``By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens.” -- John Maynard Keynes

The Phisix remained vivacious (up 1.94% week-on-week) amidst the recent precipitate correction across diverse asset classes in the global financial markets. (Needless to say, the Philippine benchmark has been markedly supported by torrential foreign money inflows and surprisingly inexorable signs of continued enthusiasm exuded by local investors taking up a majority of last week’s trading turnover despite the huge groundswell in aggregate peso volume turnover sans special block sales.)

Whereas in contrast to 2003 to early 2005, despite the falling US dollar trade weighted index, global markets rose on a tide of ex-US dollar asset accumulation, today, we are witnessing an antipodal perspective; falling markets in synchronicity, as shown in Figure 6.

One week does not a trend make though, yet what is bruited about by mainstream media as the causal factor behind the series of decline is of the growing “inflation” concerns as exhibited by rising commodity prices. And that being so, rising inflation would translate to the FED continuing to raise interest rates. I have noted that rising gold prices has in the past signaled rising interest rates (see March 27 to 31 edition, Listen To Your Barber On Higher Rates and Commodity Prices!).

Hogwash!

Today’s market has been dissonant. Commodities have been rising since the advent of the millennium (media notices it only now?). Second, if the Fed’s continued rate increase is a concern then why is the US dollar down 1.3% this week to its lowest level since March 2005, considering that the trade deficit has fallen below expectations should have ameliorated its cause? Should it not be that rising short rates would benefit the US dollar by manner of a larger yield disparity as the case was throughout most of 2005?

Inflation has long been extant in the financially driven global economy suppressed only by government’s manipulation of its statistical data.

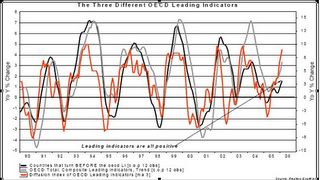

For instance, courtesy of Gavekal Research as shown by Figure 7, three leading indicators have been warning of a rising clip of economic growth indicative of emerging inflationary pressures since its trough in 2005 in OECD countries.

Figure 7 Gavekal Research: OECD leading indicators

Economist John Williams see figure 8, shows that using past methodology prior to the massive changes in the statistical makeup of the present CPI framework, CPI figures are running about 3 percentage points above officially stated figures!

Figure 8: Shadow Government Statistics: Alternate CPI Measures

Such is the reason why Gold and commodities are running berserk simply because real interest rates are still in the negative! This translates to effectively a still EZ money policy in spite of the recent 16th rate increase by the US Fed.

What we could possibly be seeing now is a symptomatic prelude to a US dollar run, if gold ever hits over and above $1,000 per oz, aggravated by signs of continued decline of US sovereign bonds and rising inflation pressures! Again I don’t wanna sound alarmist but we’ll take the market as it is.

Finally, rising currencies have not been detrimental to the advancement of the equities in Asia, but a slowing world growth will, notes the BCA Research’s on its latest outlook on present currency trends and Equity performances Asia; (emphasis mine)...

Figure 9: Emerging Asia Rising Currencies and stock Indices

No comments:

Post a Comment