``Credit expansion can bring about a temporary boom. But such a fictitious prosperity must end in a general depression of trade, a slump.” Ludwig von Mises

As we have long reiterated, the main driver of the financial assets isn’t economic growth nor is it about earnings but mainly about monetary inflation and credit.

Well it appears that the prominent mainstream research company McKinsey Quarterly somewhat shares our view (see figure 3)

Figure 3 McKinsey Quarterly[1]: Watch For Credit Conditions

Tim Koller of McKinsey writes that the stock markets are not reliable economic indicators of the economy (left window), ``While the equity markets may not predict economic trends well, their depth does provide investors with liquidity, so they generally continue to function smoothly even in difficult times.”

And importantly, Mr. Koller identifies credit conditions as the chief mover of the economy and of the financial markets: ``The credit markets are where crises develop—and then filter through to the real economy and drive downturns in the equity markets. Indeed, some sort of credit crisis has driven most major downturns over the past to 40 years.” (see right window of chart)

And four common patterns of credit crisis cycles can be observed: yield curve inversion and the freezing up of the debt markets, marketplace illiquidity, bandwagon effect on the industry participants and enlarged risk appetite out of the expectations that governments will provide support (moral hazard problem).

And naturally the common symptoms of a blossoming bubble would be loose lending standards, unusually high leverage and what Mr. Koller calls as “transactions without value” or euphemism for outrageous valuations, which are rationalized as the new paradigm.

Interest Rate Manipulation Fuels Imbalances

In reality, credit conditions are hardly shaped by free markets, otherwise boom bust conditions would largely be limited in scale and in duration. Instead, as a major policy tool used by central banks, interest rates are mainly used to perpetuate boom conditions, mostly based on political considerations.

As the great Professor Ludwig von Mises described of the Business or Trade cycle fostered by central bank manipulation of interest rates[2],

``The creation of these additional fiduciary media permits them to extend credit well beyond the limit set by their own assets and by the funds entrusted to them by their clients. They intervene on the market in this case as "suppliers" of additional credit, created by themselves, and they thus produce a lowering of the rate of interest, which falls below the level at which it would have been without their intervention. The lowering of the rate of interest stimulates economic activity. Projects which would not have been thought "profitable" if the rate of interest had not been influenced by the manipulations of the banks, and which, therefore, would not have been undertaken, are nevertheless found "profitable" and can be initiated.”

In short, artificially tampering of interest rates leads to an unnecessary pile up in systemic leverage along with massive malinvestments which also drives up valuations of securities or assets to extreme levels.

Of course the market psychology here is to rationalize such actions as being warranted to the prevailing conditions, when they genuinely account for “flaws in perception” as billionaire George Soros rightly identifies[3], or a false sense of reality brought about by distorted incentives.

Yet in order to maintain these lofty levels would require constant infusion of fresh credit at far larger scale than the former.

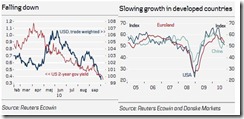

Figure 4: Economic Slowdown and Quantitative Easing (chart from Danske Bank[4])

We seem to be seeing this episode playout today with renewed clamor[5] and the growing expectations by the mainstream for the US Federal Reserve to implement Quantitative Easing 2.0 on escalating fears of a global economic relapse (see figure 4 right window) by further pushing down interest rates.

Market expectations of the realization of the Federal Reserve’s QE 2.0 have thrashed the US dollar (left window), even as US treasury yields fall!

Even the resurgence of Ireland’s debt woes have failed to bolster the US dollar relative to the Euro. The rising Euro seems to validate our earlier prediction in contrast to mainstream expectations, but appears to have overshot our target[6].

So we have now a phenomenon outside or opposite to what had occurred in 2008, where a rally in US treasuries coincided with a rally in the US dollar.

And this should be a prime example of how past performances or patterns do NOT repeat.

Unravelling Of The Business Cycle

However, artificial suppressed rates can last only for so long.

Since resources are scarce and where interest rate manipulation essentially diverts massive amount of resources and labor into unproductive speculative activities, the increased demand for resources are eventually reflected on the price levels.

The current run-up in most prices of commodities[7] seem to be manifesting symptoms of the Austrian business cycle theory at work.

Eventually the whole artifice unravels with a bubble bust or with a destruction of the currency system if central banks persist to inflate.

Again Professor von Mises,

``This upward movement could not, however, continue indefinitely. The material means of production and the labor available have not increased; all that has increased is the quantity of the fiduciary media which can play the same role as money in the circulation of goods. The means of production and labor which have been diverted to the new enterprises have had to be taken away from other enterprises. Society is not sufficiently rich to permit the creation of new enterprises without taking anything away from other enterprises. As long as the expansion of credit is continued this will not be noticed, but this extension cannot be pushed indefinitely. For if an attempt were made to prevent the sudden halt of the upward movement (and the collapse of prices which would result) by creating more and more credit, a continuous and even more rapid increase of prices would result. But the inflation and the boom can continue smoothly only as long as the public thinks that the upward movement of prices will stop in the near future. As soon as public opinion becomes aware that there is no reason to expect an end to the inflation, and that prices will continue to rise, panic sets in. No one wants to keep his money, because its possession implies greater and greater losses from one day to the next; everyone rushes to exchange money for goods, people buy things they have no considerable use for without even considering the price, just in order to get rid of the money....

``If, on the contrary, the banks decided to halt the expansion of credit in time to prevent the collapse of the currency and if a brake is thus put on the boom, it will quickly be seen that the false impression of "profitability" created by the credit expansion has led to unjustified investments. Many enterprises or business endeavors which had been launched thanks to the artificial lowering of the interest rate, and which had been sustained thanks to the equally artificial increase of prices, no longer appear profitable. Some enterprises cut back their scale of operation, others close down or fail. Prices collapse; crisis and depression follow the boom. The crisis and the ensuing period of depression are the culmination of the period of unjustified investment brought about by the extension of credit.

Therefore, it has been long contention of mine that the interest rates and market psychology working as a feedback loop mechanism ultimately sorts out the phases of the business cycle.

[1] Koller, Tim A better way to anticipate downturns, McKinsey Quarterly

[2] Mises, Ludwig von The Austrian Theory of the Trade Cycle

[3] Soros George, The Alchemy of Finance p.58

[4] Danske Bank, Currency Debate Heats Up, October 8, 2010

[5] Los Angeles Times Blog More Fed help for economy now just a matter of time October 8, 2010

[6] See Buy The Peso And The Phisix On Prospects Of A Euro Rally, June 14, 2010

[7] See Commodity Inflation, October 8, 2010

No comments:

Post a Comment