Every dollar of monetary base created by the Federal Reserve has to be held by someone until it is retired. When investors are inclined to speculate, so that the allure of a higher return outweighs concerns about a capital loss, safe, low-interest liquidity is seen as an inferior asset. Holders are inclined to pass it off to someone else in return for a riskier security. The seller, who gets the cash, then tries to pass that hot potato on to yet someone else. In contrast, when investors become risk-averse, safe, low-interest liquidity is a desirable asset, because concerns about potentially deep capital losses on risky securities outweigh the discomfort of earning a low yield on safe ones—Dr. John P. Hussman

"Accommodative" Policy Stance? Trading Volume of Treasury Securities, USD-Php Market and the PSE Plunges!

The BSP says that present policies are still "accommodative." But the trading volume of the Treasury (PDS), FX, and equity (PSE) markets disagree.

Manila Bulletin, October 14: After 225 bps (basis points) rate hikes, Bangko Sentral ng Pilipinas (BSP) Governor Felipe M. Medalla said the current BSP monetary policy stance is still accommodative and supportive of a sustained economic growth. Medalla as of two days ago is still saying that the BSP’s policy rate, which is 4.25 percent as of Sept. 22, remains “quite low”.

Domestic financial markets may have a different take on liquidity conditions. And they seem barely "accommodative" for them.

I. "Accommodative" Treasury Markets? Treasury Securities Trade Turnover Slumps!

Figure 1

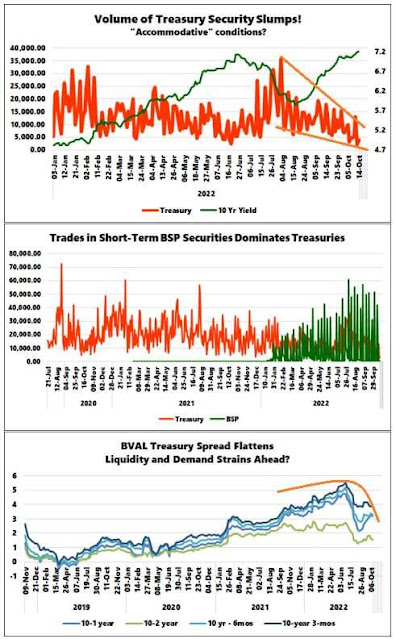

To begin with, excluding the secondary trade of mainly short-term BSP securities, the turnover of government securities (GS) has dramatically declined as treasury yields ascended faster this year. (Figure 1, topmost pane)

One has probably heard about authorities reportedly "rejecting" bids on Treasury securities from dealers due to "rising rates." But that's political flimflam. Because governments are wealth consumers, they eventually will have to accept higher rates to fund their escalating debt. And the streaking ascent of 10-year bonds persists for this fundamental reason.

Besides, it has been a 2-year downtrend (at least) in the turnover of the domestic treasuries (BVAL benchmark).

However, the increase in the volume of BSP securities could be part of the broadcasted transition to integrate it as a permanent window for monetary operations. BSP securities became active after the historic injections in 2020. (Figure 2, middle window)

Such policy amalgamation demonstrates the great Austrian Economist Robert Higgs' theory of the "ratchet effect,"—where authorities use a crisis to expand state power.

The thing is, monetary operations follow the yield trends than determine them.

And ascending rates in the face of diminishing turnover must imply symptoms of mounting liquidity (and possibly collateral) scarcity.

And a substantial reduction of liquidity would have a baneful effect on a system heavily dependent on it.

Separately, the yield spread between the 10-year benchmark and T-bills rates has been flattening too. Such are hardly signs of "accommodative." (Figure 1, lowest window)

II. "Accommodative" USD-Php Markets? FX Trading Volume Shrivels!

Figure 2

Emaciating liquidity has also started to plague the FX market considerably.

Trade in the FX market through the banking system has also exhibited a sharp drop in volume over the past month as the USD dollar has spiraled higher. Trading volume slid to the pandemic lows of Q1. (Figure 2, upper window)

It is likely indicative of a supply strain of USD. And it may also be a sign that the BSP is tightening the supply flow to control the benchmark exchange rate.

Recall that after burning up USD 13.8 billion in reserves in 2022, again, the BSP pledged to "act decisively" against speculators this week.

As we previously noted, USD-Php 59 represents the Maginot Line or the de facto ceiling for the BSP.

Perhaps at the behest of the BSP, banks have also declared war "against speculative activities that tend to distort market prices and hurt the economy."

Well, that was a fascinating manifesto!

Banks and financial institutions are also FX traders! Although FX income represents less than 5% of non-interest income since 2016, banks don't disclose the volume turnover to derive this income.

And given that FX trades usually involve significant leverage, the gross amount must be substantial. And this must be different from the volume published at the Bankers Association of the Philippines (BAP), which represents "spot" trading for clients or signifying the "general economy."

That said, will bank officials be shelving their respective FX departments or Treasury trades on FX? Will this include other forms of FX trading, such as hedges and assorted FX securities?

Or will banks be allowed to trade because they aren't "speculating"? Or will the general public be discriminated against over access to FX trades?

But only the omniscient don't engage in speculation. And politicization of the FX markets will only exacerbate the entrenched imbalances.

At any rate, a developing drought in volume transactions amidst a surging USD-Php may not be a precise manifestation of "accommodative" or economy "supportive" conditions.

And another thing.

The mainstream narrative has exhibited emerging signs of a shift.

Instead of blaming the "strong dollar," some experts have rightly pointed out the involvement of domestic factors. They cite the "trade deficit."

Good. But they don't go far enough. They don't ask who and what drove the trade deficit.

Has it been solely about the private sector? Or, since the public spending share of the GDP continues to scale higher, has a substantial portion of it signified the ramification of the fiscal deficit? Or is the trade deficit a product also of the escalation of public spending manifested through the fiscal deficit?

And they should ask further.

Since the "twin deficits" represent more spending than earnings, how is it financed? What conditions enable and promote its financing? What are its direct and indirect economic and financial costs of it? Who is responsible for this?

After all the rationalization, eventually, the truth will be out.

Finally, should authorities impose rigorous FX/USD-Php trade controls, please expect black markets to emerge.

This discussion leads to the third aspect of the financial markets, the equity market.

III. "Accommodative" Equity Markets? PSE Main trading Volume Plummets to 2017 Lows!

Figure 3

Are rates still low enough to render exposure to such markets "accommodative?"

On the surface, market lethargy is attributable to escalating sagging sentiment, primarily evidenced by the decline in the main board volume turnover, which plummeted below the 2017 lows! (Figure 3, upper window)

But the vulnerable public, guided by mainstream experts, barely see that the money used to acquire stocks originates from savings and credit. With the economy increasingly dependent on liquidity, hence the obsession by the experts to monitor central bank activities, financial conditions generally determine general equity performance.

And as evidence, the liquidity conditions, reflected by the cash-to-deposit ratio, appear to be tightly correlated to the returns of PSEi 30. (Figure 3, lowest window)

Figure 4

Another, since volume help determines returns, the same correlations affect the rate of volume changes in the PSEi 30. In this context, the trend slump in volume and returns are caused by deteriorating liquidity conditions. (Figure 4)

Finally, there is also a close correlation between bank lending to the financial industry. It likely shows the extent of margin trades used by financial institutions or their clients.

IV. Conclusion

So how have the still "low rates" been "accommodative" to the financial markets (Treasury, FX, and Equities)?

And while bank credit expansion continues in the face of spiking rates in response to the industry's balance sheet predicaments, this dynamic is unlikely to continue. Curiously, isn't the goal of the current monetary policies of increasing rates designed to temper demand by making credit costs more restrictive?

Financial markets have already been portending this. And the feedback loop mechanism will become more conspicuous over time.

Once tightness spills over to the economy, financial markets will react further.

But once something breaks in the economy or the financial sphere, we can only expect the BSP to respond with MAGNIFIED interventions.

And its outcome would be to rekindle inflation that entrenches stagflation.

No comments:

Post a Comment