``The job of the Federal Reserve is to take away the punchbowl just when the party is getting good." Former Fed Chairman William McChesney Martin

Instead of inflation as the culprit of the recent turmoil, key financial bellwethers appear to indicate of the contrary. As shown in Figure 1, the US Dollar index appears to have benefited from the recent shocks.

Figure 1: US Dollar Index Double bottom

A strong dollar denotes of a restrictive money environment. With global central banks in a consonant motion to lop off excess liquidity, these developments are hardly conducive for equity investments.

In addition, US 10-year yields have broken down (see Figure 2)!

Figure 2 US 10 Year benchmark Yields Breaking down?

Three things to bear in mind. One is that the present attempt by the benchmark US Treasury yields to breakdown from its support level could not be indicative of heightened INFLATIONARY expectations in distinction to what media or mainstream analysts have been speculating about.

Fixed income treasuries rally on the account of expected economic weakness. With global bonds (including emerging markets) appearing to show signals of bottoming out, the bond markets seems to suggests a coherent view of a global economic growth deceleration.

Second is that the present yield curve has gone flat with negative biases to fore. At less than 5%, relative to the FED interbank rate, the yield spread between the 10 year benchmark and the FED rate has gone marginally negative. If the FED continues to raise its short term rate on June 29th to 5.25%, this effectively inverts the yield curve for as long as the longer end stays at present levels. The inverted yield curve indicator has correctly called on the majority of the recessionary economic downturns in the US during the 20th century.

Mr. Van Hoisington and Lacy Hunt of the Hoisington Investment Management Company see similar risks in their recent outlook (emphasis mine)...

``In assessing the movement of these important financial economic and monetary leading indicators, it is our conclusion that a significant slowdown will embrace the United States before 2006 is completed. Furthermore, if the year over year growth rate of real M2 turns negative and the yield curve inverts for more than three months, the probability of recession will rise to over 50% on a statistical basis. Judgmentally we are already over 50%.”

This leads me to the third premise. That the bond markets dictate where the FED RATE direction goes and NOT the FED leading the bond markets. This is an important misconception deeply ingrained in the mindset of the average investors; that government policies dictate markets.

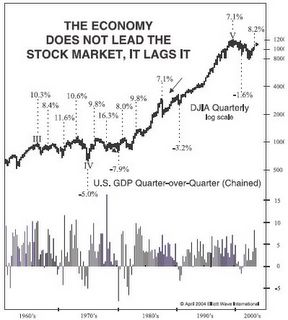

Figure 3 Courtesy of Elliott Wave’s European Market Watch

As shown in Figure 3 courtesy of Elliott Wave’s European Market Watch, the US treasury 3 month yields have in the past determined the policy actions of the Federal Reserves. Markets have essentially dictated on policy actions rather than what is commonly believed.

According to Mr. Vadim Pokhlebkim, Elliott Wave European market Watch (emphasis mine), ``Bond yields change daily, and central banks have no control over them: Yields (and prices) are set by the market. After years of observing the timing of monetary policy decisions, we’ve noticed one surprising fact: Central banks are almost never proactive when it comes to changing interest rates. Usually, they only react to what the bond market dictates. In other words, central banks’ decisions generally lag the bond market.”

Moreover, recent declines in the major US equity markets benchmarks may validate such bleak forecasts.

Figure 4 From Elliott Wave International, Dow Jones Industrial Average and the quarter-by-quarter performance of the US economy.

The stock market leads the economy, according to Robert Prechter of Elliott Wave international, ``Much of the time, the trends are allied, but if physics reigned in this realm, they would always be allied. They aren’t. The fourth quarter of 1987 saw the strongest GDP quarter in a 15 year span (from 1984 through 1999). That was also the biggest down quarter in stock prices for the entire period. Action in the economy does not produce reaction in stocks. The four-year period from March 1976 to March 1980 had not a single down quarter of GDP and included the biggest single positive quarter for 20 years in either side. Yet the DJIA lost 25% of its value during that period. Had you known the economic figures in advance and believed the financial laws are the same as physical laws, you would have bought stocks in both cases. You would have lost a lot of money.”

Last week, I mentioned that the incumbent Fed Chief Ben Bernanke and former Fed Chief Alan Greenspan acknowledged of the possibility of an ‘orderly’ housing industry induced economic growth ‘moderation’ in the US.

Since the US Federal Reserves future policy action is said to be “data dependent” which means its future course of action depends on its forecasts and on the effects on the incoming economic data on such forecasts, putting aside the assumption that the market dictates on the Fed policies, the $64 question is what if the Fed’s forecasts proves to be wrong as in the previous instances.

According to David Rosenberg, North American economist of Merrill Lynch (emphasis mine), ``the Fed overshot in the other direction in 2003 after overshooting to the upside in rates in 2000, and this is what business cycles are made of - policy mistakes."

``Bear in mind there was no evidence of a Nasdaq crash in spring of 2000 either. But given that Greenspan has been wrong at every critical juncture (emphasis mine) in his entire career, we know housing will collapse sooner or later...Actually, his position is peculiar, to say the least. He claimed there was a bubble in stocks in 1994; he embraced the productivity miracle in 1999-2000, looking for upside in the economy as shown by Fed minutes; then, after the bubble burst, claimed that bubbles could only be detected after they pop. Now he is claiming "very orderly and moderate cooling…where prices will not go down." This is, of course, reminiscent of esteemed economist Irving Fisher's statement in October 1929: "Stock prices have reached what looks like a permanently high plateau." wrote Mish Shedlock of whiskeyandgunpowder.com

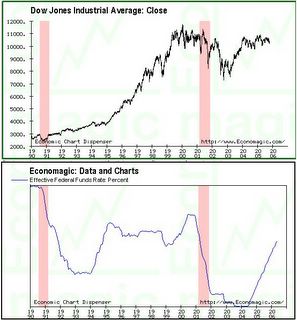

Figure 5: Economagic.com: Dow Jones and the Fed Funds Rate

According to Bloomberg’s Prashant Rao and Deborah Finestone, ``Traders this week raised bets Fed policy makers will lift lending rates to 5.25 percent on June 29, as central bank officials suggested the Fed will remain vigilant to keep inflation from accelerating. Interest-rate futures are pricing in an 84 percent chance of a quarter-point increase in the Fed's key rate this month, up from 48 percent a week ago.”

In short, while today’s market could be pricing in another rate hike, market consensus has been essentially tussling over a quarter point rate increase and a pause. This leads us to the next UNSEEN variable. Figure 5, courtesy of economagic.com, shows of the Dow Jones Industrial Averages and the Fed Funds rate since 1990. Notice that at the onset of the past two recessions (1990 and 2001) marked by the red lines, had been accompanied by severe price declines in the Dow Jones benchmark. Subsequently, in both cases, the FED Rates COLLAPSES as liquidity was injected back into the system!

This suggests that IF the FED ends up chasing its own tail, as had been in the past, continued massive declines in the key equities benchmarks could be a harbinger of an ongoing recession instead of an impending one!! Notwithstanding concomitant to notable declines in benchmark US Treasury yields. And instead of a HIKE or a PAUSE, the likelihood is for a cut at the next June FOMC meeting or in August 8th. Again this is strictly conditional on the performances of both the equities and bond markets.

As of Friday’s close at 10,891.92, the Dow Jones Industrial Average is a meager 6.6% away from its May 10th high of 11,670.19, hardly a sign of a reversal YET. All these could be an instance of Aesop’s “Boy Who Cried Wolf” though. However, until the world financial market resolves its present impasses the probabilities of risks remains greater than potential returns.

As for the Philippine equity market, which had been highly dependent on foreign money, the ongoing global rush to exit levered positions on a declining economic growth backdrop is hardly an auspicious landscape for investing. Sans foreign money and sufficient local volume to meet the onslaught of foreign outflows, our Phisix becomes vulnerable to the vagaries of political sentiment. I would suggest for you to avoid catching the proverbial “falling knife.” Stay clear until the dust settles.

No comments:

Post a Comment