When tragic events hit, some people have the habit to resort to sensationalist babble.

They read one bad event as a trigger to even more untoward events.

Such thinking represents more of personal bias rather than a reflection of actual events.

For instance, some have argued that Japan faces a risk of a fiscal crisis following today’s catastrophic earthquake-tsunami.

While there may be some grain of truth to this, this view essentially ignores the option of having markets forces help in the recovery process and the role and the actions of Bank of Japan.

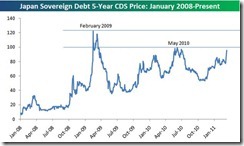

So far the markets have priced some concerns over Japan’s liabilities.

According to Bespoke Invest, (graphs and tables from Bespoke too)

At the moment, it costs $95 per year to insure $10,000 worth of Japanese sovereign debt for five years. As shown in the table of CDS prices below, Japan remains at the low end of default risk compared to other countries around the globe. With the resilient country fighting to get back on track, investors don't appear to be worried about Japan having financial problems.

Bottom line: There are concerns over Japan’s debt conditions alright, but this seems far far far away from real risks of default yet.

In other words, despite the uptick in Japan’s default risk, the Philippines still has higher CDS premium or that the Philippines is seen as more susceptible to a default than Japan.

I am not saying that Japan isn’t vulnerable. I am saying that concerns up to this moment represents more of exaggeration than what is being reflected on the marketplace.

Let me add that what appears to be hounding the markets are the uncertainty of the possible escalation of the meltdown of Japan’s nuclear reactors. Once news reveal of the containment of the problem, you can expect these string of bearish news to gradually get discounted.

No comments:

Post a Comment