We

are currently wealthy, fat, comfortable, and complacent. We have a

built-in allergy to unpleasant or disturbing information.

Our mass media reflect this. But unless we get up off our fat

surpluses and recognize that television in the main is being used to

distract, delude, amuse, and insulate us, then television, and those

who finance it, those who look at it, and those who work at it, may

see a totally different picture too late. Edward R. Murrow: "Good

Night and Good Luck"

In

this issue

Phisix

6,900: Surprise! SM Investments Posted ZERO Net Income Growth for

2015!!! Why PLDT’s 2015 Income Tumbled!

-Phisix

6,900: Intensifying Fear of Missing Out Trade or the Mania has

Returned!

-Why

has the Fear of Missing Out Ignored Domestic Banking Stocks?

-Eerie

Parallelism Between the PSEi and Brazil’s Bovespa, The Fumbling USD

as Key Driver to Global Risk ON

-PLDT’s

Crash: Business Model Based on Stagnating Top Line and Ballooning

Operating Costs

-Surprise!

SM Investment’s Net Income Growth for 2015 was ZERO!!!!

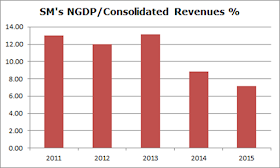

-SM’s

Price Surge: An Upcoming SM Retail IPO?

Phisix

6,900: Surprise! SM Investments Posted ZERO Net Income Growth for

2015!!! Why PLDT’s 2015 Income Tumbled!

Phisix

6,900: Intensifying Fear of Missing Out Trade or the Mania has

Returned!

Fear

of Missing Out (FOMO).

Present

actions at the Phisix can only be described as an increasingly FOMO

strain

The

Philippine stock market has been a manifestation of violent shifts in

extreme sentiments: particularly from January’s ‘Fear’ to

February-March FOMO’s ‘Greed’.

Since

“fear” accounts for one of the base human emotion—as it is

with its opposite: greed—then the violence in market response have

only exhibited emotional distress or signs of growing instability.

First

some numbers.

From

the lows of January 21 6,084.28 through March 4’s 6,899.77, such

ascent translates to a 13.39% in 29 days. This has basically almost

erased all of the year’s losses, although the Phisix is still down

by miniscule .76%. Yet the average daily gains during this ripfest

have moderated to .46% from about 1% during the initial blast-off.

This

was primarily because of the other week’s hiatus which has been

short lived. That’s because this week the PSEi went into another

overdrive where the index soared by 1.89%.

From

a technical perspective, in contrast to the January breakdown from

key support levels, this time the Phisix have broken through key

resistance levels.

So

while the bullish outlook may read this as a key reversal, current

technical conditions would make the January breakdown a “whipsaw”.

Whipsaws

neither confirm nor deny the reversal from the previous trend.

In short, from a technical perspective, current trends suggest of a

“no man’s land” or a “purgatory”.

Additionally,

current conditions have been indicative of a seething “overbought”

condition.

The

“fear of missing out” syndrome represents a social phenomenon

stimulated by emotion.

Fundamentally, FOMO represents a dopamine

rush to find satisfaction by emulation or “a pervasive

apprehension that others might be having rewarding experiences from

which one is absent”. Or FOMO can be qualified as “the fear of

regret”, which according to Wikipedia, “may lead to a compulsive

concern that one might miss an opportunity for social

interaction, a novel experience, profitable investment or other

satisfying event”1

In

short, FOMOs function as the basic psychological ingredient to or

bandwagon effect or in financial market lingo, manias.

The

ultimate sign of FOMO is when bad news has been construed as fodder

for frantic bidding sessions.

Let

us take last week as an example:

On

Monday, PLDT’s shares had been taken to the woodshed for the

revelation of a collapse in earnings in the 4Q. PLDT reported a

negative Php 3.27 billion income in the 4Q while reported income was

down 33% to Php 22.1 billion for the year 2015.

Because

PLDT was crushed by a shocking 17.9%, the PSEi fell

by 1.48%.

By

the way, the largest telecom firm accounts for the third largest

market share weight among the 30 composite issues index. In spite of

this week’s freefall, TEL still has a share weight of 6.24%.

And

visibly hurt by deterioration in fundamentals and the slump on the

index, as if by coincidence, SM Investments went on to announce a

merger of its unit while at the same time, disingenuously declared

2015 as a year of G-R-O-W-T-H!

Stunningly,

what was sold as year of G-R-O-W-T-H had nothing been more than a

public relations legerdemain because SM’s consolidated income

growth for 2015 was Z-E-R-O!

Let

me repeat: SM

posted ZERO earnings growth for 2015!!!

(see below)

Yet

SM’s announcements spurred manic buying over its stocks that

spilled over to key issues with the biggest market weight. This has

sent the Phisix skyrocketing by a stunning 4.31% in three

straight

days!

Remember,

at 10.8% SM has the largest market weight share in the Phisix

Instead

of showing the price changes, the above diagram exhibits on the

weekly market weight changes of the PSEi basket in %.

It

shows that the share-weight gains by 5 of the top 12 issues at

22.03%, brought about by price surges, more than offset the 20.81%

loss in market share by the PLDT. PLDT lost a horrifying 19.34% share

this week!

In

terms of % changes in weekly prices, the top 5 performers were as

follows: SM +7.69%, ALI 6.08%, JGS 6.42%, AC 6.91% and GTCAP +4.74%.

Yet

the distribution of gains for the top 15 in both market cap and

weekly changes appears to be in the direction of the biggest to the

next smallest.

Additionally,

the market gains of the next 15 issues had been tilted towards the 5

of the bottom 12.

In

terms of % changes in weekly prices, 7.68%, RLC 10.22%, MEG 9.46%,

PCOR 13.79% and BLOOM 17.35%. Yet the distribution of gains for the

next 15 in both market cap and weekly changes appears to be in

reverse

of the top 15: biggest gains from smallest to the biggest

weightings.

In

sum, the PSEi’s weekly gains of 1.89% that led to 6,900 had been

brought about by a frantic pump of 5 issues of the top 12 biggest

market share, which negated the collapse of PLDT, combined by the

marginal contributions from the substantial gains of mostly the 5 of

the 12 bottom issues, as well as, the modest advances by the rest of

the members.

For

the week, advancers walloped decliners 26-3 with one issue unchanged.

Last

week’s dynamic would seem like the PSEi spike had been programmed.

Conspicuously

absent in the week’s frenetic pumping has been the banking and

financial sector (blue rectangles). Why? Because FOMO forgot the

banks, which ironically functions as the lifeblood for statistical

GDP? Because FOMO believes that bubble industries have been

generating huge free cash flows to internally finance “G-R-O-W-T-H”?

That’s not what balance sheets of listed companies have been

showing us.

For

the FOMO week, the banking index delivered only .52% gains! Year to

date banks remain in deficit, down by 2.86%. Meanwhile gains from the

mainstream industries (which includes the mines) dwarfed the banks.

In pecking order by week, holding 5.3%, (year to date 2.52%),

property 4.78% (y-t-d -3.22%), mining sector 4.34% (+6.29%) and

Industrial 2.66% (+3.21%).

The

service sector crashed 8.44% to accrue an annualized -8.11%

Meanwhile,

the 29 day pump has yanked out the industrial and holding sectors

from the negative to post positive returns on a year to date basis.

The

mining sector remains as the top performer, buoyed largely by the

general sentiment rather than by international price of gold.

Domestic

mines have substantially underperformed its US peers. USD prices of

gold soared by 3.05% this week as the gold prices appear to have

returned to the bullmarket according

to Bloomberg. Meanwhile, the US gold bugs index (HUI), a

composite index of US gold mining majors vaulted by 6.45% over the

week. Year to date, the HUI had been up an astounding 54.67%!

Yet

the domestic mining index has been up by only 6.29%. This only

confirms my views that the rise

in domestic gold miners has hardly been about the essence of gold—as

alternative money and as insurance against financial instability—but

as momentum for yield seeking casino gamblers.

Curiously

despite considerable gains in some property stocks that spiked the

index this week, the property index also remains down for the year.

Why

has the Fear of Missing Out Ignored Domestic Banking Stocks?

I

noted above that banking stocks appear to have been overlooked by the

FOMOs.

Has

the above been the reason why the FOMOs forgot a push on the banks?

Despite

the sporadic pumps at the Philippine treasuries, spreads of the 10

year relative to the 3 year have not just been NEGATIVE in three out

of the past FOUR weeks, but the inversion has deepened! The NEGATIVE

spread has now reached 40 bps!

The

belly of the curve (10-5yr) has signified an even more critical

juncture. Aside from four weeks into inversion, the negative spread

has dived to 62 bps!

The

Bangko Sentral ng Pilipinas’ (BSP) January data showed of a big

jump in bank

credit expansion to 16% from December’s 13.7%, as well as, in

liquidity

growth at 11.5% from December’s 9.4% (see top). It’s not

clear whether January’s data represents a reversal and a pickup on

inflationary activities or if this has been merely a one month quirk.

One month does not a trend make.

Yet

Domestic banks may already be panicking. In

recognition of the implied tightening of the financial system due to

an ongoing squeeze in interest rate arbitrages, the surge in

January’s bank lending extrapolates to the thrust to wangle profits

and earnings through volume expansion at the expense of credit

quality.

I

don’t need the BSP to tell me that banking system’s portfolio has

been rotting. Shouting

statistics

won’t shoo away developing balance sheet decay.

Yet

if January’s credit expansion and liquidity growth momentum will be

sustained, then CPI and all other real economy prices can be expected

to advance going forward. If

so, higher inflation expectations should eventually reveal its ugly

head through HIGHER treasury yields, with most of the pressures

likely to occur at the front end. And

this

will only exacerbate on the extant negative yield curve strains

So

far, results on prices in the real economy have been mixed (although

with a bias for lower prices). Based on government tabulations, for

January manufacturing

input remains in deep deflation (manufacturing boom?), retail

prices of construction materials dived and wholesale

prices of construction materials popped out of deflation for the

first time in at least a year (construction boom?).

Hasn’t

the recent financial strains by PLDT and SM not been tied to the

NEGATIVE spread? Have I not been repeatedly warning about this? My

December 2014 post is an example2

Current

developments in the Philippine bond markets suggest that yields have

been rising across the curve but the pressure of increases has been

in the short (bills) maturities than the longer bonds…thus the

flattening. The

flattening of the yield curve thereby signals the ongoing tightening

of monetary conditions. Rising short term yields are symptoms of

emergent strains in the Philippine financial system…

Via

the law of scarcity, this means that eventually the developing

entropy in the domestic credit markets, presently being ventilated in

the bond markets, will reach a point to expose on the Potemkin

Village pillared on a credit bubble; an inflection point from which

the BSP won’t be able to control.

Today,

the issue has transitioned from flattening to inversions or negative

spreads (where long term rates are LOWER than some of the shorter

equivalent).

In

short, current conditions have been WORST than when it was in 2014

(see below PLDT and SM’s topline performance)

And

so far, anent consumer prices, February CPI, as reported by both the

BSP

and the PSA,

dropped to .9% from January’s 1.3%.

Yet

the monthly

decline of February’s CPI at .3% represents the largest drop

since 2008! (see

lower window)

Hasn’t

it been an irony, where underneath

the façade of tranquility as painted by the mainstream, there have

been palpable indications of progressing strains in the financial

system?

Yet

the FOMO represents an act of desperation in the hope that higher

stocks will expunge all these adverse developments.

More

signs of terminal

phase of the domestic bubble.

Eerie

Parallelism Between the PSEi and Brazil’s Bovespa, The Fumbling USD

as Key Driver to Global Risk ON

The

PSEi seem to have a stock market sibling. By sibling I mean

parallelism in the movements or undulations of the aggregate stock

prices or the stock price trend. In fact, an eerie affinity which

extends from the start of 2015. The upside and downside violent

swings, particularly in late 2015 through 2016, has almost been an

exact mimic/copy.

Unfortunately,

the sibling has not hailed from the same region, but has been

situated across the Pacific Ocean, a

distance of an estimated 19,300+ km.

In

economic performance, however, unlike the domestic conditions, the

Latin American sibling, or particularly Brazil, has

fallen into a deep economic contraction -6% as of January. The

said country has been in a recession and is expected

by the mainstream to sink deeper into an economic quagmire.

I

have previously pointed out how international

media’s darling in 2009 became an outcast in 2013. Today,

Brazil

has been paying for the sins she committed from her easy money boom

regime.

But

hold on. Hasn’t the Brazil’s stocks boomed along with the

Philippines during the past month? Brazil’s benchmark, the Bovespa

(BVSP), skyrocketed by an eye-popping 18% last week (see black

line)!!!!

This

week’s sudden stock market boom has lifted year to date performance

from negative to 13.23%!

Will

the PSE follow?

Yet

just why should the PSEi share an uncanny likeness with the BVSP?

How

long will such correlation last?

Has

current correlations have been due to the USD?

The

USD peaked against Brazil’s

real during the third week of the January which coincidentally

was the same time the USD

climaxed against the Philippine peso

Like

the BVSP, Brazil’s currency real soared by a titanic 6.2% this

week! The huge rally in Brazil’s financial assets had been

attributed by media to the detention by the former president Lula da

Silva.

But

upon closer inspection, whether it has been Brazil real or the

Philippine peso, to soaring stocks worldwide to an upturn in prices

of commodities…everything seems to have linked to the USD. The USD

index was down by .9% this week.

Meanwhile,

movements of oil prices, which has had increased correlations with

movements of stocks, have become a major conduit for authorities to

conduct stimulus. This week, US crude WTIC spot prices soared 10.62%

to $36.33 on talks of agreement

by producers to cut production.

More

evidence that the current risk ON conditions have significantly been

a driven by the sinking USD.

This

week’s peso’s surge (USD PHP down by 1.2%) reflected on a

regional dynamic.

The

USD plunged most against the South Korean won (-2.8%), Malaysia’s

ringgit (-2.39%), Singapore’s dollar (-2.37%) and the India’s

rupee (-2.24%). See top frame.

The

JPM Bloomberg Asian

Index zoomed this week (lowest window)

The

USD peso closed at 46.945 this week. This means that the peso

underperformed the region.

Nonetheless,

of most of Asian equities has rallied mightily as a consequence of

the weak USD (middle pane.) To cite a few weekly booms: Singapore’s

STI +7.08%, India’s Sensex +6.44%, Japan’s Nikkei +5.1%,

Australia’s ASX 200 +4.3%, Hong Kong’s HSI +4.2% and China’s

Shanghai index +3.86 (the latter had been once again boosted by

government intervention according to the Bloomberg)

As

previously

noted, the USD dollar has been the “most crowded trade in

2015”. Since

no trend goes in a straight line, what we are likely has been a

typical counter trend rally characterized by violence.

Back

to the parallelism between the PSEi and BVSP: Could the unusually

tight correlation between the PSEi and BVSP signify a Brazilian

template for the Philippine economy once the USD rally resumes?

PLDT’s

Crash: Business Model Based on Stagnating Top Line and Ballooning

Operating Costs

Officials

at the Philippine Stock Exchange perhaps believe that deteriorating

conditions of corporate fundamentals of the cumulative listed firms

may have been an anomaly. This may have been the primary reason for

them to withhold disclosure of information to the public for the past

two quarters, particularly 2Q

and the 3Q.

They

probably believe that the market’s ‘animal spirits’ may

continue thrive in the absence of adverse information. And that such

suppression of information will bring the ailing corporate health

back to salutary conditions.

Well,

they are gravely mistaken. With PLDT’s surprise announcement, (and

with SM’s Zero Growth), the

general conditions of listed companies have markedly worsened!

With

two of the three largest companies in trouble, how will the PSE put a

spin on them? Or will the accrued performance of listed companies

remain silenced?

PLDT’s

reported income for 2015 was down steeply by 35% for 2015!

Such

was mainly brought about by 4Q’s NEGATIVE performance. According to

Reuters,

PLDT suffered a “net

loss of 3.27 billion pesos ($69 million) in Q4 of 2015 versus net

income of 6.13 billion pesos in the same quarter the previous year”.

Aside

from reported net income, core income and EBITDA as provided

by PLDT had been markedly down by 6% and 9%, respectively, for

the year.

While

it has been true that losses by the largest telecom firm as

attributed by many media outfits has been brought about by its

investments in German firm Rocket Internet

which shares collapsed in 2015 (Php 5.124 million impairment

based on PLDT’s 4Q disclosure, p. F-43), and by foreign exchange

losses (Php 3.036 billion, p. F-4)3,

what has been largely missed has been that the company’s gross

revenues continue to stagnate. PLDT’s NGDP grew by only 1.6% in

both 2015 and 20144!

[UPDATED to add: correction to PLDT's 2015 NGDP: It's not 1.6% but .16%]

So while PLDT’s gross revenues had barely advanced, operating expenditures has grown 10.71% and 3.94% during the same period. In short, when costs have been growing faster than revenues then losses will become the eventual outcome.

So while PLDT’s gross revenues had barely advanced, operating expenditures has grown 10.71% and 3.94% during the same period. In short, when costs have been growing faster than revenues then losses will become the eventual outcome.

So

even

without the shocks from investment and foreign currency losses, PLDT

has been bound for losses under the current business model template.

Yet

to compound on the cost factor, has been PLDT’s surging debt load

(long term debt up 24.76%).

Competition

can partly be attributed to this. Globe’s NGDP/consolidated

revenues grew by 16.21% and 8.51% in 2015 and 2014. But competition

would not be enough.

That’s

because crawling topline growth has been the industry’s

predicament!

To

reckon on the duopoly or the combined PLDT and GLO’s

topline, nominal growth rates for 2015 and 2014 had been miserly

6.2% and 4.08%. In short, the

industry’s gross revenues have hardly been growing.

So controlling costs has been pivotal factor in determining earnings.

That’s

unless these companies find new products or services to sell in order

to augment their incumbent business models.

Nonetheless,

the industry’s topline growth rate bespeaks of the government’s

much touted economic variable called the GDP. 5.8% GDP for 2015 eh?

And

instead of hunkering down to conserve on existing resources, the top

PLDT official said that capex would remain at Php

43 billion for 2016. Question is, given the current decline in

income growth, which should translate to lower or tighter free cash

flows, how will this be financed? More debt perhaps?

While

the temporal strengthening of the peso should provide a breathing

room, PLDT’s incumbent model would have to be recalibrated to

adjust with the changing reality.

Yet

apparently, bad

business models thrive mainly because of the low interest environment

or financial subsidies provided for by monetary officials. Why

improve on business models when financing is cheap and plentiful?

More

importantly, bad

business models survive due to restrictive

regulatory environment that serves as substantial barriers or

‘protection’ against the entry of more efficient competitors.

In

other words, instead of prioritizing consumers, such companies

subsist on political rent

seeking.

Said

differently, the advantage of inefficient industries and firms has

been from the protection

provided

for by incumbent political institutions.

But

such

advantage cannot escape the fact that they are economic entities

subject to the basic laws of economics.

TEL’s

crash shows of an all-important breakdown of 2008 support levels.

Of

course, entropic fundamentals have not just been restricted to PLDT.

Yet

how much more losses would accrue to such firms when the liquidity

conditions worsen?

As

an old saw goes, prices are relative. High prices can go higher. Low

prices can go lower.

Surprise!

SM Investment’s Net Income Growth for 2015 was ZERO!!!!

By

and large, stagnating revenues and ballooning costs will be the model

seen behind many of today’s high profile industries.

Despite

this week’s meltup in stocks, the largest listed firm in the PSE,

SM Investments, seem to now manifest initial strains somewhat similar

to PLDT’s model

Yet

it’s truly a sad spectacle for some listed firms to use publicity

relations gimmickry to conceal the real state of their financial

health. And it’s especially unfortunate when such devious maneuvers

appear to have been used by the largest firm, SM Investments

Aside

a side note, from the behavioral perspective, inattentional

or perceptual blindness from selective attention accounts for one

of human’s psychological or behavioral foibles.

In

a 1999 study presented by psychologist

Daniel Simons and Christopher Chabris, popularly known as the

“gorilla experiment”, the audience had been instructed to

count the number of ball passes made by a group of people wearing a

specific colored shirt. There are two groups of people wearing two

different colored shirts moving and passing balls within their group.

As the two groups conducted their moving and ball passing routine, a

gorilla casually walked across these groups.

At

the end of the experiment the audience was asked, not of the number

ball passes, but if they had seen the gorilla. And surprisingly, half

of the observers said that they had not seen gorilla at all.

The

psychologists said that “It

was as though the gorilla was invisible”, such that they concluded

of the two vital messages from the experiment “that we are missing

a lot of what goes on around us, and that we have no idea that we are

missing so much”.

See

the you

tube experiment here

I

offer a third insight: That half of the audience blindly followed

what the psychologists instructed them to do by suppressing the other

sensorial information, viz., the gorilla.

In

short, perceptual

blindness can arise from the manipulation of information.

Proof

of this can be seen in magic tricks.

The

secret of many theatrical or street magic has hardly been due to the

‘hands is faster than the eyes’ but mostly on the refocusing of

the attention of the audiences to the effects of the magic trick by

the magician while at the same distracting them through the

suppression of attention on others. Such is called the art of

misdirection.

Let

us see how SM Investment seems to have applied the ‘art of

misdirection’ and the ‘gorilla experiment’ to their latest

press release.

In

last week’s disclosure, the company bannered “SM Recurring Net

Income Rises 13% in 2015”5.

The

press release opened with the key paragraph:

“SM

Investments Corporation (SM) reported a 13% growth in recurring

net income in 2015. Consolidated net income stood at PHP28.4 billion

in 2015, posting the same level as last year. Consolidated revenues

grew 7% to PHP295.9 billion for the period.”

In

the succeeding paragraphs, the disclosure went on to describe growth

in the context of the industries which their subsidiaries catered to,

in particular, retail, banking and property.

The

press release ended leaving the impression that SM’s performance in

2015 was about G-R-O-W-T-H.

And

as usual, media swallowed hook line and sinker what SM reported that

made them seeming extensions of SM’s PR outfits.

Given

the huge expansions, NO ONE bothered to ask: Whatever happened to

these expansions or to the non-recurring financial conditions? Or why

focus only on recurring income when the company had spent so much to

expand capacity?

Moreover,

to extend on this: just what had happened to the non recurring

segment for SM to declare: “Consolidated net income stood at

PHP28.4 billion in 2015, posting

the same level

as last year”?

With

emphasis: the SAME LEVEL as last year!

To

verify on the claim, here is SM Investment’s disclosure for the

performance of the year 2014 in March 4, 20156:

“SM

Investments Corporation (SM)

reported a record net income in 2014 of PHP28.4 billion. Excluding

extraordinary items, recurring net income grew 14.4%”

So

consolidated net income for 2015 was PHP28.4 billion. Net

income in 2014 was a record PHP28.4 billion. So

there was no reportorial error in SM’s disclosure.

Given

that consolidated

net income in 2015 was at the SAME level as last year at Php 28.4

billion, this means SM posted growth rates of NADA, ZILCH ZIPPO or

ZERO!!!!!!!!!

Like

the gorilla experiment and the art of misdirection, the audience had

been asked to read on the SM press release by following all the

growth numbers by segment as the firm recited upon.

Again,

at the end of the press release, the dominant impression conveyed to

readers must have likely been about G-R-O-W-T-H! But that’s even

when there was NO growth at all!

By

enthralling the audience with G-R-O-W-T-H, the second paragraph of

the report’s opening “Consolidated net income stood at PHP28.4

billion in 2015, posting the same level as last year” had

tacitly been suppressed!

Of

course, SM didn’t bother to account for WHY the growth rate on

consolidated NET INCOME was ZERO. If they explained it then the magic

art of misdirection would not work.

SM’s

record income of 2014 was at Php 28,398,584. Then, the Weighted

Average Number of Common Shares Outstanding was at 796,317. Since

SM’s weighted average common shares have grown by 1% a year in the

last two years, I apply this rate of growth to net income in 2015.

If

my estimates of weighted common shares outstanding have been

inaccurate, at best, SM EPS will be at ZERO. Yet if my guess is

right, then SM’s EPS will reveal a NEGATIVE in 2015.

So much for

G-R-O-W-T-H.

And

that’s just the second paragraph.

There

yet has been the pivotal THIRD paragraph that needs to be reckoned

with:

Consolidated revenues

grew 7% to PHP295.9 billion for the period.

Huh???

After all the bruited about expansions, SM’s NGDP was only

7%??????!!!!! Holy Smokes!!!!!!!!!!! What happened????

The

third paragraph has likely been reason for the ZERO growth…

To

reiterate with emphasis, despite the massive wave of additional

inventories to retail stores, to shopping malls to property to bank

branches, bank loans and bank assets, the shrinkage in growth rates

of SM’s consolidated revenues has been accelerating

for the past two years:

2015’s 7.17% growth rate accounts for a 45% decline from 2013’s

13.14%! 2015’s topline has been down 19% from last year’s 8.85%.

That’s

in NO WAY signs of G-R-O-W-T-H!

Again,

just what happened to all the increased inventories??????

Massive

inventories should be augmenting on the growth rates. But what SM’s

numbers have shown has been a deduction for two straight years.

Two

possibilities: have new inventories accounted for much of the 7%

revenue growth that masked weakness on the same store sales growth???

Or as per press release, has the gist of the 7% revenue growth been

from same store sales with much of the expansion providing little

boost to the top line????

Too

much competition now chipping on the market share of SM?

Or

has the ‘domestic demand’ in the real economy been faltering?

Yet

if

SM’s NGDP has been reduced to 7%, then what happens to the lesser

ones?

Moreover,

the growing slack in SM’s NGDP or consolidated current based

revenue growth underscores that there must have been an outgrowth of

excess supply or vacancies!!!

Has SM's 2015 performance been a confirmation

of Robinson Land’s 5% vacancy rates????!!!

In

the aftermath of the record PSEi, ast year I warned of the likelihood

of the 2015 predicament7:

(bold and italics original)

The

nub: A

lot of SM present activities have hardly been about profits but about

the use of profits to justify incurring more DEBT.

This comes even as the real economy has been materially slowing,

regardless of what government G-R-O-W-T-H statistics says. SM’s

topline numbers all support the ongoing slowdown.

Bingo!

*note

SM has not released its official financial statements. The above are

based solely on current press release and their previous financial

statements.

SM’s

Price Surge: An Upcoming SM Retail IPO?

So

just why has SM’s equity prices made a vertical three day

Cialis-like leap??? Or why the astounding 7.69% price surge for the

week?

Given

the ZERO net income growth, last week’s price surge translates to

only massive

multiple expansion

or people panic buying in the hope to sell these to an even greater

fool!

Could

it be because SM plans to merge

all its retail holdings into the fold of SM retail?

Yet

the merger would be nothing but a legal and accounting exercise that

will hardly account for a meaningful expansion of current financial

conditions.

Given

its scale, SM’s topline are ultimately DEPENDENT on economic

conditions and on COMPETITION.

Yes

SM’s topline debunks on the populist incantation of ‘strong

domestic demand’ and of the government’s GDP numbers!

What

the merger will likely entail is for SM Investments to have SM Retail

listed at the PSE.

And by selling shares to the public SM will benefit from a one time

non-recurring windfall.

Moreover,

by

having SM Retail as a listed entity, this will give the SM group

additional means to secure financing via the capital markets. Yes, it

means access to financing independent of the parent.

Having

more stories through more entities extrapolate to more avenues or

expanded access to financing.

Yet

how can SM have its retail arm listed with a premium when the overall

market is down? A down market translates to ‘less’ confidence or

diminished incentive for the public to subscribe to a highly priced

IPO.

Or

how can SM generate a windfall or premium from the prospective

listing of SM Retail if parent SM’s stocks are down?

Something

has to be done to make conditions propitious, right?

The

answers to these questions could likely serve as drivers behind last

week’s meltup of SM and the PSEi.

As

predicted

in January 2016, “since

the elites have greatly benefited from the BSP inflationary boom,

then I expect some of them to try to put up a passionate last stand

to prop up the sham boom”.

Oh

if SM’s faltering topline and income growth had been a belated

consequence of the BSP’s 10 months of 30%+++ money supply growth in

2013-14, just watch what happens if M3 reaccelerates!

___

1

Wikipedia.org

Fear of

missing out

2

See

Philippine

Bonds Close the Year with a Rally; Flattening Yield Curve as

Business Cycle Indicator December 29, 2014

3

PLDT

CONSOLIDATED

FINANCIAL STATEMENTS AS

AT DECEMBER 31, 2015 AND 2014 AND FOR THE YEARS ENDED DECEMBER 31,

2015, 2014 AND 2013

4

I

wanted to plot PLDT’s topline numbers to establish a trend,

unfortunately, PLDT changes its headline numbers. For instance in

2014’s total revenues was 170,835 based on 4Q 2015 report, that’s

against 170,962 from their 4Q

2014 FS report. Mismatches can lead to distortions. So I just

relied on current data

5

SM

Investments SM

Recurring Net Income Rises 13% in 2015 February 29, 2016

6

SM

Investments SM

Posts 14.4% Growth in Recurring Net Income in 2014 March 4, 2015

No comments:

Post a Comment