When authorities say that regulations would do the wonders of effecting price controls, they are mostly propagandizing. That's because markets will prove them utterly wrong.

One great example, the stiff property curbs in Beijing has failed to stem the locality’s ballooning property bubble.

From Bloomberg: (bold mine)

Beijing, which already has China’s strictest real estate curbs, is being forced to take additional steps to contain surging home prices as demands for record-high down payments fail to deter buyers.The city has enforced citywide price caps since March by withholding presale permits for any new project asking selling prices authorities deem too high, according to developer Sunac China Holdings Ltd. (1918) and realtor Centaline Group. Local officials will need further tightening as they struggle to meet this year’s target of keeping prices unchanged from last year, said Bacic & 5i5j Group, the city’s second-biggest property broker.The failure of official curbs to stem price increases in the nation’s capital highlights the government’s struggle to keep housing affordable as urbanization sends waves of rural workers into China’s largest cities. New-home prices in Beijing rose by 3.1 percent in April from the previous month, the biggest gain among the nation’s four so-called first-tier cities, and climbed by the most after Guangzhou in May, according to SouFun Holdings Ltd. (SFUN) They rose in each of the first five months of this year…Beijing, the nation’s third-most populous city, is the only city that enforces price caps in earnest, according to Bacic & 5i5j. Guangzhou and Shenzhen in the southern province of Guangdong are rejecting presale permits for some projects seen as too expensive, CEBM’s Luo said. The three cities, along with Shanghai, are considered first-tier.In one of his last policies, Wen, replaced by Li Keqiang less than a month later, on Feb. 20 called on city governments to “decisively” curb real estate speculation after home prices surged the most in two years in January.Beijing followed with the toughest curbs among the 35 provincial-level cities that responded with price-control targets, becoming the only region to raise the minimum down payment on second homes from 60 percent and to enforce a 20 percent capital-gains tax on existing homes, according to Centaline Property Agency Ltd., China’s biggest property agency.Still, new-home prices in the city of 19.6 million, jumped 10.3 percent in April from a year earlier, the biggest rise after Guangzhou and Shenzhen, the National Bureau of Statistics said May 18. Prices of existing homes jumped 10.9 percent, the most since they reversed declines in December, and the greatest gain among all the 70 cities tracked by the government.

Given China’s underdeveloped capital markets, the ongoing consolidation of their stock markets, the artificially low rates designed to attain negative real rates or via the "inflation tax" (I doubt the accuracy of official statistics suggesting otherwise) and the massive credit expansion channeled mostly through State Owned Enterprises, where do you think the average Chinese will put their savings?

Bubble policies motivates people to go into wild (yield chasing) speculative activities. Thus, property bubbles and property sector backed shadow banking system are merely symptoms of bubble policies.

For as long as the Chinese government promotes credit inflation, bubbles will be the economic and financial order.

The failure of property curbs only exhibits of the flagrant myopia of politics—where authorities see their constituents as unthinking subjects or automatons who will merely surrender to their whims.

In reality, many Chinese look for loopholes such as resorting to “divorce” in order to circumvent property regulations.

Moreover, additional regulations only complicates a fragmented and diverse system which only encourages corruption and other unethical behavior.

Yet aside from property bubbles and the shadow banking system, the more cautious Chinese protect their savings through accumulations of gold.

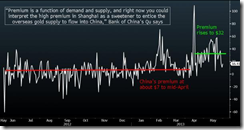

The recent flash crash has only prompted many of the the Chinese to a gold buying spree. Premiums on physical gold in China has “jumped four-fold in the last six weeks” according to the the Zero Hedge.

In the illusory world of the fiat based monetary political economy, people have been incentivized to either indulge in wanton speculation or to hedge on real assets rather than to engage in productive activities. Thus bubbles everywhere.

And price controls only worsens such imbalances.

No comments:

Post a Comment