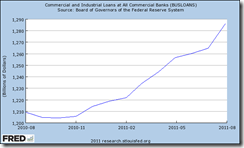

I pointed out US Federal Reserve Ben Bernanke’s most recent statement

If inflation falls too low or inflation expectations fall too low, that would be something we have to respond to because we do not want deflation

It would seem that Mr. Bernanke has been applying the power of suggestion, in the implication that his favorite tool, the Helicopter option (QE), would only be used when the menace of a ‘deflation risk’ is present.

What better way to convey the impression of deflation than by having commodity prices fall.

And perhaps through indirect channels, the team Bernanke may be influencing credit margins policies of the CME.

From marketwatch.com,

CME Group the parent company of the New York Mercantile Exchange, on Monday raised margin requirements for trading copper and platinum futures contracts. The changes go into effect Tuesday. Margins are money investors must put up to be able to trade and hold futures contracts. Initial requirements for copper contracts on the Comex division rose to $7,763 per contract from $6,750, and maintenance margins climbed to $5,750 each contract from $5,000. For platinum futures on Nymex, initial requirements were hiked to $4,950 per contract from $3,850, and maintenance margins rose to $4,500 each from $3,500

This war against commodities has been in place since May.

Intervening in the markets essentially distorts price signals which consequently creates supply-demand imbalances that would lead to more volatile price actions.

Furthermore, manipulating policies to pick on winners (in this case favors the commodity shorts) only politicizes the markets.

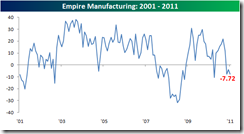

Lastly, I would say that in piecing together the jigsaw puzzles, Ben Bernanke has earnestly been trying to achieve the perception of ‘deflation risk’ by adding more pressures to the marketplace