Like her Western contemporaries, the Chinese government has decided to delay the day of reckoning by bailing out a troubled trust product.

Reports the Bloomberg:

China’s eleventh-hour rescue of wealthy investors in a high-yield trust threatens to drive more money into the nation’s $6 trillion shadow-banking industry, undermining regulators’ efforts to deter excessive risk-taking.Industrial & Commercial Bank of China Ltd., the nation’s largest lender, yesterday told customers who had invested in the 3 billion-yuan ($496 million) trust product that they can sell their rights to unidentified buyers to recoup the principal. Some clients plan to visit ICBC branches to demand more interest ahead of tomorrow’s 5 p.m. deadline for accepting the offer, according to Du Ronghai, a Guangzhou-based investor.Averting the nation’s biggest trust default may reinforce investors’ belief in implicit guarantees and the government’s backing of such risky products, stoking their appetite for products in the $1.67 trillion trust market. The bailout underscores the pressure on authorities to maintain financial and social stability even as they aim to prune the government’s role in the world’s second-largest economy and curtail debt.

This shows how government’s today fervidly dreads short term pain by undertaking measures that will even be more agonizing in the future.

Yet the article rightly puts into spotlight the risks of moral hazard from the bailout. Local governments, whom has used shadow banks as a main conduit for financing, along with other private sector borrowers will likely pile into the shadow banking sector since the government has placed an implicit guarantee via today’s actions.

China’s shadow banks—which includes wealth management products (WMPs) or a pool of securities like trust products, bonds and stock funds that offer higher yields than the bank deposits—have grown significantly.

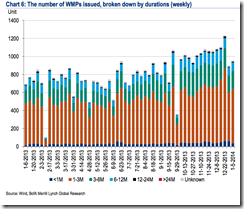

And according to a report from Businessinsider, WMPs soared by 47.4% in the third quarter of 2013 from a year ago. Trust products, which are part of WMPs, jumped by 60.3% over the same period while LGFV loans rose sharply by 59.7% as interest rates for these products rise. The diagram above shows of the WMPs issued in 2013.

Moreover, according to the same Bloomberg report above, there are about 5.3 trillion yuan of trust products that will be due this year compared with 3.5 trillion yuan in 2013. However shareholder equity backing these has been estimated only at 236 billion yuan. This extrapolates to a higher likelihood of a wave of defaults.

Will the Chinese government bailout all problematic WMPs? At what costs will any succeeding bailout/s bring about? How long before the next debt problem surfaces?

It’s odd that today’s rescue efforts has not spurred a celebration in China’s financial markets.

Yields of Chinese 10 year and 5 year treasuries while down from recent highs remains elevated at 4.52% and 4.44%. Recent highs were 4.71% for the 10 year and 4.6% for the 5 year.

Chinese equities via the Shanghai Index, rose modestly by .26%.

And what’s more peculiar has been that Shibor (interbank) rates seem to have surged (green ellipse), particularly from overnight to 1 month maturities. This seem to indicate signs of a squeeze. Although it's not clear whether the above rates reflected before or after the bailout.

As I previously asked will China be a trigger to 2014’s possible Black Swan event?

2014 is certainly proving to be interesting times.

No comments:

Post a Comment