The mainstream has been focused on the price of gold vis-à-vis the US dollar.

Although the US dollar, as the world’s major reserve currency, through the US Federal Reserve, dominates global central bank policymaking, apparently other major international reserve currencies have mimicked US Fed Chair Ben Bernanke’s approach.

The result of concerted inflationism has been to devalue respective currencies against gold.

All charts from gold.org

Gold: British Pound (approaching record highs)

Gold: euro (at record highs)

Gold: Australian dollar (approaching record highs)

Gold: Canadian dollar (approaching record highs)

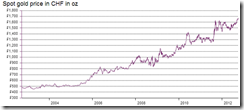

Gold: Swiss Franc (at record highs). Since the Swiss franc has been pegged to the euro thus the franc essentially reflects on the euro’s conditions

Gold: Japanese Yen (near record highs)

Gold: South African Rand (record highs)

Gold: India’s Rupee (record highs)

Gold: China’s yuan (near record high despite China’s aggressive gold accumulation)

Gold: Hong Kong dollar (near record highs) HKD is pegged to the US dollar

Gold: Mexican peso (near record highs)

The above clearly shows that governments have not been engaged in devaluation against other currencies but against gold, which should eventually spillover to other commodities.

As the great dean of the Austrian school of economics once wrote,

It must be emphasized that gold was not selected arbitrarily by governments to be the monetary standard. Gold had developed for many centuries on the free market as the best money; as the commodity providing the most stable and desirable monetary medium. Above all, the supply and provision of gold was subject only to market forces, and not to the arbitrary printing press of the government.

2 comments:

It is the amazing race to the bottom..

This reminds me of another failed effort - Fast and Ferocious...

Are we setting up a Grand World Depression?

Brilliantly stated, Mr Te..The regulation industry is the bane of society.

Consumers are the first line of regulatory defense and the government the last.

The former provides market efficiency, whereas the latter disruptive tyranny.

Post a Comment