In 2014 I wrote that Abenomics will hardly bring about a recovery:

It’s a wonder how the Japanese economy can function normally when the government destabilizes money and consequently the pricing system, and equally undermines the economic calculation or the business climate with massive interventions such as 60% increase in sales tax from 5-8% (yes the government plans to double this by the end of the year to 10%), and never ending fiscal stimulus which again will extrapolate to higher taxes.The mainstream has all been desperately scrambling to look for “green shoots” via statistics. They fail to realize that by obstructing the business and household outlook via manifold and widespread price manipulations, this will only lead to not to real growth but to greater uncertainty which translates to high volatility and bigger risks for a Black Swan event.

There's been no black swan yet, but greater uncertainty has indeed been unfolding.

Despite cumulative monetary and fiscal stimulus, Japan's economy as measured by their statistical GDP contracted for two successive quarters once again.

This means Japan has fallen into a recession

From Bloomberg: (bold added)

Japan’s economy contracted in the third quarter on sluggish business investment, confirming what many economists had predicted: The nation fell into its second recession since Prime Minister Shinzo Abe took office in December 2012. Gross domestic product declined an annualized 0.8 percent in the three months ended Sept. 30, following a revised 0.7 drop in the second quarter, the Cabinet Office said Monday in Tokyo. Economists had estimated a 0.2 percent decline for the third quarter.Weakness in business investment and shrinking inventories contributed to the contraction amid concerns over slower growth in China and the global economy that prompted Japanese companies to hold back on spending and production. While growth is expected to pick up in the current quarter, the GDP report could put pressure on Abe and Bank of Japan Governor Haruhiko Kuroda to boost fiscal and monetary stimulus. The BOJ holds a policy meeting later this week...Businesses in the third quarter reduced investment, in a rebuff to Abe’s call for Japanese companies to put more of their record cash holdings into capital spending. From the previous quarter, business investment fell 1.3 percent in the July-September period, following a revised 1.2 percent contraction, according to the report.

A milestone FIFTH recession in 8 years! And second recession in PM Shinzo Abe's tenure! What a legacy!

Zero Hedge provides the 'Quintuple Dip' chart...

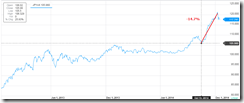

But recessions are really good news for stocks!

That's because the BoJ will be expected to pour more of the same stuff that has plagued its economy!

.png)

.png)

.png)

.png)

.png)

.png)

.png)