In the world capital markets, the US appears to be losing its leadership

Reports the New York Times (bold highlights mine)

Reva Medical did what a small but increasing number of young American companies are doing — it looked abroad for money, in Reva’s case the Australian stock exchange.

After an eight-month road show, meeting investors and pitching the prospects of a biodegradable stent, the 12-year-old company sold 25 percent of its stock for $85 million in an initial public offering in December.

“There are so many companies that require capital like our company, and they don’t have access to the capital markets in the United States,” said Robert Stockman, Reva’s chief executive. “People are looking at any option to stay alive, which is what we did.”

Reva’s example shows that nearly three years since the financial crisis began, markets in the United States are barely open to many companies, leading them to turn to investors abroad. Denied a chance to list their stock and go public here, they are finding ready buyers of their shares on foreign markets.

Nearly one in 10 American companies that went public last year did so outside the United States. Besides Australia, they turned to stock markets in Britain, Taiwan, South Korea and Canada, according to data from the consulting firm Grant Thornton and Dealogic.

The 10 companies that went public abroad in 2010 — and 75 from 2000 to 2009 — compares with only two United States companies choosing foreign exchanges from 1991 to 1999.

The trend reflects a decidedly global outlook toward stocks, just as the number of public companies in the United States is shrinking.

From a peak of more than 8,800 American companies at the end of 1997, that number fell to about 5,100 by the end of 2009, a 40 percent decline, according to the World Federation of Exchanges.

The drop comes as some companies have merged, or gone out of business, or been taken private by private equity firms. Other young businesses have chosen to sell themselves to bigger companies rather than go public.

Here’s why...

Again from the New York Times, (bold emphasis mine)

A variety of factors explain each company’s decision to list on a foreign exchange, like the increased regulatory costs of going public in the United States. Underwriting, legal and other costs are typically lower in foreign markets, companies say.

The Alternative Investment Market, or AIM, a part of the London Stock Exchange intended for small company listings, is a popular destination for some American companies. The cost of an initial public offering there is about 10 to 12 percent of total capital raised, compared with 13 to 15 percent on Nasdaq, according to Mark McGowan of AIM Advisers, which helps American companies list on AIM.

In addition, the extra annual cost of maintaining a public listing, including complying with Sarbanes-Oxley rules, can be typically much higher in the United States: $2 million to $3 million each year depending on the size of a company compared with a cost as low as $320,000 on AIM or $100,000 to $300,000 in a market like Taiwan, according to advisers.

There are concerns that some foreign exchanges attract companies because their oversight may be less stringent. But companies insist standards are high.

A more important factor than cost, said Sanjay Subhedar, managing director of Storm Ventures, a California venture capital firm, is that investors in the United States who traditionally participate in I.P.O.’s and the banks that underwrite the offerings are no longer interested in share sales by small companies.

Institutional investors like mutual funds want the liquidity of larger offerings with abundant buyers and sellers, he said; bank underwriters want to focus on the more lucrative fees that bigger deals generate.

So fundamentally the article cites compliance cost, cost of listing and maintenance and liquidity as direct costs for the erosion of the dominance of the US.

True, direct compliance costs have been a major hurdle.

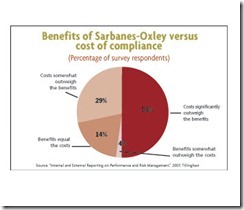

Many see that the cost-benefit trade off of the Sarbanes Oxley act (SOX) has been weighted towards costs. In short, the law has been economically unviable and has prompted for unforeseen consequences.

Companies have been spending billions of dollars a year to comply with the SOX with little benefit in return.

Richard Karlgaard of Forbes magazine exhorts for the repeal of SOX

Dump Sarbanes-Oxley. Enacted in 2002 to prevent the next Enron scandal, Sarbox has thrown sand into the gears of entrepreneurship. It has severely slowed the U.S. market for IPOs, since companies earning less than $200 million in revenue can't afford the legal and accounting costs of being a public company today. Deprived of capital, young companies not named Facebook or Twitter prematurely stagnate or sell out. Investors are deprived of opportunity, and the nation is deprived of independent companies that surpass the $1-billion-in-revenue mark.

But there are other indirect factors that also contributes to such dynamic

There is the expanding risk of changing the rules of the game midway or “regime uncertainty” as government intrusions adds onus to the business climate by the contorting expectations and upsetting the balance of risk-reward tradeoffs. This penalizes existing firms and provides disincentives for prospective ventures.

Part of which have been policies that push for boom bust cycles which engenders widespread malinvestments or misdirection of resource allocation.

Another is the effects of policies to devalue. Eroding value of the US dollar may have prompted US companies to go overseas and tap (or arbitrage on) savings denominated in foreign currencies.

There is also the crowding out effect where companies spend money on lobbying to protect their political interests than for expansion.

The Business Insider gives an example of how tech companies have been spending to placate the political deities of Washington.

All these interventions add up to the intensive diversion of productive resources, raise the cost of doing business and consequently reduce the public’s appetite to invest, thereby adding to pressure on jobs creation.

It doesn’t stop here. Taxes have also been a significant part of these growing costs.

Tax Laws have been mounting as government intervention increases.

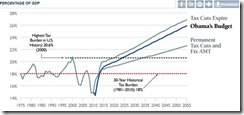

Chart from Taxes for expats

Also US government’s social spending will likely mean higher taxes.

From Heritage Foundation

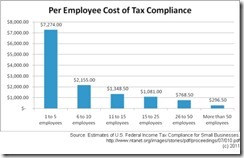

And this has already been hurting small businesses which makes up the biggest share of jobs creation.

Total compliance cost for the US economy on current regulations has been estimated at $380 billion per year

So much money has been lost to politics.

As supply-side economist Art Laffer writes at the Wall Street Journal in June of last year

On or about Jan. 1, 2011, federal, state and local tax rates are scheduled to rise quite sharply. President George W. Bush's tax cuts expire on that date, meaning that the highest federal personal income tax rate will go 39.6% from 35%, the highest federal dividend tax rate pops up to 39.6% from 15%, the capital gains tax rate to 20% from 15%, and the estate tax rate to 55% from zero. Lots and lots of other changes will also occur as a result of the sunset provision in the Bush tax cuts.

Tax rates have been and will be raised on income earned from off-shore investments. Payroll taxes are already scheduled to rise in 2013 and the Alternative Minimum Tax (AMT) will be digging deeper and deeper into middle-income taxpayers. And there's always the celebrated tax increase on Cadillac health care plans. State and local tax rates are also going up in 2011 as they did in 2010. Tax rate increases next year are everywhere.

So with the prospects of tax increases, capital investments are likely to be constrained (manifested by declining number of public companies) or will shift outside (raising capital overseas).

Bottom line: The eroding dominance of the US capital markets signifies a symptom of an underlying disease- government interventionism (mostly via inflationism)