From Bloomberg,

Federal Reserve Chairman Ben S. Bernanke spent six years pushing for an inflation goal. Now that he has it, some investors are betting he’ll breach the 2 percent target in the short run to lower unemployment.

The Fed chairman told lawmakers last week that an increase in energy costs will boost inflation “temporarily while reducing consumers’ purchasing power.” He also said the central bank will adopt a “balanced approach” as it pursues its twin goals of price stability and full employment, which it defines as a jobless rate of between 5.2 percent and 6 percent.

Things that team Bernanke could be working on with the 'inflation goal': inflating away debt, boosting asset prices to give strength to balance sheets of the embattled banking and financial industry, the money illusion or the lowering real wages by inflation and currency devaluation.

I don’t think inflation targeting has been about competitive devaluation, as central bankers have collaborated in conducting current monetary policies. Neither has these been the money illusion.

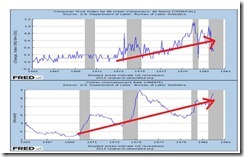

I am sure Mr. Bernanke is aware that elevated inflation (upper window) and high unemployment (lower window) coexisted in the 1970s, known as the stagflation era. In short, Mr. Bernanke understands the risk of inflation, i.e. inflation does not solve the unemployment problem. In reality, in contrast to mainstream thinking, inflation even worsens economic performances by distorting economic calculation of entrepreneurs and businesses which impairs the market's functionality through the division of labor.

So by process of elimination this leads us to Bernanke’s primary goal of saving the banking system and the welfare state.

Yet Mr. Bernanke’s inflation goal is like playing with fire. Since the world's monetary system operates in a de facto US dollar standard, Bernanke's playing with fire translates to the risk that we all get burned.

No comments:

Post a Comment