``There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose."--John Maynard Keynes, The Economic Consequences of the Peace (1919)

Based on the circumstances presented by the developments in the financial markets, it would be safe to assume that the US is still a major driver of the world financial markets and economies, despite persistent chatters about “decoupling”. Ergo, we should be vigilant about the ongoing development abroad that may influence our local market.

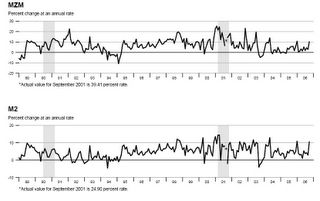

Figure 5: St. Louis Fed: Spike in the US money supply!

Recently I pointed out that despite steps by world central banks to normalize its monetary policies, buoyant equity markets, the surge in base metals and a bullrun in the bond markets signified a backstop of an easy money environment, where credit has emanated from non-traditional sources such as structured finance products and derivatives, rather than tightness.

However, in figure 5, the St. Louis Fed chart recently shows a spike in Money supply as measured by MZM or Money Zero Maturity or a measure of liquid money supply where MZM represents all money in M2 less the time deposits, plus all the money market funds and M2 or M1 (physical money and demand deposits or checking accounts) in addition to all-time related deposits, savings deposits and non-institutional money-market funds.

This shows that the US has suddenly opened its liquidity spigot amidst an economic slowdown prompted by the rapid deceleration of its real estate industry.

In the past, significant surges in liquidity could be seen for sometime prior to periods of recession (gray areas-1990 and 2001).

While today’s surge hasn’t been as strong, I suspect that the Fed could be attempting to “soft land” economy by unleashing liquidity. Could it be that the recent economic developments or the ongoing recession in the real estate sector have expanded far beyond the FED’s expectation?

Figure 6: Stockcharts.com US Dollar Breaksdown while Gold test resistance!

As possible corollary to the precipitate surge in liquidity we note that the US Dollar plunged below its recent support level and is treading at its May levels. For the week, the trade weighted index fell by 1.93%, see Figure 6. The US dollar’s decline has almost been across all currencies.

So even while the COMEX market was closed following the US Thanksgiving Holiday, gold surged in Europe to test its critical resistance at USD $640 amidst the US dollar selloff!

It looks likely that considering the present move by the Fed to considerably ease, the US dollar index could drift towards its December 2004 low at 80.42 in the coming months.

Figure 7: stockcharts.com: Phisix’s inverse correlation with the USD

In the past, the Phisix has benefited greatly from a falling US “trade weighted” Dollar as the shown in Figure 7. The rise of the US Dollar (upper pane) in 2005 has led to a consolidation of the Phisix (box), which had been compounded by local political noise. Nonetheless, as the US Dollar resumed its decline, the Phisix continued with its upside ascent.

While history is no guarantee of an exact repetition, the US dollar’s losing momentum should continue to provide support for the Phisix over the long run. Although, present developments may not be clear as today, where global equity markets appears to have priced in such on expectations as vividly manifested by the bond markets. You can see from the chart that the US dollar had been consolidating even as global equities soared! This could even result to a “sell on news”.

The asymmetric messages emitted by the different markets gives us little clue as to the near future expectations. The global stockmarkets appears to have priced in a “goldilocks or soft landing” scenario, which aside from being overbought, could have overestimated its buoyant outlook, whereas the bondmarkets appear to have consistently factored in a weaker economic landscape.

The surge in money supply could translate to a confirmation of the prospects of a weaker than expected US economic environment and may cause global equities to either pause or retrace, or shift money flows into other asset class as to fuel further the rallying bond markets or into gold.

But again, in my view, liquidity is the main driver. The fall of the US dollar translates to an easy money environment, where, should there be any corrections in the global equity markets, the impact would be of less significance, while on the other hand gold should prosper!

No comments:

Post a Comment