In this issue:

Phisix: Have You Been Aware of This Week’s Peso Meltdown?

-The Numerous Impossible Things before Breakfast

-Philippine Peso Crushed as Ms. Yellen Spoke of Interest Rate Increase

-The Peso-Phisix Correlation

-More “Marking the Close” at the PSE

-The Peso as Secondary Source of Stagflation

-The BSP Indicates Tightening, Really?

-Are the Risks to Philippine BoP coming from the Capital Account?

Phisix: Have You Been Aware of This Week’s Peso Meltdown?

The Numerous Impossible Things before Breakfast

Alice laughed. "There's no use trying," she said: "one can't believe impossible things.""I daresay you haven't had much practice," said the Queen. "When I was your age, I always did it for half-an-hour a day. Why, sometimes I've believed as many as six impossible things before breakfast."[1]

Much more than the ‘six impossible things’ Lewis Carroll’s White Queen’s advice to Alice, a vast majority of global financial industry—including the so-called economic sphere whose preaching has underpinned the wisdom of populist politics—have entrenched their beliefs in a constellation of the impossible things.

Fantastic examples…

Savings is BAD, spending is GOOD…

Currency (theft) devaluation EQUALS economic growth…

Economic repression GENERATES economic growth…

Wealth transfer channeled through policy induced debt financed asset bubbles PRODUCES economic growth…

Asset bubbles have NEUTRAL effects in the price levels of the general economy (particularly, consumer and input prices)…

Asset Bubbles WILL last forever…

Welfarism ENCOURAGES productivity…

Wars have MORE benefits than costs…

Nationalism (and nationalism based spending) is BEYOND the scope of economics and economic reasoning…

Technocracy backed political administration KNOWS best…

The political economy of 1 MINUS 1 EQUALS TWO…

Corruption is a function of PERSONAL ethical depravity (rather than from the politics of resource distribution that enables and facilitates such unscrupulous behaviors via arbitrary, immoral, repressive and uneconomic legislation and social policies)

Tea leaf reading from statistics IS economic analysis…

Momentum-Yield chasing REDOUNDS to investment…

And stratospheric stock market valuations as reflected by prices have reached “PERMANENTLY high plateau”

I have repeatedly[2] been writing about how outrageously mispriced Philippine stocks (and even bonds[3] via the convergence trade) have been at current levels; well, based on the contrast principle/effect, 30-60 PERs of Philippine stocks seem a speck or ‘dirt cheap’ to the even more outlandish valuations of popular tech stocks in the US.

As you can see on the left pane, the financial ratios data from Fairfax Holdings as of March 7, 2014[4] reveals that Linkedin, Netflix and Facebook has an astronomical PER of 887, 186 and 116 respectively!!! Incredible.

Given the fresh record for key benchmarks as the Dow Industrials, S&P 500 and Russell 2000 or the near record levels of the NASDAQ), it is likely that the above mentioned ratios could be much higher.

And such seems even peanuts relative to the other technology based companies which continue to post losses yet whose market values have been priced to perfection! The still capital burning companies of Twitter, Yelp, Service Now and Netsuite has price to sales ratios of a jaw dropping 38, 27, 22 and 21!!!

And as illustrated on the right pane, where “equities no longer follow earnings”[5] or stated differently, central bank policies have been intensifying the yield chasing momentum by pushing participants out on the risk curve through the bidding up of the markets via PE multiple expansion rather than by earnings growth. Such dynamics reverberates with actions in the Philippine Stock Exchange or elsewhere.

And this comes as US IPOs from companies with negative earnings (similar to the above) has been gushing into the markets to almost reach February 2000 highs[6]!

The legendary investor Benjamin Graham, in one of his recorded lectures, admonished on the risks from the herding effect [7] (bold mine)

Investors do not make mistakes, or bad mistakes, in buying good stocks at fair prices. They make their serious mistakes by buying poor stocks, particularly the ones that are pushed for various reasons. And sometimes — in fact, very frequently — they make mistakes by buying good stocks in the upper reaches of bull markets.

And such excessive speculation comes as record issuance of junk bonds has nearly doubled from $1 trillion in March 2009 to the recent $1.97 trillion that has prompted bond guru Jeffrey Gundlach to warn that “They’ve squeezed all the toothpaste out of the tube,” in a Bloomberg interview such that “There is interest-rate risk that’s just being masked by fund flows holding up the prices of junk bonds.”[8]

In Ms. Janet Yellen’s debut as US Federal Reserve chairwoman presiding over the Federal Open Market Committee, she and the FOMC made good the third round of “taper” last March 19th which brought down the Fed’s asset buying program by another $10 billion to $55 billion[9].

The result has been to materially push up US Treasury yields across the curve. However the spike has been pronounced on the shorter end of the curve, particularly the 2 year (left) and the 5 year (right) notes (stockcharts.com).

In addition, the spread between the longer end of the curve particularly the 10 year notes and 30 year bonds has markedly narrowed[10] which has been indicative that markets are now pricing in higher interest rates.

So we seem on track towards ‘Wile E. Coyote moment’ via the deepening convergence of 3 contravening forces: soaring asset prices (financed by credit) and sustained increase in record debt levels in the face of rising rates (or a tightening environment).

The Wile E. Coyote moment will extrapolate to the disorderly unmasking of most of the impossible things the mainstream has come to firmly believe in. Psychological escapism which has evolved out of asset bubbles will see a rude awakening pretty much soon.

Philippine Peso Crushed as Ms. Yellen Spoke of Interest Rate Increase

Ms. Yellen didn’t just reduce the Fed’s quantitative easing programs, she uttered something considered a taboo in today’s contemporary finance: raising interest rates.

Ms Yellen’s signaling, either deliberate or may have been Freudian slip, has rattled most of Asian-ASEAN markets[11]. Except for Indonesia, the bulk of the damage has been endured by the bond and currency markets.

Incidentally, Indonesia’s equity bellwether, the JCI, has more than eviscerated the previous Friday’s 3.23% jump. This week the JCI sank 3.66% and chipped of 89% of last week’s 4.11% gains.

This marks another evidence of extreme volatility in both directions.

And surprise, surprise, surprise the Aldous Huxley (Facts do not cease to exist because they are ignored) syndrome strikes again!

Little of mainstream media has covered how the Philippine peso has been crushed last week! And the little attention paid to the domestic currency only dealt with facts with hardly any rationalization from their favored experts.

The implication is that the falling peso has little or no bearing on the Philippine economy or that such development has not been aligned with the views of the politically correct theme of asset bubble worshipping.

Except for India’s rupee, Asian currencies fell hard against the US dollar.

But the most devastated has been the Philippine peso which relative to the US dollar crashed by 1.42%! The Philippine peso even performed worse than the collapsing Chinese currency the yuan, where the latter tanked by 1.23% over the week.

As a side note, Chinese stocks rocketed this week by 2.16%. Yet each time news of a default or coming default comes out, the Chinese government counters such negativity or adverse events with promises of stimulus or of reinvented means of access to new credit—this time “preferred shares”[12]. Chinese stock markets has so far ignored what seems as tremors occurring in increasing frequency and intensity and focus on such promises.

The Chinese government’s operating standard to resolve her nation’s debt problem—promise more debt and debt financed spending. More impossible things before breakfast

Back to the Peso.

Didn’t the credit ratings agency the Moody’s declared last week that the Philippines won’t be hurt by a sudden stop? So what happened to the supposed strength of the Philippines? Why did the peso hemorrhage?

And it has not just been the peso, yields of 10 Philippine sovereign bonds spiked by 39 bps last Thursday to 4.571% from last week’s 4.18%. I would expect a much lesser reaction to Philippines treasury markets since banks and the government holds a tight grip of the said fixed income market.

As of the 4Q13 according to ADB’s AsianBondsOnline[13], the largest grouping of investors in government securities comprised banks and financial institutions with 31.6% of the total. Contractual savings institutions—including the Social Security System (SSS), Government Service Insurance System (GSIS), Pag-ibig, and life insurance companies—and tax-exempt institutions—such as trusts and other tax-exempt entities—accounted for 24.4% or the second largest holders. The share of funds being managed by BTr, which includes the Bond Sinking Fund, ranks third at 18.9%. Custodians (BSP accredited agencies mostly banks) hold a 13.2% share while other government entities and other investors, which include individuals and private corporations had 11.8% share.

Essentially the local currency denominated sovereign bonds market has largely been a duopoly of Philippine banks and the Philippine government. The stranglehold by both parties backed by the ‘boom’, e.g. trifecta of credit rating upgrades, justified the further lowering down the Philippine yield spread with the US counterparts to a record 78-80 bps last November. Such convergence trade has served as this administration’s trade secret that has pillared much of the so-called this ‘time is different’ economic boom that really has been bank credit inflation driven statistical economic growth. There is an ocean of difference between statistical and real economic growth.

Yet mainstream growth has been limited to a minority segment of the society, specifically to those with access to credit in the formal banking system. Yet the inverse side of such growth has been that credit risks have become increasingly concentrated. But because of the lack of exposure of the general populace to the formal sector financing, the growth in credit risks has largely been unnoticed by mainstream pundits whom has largely been focused on statistical reading.

Through public subsidies of government liabilities via negative real rates, zero bound rates benefited the government foremost. This is known as the financial repression. Second, zero bound rates engendered a massive credit driven boom in the bubble sectors, particularly real estate, construction, trade, hotel and financial intermediation. Such credit fueled boom provided the government with inflated tax revenues. Thus inflated revenues from a bubble boom and from low refinancing costs through public subsidies via negative real rates have been feeding on the insatiable expansion by the Philippine government as evidenced by rate of spending growth and her continued assault on the informal economy.[14]

On the other hand, the banks, the government’s key partner in the domestic sovereign bond market, have been the primary avenue for financing the boom, and have thus been the secondary beneficiaries. The banks’ implicit role has been to finance government expenditures through credit issuance to mostly bubble industries as well to provide financing access to the government and to government related institutions. Banks also operate as sales agencies for government securities and as collection agencies for taxes, and finally as strategic partner in control of the domestic LCY sovereign bond markets. So one should expect that should any substantial problems befall on the ‘too-big-to-fail’ version of domestic banks, such will translate to a prospective bailout.

This brings us back to last week’s surge in bond yields.

Given the tight relationship between banks and the government as explained above, the spike in bond yields, or inversely bond prices fall, should imply of a ‘crack’ in the consortium’s tight control of the supposed ‘risk free’ version of the fixed income markets. One or some of the parties could be experiencing pressures from the recent tightening for them to allow for a yield spike.

Should bond yields continue to ascend then such unseen or undeclared strains may likely signify escalation of tensions.

The Philippine central bank, the Bangko Sentral ng Pilipinas (BSP) even appeared to have attempted to stem the peso’s dive through information management—through the release of two positive developments last Friday—at the heat of the meltdown. Such involves the improvement in external debt down to $58.5 billion[15] and fourth quarter’s $1.8 billion current account surplus[16]. Yet the peso seems to have shrugged off the good news to close the day’s session near the USD-Peso peak or inversely near lows for the peso.

So who has been selling the peso and buying the US dollar? And why?

The Peso-Phisix Correlation

The mainstream hardly seems to realize that since Abenomics and Bernanke’s June Taper, the USD-Peso and the Philippine Phisix has been demonstrating an increasingly tighter correlationship.

As I have been saying today’s operating environment has been vastly different from the heydays of 2013. Then the Phisix boom has been in confluence with zero bound rates, low statistical consumer price inflation figures and a firming Peso. In essence, the Phisix sailed in the tailwind of a Risk ON easy money landscape. Today, tailwind has morphed into headwind—falling peso, rising yields and even higher statistical price inflation. Yet stock market punters have been desperately forcing to reinstate or resurrect the past.

The Abenomics-Bernanke Taper appears to have reconfigured the domestic marketplace. Notice that each time the USD-Peso soared in the last 3 occasions (green lines), namely May-July, July-September and October-February, the 3 accounted rallies in the Phisix had been aborted (red curved lines).

Also notice that this week’s sharp ascent, which seemed like a fat-tailed move either indicated a further upside swing as in June (see left violet rectangle) or a top as in September (mid violet rectangle).

To be fair to Ms. Yellen, her interest rate signaling only functioned as aggravating circumstance to a prior weakening peso. The 2-day .98% loss equates to about 70% of this week’s drubbing.

I believe that the February 3rd closing high of 45.41 will serve as the critical resistance level for the USD-PHP. This will signify as only 1,200 pips (percentage in points—equivalent to 1/100 of a cent). Given the lack of liquidity and thus the gaping bid-ask spread in the USD-Php forex trade, 1,200 pips signifies just a stone throw’s distance that may easily be breached.

More “Marking the Close” at the PSE

Let me add that Phisix participants have been highly complacent. Proof of this has been that despite the weakening peso, punters continue to frantically support an increasingly fragile risk-reward environment characterized by a stunningly overvalued and outrageously overpriced securities.

The Phisix was supposed to end at a positive note this week, but another “marking the close” event struck on a curiously none end of the month Friday session.

Opposite to the February 28th session which had an intraday upside spike, the Phisix collapsed by about 1% from the pre-close to the closing bell (leftmost chart from technistock.net) where the difference spelled the 1.22% retracement of the day and the -.81% for the week. The amazing intraday dive came with a heavy volume similar to February 28th of 2013. You can see the February 28th intraday charts of 2013 and 2014 in the link; this I tackled early March[17].

Eight companies with the exception of EDC, comes from three sectors (see middle table from the PSE), particularly holding (-1.72%), services (-1.44%) and financials (-1.06%) that spurred the fantastic 5 minute interval dump. The eight companies that suffered a last minute reversal of sentiment as measured by the difference between the last pre-close trade and closing prices: JG Summit (-5.34%), GT Capital Holdings (-3.4%), Energy Development Corporation (-2.6%), BDO Unibank (-2%), Globe Telecoms (-1.9%), Bank of the Philippine Islands (-1.79%), PLDT (-1.6%) and SM Investments (-1.4%).

Interestingly JG Summit which had been the hardest hit (rightmost chart from COL Financial) was even up by .1% at the last pre-close trade, thus the closing variance of -5.24%.

Of the 8 companies, 2 posted foreign buying and 6 foreign selling. And there is no clear indication if such actions had been in response to the peso or the spike in bond yields.

Last minute spikes and dumps appear to have increased in frequency.

Last October[18], the Philippine Stock Exchange’s publicly declared that the stated purpose of extending the pre-close period has been to “allow the trading participants to assess and counter a sharp price move at the close”. This seems to have only amplified the opposite. Such last minute spike or dumps are manifestations or symptoms of the severe lack of depth and liquidity by the domestic stock market. And by adapting programs intended to “align with practices in the region” appears gravely misguided because the relative operating environment which the PSE uses as basis for her actions have been almost entirely different. Thus even from the perspective of private practice—the PSE is a monopoly—we see the law of unintended consequence in action.

Like most of how the political environment operates here, actions have been focused at the superficial rather than from the structural.

The Peso as Secondary Source of Stagflation

Back to the Peso.

I believe that the Philippine peso will continue to significantly weaken overtime primarily based on the maturation of the credit boom which presently is being vented via the shocking 38.6% M3 annualized January 2014 growth[19]. As I noted last February, the peso has now become a victim of BSP’s credit boom which has led to a deepening stagflationary environment.

And such stagflationary environment will be further compounded by the slumping peso.

38.6% M3 growth accounts for about 68% of claims on other financial corporations and non-financial private sector. Those are past economic actions of which the effects in the relative price levels are being felt today in asymmetric time intervals and in relative sectors attached to the real estate industry and beyond.

My projections show that the property sector will be raising a very conservative Php 250 billion in capex for the 2014, this means another wave of mostly credit fuelled spending spree. And there are other industries that will likely have real estate requirements too such as manufacturing or services. So demand from other industries will add to the price pressure on property prices.

Think of it, land is not produced or generated therefore are fixed asset inventories. Thus money creation relative to land means higher land prices. The race to bid up on acquiring land inventories should further intensify the property price increases. In essence there will be too much money chasing on a limited inventory of property for development.

But developers won’t just be land banking, they will be putting up edifices. So they will be contracting or sub-contracting construction companies who will use steel, cement, nuts and bolts, paints, construction equipment, transportation and etc… in the erection of these buildings.

Thus the competition to bid up property would extrapolate to added demand for construction materials, transportation, equipment, machinery and others. The items in demand may be sourced entirely from local producers or from external agents or from foreign producers or from a combination of both. Prices will, thus, act as signal to coordinate the use of resources.

Even if sourced locally, if the demand surpasses available stocks then prices will rise. And rising domestic prices will likely push domestic companies to seek relatively affordable alternative sources from abroad

But the latter window will now be closing. The falling peso should mean higher priced imports. And the slumping peso will even impact more supplies with limited competition or availability from domestic sources. Eventually high prices will increase project costing of companies and thus reduce demand or expansion

Philippine external trade data suggest that perhaps a significant portion of the supplies of the domestic property and ancillary industries comes from imports.

Philippine import data as of December 2013[20] show that Mineral Fuels, Lubricants and Related Materials ranks second only to Electronic Products which has been the largest in terms of Philippine import bill. But the difference in their share of the import pie has been only marginal: 22.4% for the former and 22.6% for the latter. Transport Equipment placed third with 12.5 percent% share. Industrial Machinery and Equipment, ranks fourth with 4.5 % while Iron and Steel has been part of the top ten.

This also implies that the plunging peso will likely impact the non-bubble manufacturing sector and even perhaps exports of electronic products.

So relative price inflation will come from two directions.

The main source will be from the credit driven spending activities of the property and property related bubble sectors. The second source will emanate from import prices.

Given that the Philippines has been relatively significantly less productive economy (as revealed by the huge informal economy and the lack of depth in both formal banking and capital markets) the average populace are likely to be more prone or highly sensitive to price inflation compared to her much wealthier neighbors.

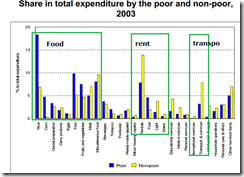

Price increases in energy, food, rentals and transportation will effectively reduce the average resident’s disposable income as spending will be diverted to essentials. This is the income effect.

And should there be residual disposable income, rising prices may impel the average consumer to conserve resources by switching into the more affordable alternatives. This is the substitution effect.

Sustained price pressures on basic goods would imply that the forces of the income and the substitution effects[21] will increasingly come into play.

Note: While the above data is from 2003[22], I doubt if there has been a material change in the above distribution.

Aside from higher input costs and reduced demand, the falling peso (in tandem with the domestic source of inflation via credit financed spending) will compound on the predicament of entities with exposure to foreign currency, or specifically, US dollar denominated debt.

Even if these companies secured their financing via fixed rates, the falling peso would mean more pesos required to pay for every US dollar debt. This will be even worse for companies whose foreign liabilities are priced from variable rates especially that Ms. Yellen has hinted on raising interest rates.

Thus in the face of slowing demand and higher input costs, the declining peso will add to the increase business costs further crimping profits and thus raise the risks of defaults.

I have already noted that many publicly listed companies[23] have acquired and will likely be burdened by foreign currency debt.

And add to the interest rate pressure will be the increased demand for credit.

The BSP Indicates Tightening, Really?

The BSP governor Amando Tetangco Jr responded to Ms. Yellen’s statement hinting to a possible pre-emption of interest rate increase as “early measured adjustments” that would make his “monetary policy as ideal”. He notes that domestic inflation remains “within target”[24]

Political rhetoric has been mostly devious and evasive.

First of all, this is not the first time the BSP governor played into the taper talk. Following the first account of emerging market tremors from Abenomics-Bernanke Taper in May-June, the BSP governor floated on the idea that the BSP may tighten in July 2013 since he boasted “we don’t see any real need for stimulus at this point”[25]. From then until last week, the BSP governor spent the entire period defending the current monetary stance or the “stimulus” of zero bound interest rate subsidies.

Second, another proof is in BSP’s self imposed banking sector loan cap to the real estate industry. The cap has been breached in May 2013, but the BSP apparently looked the other way. By November loan quota on the real estate sector has grown to 22% of overall loans or a 10% increase. Yet there are hardly any signs that the BSP will curtail such loans as I believe the BSP knows that restricting the real estate industry would extrapolate to the emperor has no clothes.

Third the good governor says that inflation remains “within target”. Well that’s in the context of price inflation as measured by his political organization.

I am reminded by my indirect mentor Dr. Marc Faber who in a recent interview made a very pertinent comment about government statistics[26].

Governments will always publish the statistics that they wish to show irrespective whether that is in China or in other countries. Governments control basically the statistical offices, so they can show whatever they want. As Stalin said, it’s not important who votes but who counts the votes. And the government counts the statistics.

So instead of looking at solely looking at government statistics we look at market prices to see how they conform to government’s declared actions. The Austrian school of economics calls this demonstrated preference.

The peso fell to its lowest point in February 3rd 2014 a level last seen in August of 2010. What has been the BSP’s response? Well instead of using the interest rate channel, the BSP opted to expend some 5.7% of her US dollar Gross International Reserves last January in an obvious attempt to contain the peso’s fall. Why GIRs instead of policy interest rates? The most likely answer is that subsidies of low interest rates must be kept to support his “ideal” monetary policy.

While February GIR has partly recovered, this week’s peso meltdown will likely test the BSP’s resolve. My guess is that BSP will use the GIR option anew.

Again the epileptic convulsion by the peso is a sign that markets have also not been “within target” of the BSP.

Let me repeat again again and again. The BSP has been BOXED into a corner.

Option 1. If the BSP tightens then the whole phony credit fueled statistical economic boom collapses. So will be the destiny of free lunch for the Philippine government.

Option 2. If the BSP maintains current negative real rates or invisible subsidies via financial repression to the government through a banking financed boom, then stagflation will deepen and spur higher interest rates despite the BSP’s King Canute rhetoric.

So we are most likely to end up with Option 1 where economic reality via the markets will force the BSP to eventually tighten, or else God forbid, the Philippines suffer even a far worst fat tailed disaster: hyperinflation.

The difference between Option 2 and Option 1 is that the BSP intends to buy time and hope that the problem of economic imbalances from monetary interventions will merely breeze over. Unfortunately a policy based on hope will have a serious backlash. This is going to be a man-made disaster and not some nature based Typhoon that will exhaust itself and vanish.

This is another example of policy based belief of impossible things before breakfast.

The Falling Peso, Rising Exports and Positive Trade Balance Fallacy

I hear people say that weak peso should benefit exports and remittances. How you wish.

Yet any of such positive effects will be transient and limited. The problem with devaluation is that any advantages from a weak currency regime will be neutralized by the impact of domestic price inflation.

In the current case of the Philippines, domestic inflation has been prompting for a lower currency. As explained above the declining peso will function as a second order cause that will feed into domestic inflation which should worsen the current conditions.

Let us look at the proportionality of foreign revenue gains from remittances and exports relative to the overall statistical economy.

Philippine merchandise trade as % of GDP equates to 47% in 2012 according to the World Bank. It is important to note that the share of merchandise trade to the Philippine economy has halved from 2004.

Let us assume that we split these evenly between exports and imports. This means only 23.5% foreign revenues from exports contribute to the statistical GDP.

Let us further take into consideration the role of remittances. Remittances grew by 7.6% to hit a record US $25.1 billion in 2013[27]. The cash remittance share of GDP accounts for 8.4% according to the BSP

Combined foreign revenues contribute to only 31.9% of the GDP. This means that while part of that number may benefit, a still bigger 68.1% will pay for the transfer price or subsidies to foreign exchange recipients. So how in the world will 31.9% become greater than 68.1%???

But again the cheap currency equals strong exports has little relevance with reality.

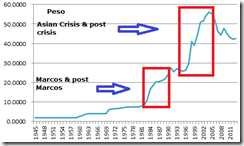

The Peso has lost 95.3% against the US dollar—from 2 pesos in 1960 to the 2013 BSP’s annual average rate of 42.45 per US dollar. So the destruction of the peso’s exchange rate value should have implied strong exports and positive trade balance for the Philippines. But where?

But before I proceed, let me cite that there are practically two phases of the Peso’s decline. One is the Marcos and post Marcos transition where the Peso declined from 2 to 27 against the US dollar. The salad days of the pre-Asian crisis era had the peso rangebound, which traded between 25-27 against the US dollar from 1991 to 1996. Then the second stage of collapse; the Asian crisis and its aftermath which culminated in 2004 where the peso peaked at an annual average of 56.04.

While Philippine exports grew from 1995 until 2007 in nominal US dollar terms, Philippine trade balance chart reveals that a majority of deficits means relative MORE import growth rather than exports. There were instances of surpluses from 1999-2000 but such didn’t last. From 2008-2013 exports traded sideways.

So the collapse in the peso hardly helped in promoting exports. Why? Because domestic policies remain highly restrictive against enterprises. Policies such as choking capital controls continue to inhibit capital movements.

From 2001 until 2013, Philippine trade balance remained in a deficit despite the seesaw movements in the peso. Since 2009 when the peso began to recover from the global crisis, the trade deficit has only worsened. This has not been due to a tradeoff in exports relative to imports in the way mercantilists would prefer to see them.

But instead, the halving of merchandise trade meant that both exports and imports have stagnated or declined relative to GDP as the economic structure shifted. But exports bore the brunt. That’s because 2010 represented the spring board leap to the domestic credit fuelled asset bubble boom. This implies that a large force of the formal economy redirected their efforts to blowing the property and property related bubbles rather than to the production for exports.

Another offshoot from the long term collapse of the peso has been labor exports. The dearth of investment and job opportunities in the face of the shrinking peso has compelled 10+% of the citizenry to seek greener pasture abroad. Finding job overseas has been a product of spontaneous response to impoverishment brought about by systematic political interventions to the economy[28]. The informal economy has been the sibling of the unintended labor exports.

Now the government claims credit to what has been the positive effects from circumventing political order. The government calls OFWs as modern day heroes because of the voting constituents the sectors has influence on. Yet the government has been the albatross over the neck of OFW families.

Yet remittances and the growth of BPO service industry has essentially offset trade deficits and contributed to current day surpluses

Are the Risks to Philippine BoP coming from the Capital Account?

As a final observation, the index mundi chart reveals that capital account as of 2011 has sharply risen.

Capital account should reflect on the net change in ownership of national assets. Capital account includes the financial account which represents portfolio flows, net foreign direct investments, other investments or flows into and out of bank accounts or provided as or payments of loans and reserve account or the buying and selling of foreign currencies by the central bank.

Movements in capital according to Wikipedia.org[29] reflects on either “a surplus in the capital account means money is flowing into the country, but unlike a surplus in the current account, the inbound flows will effectively represent borrowings or sales of assets rather than payment for work. A deficit in the capital account means money is flowing out the country, and it suggests the nation is increasing its ownership of foreign assets.”

I have yet to dwell into the details of the BSP's capital account but in passing by looking at FDIs and portfolio flows, these have largely vacillated.

I suspect that part of the big jump in capital flows could either be from foreign speculation on local property markets or borrowing from external sources.

If the latter two has been true, then the mainstream could be overlooking another major source of risks.

The risk from external originated loans is that if foreign lenders see rising risks in emerging markets from changes in developed economy monetary policies, they could call on these loans[30].

Moreover if the part of the BoP surpluses comes from speculation on local properties then the reported “scramble” to sell properties by Chinese speculators on their Hong Kong portfolio[31] due to “liquidity issues” risks sparking a wave of global selling of properties even in the Philippines. Liquidity issues signify debt repayment problems.

To recall, domestic real estate insiders has swaggered about foreign speculation on local properties as alternative to Hong Kong and Singapore[32] Unfortunately if the issue of Hong Kong property sell off has been debt repayments then there won’t likely be a shift to anywhere. Rather if there are Chinese investors in local properties they could start the domestic liquidation process.

At the very least Chinese selling of Hong Kong property markets translates to a shrinking pie of foreign buyers for local properties. In the worst case, the forces of financial and economic Black Swan have begun to snowball.

The bottom line is that the peso is vulnerable from mainly internal sources but also sensitive to external contagion risks.

The risks environment seems to be intensifying.

[1] Lewis Carroll (Charles Lutwidge Dodgson), Chapter 5: Wool and Water Through the Looking-Glass wikiquote.com

[2] See Phisix: A Deeper Look at the Philippine and Indonesian Stock Market Mania March 17, 2014 and See Phisix: The Stock Market Mania Deepens March 10, 2014

[3] See Phisix: The Convergence Trade in the Eyes of a Prospective Foreign Investor November 11, 2013

[5] Zero Hedge Just Two Charts March 20, 2014

[6] See Record US Stocks Drive Wealth Inequality March 13, 2014

[7] Benjamin Graham Lecture Number Seven The Rediscovered Ben Graham

[8] Bloomberg.com Junk Bonds at $2 Trillion as Gundlach Pulls Back: Credit Markets March 19, 2014

[9] Forbes.com Fed Cuts Monthly Asset Purchases To $55 Billion Maintaining Taper Pace, Market Awaits Yellen Remarks, March 19, 2014

[10] Bloomberg.com Treasury 10-to-30-Year Curve Narrowest Since 2010 on Fed Outlook March 21, 2014

[11] See ASEAN Financial Markets Convulses on Janet’s Yellen’s FOMC Debut March 20, 2014

[12] See Lured by More Debt, Chinese Stocks Zoom March 21, 2014

[13] Asian Development Bank ASIA BOND MONITOR March 2014 p.73 illustration p.76

[14] See Phisix: The BSP’s Self Imposed Hobson’s Choice March 9, 2014

[15] Bangko Sentral ng Pilipinas Outstanding External Debt Drops Further in Q4 2013 March 21, 2014

[16] Bangko Sentral ng Pilipinas Strong Current Account Continues to Support BOP Surplus in 2013 March 21, 2014

[17] See Phisix: Why Tomorrow’s Fundamentals will be Distinct from Yesterday March 3, 2013

[18] Philstar.com PSE extends pre-close period October 17, 2013

[19] Bangko Sentral ng Pilipinas, Domestic Liquidity Growth Rises in January February 28, 2014

[20] National Statistics Office External Trade Performance: December 2013 February 25, 2014 census.gov.ph

[21] Economicshelp.org Income Substitution effect

[22] Hyun H. Sun Has Inflation Hurt the Poor? Regional Analysis in the Philippines in the Philippines Asian Development Bank

[23] See Phisix: Are ASEAN Markets Signalling Trouble?; More on Typhoon Yolanda November 25, 2013

[24] Wall Street Journal, After Fed Guidance, Philippine Banker Fires Warning Shot on Rates March 20, 2014

[25] See Phisix: BSP’s Tetangco Catches Taper Talk Fever July 29, 2013

[26] See Video: Marc Faber: A lot of funny deals in China’s colossal bubble March 18, 2014

[27] Philstar.com Remittances hit record high of $25.1 B in 2013 February 17, 2014

[28] See The Message Behind the Phisix Record High May 27, 2012

[29] Wikipedia.org Capital account

[30] See Emerging Market $2 trillion Carry Trade: The Pig in the Python February 24, 2014

[31] Reuters.com As credit tightens at home, Chinese sell Hong Kong luxury real estate March 19, 2014

[32] See Phisix: Scrutinizing the Property Inspired Rally February 24, 2014

2 comments:

Thanks for the article

Perhaps you might enjoy point 15 on my article Bear Market Becomes Entrenched After Yellen’s First FOMC Meeting.

http://tinyurl.com/plqg5m9

I expect that Small Cap Nation Investments, SCZ, such as IDX, DFE, EWUS, GULF, EGPT, GREK, EDEN, SCIN, IWM, and GERJ, to fall faster that EPHE.

@theyenguy thanks

Post a Comment