Here is an investment tip for those who wish to protect themselves from market volatilities [dedicated to my friends at Stock Market Pilipinas]

As I have been writing, inflationary bullmarkets tend to inflate almost every issue on the stock exchange (rotational process).

This does not apply only to stocks but also to other assets.

In the US, small caps have been beating large caps… (US Global Investors)

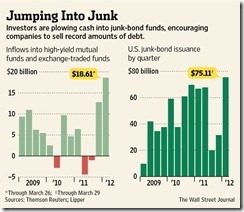

…while junk bonds have been thrashing investment grade bonds as US companies with junk ratings pile into the bond markets at record pace to take advantage of ultra low interest rates (Wall Street Journal)

These are evidences of yield chasing phenomenon as an offshoot to central bank policies.

Because the world has been flushed with money, this only implies of highly volatile markets which are characterized by huge swings or strong surges and equally sharp retracements.

Again inflationary markets will tend to push up almost every issue but in different degrees and at different times. This impacts the stock markets in a similar manner. Eventually we will see this happen in consumer prices.

The same phenomenon impacts the second or third tier issues in the local markets, as money spillovers into the broader market.

Second while there will always be unscrupulous people (or stock market manipulators or operators), pump and dump and short and distort are activities that are difficult to establish.

Take for example of the 6 major holding issues constituting the Holding firm index of the Philippine Stock Exchange, 4 have been drifting in near or at record levels.

DM Consunji [PSE: DMC, RED], JG Summit [PSE: JGS, black], and Aboitiz Equity Ventures [PSE: AEV, black] (I did not include Ayala Corp [PSE: AC] because AC has yet to beat, but is about to, the 2007 high)

Are the record levels of stock prices of heavy caps JGS, AEV and DMC (and partly AC) justifying their valuations? So does this make JGS, AEV and DMC a pump and dump?

Some would say no because they are heavyweights (highly liquid issues with real cash flows). But this is would be a non-sequitor or irrelevant to the issue.

The following are the income statement statistics and estimates from 4-traders.com

JGS Summit

Aboitiz Equity Ventures

DMCI

The crux of the matter is: does the earnings trend justify the current price volatility?

In my view no, earnings in the contemporary sense DO NOT justify such volatility as shown above. There seems hardly any correlation between corporate performance and stock prices

And again this brings to fore the largely mistaken orthodox belief about earnings.

Today it has hardly earnings that drive prices but high powered money from central banks. By such thesis, one would understand the nature of inflationary booms and deflationary busts (Was there any pump and dump during the bear market in 2007-2008?)

Nevertheless here are very important tips for stock market participants to keep in mind which I will convey through the wisdom of my favorite stock market savants

Warren Buffett: Risk comes from not knowing what you are doing.

Warren Buffett: The dumbest reason in the world to buy a stock is because it's going up

My comment: Both of the above quotes from Mr. Buffett are intertwined.

Apparently many participants, both neophytes and veterans, are drawn to the fervent desire to earn fast buck while at the same time disregarding the risks involved that makes them easily fall prey to market volatilities and to manipulators.

Jesse Livermore (my all time favorite): “the average man doesn't wish to be told that it is a bull or bear market. What he desires is to be told specifically which particular stock to buy or sell. He wants to get something for nothing. He does not wish to work. He doesn't even wish to have to think. It is too much bother to have to count the money that he picks up from the ground.”

My comment:

Many people don't really want to think.

Example: getting information from newspapers and extrapolating them into investment isn't thinking at all. 50k-100k people read business section of the newspapers everyday. This means by the time one reads the newspaper, others may have already read them and may have already acted on the new information provided.

Yet in reality, these newspaper based information are likely to affect markets over the short run and are splashed with logical errors and fallacies.

That’s why I call the allure of mainstream media’s information as largely toxic.

So instead of working to get ahead of the curve, one acts at the tailend. As a famous Wall Street axiom goes,

Bulls make money, bear make money but pigs get slaughtered.

Moreover, many want to use the stock market to talk themselves or bloat their egos.

Aside from the economic role, stock markets or financial markets have social aspects, which is evident by the bandwagon effects.

More quotes of wisdom

Jesse Livermore: I began to realize that the big money must necessarily be in the big swing. Whatever might seem to give a big swing its initial impulse, the fact is that its continuance is not the result of manipulation by pools or artifice by financiers, but depends on underlying conditions. And no matter who opposes it, the swing must inevitably run as far and as fast and as long as the impelling forces determine.”

Jesse Livermore: In actual practice a man has to guard against many things, and most of all against himself—that is, against human nature.

The basic lesson from the above is that in order to protect one self, one needs to practice self-discipline which means controlling emotions or egos (Emotional Intelligence), as well as, to understand the underlying conditions of the marketplace.

As I previously noted, relying on tips and rumors can be a disastrous proposition.

Manipulators are hardly responsible for losses incurred by market participants. In reality, it is the self who is mostly culpable. Worst, it is policies of political authorities that influences people’s incentives to become short term oriented and to undertake reckless activities and makes them vulnerable to bubbles and to manipulation.

No comments:

Post a Comment