How will the world not have price inflation when practically political leaders of every developed economies have seen inflationism as a philosopher’s stone and have been intensely pushing for it via monetary policies?

From Bloomberg,

Japan’s incoming Prime Minister Shinzo Abe backed the central bank when it raised interest rates in 2006, a move he now says was a mistake. His shift may signal less tolerance for deflation in the third-largest economy.Abe, whose party swept to victory in elections for the lower house of Parliament two days ago, will have the chance to reshape the Bank of Japan (8301) next year, when the terms of its governor and two deputies expire. He reiterated yesterday he wants a 2 percent inflation target for the BOJ, which is forecast to boost its asset purchases as soon as Dec. 20…Kasman’s colleague Masamichi Adachi in Tokyo said last week that the BOJ may this week adopt a “new style of open-ended asset purchases.”

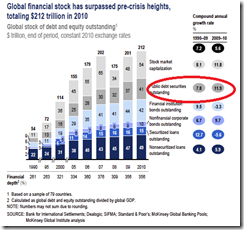

Governments of the US, ECB, Japan and the UK whom has undertaken massive balance sheet expansions via QE, compounded by various forms of declarations for “unlimited” asset buying programs, accounts for over 95% of the $98.4 trillion global bond markets.

The government’s share of total bond markets has been 45% and growing. (charts courtesy of climatebonds.com)

This means that as government debt grows (chart above from McKinsey Quarterly), given either the lack of savings or private sector qualms of sustained financing of profligate governments, central bank support of domestic sovereign bonds will also expand through their respective QE or balance sheet expansion programs.

And central bank purchases of government securities are not only inflationary, but raises the risks of hyperinflation.

This also implies that the global bond market represents a ballooning bubble.

And as I have recently pointed out, Japan’s demographics, declining savings, which has been expressed through the declining support by domestic investors on Japan government bonds (JGB) and the reversal of current account balance from surpluses to deficits, only aggravates her unsustainable fiscal conditions that would lead to a debt crisis, perhaps sooner than later.

In addition, the above debunks the myth about central banking independence. As appointed agents, central bankers will most likely pursue policies preferred by the executive branch of government.

While the elixir of inflationism continues to revitalize the “animal spirits” for now, a crisis of monumental proportions has been building up.

Philosopher Karl Popper as recently quoted by Charles Gave of Gavekal Research strikes at the heart of today’s “free lunch” policies that favors the political elites and their cronies

In an economic system, if the goal of the authorities is to reduce some particular risks, then the sum of all these suppressed risks will reappear one day through a massive increase in the systemic risk and this will happen because the future is unknowable.

No comments:

Post a Comment