmoney.com

[35] Ludwig von Mises 3. The Illusion of the Old Liberals XXXVII. THE NONDESCRIPT CHARACTER OF ECONOMICS, Human Action, Mises.org

No comments:

Post a Comment