The art of economics consists in looking not merely at the immediate hut at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups—Henry Hazlitt

Sunday, July 03, 2016

The PSE Jinx Indicator? The PSE Awakens From Hibernation to Declare Boom’s Back!

Friday, July 20, 2012

US Stocks Markets: Earnings Trump Economic Data, Leading Economic Indicators Fall

The recent rally by US stock markets seems quite impressive but not convincing enough to suggest that treacherous days have been mitigated.

The S&P 500 has nearly broken out of the current resistance levels

Earnings, which the rally has mostly been attributed to, have fundamentally trumped economic data.

From the Bloomberg,

U.S. stocks rose, sending the Standard & Poor’s 500 Index to a two-month high, amid better- than-estimated earnings and bets that disappointing economic data will lead the Federal Reserve to add stimulus.

International Business Machines Corp. (IBM), the biggest computer-services provider, and EBay Inc. (EBAY), the largest Internet marketplace, gained at least 3.7 percent as profits beat forecasts. Walgreen Co. (WAG) soared 12 percent after renewing a contract with Express Scripts Inc. (ESRX) Morgan Stanley (MS) slid 5.3 percent after missing estimates as trading revenue plunged. Google Inc. (GOOG), owner of the most popular search engine, rose 3.1 percent at 5:34 p.m. New York time as revenue surged 35 percent.

The S&P 500 (SPX) advanced 0.3 percent to 1,376.51 at 4 p.m. New York time, the highest since May 3. The Dow Jones Industrial Average added 34.66 points, or 0.3 percent, to 12,943.36. The Nasdaq Composite Index gained 0.8 percent to 2,965.90. Volume for exchange-listed stocks in the U.S. was 7 billion shares today, up 4.8 percent from the three-month average…

Today’s advance extended a three-day rally in the S&P 500 to 1.7 percent. Earnings have exceeded analyst estimates at about 71 percent of the 108 S&P 500 companies that have reported quarterly results so far, according to data compiled by Bloomberg. Analysts project a 2.1 percent decline in second- quarter profits, the data showed.

As one would note: aside from earnings, equity markets again, are being serenaded by the prospects of more steroids from the FED. The article devotes two more paragraphs on these.

Bad news is good news again.

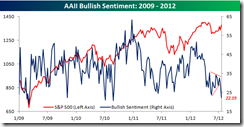

Extreme bearish sentiments or the ‘crowded trade’, chart from Bespoke Invest, may have provided the fulcrum for the current bullish momentum.

But current economic figures does not seem to support the continuation of this rally.

From the same article,

Sales of existing U.S. homes unexpectedly dropped and manufacturing in the Philadelphia region contracted for a third month. Other reports today showed consumer confidence weakened, claims for unemployment benefits rose and an index of leading economic indicators declined more than forecast.

Moreover, leading economic indicators fell more than expected.

From another Bloomberg article.

The index of U.S. leading economic indicators fell more than forecast in June, a sign the U.S. economic expansion is slowing.

The Conferences Board’s gauge of the outlook for the next three to six months decreased 0.3 percent after a revised 0.4 percent increase in May, the New York-based group said today. Economists projected the gauge would drop by 0.1 percent, according to the median estimate in a Bloomberg News survey.

Retail sales unexpectedly declined in June for a third straight month, indicating that slow progress in job creation is holding back consumer spending, which accounts for about 70 percent of the economy. Federal Reserve Chairman Ben S. Bernanke said July 17 that progress in reducing unemployment is likely to be “frustratingly slow.”…

Six of the 10 indicators in the index contributed to the decrease, led by a drop in a gauge of manufacturing orders and consumers’ expectations for business conditions. Four indicators increased.

And worst, % annual change of M2 have been dropping steeply which should impact both the economy and the markets in the coming months.

Again, outside real actions from the FED, eventually US stock markets, which provides the leadership to world markets, will have to price in real events to sustain such momentum.

But don’t forget political deadlocks, as manifested by Bernanke’s recent warning on the fiscal cliff and taxmaggedon, and on other issues, such as the debt ceiling and or even the Barclay’s LIBOR scandal, can simply swell out of proportions that may trigger mayhem in an environment clouded by immense UNCERTAINTY.

Even external shocks as the worsening of the Euro debt crisis or of a China economic recession could also tilt the balance of risks in US stocks.

Eventually promises are not going to be enough.

Monday, November 28, 2011

UK Prepares for Euro Collapse

From the Telegraph

As the Italian government struggled to borrow and Spain considered seeking an international bail-out, British ministers privately warned that the break-up of the euro, once almost unthinkable, is now increasingly plausible.

Diplomats are preparing to help Britons abroad through a banking collapse and even riots arising from the debt crisis.

The Treasury confirmed earlier this month that contingency planning for a collapse is now under way.

A senior minister has now revealed the extent of the Government’s concern, saying that Britain is now planning on the basis that a euro collapse is now just a matter of time.

“It’s in our interests that they keep playing for time because that gives us more time to prepare,” the minister told the Daily Telegraph.

Recent Foreign and Commonwealth Office instructions to embassies and consulates request contingency planning for extreme scenarios including rioting and social unrest.

Greece has seen several outbreaks of civil disorder as its government struggles with its huge debts. British officials think similar scenes cannot be ruled out in other nations if the euro collapses.

Diplomats have also been told to prepare to help tens of thousands of British citizens in eurozone countries with the consequences of a financial collapse that would leave them unable to access bank accounts or even withdraw cash.

I don’t trust how politicians and bureaucrats assess and analyze events. Usually more planning extrapolates to the extension of political control over the citizenry under the guise of sundry crises.

In the memorable words of the great Libertarian H.L. Mencken

Civilization, in fact, grows more and more maudlin and hysterical; especially under democracy it tends to degenerate into a mere combat of crazes; the whole aim of practical politics is to keep the populace alarmed (and hence clamorous to be led to safety) by an endless series of hobgoblins, most of them imaginary.

On the other hand, could this signify as more signs of a crowded trade?

Sunday, November 01, 2009

5 Reasons Why The Recent Market Slump Is Not What Mainstream Expects

``The next bubble in asset markets will not be in the West but in emerging Asia, led by China. The irony is that the more anaemic the Western recovery proves to be, the longer it will take for Western interest rates to normalize and the bigger the resulting asset bubble in Asia. Emerging Asia, not the U.S. consumer, will be the prime beneficiary of the Fed's easy money policy.”- Christopher Wood, Is the U.S. Economy Turning Japanese?

In this issue:

5 Reasons Why The Recent Market Slump Is Not What Mainstream Expects

The Cost of Self Esteem

5 Reasons Why The Recent Market Slump Is Not What Mainstream Expects

1. Reflation Trade Has Been A Crowded Trade

2. No Trend Goes In A Straight Line

3. Markets Have Been Liquidity Driven

4. Tightening Trial Balloons Responsible For Recent Shakeup

5. Nothing But A Head Fake Signaling

In a recent commentary marketing guru Seth Godin asked ‘Why do people celebrate Halloween?’

His answer, ``Because everyone else does….Most of what we believe is not a result of direct experience (ever seen an electron?) but is rather part of our collection of truth because everyone (or at least the people we respect) around us seems to believe it as well.” (bold highlights mine)

Let me add, for many, there is that need to be seen as conforming to traditions (social status), aside from the need to use such opportunities for networking.

Mr. Godin concludes that “social constructs” drive people to behave in traditional ways. In behavioral finance or economics, such traditionalism represents as the “comfort of the crowds” or the Bandwagon Effect or the Herding instinct.

In other words, it isn’t much about rationality vis-à-vis irrationality or evidence against theory but social impulses predicated on assumed experiences that motivates people’s actions to observe traditions.

The Cost of Self Esteem

In the marketplace, mainstream behavior represents the same dynamics-traditionalism, where the underlying assumption is that the consensus mindset applies as the self-evident truth, regardless of proofs.

For instance, interventionists or inflationists or the left predominantly use industrial era metrics to justify government interventionism in a world evolving around the “information age” whose platform is principally structured upon the twin forces of globalization and competition inspired technological revolution.

By postulating that today’s economic landscape as dissimilar compared with the configurations of the past, they argue that markets have been failing and thereby justify more intervention by the government via inflation (fiscal deficits, centralization, price controls, devaluation and so forth…) or increased regulation.

Moreover, the same line of thinking pervades the mainstream mindset when traditionalist fundamental models appear to be ‘foisted upon’ the public in the hypothesis that markets have been operating under “normal” or basic law of scarcity conditions, when the reality is that governments have been the markets!

For instance, some has sternly argued that can’t consumer price inflation can’t occur when unemployment is high. Yet, Iceland seems to be a real life example debunking such unrealistic model [see Iceland's Devaluation Toll: McDonald's].

In other words, the conventional approach have been to read and interpret the market or the global economy as operating under assumed models with historically similar dynamics, when the reality is ‘this time is different’ or that we are operating under uncharted territory.

Mr. Doug Noland in his Credit Bubble Bulletin hits the nail on the head in arguing that today’s economic environment is starkly different from any previous conditions we have ever seen, ``the unfolding reflation will be altogether different than previous reflations. The old were primarily driven by Fed-induced expansions of U.S. mortgage finance and Wall Street Credit. Our mortgage industry, housing and securitization markets, and Bubble economy were at the epicenter of global reflationary dynamics. The new reflation is fueled by synchronized fiscal and monetary stimulus across the globe. China, Asia and the emerging markets/economies have supplanted the U.S. at the epicenter. U.S. housing is completely out of the mix. Those fixated on old reflationary dynamics look today at tepid U.S. housing markets, mortgage loan growth, consumer spending, and employment trends and see ongoing deflationary pressures. The Fed is wedded to the old and is positioned poorly to respond to new reflationary dynamics. A stable dollar used to work to restrain global finance – hence global inflationary forces. The breakdown in the dollar’s stabilizing role has unleashed altered inflationary dynamics – forces that the Federal Reserve disregards.” (bold emphasis mine)

So why is it difficult to change peoples’ thinking even when presented by strong evidences?

Based on social constructs, Professor Arnold Kling of EconoLog argues that change comes at the cost of “acknowledging a loss of status” or “loss of group identity”.

This implies that self esteem derived from social linkages account for as one of the basic human needs, which can be seen in the order of values as framed by Maslow’s hierarchy of needs (see figure 1)

Figure 1: Wikipedia.org: Maslow’s Hierarchy Of Needs

According to Wikipedia.org ``Maslow's hierarchy of needs is predetermined in order of importance. It is often depicted as a pyramid consisting of five levels: the lowest level is associated with physiological needs, while the uppermost level is associated with self-actualization needs, particularly those related to identity and purpose.”

In short, one of the major costs or barrier or resistance to change dynamics of changing people’s thinking is self esteem. Professor Kling suggests, ``On political issues, I think that it is harder to change the mind of someone who is highly educated than someone who is not. The highly-educated person is more likely to have his sense of status and identity tied up in his political beliefs. He is more likely to have a made a larger investment in finding facts and theories that confirm his beliefs.”

This applies not only to politics but likewise to other aspects such as economic or social dimensions.

So what has this got to do with today’s market actions or more particularly today’s market slump?

A whole lot.

The “desperately seeking normal” camp or those “fixated on old reflationary dynamics” as distinguished by analyst Doug Noland, has interpreted the recent plunge in global markets as a semblance of vindication of the “ongoing deflationary pressures”.

Where they have been mostly wrong throughout the recent episode, fleeting market signals that appear to validate their supposition may otherwise be construed as “even a broken clock is right twice a day”.

5 Reasons Why The Recent Market Slump Is Not What Mainstream Expects

We see five factors why today’s market slump isn’t the scenario from which the desperately seeking normal camp expects.

1. Reflation Trade Has Been A Crowded Trade

There is a limit on how much a rubber band’s elasticity can be stretched before it snaps or the breakage of the so called “cross links”. The degree of elasticity depends on the basic dimensions and the quality composition of the rubber band.

Applied to the markets, there is also a limit on how markets can be manipulated or a maximum elasticity on how markets can accommodate extreme sentiment. This applies even across varying time dimensions, which means that even as fundamental imbalances of inflation are being built globally over the long term, strains from one sided or popular trades can be vented to reflect on an interim “breakage of cross links” or snap backs. Hence, long term or secular trends will always be spliced with intermittent countertrends.

In the context of the US dollar Index, which have been the foundation of today’s reflation dynamic, the recent rebound amidst the hefty decline in global markets epitomizes the interim crowded traded snap back (see figure 2).

The chart from futures.tradingcharts.com demonstrates on the crowded trade phenomenon where non-commercial positions (banks, hedge funds, or large speculators) have overwhelmingly shorted the US dollar, as shown by the blue vertical lines. Commercial positions (red lines) are the end users (as importers or exporters) who apply currency hedges.

In the most recent past, each time US dollar short contracts reached the -19,200 level, the US dollar “recoiled” (June and August). Today, large speculator short contracts have vastly broken below said levels. And this signifies the crowded trade.

Alternatively this means that as the US dollar rebounded, carry trades based on the US dollar may have all been closed which oppositely results to the steep drop in so-called risks assets.

2. No Trend Goes In A Straight Line

When we say long term or secular trends will always be spliced with intermittent countertrends it simply means that markets don’t move in a linear fashion.

In other words, there is a distinction between secular trends and countertrends or a difference between the short-term and the long term.

Confusing one for the other could risk a disastrous portfolio.

Today’s massive asset speculations have resulted to overextended markets as in the case of the US (see figure 3)

Chartoftheday.com sees an exceptional episode in today market action by the Dow Jones Industrials from whose chart ``illustrates the duration (calendar days) and magnitude (percent gain) of all significant Dow rallies that occurred during the 1929-1932 bear market (solid blue dots). For example, the bear market rally that began in November 1929 lasted 155 calendar days and resulted in a gain of 48%. As today's chart illustrates, the duration and magnitude of the current Dow rally (hollow blue dot labeled you are here) is greater than any that occurred during the 1929-1932 bear market.”

It is quite obvious that the referenced site is biased towards the “old reflation model” with their view predicated on a bear market rally, and perchance, expects the US markets as in a path towards the Great Depression levels.

Unfortunately, using the basic metrics of the monetary standards alone, where the Great Depression was anchored to gold while today operates on a pure paper ‘US dollar’ standard, comparing the Great Depression with today would fundamentally be immaterial.

Nevertheless today’s significant correction amidst the vastly overstretched or overbought market denotes of a “normal” corrective phase of market dynamics.

While we haven’t bullish with the US markets, we can’t also be equally bearish for the simple reason that we see the US government as supporting their asset markets as a priority over the other areas of concern. As 2008 meltdown has shown, the survivability of the US dollar standard depends on the Federal Reserve’s key agents, the US banking system.

This is a fundamental variable that can’t seem to be comprehended by the consensus.

3. Markets Have Been Liquidity Driven

As earlier noted, another outstanding fallacy utilized by the old reflation model or desperately seeking normal camp is to extrapolate conditions of the yesteryears through traditional metrics to project a preferred or biased scenario.

For instance we noted that the humongous profits reaped by ‘Too Big To Fail banks’ have been fundamentally derived from trading [as previously discussed in What Global Financial Markets Seem To Be Telling Us]

This seems to have confounded mainstream analysts like MSN’s Jim Jubak who recently wrote, ``What's really disturbing to me, however, is that the model is relatively new, even at Goldman Sachs, and current financial policy is pushing Goldman and JPMorgan Chase to even more extreme versions of the "bank as trader" model.” (bold emphasis mine)

But of course, the “bank as trader” represents as the du jour model.

That’s because the only significant alternative way to rehabilitate the US banking system’s balance sheet is to profit from trading. The industry has been hobbled by balance sheet impairments from the recent bubble bust and this has reduced their incentives to engage in the traditional model of lending.

And the only way to consistently profit from trading is to have an environment that will be conducive to this. And the only way to attain this is to create it. Hence, the US government has engaged in a decisive, massive, monumental and unprecedented scale of operations. The US government, according to Bloomberg, ``has lent, spent or guaranteed $11.6 trillion to bolster banks and fight the longest recession in 70 years, according to data compiled by Bloomberg. That’s a 9.4 percent decline since March 31, when Bloomberg last calculated the total at $12.8 trillion.” (bold highlight mine)

And this is why too the world appears to likewise adopt a seemingly complementary set of policies too.

This refusal to acknowledge the massive influence of government in today’s market system, results to this deep confusion between conventional models and evolving market realities.

Yet the ‘Bank As Trader’ model has been underpinned by the following sequence:

1. Taxpayers provide the Too Big To Fail banks with liquidity, loans, guarantees and equity.

2. Financial conditions has been stage managed by the US Federal Reserve via zero interest rate, quantitative easing, expansion of loan books of Fannie Mae, Freddie Mac and the FHLB, and through various programs where the US government acts as market maker (such as Term Discount Window Program, Term Auction Facility, Primary Dealer Credit Facility, Transitional Credit Extensions, Term Securities Lending Facility, ABCP Money Market Fund Liquidity Facility, Commercial Paper Funding Facility, Money Market Investing Funding Facility, Term Asset-Backed Securities Loan Facility, and Term Securities Lending Facility Options Program.)

3. Investment banks, hence, profit immensely from the spread generated by these manipulated markets.

4. The resultant handsome profits generated from these arbitrage opportunities prompts companies to deploy huge employee bonuses which prompts for an uproar from politicians and media over the ‘evils of greed’.

Incidentally, this brouhaha over greed is obviously a myopic distraction in the sense that pay and profits simply signify as symptoms of the main disease.

The underlying fundamental malaise is that the ‘bank as trader model’ has been a product of the collusion between the banking system and the US government to inflate the economy to the benefit of the elite bankers!

Nevertheless, the ‘Bank As Trader Model’ appear to synthesize with the overall the fundamental strategy employed by the US Federal Reserve to revitalize its banking system.

How?

1. By manipulating the mortgage markets and US treasury markets with the explicit goal of lowering interest rates, in order to ease the pressures on property values and to mitigate the losses in the balance sheets of the banking system,

2. By working to steepen the yield curve, which allows for conducive and favorable trading spreads for banks to profit and to enhance maturity transformation aimed at bolstering lending, and

3. By providing the implicit guarantees on ‘Too Big To Fail’ banks or financial institutions, this essentially encourages the revival of the ‘animal spirits’ by fueling a run in the stock markets. As we have noted in Investment Is Now A Gamble On Politics, 5 financial stocks otherwise known as the Phoenix stocks accounted for most of the trading volume last September.

In short, the recovery of the US banking and financial system has basically been entirely dependent on government actions via inflation.

One cannot simply read today’s markets without addressing the policy recourse or anticipating the prospective actions of the US government.

And the impact to the global marketplace has been the same dynamics: a high correlation of market activities.

The inverse correlation of US dollar vis-à-vis ‘risk’ asset markets (commodities and stocks) seems like a déjà vu. This should be music to the ears of the ‘desperately looking for normal’ camp.

However, this isn’t about traditional fundamental model, but about liquidity.

A rising US dollar signifies global liquidity contraction, as leverage in parts of the global financial system could have forcibly been unwinded. Moreover a spike in the VIX or volatility sentiment appears to be chiming with the underlying theme.

In addition, given the synchronous market actions brought about by a seeming reversal in liquidity dynamics, then the impact should be reflected on Asia over the coming sessions due to the recent strong correlation (Figure 5)

According to Chris Sholto Heaton of Money Week Asia, ``the markets are generally highly correlated in terms of direction, with an R-squared value of 0.94 (the maximum is one, implying perfect correlation). In short, when Wall Street rises, Asia rises; and when Wall Street falls, Asia falls.”

In other words, Asian Markets may indeed fall from a US dollar rally over the interim. But this should be a short-term countertrend or a buying opportunity more than a secular trend as liquidity dynamics favor Asia and emerging markets/

4. Tightening Trial Balloons Responsible For Recent Shakeup

High profile and prolific investment strategist of CLSA, Mr. Christopher Woods in a recent opinion column at the Wall Street Journal basically echoed my observation, Mr. Woods wrote, ``The reality of an increasingly command-driven economy in America means that government policy is likely to become the key determinant of where investors should place their money.”

If the recent hyperactivity of the markets had been based on government policy to reflate the system, then the easiest explanation should be to attribute the recent correction as a reversal of the liquidity flows.

However, what drives such motions? Could it be that monetary inflation hasn’t kept up with present price levels? Or has present price levels been too high for monetary inflation to support?

Or could it be that governments have suddenly rediscovered sound banking, where signs of bubbles may have prompted for active strategies to ‘exit’ from the today’s policy induced liquidity environment?

Aside from Israel and Australia, which had been the early birds in raising interest rates, Brazil followed suit with capital controls to stem foreign inflows, a week earlier.

Late this week, we find an eerie coincidence of central banks in a tightening mode.

Norway was the first European country to raise interest rates Friday, while India ordered its banks to keep more of its cash funds in government bonds, last Thursday.

In addition, four of the world’s biggest central banks signaled the end or the near end of their Quantitative Easing programs.

On Friday, the Bank of Japan announced that ``it will stop buying corporate debt at the end of the year, as central banks around the world phase out emergency measures taken at the height of the financial crisis” (Bloomberg).

Also last Friday, the US Federal announced that it has ``completed its $300 billion Treasury purchase program today amid signs the seven-month buying spree helped stabilize the housing market and limited increases in borrowing costs” (Bloomberg).

In addition, likewise on Friday, a former official of the Bank of England announced a prospective downscaling of their own Quantitative Easing program, ``Former Bank of England policy maker Charles Goodhart said the bank may scale back or pause its bond- purchase program next week as officials around the world start to pull back stimulus for their economies.” (Bloomberg).

The European Central Bank wouldn’t be left behind, again on Friday, ``European Central Bank council member Axel Weber signaled the bank may start to withdraw its emergency stimulus measures next year by scaling back its “very long- term” loans to banks.” (Bloomberg)

Articles like this also published last Friday (Financial Times) exacerbated on the uncertainty brought about by the changes in the direction in global central bank policies, ``As the Federal Reserve’s programme of buying mortgage debt edges towards $1,000bn this week, investors are starting to worry about what happens once the central bank starts to slow down and exit from this key plank of its monetary easing policy.”

Of course, Friday had been catastrophic for global equity and commodity markets. And perhaps, the ensuing selling pressure from these agitations may likely spillover to the coming sessions.

However, given the latest round of triumphalism from being able to pivot or manipulate markets higher enough to project an economic recovery, global governments seem to increasingly exude confidence over their actions, so as to embark on an audacious experiment to conjointly orchestrate an apparent end to the quantitative easing programs, in order to keep a rein on asset prices from spiraling higher.

Again this is new stuff for central banking: Concerted policies are seemingly aimed at nipping an asset bubble from its bud!

Nevertheless, this lamentably reflects on the artificial nature of today’s marketplace, as it has been primarily negotiated by global political and bureaucratic authorities.

This week’s violent reaction in the marketplace following the policy signaling ploy by key central bankers seems like trial balloons to test for market reactions.

It is likely that the corresponding events may prove to be knee jerk and temporary as the overall environment remains accommodative. Perhaps, central bankers have been heeding the PIMCO’s Paul McCulley advice when he recently wrote, ``that markets can stray quite far from “fundamentally justified” values, if there is a strong belief in a friendly convention, one with staying power. And right now, that convention is a strong belief in a very friendly Fed for an extended period. Thus, the strongest case for risk assets holding their ground is, ironically, that the big-V doesn’t unfold, because if it were to unfold, it would break the comforting conventional presumption of an extended friendly Fed.”

By trying to prevent a V-shape recovery as Central Bankers appears to have done, Mr. McCulley, banking on behavioral dynamics, suggests that markets can expect more of extended friendly policies from the Fed (and from other global central banks) which should prolong the rise in asset markets.

I wouldn’t share Mr. McCulley’s confidence though. His theory discounts the Ponzi dynamics required to maintain and improve on asset pricing.

What we seems certain is that volatility risks from bi-directional interventionist policies have been reintroduced and could be the dominant theme ahead of us.

However, it is my view that the upside risks as having more weight than the downside over the longer term, because the US government will likely sustain an implied “weak” US dollar policy.

Remember, with the goal to stabilize and promote interests of the banking system, as seen from Bernanke’s doctrines, the US will likely proceed with the devaluation path in order to reduce real liabilities via inflation.

Further, the Fed will likely work on normalizing its credit system by keeping the banking system’s balance sheets afloat with elevated asset prices from which the only recourse is to inflate the asset markets.

In the interim, markets can go anywhere.

5. Nothing But A Head Fake Signaling

In the US, the so-called exit from the Quantitative Easing seems likely a head fake move.

Figure 6: T2 Partners: Woes of Mortgage Markets Still Ahead

Figure 6: T2 Partners: Woes of Mortgage Markets Still Ahead

With the risks of the next wave of resets from the Alt-A, Prime Mortgages, Commercial Real Estate Mortgages, aside from the Jumbo and HELOC looming larger [as previously discussed in Governments Will Opt For The Inflation Route] (see figure 6), they are likely to exert more pressure on the banking system.

Resets of Alt-A mortgages will crescendo until the end of 2012. And as you can see the subprime is dwarfed by risk exposures from Alt-A, Commercial and the Prime Mortgage.

In addition, commercial mortgages which has a risk exposure of around $1 trillion, is more widely held by US financial institutions.

According to Wall Street Journal, ``In contrast to home loans – the majority of which were made by only 10 or so giant institutions – thousands of small and regional banks loaded up on commercial property debt. As a result, commercial real estate troubles would be even more widespread among the financial system than the housing woes. At the present, more than 3,000 banks and savings institutions have more than 300% of their risk-based capital in commercial real-estate loans.” (emphasis added)

So the Fed’s communiqué and the real risks appear to be antithetical. One will be proven wrong very soon.

In addition, the Fed has been actively trying to expand its power which at present is being heard by the US Congress.

Moreover, worries over the politicization of the Fed as a proposed law grants veto power to the Secretary of the Treasury over Section 13(3) emergency action by the Federal Reserve Board of Governors (David Kotok).

In short, there is little indication that the Fed has embraced a tinge of sound banking. Instead, all these could be read as growing signs of the politicization of the monetary policies.

As Murray N. Rothbard in Mystery of Banking wrote, ``When expectations tip decisively over from deflationary, or steady, to inflationary, the economy enters a danger zone. The crucial question is how the government and its monetary authorities are going to react to the new situation. When prices are going up faster than the money supply, the people begin to experience a severe shortage of money, for they now face a shortage of cash balances relative to the much higher price levels. Total cash balances are no longer sufficient to carry transactions at the higher price. The people will then clamor for the government to issue more money to catch up to the higher price. If the government tightens its own belt and stops printing (or otherwise creating) new money, then inflationary expectations will eventually be reversed, and prices will fall once more—thus relieving the money shortage by lowering prices. But if government follows its own inherent inclination to counterfeit and appeases the clamor by printing more money so as to allow the public’s cash balances to “catch up” to prices, then the country is off to the races.”

At the end of the day, the policy path appears heavily skewed towards more inflation to insure against additional losses and to safeguard against renewed disruption in the banking system.