Turkey’s central bank just made a stunning “shock and awe” move in order to calm her mercurial financial, particularly the currency market. The central bank substantially raised interest rates by 400-500 basis points

From Bloomberg:

Turkey’s central bank raised all its main interest rates at an emergency meeting, resisting political pressure and reversing years of policy, after the lira slid to a record low.The bank in Ankara raised the benchmark one-week repo rate to 10 percent from 4.5 percent, according to a statement posted on its website at midnight. It also raised the overnight lending rate to 12 percent from 7.75 percent, and the overnight borrowing rate to 8 percent from 3.5 percent. The lira extended gains after the announcement, adding 3 percent to 2.18 per dollar at 1 a.m. in Istanbul.

Turkey is one of the supposed member of the emerging market Morgan Stanley coined “fragile 5”—along with Brazil, South Africa, India and Indonesia.

Some have cheered that Turkey’s central bank’s surprising move may have contained the emerging market contagion, but such optimists may be overlooking the possible impact of these rate increases on the real economy.

The central bank’s action has been meant to stabilize the Turkish lira which has been in a collapse mode vis-à-vis the US dollar.

This is the historical performance of Turkey’s interest rates. Like everywhere else, Turkey rates has been zero bound since 2008. Yet the recent rate hike is still far from the highs of the 2008 crisis

What has been the outcome of the zero bound rates?

Again like everywhere else, the short answer is a Credit Bubble.

Loans to the private sector spiraled to the firmament. Turkey’s credit backed spending spree has led to massive deficits in her trade and current account balances. This means that her lavish debt financed spending depended also on foreign money to plug these holes. This is another symptom of the Credit Bubble.

Moreover Turkey government continues to spend more than she collects thus sustaining a budget deficit.

And this gap has been financed by external borrowing which has leapt since 2010. External debt has grown by about 40% from the 2010 lows.

So zero bound rates promoted debt financed spending of the private sector and of the government which had been funded by banks and by foreign money.

This is very interesting because there are about $160+ billion short term external debt due this year according to Turkey’s Central Bank, mostly held by private banks and by the other sectors.

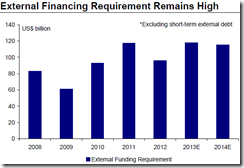

And the other concern is of the external financing requirements excluding short term debt.

Another point of concern is of the $350 billion worth of foreign banking exposure on Turkey. Should there be any default/s will these foreign banks not be affected?

Interesting no?

Some questions

Will the current shock and awe be enough to stabilize Turkey’s financial system? Or will this just have a short term effect, where the current hike could be the first of the series of many more rate hikes to come?

How will the current dramatic rate hike impact the real economy (private sector and the government)? Importantly how will the current interest policy affect Turkey’s government and the private sector’s capacity to service debt?

The markets have already been pricing in higher probability of Turkey’s debt default via higher CDS spreads

Mind you, for all those singing hosannas that forex reserves serve as talisman from a crisis, so far Turkey’s massive record foreign exchange reserves has done little to contain the financial upheaval.

It’s very interesting because Turkey could function as a paradigm to a possible crisis contagion or ‘domino effect’ in emerging markets.

It's even more interesting for Emerging Markets and for Asia to pray that the US Federal Reserve, whom are meeting today, won't add to their woes by increasing the "taper"

1 comment:

Great article, the best of any on the Internet.

You ask, How will the current dramatic rate hike impact the real economy (private sector and the government)?

I respond it will choke the economy, creating economic deflation.

But wait!!!!! there is more!!!!!

I respond that all economies today are debt based money systems.

The subprime crisis led to the financial system crash of 2008. And that crash is likened by a number of economists to a fatal automobile crash that killed all the occupants. Regeneration of economic life came through Paulson’s Gift, that being Ben Bernanke’s QE1 and TARP, which traded out “money good” US Treasuries for Distressed Investments, such as those traded in Fidelity Mutual Fund FAGIX.

So the US, the very lynchpin of liberalism as a paradigm and age, has been existing and underwritten on a debt based money system, and this has served as model for democratic nation state investment, traded by the ETF, EFA, and served for similar credit stimulus coming as the EU’s OMT and as Japan’s Abenomics, which resulted in terrific fiat asset bubbles, seen in the charts of the Eurozone Nations, EWI, EWG, EFNL, EWN, EWQ, EIRL, EWP, EWO, PGAL, GREK, as well as in the chart of the Nikkei, NKY.

In writing “Turkey’s loans to the private sector spiraled to the firmament”, you communicate that Turkey in developing economic life, took the US model of a debt based money system, and expanded it terrifically, like exponentially, with the result being a massive economic and credit crisis, similar in extent to that of the EU Debt Crisis and the China Trust Crisis, which should be termed the Turkey Credit Crisis.

The only result can be and will be a massive implosion in the fiat asset value of Turkey’s international trading fiat wealth, that is in the ETF, TUR, as well as in domestic economic life. Something far more dramatic than economic deflation is about to occur in Turkey, that being economic implosion.

Fiat money defined as Aggregate Credit, AGG, and Major World Currencies, DBV, and Emerging Market Currencies, CEW, died on October 23, with the rise of the Benchmark Interest Rate, ^TNX, from 2.48%. And fiat wealth, defined as World Stocks, VT, Nation Investment, EFA, Global Financials, IXG, and Dividend Paying Stocks Excluding Financials, DTN, died on January 24, 2014, on the failure of trust in the world central banks’ monetary policies of credit stimulus.

Now as the tide of liquidity from the world central banks recedes, and as investors derisk out of debt trades, and currency traders deleverage out of currency carry trades, we will soon see that all investors, yes, everyone of them, have been swimming naked.

According to bible prophecy of Revelation 13:1-4, out of Club Med waves of sovereign, banking and corporate insolvency, leaders will meet in summits to waive national sovereignty, and announce regional pooled sovereignty, to establish regional security, stability, and sustainability.

All those in Euroland will be given swimsuits of diktat money, that is garments of diktat policies of regional governance which are woven in schemes of totalitarian collectivism. This will be an evolving pattern throughout the world, as the beast regime, with its feet of a bear, mouth of a lion, and cloak of a leopard, comes to rule in all of mankind's ten regions, and occupy in all of mankind’s seven institutions.

Regionalism is the new economic dynamo, and under authoritarianism, it produces the debt serf. All of liberalism’s debts will be applied to every man, woman and child on planet earth. The beast regime’s ordained purpose is presented in Daniel 7:7, that being to utterly pulverize all of liberalism’s prosperity into dust.

Post a Comment