Last night the US equity markets made a substantial move

Here’s how the mainstream sees it. This from Bloomberg, (bold emphasis)

U.S. stocks rallied, driving the Standard & Poor’s 500 Index up from the cheapest valuations since 2009, as weaker-than-estimated economic data reinforced optimism the Federal Reserve will act to spur growth.

Monsanto Co. (MON), Chevron Corp. (CVX) and Microsoft Corp. (MSFT) added at least 3 percent, pacing gains in companies most-tied to the economy. The Morgan Stanley Cyclical Index rose 2.9 percent, breaking a five-day losing streak. Sprint Nextel Corp. (S) jumped 10 percent, the most since May 2010, after the Wall Street Journal said it will start selling Apple Inc.’s iPhone. Financial shares reversed losses after the Federal Deposit Insurance Corp.’s list of “problem” banks shrank for the first time since 2006.

I have talked about this earlier here

This only shows that current behavior of stock markets

-has hardly been driven by earnings but by politics,

-have been artificially boosted

-reacts like Pavlov’s Dogs, and

-importantly like addicts, has totally become dependent on steroids.

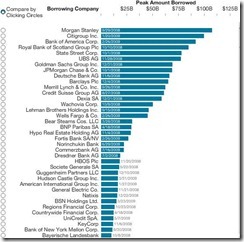

Never mind if recent reports say that stimulus money ends up going to the coffers of the rent-seekers, as graph of the bailout money by the US Federal Reserve in 2008 shows

The important thing is to have the Fed print money to pacify Wall Street insiders, who constitute part of the cartelized incumbent political system.

Profit from folly.

No comments:

Post a Comment