An economist is an expert who will know tomorrow why the things he predicted yesterday didn't happen today—Laurence J. Peter

Wishing you an exciting 2026: record highs, easy money, and all the risks that come with it.

In this issue:

Why the PSE Failed in 2025: Engineered Markets and Broken Policy Transmission

I. The Echo Chamber of Optimism

II. Institutional Conflicts of Interest: Agency Problem and the Information Asymmetry

III. Global Euphoria vs. Local Fragility: A Market That Failed to Respond—Despite Every Attempt to Boost It

IV. Engineered Rallies and the BSP’s Easing Cycle Elixir

V. Mounting Concentration Risk and the ICTSI Distortion

VI. Foreign Selling, CMEPA, and the Gaming Bubble

VII. From Equities to Energy: Bailouts Without Calling Them Bailouts

VIII. A Lone Divergence: Mining and the War Economy

IX. The Philippine Treasury Market Confirms the Diagnosis

X. Conclusion: When Policy Loses Its Grip

XI. Epilogue: The Façade of January Effects

Why the PSE Failed in 2025: Engineered Markets and Broken Policy Transmission

Why the PSEi 30 underperformed despite rate cuts, engineered rallies, and unprecedented policy support

I. The Echo Chamber of Optimism

Figure 1

Does the public even remember the barrage of starry-eyed headlines and sanguine projections that dominated discourse from late-2024 through 2025? (Figure 1)

From Goldman Sachs’ overweight upgrade on Philippine equities (November 2024), to the relentless amplification of projected PSEi 30 returns by the mainstream echo chamber, to a business media outfit hosting a Pollyannish stock market outlook forum in February 2025, optimism was not merely expressed—it was drilled into the public consciousness.

Strangely, at the forum, Warren Buffett’s aphorism—“be greedy when everybody is fearful”—was cited ironically at a time when virtually every expert was advocating optimism. Even “cautious optimism” emerged as the most defensive stance.

All told, media and institutional narratives throughout 2025 projected rising equities anchored on a strengthening GDP—an assumption that would soon have the rug pulled out from under it.

Figure 2

In hindsight, the establishment’s posture resembled a classic denial phase in a deflating PSEi 30 bubble cycle. (Figure 2)

II. Institutional Conflicts of Interest: Agency Problem and the Information Asymmetry

The fundamental problem lies in the structural conflicts of interest between financial institutions and the investing public.

This dilemma reflects classic agency problem and asymmetric information. The objectives of buy- and sell-side institutions—fees, commissions, deal flow—diverge materially from those of retail investors seeking risk-adjusted returns.

As a result, sales pitches camouflaged as institutional research or news are designed to attract savings/capital, not to interrogate risk–reward tradeoffs. The information disseminated to the public is therefore shrouded in adverse selection and biased framing.

Despite serious unintended consequences from excessive interventions—easy money distortions, fiscal crowding-out, regulatory interference, capital controls, bailouts, and capital-market price manipulation—this savings-depleting dynamic receives scant acknowledgment.

There is also little recognition that the Philippine Stock Exchange has vastly underperformed, despite extraordinary efforts to support it.

Figure 3

As global central banks embarked on a historic easing campaign and global equities posted a third consecutive year of double-digit gains, the PSEi 30 closed 2025 as the second-worst performer in Asia, ahead of only Thailand. (Figure 3, topmost pane)

Of 19 national bourses tracked by Bloomberg, 16 ended the year higher, averaging a striking 19.22% return—led by South Korea, Pakistan, Sri Lanka, and Vietnam. The Philippines, alongside Bangladesh and Thailand, stood out as an underperforming outlier. (Figure 3, middle graph)

This flagrant underperformance—despite substantial engineered pumps in Q4—laid bare the market’s internal fragilities.

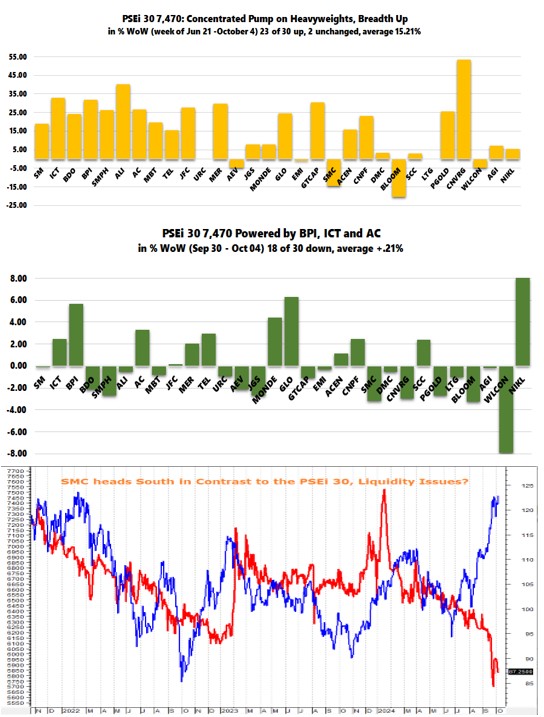

IV. Engineered Rallies and the BSP’s Easing Cycle Elixir

In December, a series of price-distorting late-session “afternoon delight” and pre-closing “rescue pumps” lifted the PSEi 30 by 0.51% MoM.

These were concentrated in banks and property stocks, echoing the mainstream narrative that rate cuts should disproportionately benefit them. (Figure 3, lowest table)

Additional support came from ICTSI, following its powerful October–November advance. Although the rally peaked on December 12 before a mild pullback, ICT’s surge drove the services sector up 10.5% and lifted the headline index by 1.67% in Q4.

Figure 4

For context, the BSP’s first rate cut in August 2024 was initially sold as an elixir, propelling the PSEi 30 up by a remarkable 13.4% in Q3 2024. Yet a surprise weak Q3 2024 GDP print (+5.2%) triggered a sharp reversal: –10.23% in Q4 2024 and –5.33% in Q1 2025. After another significant setback in Q3 2025 (–6.46%), the index fell –4.9% in 2H 2025. (Figure 4, topmost window)

Despite repeated interventions, the PSEi 30 closed 2025 down 7.29%.

V. Mounting Concentration Risk and the ICTSI Distortion

Since peaking in 2018, the PSEi 30 has recorded six negative return years out of the last eight—an unmistakable sign of a debt-trapped, late-cycle economy. (Figure 5, middle chart)

The index’s internals underscore this bearish backdrop: 24 of 30 constituents ended 2025 in the red, averaging a –6.87% decline. (Figure 4, lowest image)

Figure 5

Yet again, ICTSI—the PSE’s largest market-cap stock—nearly single-handedly prevented a deeper collapse. Its 46.9% full-year gain pushed its free-float weight to a record 17.8% in mid-December, ending the year at 16.5%. (Figure 5, topmost diagram)

Consequently, the combined free-float weight of the top 5 heavyweights to a record 53% but closed at 52.16% still proximate to an all-time high. (Figure 5, second to the highest visual)

Adjusted for the peso’s 1.6% YoY depreciation to a record low, the PSEi 30 fell 8.78% in USD terms—its seventh year of decline since 2017. (Figure 5, second to the lowest image)

The dollar index DXY fell by about 9.6% in 2025.

VI. Foreign Selling, CMEPA, and the Gaming Bubble

The broader PSE fared no better. Outside a handful of names, most issues declined and market internals remained weak. (Figure 5, lowest chart)

While synchronized “national team” pumping supported headline levels, it was largely offset by persistent foreign selling—a dominant force since 2018.

Figure 6

Foreign participation rose to 49.18% of gross volume in 2025, the highest since 2021. (Figure 6, topmost window)

That said, under globalization and financialization, “foreign selling” does not necessarily imply foreign fund liquidation. Many elite-owned firms operate through offshore vehicles and could be part of the ‘foreign’ trading activities.

In the meantime, gross and main board volume (MBV) rose 14.64% and 19.13% in 2025, but most of this activity peaked around the CMEPA rollout in July and slowed materially thereafter. Ironically, the capital-consumption effects of the law generated unintended consequences: asset bubbles, negative returns, and corroding liquidity. (Figure 6 middle image)

For example, as the government cracked down on digital gambling, the PLUS gaming bubble accounted for a staggering 11.65% of main board volume in Q3 2025, revealing how speculative excess merely migrated into the PSE—absorbing retail savings in the process.

In 2025, concentration activities intensified: the top 10 brokers averaged 63.44% of Q4 main board volume; the top 20 accounted for over 82% both in Q4 and full-year 2025 MBV.

VII. From Equities to Energy: Bailouts Without Calling Them Bailouts

Engineered rescue rallies are not cost-free. They amplify concentration risk, intensify late-cycle fragility, and expose deeper balance-sheet stress driven by debt-financed asset support and misallocation.

This pattern extends beyond equities.

Authorities initiated a soft bailout of the energy sector—first indirectly via the SMC–AEV–MER asset-transfer triangle, and later through Real Property Taxes (RPT) waivers favoring elite-owned IPPs. This was followed by another buy-in: Prime Infrastructure’s acquisition of a 60% stake in FGEN’s Batangas LNG project, alongside higher consumer charges via GEA-All layered on top of FIT-All.

VIII. A Lone Divergence: Mining and the War Economy

For the first time, the mining sector not only outperformed but diverged meaningfully from the PSEi and broader market. Its performance reflects exposure to global commodity dynamics—finance, geopolitics, and the war economy—rather than domestic demand. (Figure 6, lowest graph)

While retracements are possible given overbought conditions, current signals suggest any correction may be cyclical rather than trend-reversing.

IX. The Philippine Treasury Market Confirms the Diagnosis

The warning signs extend to Philippine treasury markets.

Figure 7

By end-2025, the Philippine BVAL curve had clearly steepened relative to the flattish 2023–2024 profile, though it remained less extreme than the pandemic-era 2022 BSP rescue year. This shift points less to growth optimism and more to rising risk premia. (Figure 7, upper diagram)

While short-dated T-bill yields have not fallen back to 2022 levels—despite policy rate cuts, aggressive RRR reductions exceeding pandemic-era easing, and the doubling of deposit insurance—long-term yields remain materially higher than in 2023–2024, signaling mounting market concern over fiscal conditions, debt supply, and credibility.

The resulting mixed yield configuration, occurring alongside slowing GDP growth and persistently elevated bank lending rates, reflects not selective liquidity management but a failure of monetary transmission: BSP sought genuine easing, yet impaired bank balance sheets, malinvestment, and fiscal overhang have rendered markets far less malleable than policymakers expected.

X. Conclusion: When Policy Loses Its Grip

Taken together, the events of 2025 expose a Philippine financial system increasingly governed by intervention rather than price discovery—and increasingly constrained by balance-sheet fragility rather than cyclical weakness.

Despite aggressive policy easing activities, engineered equity support, regulatory inducements, and explicit and implicit bailouts, markets failed to respond as expected. Instead, concentration deepened, liquidity thinned, and monetary transmission weakened.

The underperformance of the PSEi 30 was not an anomaly but a symptom. Equity pumps masked deterioration; index ‘strength’ concealed internal decay.

The peso weakened, bond yields re-priced fiscal risk, bank lending rates remained elevated, and savings were quietly consumed through speculation and policy distortion. What appeared as support increasingly functioned as stress transfer—from institutions to households, from balance sheets to prices, and from the present to the future.

In this sense, 2025 was not merely a bad year for Philippine equities. It was a year in which markets signaled—clearly and repeatedly—that policy credibility, strained by diminishing returns and collapsing transmission/tightening effective liquidity, had become the binding constraint.

Until balance-sheet repair, fiscal discipline, and genuine price discovery are restored, further intervention may sustain appearances—but not balance-sheet health or durable confidence.

XI. Epilogue: The Façade of January Effects

January has historically been a strong month for the PSE, often reflecting the so-called ‘January effect’—seasonal inflows driven by year-end cash balance surpluses, portfolio reallocations, and tactical positioning.

Using the January 2018 peak as the reference point, the PSEi 30 has posted January gains in five of the past eight years (62.5%). Yet over that same post-2018 cycle, full-year returns have been negatives/deficits in six of those years (75%). The implication is clear: early-year strength has repeatedly failed to translate into durable annual performance. (Figure 7, lower chart)

Even so, institutional cheerleading is likely to intensify. Seasonal rallies will be framed as confirmation of recovery, even as stimulus-driven activity continues to deepen debt-led imbalances and erode household savings.

This is not to suggest that the PSEi 30 must necessarily close 2026 in negative territory. Rather, when façade substitutes for structure—when form is elevated over substance—market fragility increases.

Under such conditions, for the general market, the probability of risk and loss continues to outweigh potential gains, regardless of how loudly institutions beat the drum for a bull market.

Meanwhile, the risk of a meltdown looms.

____

Select References

Prudent Investor Newsletters, The Oligarchic Bailout Everyone Missed: How the Energy Fragility Now Threatens the Philippine Peso and the Economy, Substack, December 07, 2025

Prudent Investor Newsletters, Inside the SMC–Meralco–AEV Energy Deal: Asset Transfers That Mask a Systemic Fragility Loop, Substack, November 23, 2025

Prudent Investor Newsletters, PSEi 30 Q3 and 9M 2025 Performance: Late-Stage Fragility Beneath the Headline Growth, Substack, November 30, 2025

Prudent Investor Newsletters, The Philippine Q3 2025 “4.0% GDP Shock” That Wasn’t Substack, November 16, 2025

Prudent Investor Newsletters, The Philippine Flood Control Scandal: Systemic Failure and Central Bank Complicity, Substack, October 05, 2025

Prudent Investor Newsletters, June 2025 Deficit: A Countdown to Fiscal Shock, Substack, August 3, 2025

Prudent Investor Newsletters, The CMEPA Delusion: How Fallacious Arguments Conceal the Risk of Systemic Blowback, Substack, July 27, 2025

Prudent Investor Newsletters, The Ghost of BW Resources: The Bursting of the Philippine Gaming Stock Bubble Substack, July 6, 2025

Prudent Investor Newsletters, How Surging Gold Prices Could Impact the Philippine Mining Industry (3rd of 3 Series), Substack, April 02, 2025