The glazier's gain of business, in short, is merely the tailor's loss of business. No new "employment" has been added. The people in the crowd were thinking only of two parties to the transaction, the baker and the glazier. They had forgotten the potential third party involved, the tailor. They forgot him precisely because he will not now enter the scene. They will see the new window in the next day or two. They will never see the extra suit, precisely because it will never be made. They see only what is immediately visible to the eye.-Henry Hazlitt, The Broken Window, Economics in One Lesson

Next week’s front running issue will likely be the double whammy of the earthquake-tsunami that struck Japan.

There might be a third factor—risks of a nuclear meltdown[1] as consequence to the above.

Capital Accumulation As Life Preserver

The largest of the massive earthquakes had been one for the record books.

Figure 3: Economist: World Largest Earthquake

According to the Economist[2],

ON Friday March 11th a huge earthquake of magnitude 8.9 struck off the north-east coast of Japan's main island, triggering a tsunami seven metres tall. The earthquake is thought to be the largest ever to hit Japan, and the fifth-largest since decent records began in 1900. According to the US Geological Survey, 15 of the 16 largest earthquakes occurred in and around the Pacific "Ring of Fire". Fortunately, many of the biggest, known as "megathrust" earthquakes, as one tectonic plate is forced under another, have occurred in sparsely populated areas.

While it may be true that megathrusters have occurred in sparse areas, the terrifying aspect is when the body counts begin to pile up. And the issue isn’t about the magnitudes of earthquakes but about how wealth from capital accumulation[3] has prepared society for such contingencies.

The 2010 earthquake in Haiti which only had a 7.0 magnitude took an estimated 92,000 to 220,000 lives[4]. However, the Philippines lost about 1,621 lives when a 7.8 tremblor struck in Northern Luzon on July 16th 1990[5]. Strict building codes can’t be enforced if there is no wealth to fund it. That’s basic.

Earthquakes compounded by tsunamis increases the casualty rate. The 2004 Indian Ocean earthquake and tsunami took some estimated 227,000 lives across 15 countries and is considered as one of the ten worst earthquakes in recorded history[6]. Indonesians bore the brunt of the death toll (130,736) or about 70% of fatalities.

Outside the escalation of a nuclear radiation disaster, I am hopeful that Japan’s fatality will be fraction of Haiti and or the 2004 Indian Ocean earthquake and tsunami incident.

Framing The Impact of the Earthquake-Tsunami

Some say that the Japan tragedy is market bearish. Others see this as market bullish.

My position is that while the initial reaction could be negative, this woeful episode would be a neutral or a nonevent over the medium to the long term.

Basically it’s all about the issue of risk and uncertainty.

While it is true that such large scale devastation would likely impact the insurance industry the most, as insurance companies would have to indemnify insured claims, looking solely at the damage-indemnity framework wouldn’t be sufficient or won’t reveal market dynamics in action.

My presupposition is that these companies have factored in the Japan’s geographic risk profile, and naturally, the calamity risk that Japan is faced with, as Japan is situated in the Pacific ring of fire[7] where 10% of the most active volcanoes are.

In other words, most of them would have assumed on the risk-reward balance of actualizing insurance contracts. Otherwise failure to do so means the risk of bankruptcy.

And if there are any clues towards Japan’s earthquake risks, many geologists have spent so much time and money to predict the “big one” coming but apparently failed to do so[8]. The point is the Japanese or the insurers are most likely well aware of such risks.

Nor do I agree with the suggestion that such disaster would trigger a fiscal crisis in Japan. All Japan would need is to open its doors to rehabilation and reconstruction to domestic and international private investors, as well as, to liberalize labor.

The assumption that reconstruction should be undertaken solely by Japan’s government represents as analytical myopia.

What we should also look at instead is if Japan or Japan’s financial companies would repatriate funds from abroad, and how this might put pressure on the US dollar, as well as, US Treasuries.

To add, I think Japan will, from this event, be forced to import labor or liberalize migration given its declining population due to rapidly falling fertility rates[9].

Figure 4: Bespoke Invest[10]: Framing The Kobe Earthquake

Many charts will frame peoples thoughts as Figure 4. By looking at the Kobe incident also known as the Great Hanshin earthquake[11] without ascertaining the backround would possibly mislead people into thinking that the past performance equals the future.

The Nikkei has already been in a downtrend following the 1990 bubble bust. Thus, the Kobe Earthquake only became an aggravating circumstance rather than the key driver.

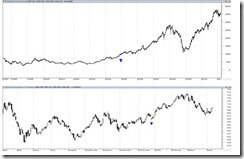

Figure 5: Jakarta Composite Index and Thailand’s SET Post 2004 Tsunami

To balance the perspective, the 2004 Indian Ocean earthquake hardly put a dent on the Indonesia’s (upper window) or even Thailand’s (lower window) stock markets, see figure 5. While both did suffer from a very short term decline they eventually proceeded higher.

Also economic data proved that the Kobe earthquake had been much less of an impact.

Figure 6: Kobe Earthquake had limited impact (Danske Bank)

According to Danske Bank[12]

From a macroeconomic point of view, the overall impact from the Kobe quake in January 1995 was limited. Industrial production dipped in February in the wake of the quake not least because of Kobe’s importance as a distribution centre, but recovered in the following two months as reconstruction started. It is harder to see any visible impact on GDP growth in 1995, but on balance we believe the impact will be positive because of the positive impact from reconstruction. Hence, the quake today is unlikely to derail the current recovery in Japan. If anything it will be a short-term boost to growth.

As you can see, when viewed from many comparisons, and from other angles, the source of “pessimism” fades.

Critical Analysis Matters

Eventually the issue boils down to uncertainty versus risk.

Event uncertainty, unless further worsened by more unseen untoward events (such as the risk of nuclear meltdown), will tend to get discounted. People learn to weigh in on the risk-reward balance as they see through the events unfold.

The diminishing returns of information or marginal value of information as I previously wrote[13],

Because the emergence of such unforeseen events are considered as uncertainty (immeasurable risk, and not possible to calculate), the markets work to reappraise of ‘uncertainty’s’ influence or impact, which gradually digests on them. So the influence of uncertainty depends mostly on the scale and the time value of influence...

Once the markets learned of and adjusted to such uncertainty, or to the new information, and subsequently established its cost-benefit expectations around it, uncertainty gets to be transformed into risks (measurable potential losses) via discounting. Discounting, thus, signifies as the diminishing returns of information or the marginal value theorem applied to information.”

And this is why critical analysis matters alot.

Broken Window Fallacy and Conclusion

On the other hand, I can’t see how such reconstruction can be positive overall.

Numerous people lost their precious lives which also mean lost human capital. Damaged property also equates to capital losses. And such capital losses are NOT captured by statistics on nominal GDP.

Capital meant for increasing productivity will now have to be redirected towards replacement. And replacement adds no value, and that’s why there’s no growth in the overall.

But what I wouldn’t deny is that there will be some sectors or entities who will profit from these. I think Filipino labourers will see an opportunity to grab. And yes, statistics could register a short term boost. But again statistics don’t capture the human experience.

On balance, the negative impact of disasters on the financial markets tends to be short term as effects of disasters get to be discounted overtime.

The underlying market trends will likely be determined by the general market direction overtime and not from a lasting impact of Japan’s earthquake-tsunami.

[1] See Aftermath of Japan’s Earthquake: Risk of A Nuclear Reactor Meltdown, March 12, 2011

[2] Economist Daily Charts, Terrifying tremors, March 11, 2011

[3] See Economic Freedom And Natural Disasters: Haiti's Tragic Earthquake, January 15, 2010

[4] Wikipedia.org 2010 Haiti earthquake

[5] Wikipedia.org 1990 Luzon earthquake

[6] Wikipedia.org 2004 Indian Ocean earthquake and tsunami death toll and casualties

[7] Wikipedia.org Pacific Ring of Fire Japan

[8] See Science Models Fail To Predict Japan’s Earthquake, March 12, 2011

[9] Japan Times, Population decline worsening January 15, 2010

[10] Bespoke Invest, Japan's Stock Market Post Kobe Earthquake in 1995, March 11, 2011

[11] Wikipedia.org Great Hanshin earthquake

[12] Danske Bank, Japan: Impact from quake should prove limited, March 11, 2011

[13] See “I Told You So!” Moment: Being Right In Gold and Disproving False Causations, March 6, 2011

No comments:

Post a Comment