``Entrepreneurial profit and loss emanate from the dedication of factors of production to definite projects. Stock exchange speculation and analogous transactions outside the securities market determine on whom the incidence of these profits and losses shall fall. A tendency prevails to make a sharp distinction between such purely speculative ventures and genuinely sound investment. The distinction is one of degree only. There is no such thing as a nonspeculative investment. In a changing economy action always involves speculation. Investments may be good or bad, but they are always speculative. A radical change in conditions may render bad even investments commonly considered perfectly safe.”-Ludwig von Mises

ASEAN Markets Ablaze!

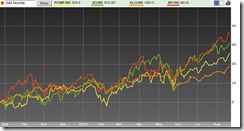

Here is an update of the seemingly majestic performances of ASEAN bourses (see Figure 1).

Figure 1: Bloomberg: ASEAN Bourses On Fire!

Of course, the reason why we should take the BIG PICTURE into perspective is primarily to avoid getting mired with the FALSE impression that domestic politics has been the DRIVER of these dynamics.

As one would note from the above, despite the tremendous showing of the Philippine Phisix (yellow trend line), which has been up over 17% on a year-to-date basis (as of Friday’s close), the fact is the local benchmark TRAILS the fiery actions of Thailand’s SETI (red line) and the Indonesia’s JCI (green line), up nearly 22% and 23% over the same period respectively.

Incidentally, the turbocharged Thailand’s SETI has already caught up and surpassed Indonesia’s JCI based on a one year basis and has been closing in fast even based on the year-to-date as reference point.

Now Asia markets have been uneven in terms of performances. What I am saying is that the inflationary milieu hasn’t lifted all boats similarly, and this simply validates the theory that inflationism has relative effects on almost everything, whether applied to financial assets, commodities to consumer goods or services. This also disproves the fictitious Keynesian construct of neutrality of money and of the obsessive fixation on aggregatism.

Yet the ASEAN bourses, while stirring hot, would seem only a shadow to the spitfire actions of South Asian bourses, particularly, Sri Lanka and Bangladesh up 64% and 49% respectively. Outside South Asia, Mongolia seems to be another bourse ablaze and has been likewise up 65% as of Friday’s close.

In other words, the trajectory of impact from global inflationism has been conspicuous in the markets (financial and non-financial) of the periphery nations. And I also would infer that these effects have been amplified by globalization.

The China Influence

Although China has been getting most of the news, such as having to successfully overtake Japan as the second largest economy in the world[1], the kernel of important actions again are in the peripheral markets but somewhat related to China.

Despite an up week, both of China’s bourses have been significantly down on a year to date basis (see figure 2).

Figure 2: stockcharts.com: China, Emerging Market Bonds and the Baltic Dry Index

One must NOT forget that the actions in China’s stock markets have been repeatedly tampered by with government interventions since late last year. This has been aimed at preventing a homegrown policy induced bubble from inflating into an unwieldy monster, and thus the material underperformance of China’s stock market indices.

And most of financial markets of developed Asia seem to either track the actions of China (e.g. Australia) or the market motions of the West (e.g. Singapore, Hong Kong and Japan).

Nevertheless following a steep decline last quarter, the Shanghai index (SSEC) seems to be manifesting of a rebound.

We can’t say if the momentum will persist until she successfully breaks out of the 2,700 level. A successful breach would possibly suggest that the Shanghai index will attempt for the threshold level of 3,000-3,150.

And China’s stock market actions appear to synchronize with the actions of the copper market (COPPER-the window below the Shanghai Index).

While we are NOT suggesting that China’s stock market has influences on the copper market, what both of these markets seem to say is that they could be responding to the current crop of policies being effected by the Chinese government.

The ongoing slowdown in China’s economy appears to reduce China’s government’s interest to tighten the monetary landscape, and thus, the prospects of lesser government intervention could be giving China’s stockmarkets a boost, especially in the light of the still generally loose credit environment.

Whereas the rebound in the copper market, while possibly partially influenced by these developments, could also be exhibiting signs of “inflationary pressures”. Monetary easing for China could extrapolate to more “speculative” flows from, or “reservation demand”[2] for, commodity buyers. As previously pointed out[3], the commodity price inflation appears to be rotating or diffusing into the “soft” or agriculture based commodities.

Debunking Selective Perception

Another thing that I’d like to point out, which the bears have been pounding on in the recent past, has been the Baltic Dry Index (BDI).

The recent collapse of BDI had been used to prognosticate a market collapse from what we see as fictitious “deflation” in a world of fiat money and central banking. And like US monetary aggregates, such as the M2 which we earlier discussed[4], these indicators have now tilted against them hence the apparent reticence or the deliberate omission of this indicator in current “deflation” discussions.

The selective use of the perma bears of these indicators to prove their case has gradually and repeatedly been falsified. Now to turn the tables, we use these indicators to disprove them.

They never seem to run out of materials to throw in, after the earlier “death cross” and the ERCI leading indicator, whose effects remain to be seen, now they point to the Hindenburg Omen[5] as a reason to take flight.

While September-October tend to be the seasonally weakest month for the stockmarket—where most crashes tend to occur—the dynamics for a crash doesn’t seem to be in place.

Not with the Federal Reserve already embarking on to replace the maturing mortgage bonds with fresh Treasury purchases[6] and certainly not with interest rates at zero bound for an extended period for key developed OECD economies.

Selective use of data for interpretation apparently disregards other things that matter more. For instance, the underlying ‘mixed’ actions (albeit mostly bullilsh) for emerging markets stocks doesn’t seem to be congruent with the actions in emerging bonds which has been exploding (JEMDX)!

Moreover we’d like to add that the steep yield curve has definitely had diversified or distinctive impact on the asset markets (see Figure 3) as we have repeatedly been pointing out[7].

We can still say that the US and Europe has very steep yield curves (as of August 13-green bar) despite recent signs of flattening.

Moreover, outside these crisis affected economies, where the effects of the yield curve could be muted due to balance sheet constrains on the respective domestic banking system, in crisis free Asia, the Philippines still has the steepest yield curve.

What this seem to imply is that Philippine banks will likely take advantage of the maturity transformation[9] (converting short term liabilities to long term assets) in a system which has relatively higher savings, less systemic leverage and unimpaired banking system. In short, credit growth is likely to explode here.

And I would discern that many of the new credit issued could be finding its way into the domestic asset markets including the domestic stock market.

And I would also suspect the same dynamics in operation in other ASEAN economies which has fuelled her recent outperformance.

And one can’t ignore the influences of the divergences of monetary policies between developed economies and emerging markets, where the expectations in the changes of policies seem to induce international capital in favour of emerging markets.

For many, the temptation to get into the bandwagon would seem irresistible. And as the region’s stock market continues to flourish, short term momentum trades would be appear to very lucrative.

In addition, these shifts appear to hallmark the seeds of the bubble.

[1] See The Power of Slow Change: The China-Emerging Market Story

[2] See Financialization of Commodities: Boon Or Bane?, May 31, 2010

[3] See Breakfast Inflation, August 5, 2010

[4] See Why Deflationists Are Most Likely Wrong Again, August 15, 2010

[5] Kahn Michael, Taking Stock of a Scary Market Signal, Barrons, August 18, 2010

[6] Bloomberg.com Fed Buys $3.609 Billion of Notes to Keep Yields Low, August, 19, 2010

[7] See What Has Pavlov’s Dogs And Posttraumatic Stress Got To Do With The Current Market Weakness?, February 1, 2010

[8] Asian Bonds Online, Weekly Debt Highlights, August 16 2010

[9] Wikipedia.org, Financial intermediary