The recent market meltdown confirmed many realities of the several thesis that I have been writing about.

Aside from the boom-bust cycles, the recent crisis debunks the decoupling theory.

When faced with the increased risks of a global liquidity contraction, market actions have converged to tighten correlations of the risk asset markets almost across the board.

As almost every markets fell, the US dollar and US treasuries became the temporary safehaven.

ASEAN markets, whom initially seemed defiant from the unfolding crisis in the West, has not been spared; even debt default risks, represented by prices of Credit Default Swaps (CDS), of ASEAN and Asian bond markets have begun to rise.

The US Dollar’s Temporary Role as Flight to Safety Haven

I’d like to further point out that the temporary status of the US dollar as refuge is largely due to the unraveling crisis of the Eurozone, or that the relative immediacy of the impact of the Euro debt crisis has been more than that of the US.

The US is NOT and will NOT be IMMUNE to the laws of economics as absurdly suggested by political zealots; the US also faces a prospective fiscal crisis from the continuing profligate ways of the welfare-warfare addicted government. The recent S&P downgrade[1] has been portentous of this.

The current record low or near zero rates almost across the yield curve, which for some represents as opportunity for the US government to further rack up expenditures, is not and will not be a permanent state. More welfare based extravagance ensures the erosion of the US dollar as safehaven status overtime.

Also since the US has largely been less reliant on cash transactions, thus US sovereign securities have temporarily assumed the role of moneyness or as an alter ego to cash.

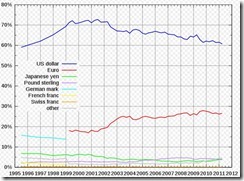

Most importantly, the US dollar remains as the world’s premier foreign currency reserve as shown above where the US dollar represents about 60% of reserves held by governments and various institutions[2]. In addition, the US dollar represents 85% share of forex transaction in April 2010 down from a peak of 90% in 2001[3]. And of the $95 trillion size of global bond markets in 2010, the US accounted for the largest share at 39%[4].

This means that in a period of dramatic loan margin calls, redemptions or liquidations, and where most of the international payments and settlement system have been based on the US dollar, then it would be OBVIOUS that the US dollar becomes the de facto safe haven. The liquidations in the Eurozone only amplify on such dynamics.

It would be foolish to believe that the US is protected by some mantle of magical or supernatural powers. The only forces that has been giving the US dollar its current strength has mainly been the relatively worst current conditions of the Eurozone, global financial market’s perception of insufficient liquidity* and Ben Bernanke’s dithering on QE 3.0.

*Banking and state insolvencies are valid issues but central banks have been covering such shortcomings with the panacea of liquidity injections. Except that today, financial markets seem to discern that the current state of liquidity injections has not been enough.

Debunking Gold as Hedge Against Deflation and Fear

Another myth demolished by the present crisis is the assumed role of gold.

Many say that gold will function as hedge against deflation. Another camp says that gold functions as refuge against fear.

Both have been proven wrong.

The day Ben Bernanke inhibited the deployment of QE 3.0, gold prices along with the broad based commodity spectrum came crashing down together with global financial markets.

Where the perception that monetary expansion will not be applied, asset liquidation has dominated and gold prices had not been exempt.

So much for the deflation refuge. May I emphasize that asset deflation does not automatically suggest of consumer price deflation or an economic wide deflation-recession.

Also crashing equity markets around the world has been coincidental with falling gold prices. Essentially this discredits the idea that gold serves as refuge against fear.

True, many central banks will continue to inflate—such as the ECB, Swiss National Bank, National Bank of Denmark, Bank of Japan and others—but current state of markets suggest that their actions has not been satisfactory to warrant maintaining lofty record gold prices.

Either these central banks would have to inflate intensively, or more importantly, that team Bernanke joins the bandwagon to deliver the meat of what the market expects.

Also, while gold may be in a natural correction mode given its previously severely overbought conditions, I would think less about the importance of the technical conditions.

I believe that the Fed’s current inaction is temporary. Ben Bernanke would want to see more market pressures to justify QE in order to stave off deflation. In his recent public appearance he again raise the deflation bogeyman[5]

"If inflation falls too low or inflation expectations fall too low, that would be something we have to respond to because we do not want deflation"

And since price trend of gold seems correlated with the actions of ASEAN markets, a wobbly gold price trend would translate to an uneasy or apprehensive markets for the Phisix or ASEAN equities.

Thus, unless I see gold prices make a substantial recovery, I am predisposed to say that ASEAN equity markets could be susceptible or vulnerable to significant price retrenchments for the time being

[1] See Misleading Discussion on US Debt Downgrade Crisis, August 9, 2011

[2] Wikipedia.org Reserve currency

[3] Marketwatch.com Daily foreign-exchange turnover hits $4 trillion, September 2001

[4] Wikipedia.org Bond Market Size Bond market

[5] See Ben Bernanke: Falling Markets will Justify QE 3.0, September 30, 2011

No comments:

Post a Comment