It appears that Vietnam has been enduring a bubble bust which somehow resonates with the China: aside from easy money policies, an artificial boom had been stoked by state owned enterprises.

First the bubble bust, from Bloomberg:

Office and retail rents in Vietnam’s two largest cities have slumped as a wave of supply entered the market at a time when slowing economic and retail-sales growth curbs demand for commercial real estate. The Hanoi market added more office and retail space since the start of 2011 than in the previous four years combined, according to property broker CBRE.The average asking rent for top-grade central business district office space in Hanoi was about $47 per square meter per month in 2009, more than double the levels for the same grade space in Bangkok and Kuala Lumpur at that time, according to data from the Vietnam unit of Los Angeles-based CBRE. The rate was 11 percent lower at $42.01 per square meter in the third quarter…

Vietnam’s credit imploding real estate has been bankrolled by State Owned Enterprises. More from the same article

Real estate loans totaled 203 trillion dong ($9.7 billion) as of Aug. 31, of which 6.6 percent were classified as bad debt, Minister of Construction Trinh Dinh Dung told the National Assembly on Oct. 31, citing a State Bank of Vietnam report. A broader category of real estate-related loans, including property-backed debt, account for 57 percent of total outstanding borrowing, or about 1,000 trillion dong, he said…Many of Vietnam’s 1,300 state-owned enterprises are reportedly facing losses because of their recent forays into property, said Alfred Chan, director of financial institutions at Fitch Ratings in Singapore.“It is not obvious, if you were just to look at the disclosure, what the potential risks to the banking sector are if you just look at the real estate sector,” Chan said. “Some of this exposure could well come from non-real estate companies that have ventured into that sector.”Non-performing loans at banks are “significantly understated” and could be three or four times higher than official estimates, Fitch Ratings said in a March report.The central bank chief, Nguyen Van Binh, said in April the level of bad debt at some lenders may be “much higher” than reported. Bad debts in Vietnam’s banking system may have accounted for 8.82 percent of outstanding loans at the end of September, Nguyen Van Giau, head of the National Assembly’s economic committee, told legislators in Hanoi Nov. 13.

So far, the impact from the mini-bubble bust has only slowed the economy which likely means that the Vietnamese has ample savings to cushion the capital consumption from the recent bust. The average Vietnamese predilection for gold hoarding has been a manifestation of savings.

Or perhaps government’s statistics may not have been forthright

Vietnam’s bubble bust has fingerprints of Keynesian policies everywhere.

Vietnam’s Ho Chi Minh Index (Bloomberg)

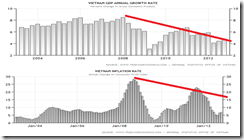

Charts from tradingeconomics.com

Easy money policy fueled a boom which got reflected on the stock market, the property sector and the inflation index. This bubble has been abetted by speculations by state owned enterprises. Some of which had been justified as infrastructure spending. The boom led to higher interest rates which eventually popped these politically induced malinvestments.

And the ensuing bust seem to have prompted the Vietnamese government to implement stabilizers in 2010 (see red ellipse) which rekindled price inflation.

The Vietnamese government’s interventions, which seems aimed at forestalling recession or preventing the market from clearing of the previously acquired malinvestments, has only delayed the economic recovery.

And the article above describes the symptoms of the capital consumption process.

Vietnam needs to allow market forces and the price signaling mechanism to function. She needs reduce her interventions by liquidating and or privatizing bankrupt state owned enterprises while simultaneously liberalizing her economy to allow entrepreneurship to blossom. Reducing government spending will also allow the economy to use scarce resources which should be channeled into productive engagements.

No comments:

Post a Comment