Major US equity bellwether have reached milestone highs

the Dow Jones Industrials

the S&P 500

the Nasdaq broke above the 2007 highs but still way below the 5,000 levels in 2000

the Russell 2000 also in record levels (all charts from bigcharts.com)

All these have been going on since the US Federal Reserve’s open-ended or QEternity or QE infinity since September 2012

US stocks are being supported by an increase in the Fed’s Reserve assets.

Last Sunday I showed this M2 chart. The current update reveals that the M2 has reaccelerated steeply and has broken beyond January highs, which proves my thesis that “any weakness may be temporary.”

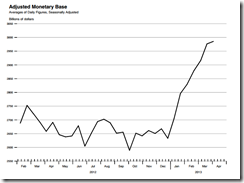

M2’s rise has also been reflected on the high powered money via the monetary base which has been sky bound.

Record stocks also translates to near record margin debt (ETF Daily News)

The current economic growth which is supposed to be happening has been underpinned by credit expansions as seen Bank Loans (higher pane and commercial industrial loans (lower pane) [charts of M2, Monetary Base, and the above from St. Louis Federal Reserve]

Credit booms end up in a bust, if not a currency crisis.

Pay heed to the warnings of the great Austrian economist Ludwig von Mises

The boom can last only as long as the credit expansion progresses at an ever-accelerated pace. The boom comes to an end as soon as additional quantities of fiduciary media are no longer thrown upon the loan market. But it could not last forever even if inflation and credit expansion were to go on endlessly. It would then encounter the barriers which prevent the boundless expansion of circulation credit. It would lead to the crack-up boom and the breakdown of the whole monetary system.

There is no such thing as free lunch even from central banks. Party times can last...until it can't

3 comments:

Benson, I do not know if you have looked at the chart of money velocity but that is where the real problem lies...all those trillions of new cash in the system but it is not moving around so no ecnomic activty increase. John

Hi John,

Thanks for comments.

You are correct in pointing out that money has not been moving around based on velocity

Velocity MZM

http://research.stlouisfed.org/fred2/series/MZMV?cid=32242

Velocity M2

http://research.stlouisfed.org/fred2/series/M2V?cid=32242

Velocity M1

http://research.stlouisfed.org/fred2/series/M1V?cid=32242

But I am no fan of money velocity.

If we use the velocity metric to predict on the movements of the stock markets, then US equities should be crashing instead of hitting record highs. That’s the mistake made by a lot of mainstream ‘experts’, especially cheerleaders for inflationism.

Three things why I think velocity is a poor measure. It assumes money is neutral. It doesn’t capture people’s preferences and utility of money. And it is a lagging indicator.

I explained them here.

http://prudentinvestornewsletters.blogspot.com/2011/10/more-inflation-myths-velocity-of-money.html

Given the relative impact (Cantillon Effects) from the Fed’s money printing, those who get the money first, particularly Wall Street, e.g. primary dealers who sell bonds to the FED via QE, the 2008 bailout money (TARP), proceeds from the Fed’s Interest Rate on Excess Reserves and etc, may have used such to speculate on the stock markets and the credit markets (e.g. junk bonds, revival of CDOs) rather than to lend to main street.

Thus the parallel universe: economic growth has been tepid, but financial market booms.

I borrowed the explanation of Ed Yardeni on the interlocking relationship between the bond and stock markets here.

http://prudentinvestornewsletters.blogspot.com/2012/12/how-us-federal-reserve-policies-linked.html

But the Fed engineered QEternity seems gaining momentum. Aside from a resurgent commercial and industrial loans and bank loans, consumer loans have also began to move higher.

http://research.stlouisfed.org/fred2/graph/?s[1][id]=CONSUMER

Even real estate loans have bottomed out and has exhibited signs of recovery.

http://research.stlouisfed.org/fred2/graph/?s[1][id]=REALLN

At the opposite end, US savings rate has been going down.

http://research.stlouisfed.org/fred2/graph/?s[1][id]=PSAVERT

All these are signs of a credit bubble in motion.

If Fed’s policies continues to induce credit expansion in the main street, then we should expect the bubble dynamics to accelerate. There will be pressures on input prices, there may be price inflation (but not necessarily), as well as pressures on interest rates. (despite the Wall Street engineered crashing of commodities)

The boom will then be jeopardized.

Hope this helps,

Benson

You relate This proves my thesis that “any weakness may be temporary.”

Money as it has been known will be taking a turn for the worse, as the seigniorage, that is the money producing capability of the world central banks’ monetary policies, is turning toxic, first as excessive credit turns “money good” assets bad, and secondly as the terms of Cyprus Bank Deposit Bailin become incresingly perceived as onerous presenting investment risk

In fact money, that is wealth as it has been known, is going to be extinguished, yes wiped out, as the monetary policies of the world central banks have passed the rubicon of sound monetary policy; monetization of debt by the world central banks have made “money good” investments bad. While Reuters reports BOJ’s Kuroda: have taken all steps needed for inflation goal, the world is actually at a point where excessive credit liquidity has finally blown the top off the stock market.

Mysteries, that is God’s secrets, are known unknowns and revolve around His Son Jesus Christ, who is working according to the law of Universal Administration, that being Dispensationalism, for the fullness of every age, epoch, era and time period, completing it, much as a ship’s captain, assures that everything on the manifest is present before the ship sets sail, Ephesians 1:10.

The road to serfdom is paved with the expansion of credit that has come from the two spigots of credit liquidity. The first spigot of credit liquidity has been the world central banks monetization of debt. And the second spigot of credit liquidity has been the sell of the Yen, FXY, beginning October 1, 2013.

Under Liberalism’s fiat money system, the sovereignty of democratic nation states provided seigniorage, that is moneyness, specifically the seigniorage of investment choice establishing credit and investment prosperity.

But under Authoritarianism’s diktat money system, the word, will and way of sovereign regional leaders, such as the nannycrats, that is the EU Finance Ministers, and regional sovereign bodies, such as the ECB, provides seigniorage, specifically the seigniorage of diktat establishing debt servitude and austerity.

Jesus Christ has produced Peak monetary expansion and peak credit liquidity, as evidenced by the crack up boom, in S&P Telecom, IST, Utilities, XLU, Pharmaceuticals, XPH, as well as the Global Industrial Producers, FXR, and by the Elliott Wave 5 High of Major World Currencies, DBV, and the Elliott Wave 2 High of Emerging Market currencies, CEW.

Debt deflation will be getting underway very soon as the FX currency traders sell currencies short, inducing Financial Apocalypse, that is a credit bust and global financial breakdown, as foretold in Bible Prophecy of Revelation 13:3.

Diktat Money is defined as the compliance required, as well as the trust that is engendered, the austerity that is experienced, such as heavy losses on large bank deposits, levying additional taxes, privatizations, and sale of a country’s central bank’s gold reserves, and the debt servitude that is enforced, when sovereign regional leaders such as Olli Rehn, and sovereign regional bodies such as the EU Finance Ministers or the ECB, invoke mandates for regional security stability and sustainability.

Diktat money is the replacement for fiat money that comes from the paradigm shift out of Liberalism and into Authoritarianism, where the Milton Friedman Free To Choose fiat money system produced fiat wealth via securitization of stocks and bonds by Asset Managers, such as BLK, WDR, EV, STT, WETF, AMG, seen in this Finviz Screener, and the Too Big To Fail Banks, RWW, such as BK, BAC, C,WFC, and Investment Bankers, KCE, such as JP Morgan, JPM.

Post a Comment