I previously wrote about the US shopping mall bubble bust. Well it appears that this retail depression episode continues to linger.

Here is an update. From a Wall Street Journal article entitled “Shoppers are Fleeing Physical Stores”

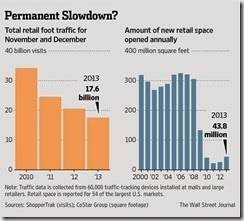

U.S. retailers are facing a steep and persistent drop in store traffic, which is weighing on sales and prompting chains to slow store openings as shoppers make more of their purchases online.Aside from a small uptick in April, shopper visits have fallen by 5% or more from a year earlier in every month for the past two years, according to ShopperTrak, a Chicago-based data firm that records store visits for retailers using tracking devices installed at 40,000 U.S. outlets. Even as warmer temperatures replace the harsh winter weather this year, store visits fell by nearly 7% in June and nearly 5% in July, according to ShopperTrak.New data from Moody's Investors Service shows that the shift to online sales has prompted retailers to scale back store openings and will likely lead them to pare back their fleets even more in coming years, as more than $70 billion in lease debt expires by 2018. Growth in store counts at the 100 largest retailers by revenue has slowed to less than 3% from more than 12% three years ago, according to Moody's.The pressure comes as consumer tastes are changing. Instead of wandering through stores and making impulse purchases, shoppers use their mobile phones and computers to research prices and cherry-pick promotions, sticking to shopping lists rather than splurging on unneeded items. Even discount retailers are finding it harder to boost sales by lowering prices as many low-income consumers struggle to afford the basics regardless of the price.

While it is true that changing shopping habits of US consumers have partly been a factor, online sales are just about 6% of total retail sales where the 94% still has mainly been from brick and mortar stores.

This means US household consumption, stricken by balance sheet constraints from the previous Fed induced overborrowing (boom), has hardly recovered since the Lehman crisis. US household have been deleveraging as evident in the chart from Yardeni.com’s US Flow of Funds.

The Fed’s manipulation of money via interest rates has distorted prices that has led to the previous excessive debt financed consumption (boom), and consequently, to the race to build retail spaces and edifices. When money tightened, the whole bubble collapsed. Vacancy in retail outlets and shopping mall surfaced. In fact, many shopping malls have been demolished.

Of course recent FED policies has only compounded the situation. By boosting (again) debt financed stock market boom, resources have been channeled into speculative activities rather than to productive activities, thus limiting economic recovery which has been transmitted to US consumption via retail sales.

So still hobbled by balance sheet problems, consumer demand continues to languish which has been reflected on the still struggling in US shopping mall/retailing.

And the US retailing shopping mall saga also extrapolates to a blueprint for the Philippine zero bound rate impelled shopping mall boom whose consumers are now buffeted by a sustained rise in consumer price inflation. Mounting inflation risks has forced the domestic central bank to raise interest rates. Boom will soon morph into a bust. And like the US, there will substantial vacancies and unoccupied retail spaces and malls or like China's "Ghost Malls".

All it takes is for one to learn from history and from development in other countries. Unfortunately who in the mainstream cares about learning?