Could Brazil’s actions of raising interest rates signify as another precursor (aside from Japan) to the culmination of the era of easy money?

From the Wall Street Journal Blog:

Brazil’s central bank on Wednesday confronted an increasingly acute policy dilemma with firm hand and clear voice, seeming to throw its customary caution to the wind.In its fourth monetary policy meeting of 2013, the central bank voted unanimously to raise its Selic base interest rate by a half point to 8%. In a brief statement, the central bank said the change was “continuing with” an adjustment in interest rates that would help put inflation on a downward path.Most analysts had expected a more modest quarter-point increase in the face of soft economic growth.“They finally woke up,” said Paulo Faria-Tavares, managing partner of Sao Paulo’s PTX Lending consultants. “But they need to stay awake or it won’t work.”The central bank’s policy dilemma became unexpectedly acute earlier Wednesday, when the government’s IBGE statistics bureau released first quarter economic growth figures. The data showed disappointing first quarter growth of only 0.6%. Most analysts had predicted 0.9% growth.But slower growth is coming at the same time as rising inflation. Brazil’s 12-month inflation rate is currently running at 6.46%, up from 5.84% at the end of 2012. The current rate is skating dangerously close to the 6.5% ceiling of Brazil’s inflation targeting range, which is 2.5%-to-6.5%.Under Brazil’s 1999 inflation-targeting law, the central bank is obliged to take action whenever inflation bursts through the top of the range. That could happen at any time

Mainstream media seems to be confused about the causal relationship between growth, zero bound rates, and price inflation.

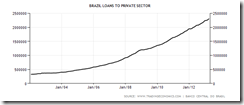

Let’s see what has been driving Brazil’s “inflation”

Loans to the private sector has essentially more than tripled since 2004!!!

Seen from a different perspective or as ratio to the GDP, domestic credit has been on a sharp upside trend since 2007.

But such upswing has been less than the sharp growth surges of the late 80s and early 90s which culminated with recessions.

The same holds true for domestic credit provided for the banking sector.

And where has all such immense growth in credit been flowing to?

The lackluster general growth of the Brazilian economy seems hardly a manifestation of an evenly distributed credit boom

Instead, booming credit as consequence from easy money policies have channeled to titles representing capital goods, particularly stock market and the real estate.

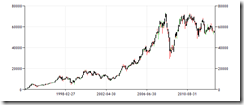

Brazil’s stock market as seen from the Bovespa appears to have been an early recipient as shown by the booms of 2002-2007 and 2008-2010, but not today.

The chart above reveals of the broadening mismatch between credit and income growth. Such mismatch represents a symptom of the property bubble in progress.

The rate of Brazil’s sizzling property boom makes it one of hottest in the world.

According to an article from Forbes:

When it comes to rising housing prices, no country in the world beats Brazil.According to Knight Frank’s Global Real Estate Index, released this month, Brazil ranks No. 3 in the world and No. 1 in the Americas for rising home prices. Only ridiculously expensive Hong Kong and Dubai, which are not countries, have seen prices rise more. So in fact, no single country has seen its housing prices rise as much as Brazil.Brazil housing prices rose 13.7% from the fourth quarter of 2011 to Dec. 31, 2012. By comparison, U.S. housing prices rose 7.3% in the same period, putting it at No. 12 in a list of 55 countries ranked by Knight Frank.The only other country in the hemisphere to make it into the top 20 was Colombia, with real estate prices rising 8.3% in 2012.Brazil stands out. And one reason is the low cost of financing. Or at least low by Brazilian standards. Mortgage rates are at least 1.3% a month, and loan payments are generally for just 15 years. It used to be that Brazilians bought homes in cash, but not anymore. They are financing purchases with down payments. Since 2009, when Brazilians starting buying homes on debt, mortgage lending has risen five fold, by 550% between then and 2012.According to Brazil’s Institute for Economic Research, or FIPE, housing prices rolled into the end of 2012 in seven capital cities on a high note. Prices in all seven cities — from São Paulo to Rio de Janeiro — rose well above the inflation rate of 5%. At the start of the fourth quarter last year, at the end of September, Brazilian housing prices had already risen by 15% while inflation was not even half that.Looking back at September, FIPE said São Paulo real estate rose 1.5%, three times higher than the national inflation average for the month.

So Brazil’s property bubbles may end soon.

But this has not been solely a private sector affair

Even as Brazil’s government have been posting surpluses, government spending has zoomed by almost 5 times in 11 years from 2002. Part of such spending growth has been financed by the explosion of Brazil’s external debt.

In other words, tight competition for scarce resources from the sector’s underpinning the property bubble which has been compounded by the burgeoning growth of government spending—all of which has been financed by credit expansion—has led to higher price inflation amidst stagnant growth.

In essence, Brazil endures from both stagflation and asset bubbles.

Yet the actions of Brazil’s authorities if sustained will put enormous strains on these wealth consuming activities over the near term. This will come with nasty repercussions

Every boom eventually turns into a bust, as the great Ludwig von Mises warned:

But the boom cannot continue indefinitely. There are two alternatives. Either the banks continue the credit expansion without restriction and thus cause constantly mounting price increases and an ever-growing orgy of speculation, which, as in all other cases of unlimited inflation, ends in a “crack-up boom” and in a collapse of the money and credit system. Or the banks stop before this point is reached, voluntarily renounce further credit expansion and thus bring about the crisis. The depression follows in both instances

Such applies to Brazil’s boom bust cycle.

1 comment:

Yes, the era of easy money is over and the age of destruction of money, as it has been known, has commenced.

Inflationism is turning into Destructionism as the result of the inappropriate policies of Brazil's central bank.

Brazil Financials, BRAF, that is BBD, and ITUB, plummeted 5%, Brazil, EWZ, 4%, and Brazil Small Caps, EWZS, 3%; and the Brazilian REAL, BZF, plunged 2.4%, in reaction to the news.

Look for new money, specifically diktat money to come into use.

Jesus Christ, through dispensation, Ephesians 1:10, is introducing Authoritarianism’s diktat money.

Diktat Money was born out of the Cyprus Bank Deposit Bailin, and is defined as the compliance required, as well as the trust that is engendered, the debt servitude that is enforced, and the austerity measures that are experienced, such as heavy losses on large bank deposits via bailins, levying of additional taxes, and capital controls.

Post a Comment