The path towards the deepening of integration of ASEAN markets and economies has moved one step forward.

ASEAN has launched a website to promote the integration of ASEAN stock markets.

Reports the yahoo,

The www.aseanexchanges.org website launch was celebrated on the sidelines of the 15th ASEAN Finance Ministers Meeting at the Laguna Resort and was attended by the chairman of the meeting -- Indonesian Finance Minister Agus Martowardojo -- and seven chief executive officers (CEOs) of the member stock exchanges.

The ASEAN Exchanges website features a product called "ASEAN Stars", which provides 210 blue chips stocks ranked by "investability" in terms of market capitalization and liquidity and made up of a selection of 30 stocks from each exchange.

"The main focus will be ASEAN's key assets -- the strength and diversity of ASEAN's companies, some of which are the largest and most dynamic companies in the world, including leaders in the banking, finance, telecommunications, commodities and automotive industries," Indonesia Stock Exchange president director Ito Warsito said at the event.

The 30 Indonesian stocks included in the ASEAN Stars come from various sectors, including Astra International (ASII), Adaro Energy (ADRO) Indofood Sukses Makmur (INDF) and state-owned firms such as Bank Mandiri (BMRI), Jasa Marga (JSMR) and Telekomunikasi Indonesia (TLKM).

Shares of firms from other countries promoted through the ASEAN Stars include Malaysia's CIMB Group and Petronas, as well as Singapore's SingTel and Wilmar International.

"Each of these 30 stocks will represent the favor of a particular exchange. Review will be done on a six-month basis in terms of liquidity, size and market capitalization," Gan said, adding that Thomson Reuters, which has thousands of terminals worldwide, would provide market data for the website.

ASEAN had a combined market capitalization of about $1.8 trillion as of January 2011, the eighth highest in the world, with total listed firms numbering over 3,000 companies and a market of more than 538 million people.

This how the nascent website looks...

If the goal is to balance trade and investment flows by reducing dependence on the US—this incorporates the vendor cycling programs of buying US sovereign securities and the implied importation of US monetary policies—then the development of ASEAN financial markets have much more much much room for progress.

The share of some of the major ASEAN members in % to the world stock market capitalization [chart from safehaven.com] reveals of the lack of depth, sophistication and the penetration levels by the local populace in the domestic equity markets which has resulted to the inadequate channeling of savings to investments.

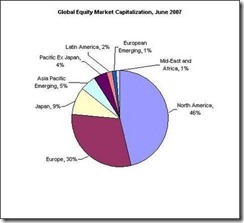

This can also be seen from the region’s share of global market capitalization (2007 chart from Leaps) where ASEAN’s role remain insignificant.

Yet ASEAN has huge foreign exchange reserves which it can use for its development.

(chart from Donghyun Park and Gemma Esther B. Estrada Asian Development Bank Foreign exchange reserve accumulation in the ASEAN-4: challenges, opportunities, and policy options)

Bottom line: This represents more indications that ASEAN (and Asia) have increasingly been adhering to free trade principles which should translate to more progress down the road.

![clip_image002[4] clip_image002[4]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhEl-ZHGXEwOoFzkugKJ1BaR6lwl_rZ6ls3ypjIAPKrhR6ArUndeswjPCQ0yTnWJYGaJ1s_OjymlVfObm8agwcNB1LBKXw23zspjKCVePB6OJrjkZG89WeFHjhRtFoW8YbX-Dxq/?imgmax=800)

No comments:

Post a Comment