Not content with the previous rounds of QEs by the Bank of Japan (BoJ), Japan’s politicians has taken interventionism to the the next level through the announcement of more fiscal spending.

From Bloomberg,

The Japanese government will spend 1 trillion yen ($12.3 billion) on a second round of fiscal stimulus as it tries to revive an economy at risk of sliding into recession.The government will tap reserve funds from this fiscal year’s budget, Chief Cabinet Secretary Osamu Fujimura told reporters in Tokyo today. The latest measures follow the announcement of 750 billion yen of stimulus last month.

Ironically, the BoJ held off or refrained from further easing today, perhaps awaiting the results of the December elections, where the leading candidate Shinzo Abe has expressed preference for the BoJ to adapt the FED’s policy of unlimited QE

From another Bloomberg,

Opposition leader Shinzo Abe, the leading contender to become prime minister after a Dec. 16 election, has called for unlimited easing and an increase in the central bank’s inflation goal to as much as 3 percent from 1 percent. His comments last week triggered the biggest two-day decline in the yen against the dollar in a year as investors speculated that more aggressive monetary loosening is looming.

Never mind that the Japanese government had engaged in a string of major stimulus packages during the bubble bust from 1992 to 1999, yet got mired into what has been known as the “lost decade” or economic stagnation brought about by the Japan's bubble cycle.

As economist Veronique de Rugy at the Reason Magazine explains,

Between 1992 and 1999, Japan passed eight stimulus packages, totaling roughly $840 billion in today's dollars. During that time, the debt-to-Gross Domestic Product (GDP) ratio skyrocketed, the country was rocked by massive corruption scandals, and the economy never recovered. All Japan had to show for it was a mountain of debt and some public works projects that look suspiciously like bridges to nowhere.

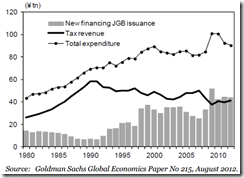

Japan’s latest pump priming will only worsen her already precarious fiscal conditions.

Yet the new spending package by Japan’s government would lead to increasing dependency on the BoJ as chief financier of their government’s profligacy, as demand for Japanese Government Bonds (JGB) by retail investors has been on the wane.

The BoJ now holds 10% of JGB. The new or recent QEs means that the BoJ's share of JGBs will balloon.

It has been said that desperate times calls for desperate measures, but such measures of desperation are likely to speed up the coming government induced train wreck for the Japanese.

Talk about doing the same thing over and over again and expecting different results and not learning from the lessons of history.

No comments:

Post a Comment